Eight 'misfit' investment trusts that scream value

These trusts don't fit in the usual boxes, which is exactly what makes them worthy of closer attention.

10th May 2019 14:53

These investment trusts don't fit into the usual boxes, which is exactly what makes them worthy of closer attention...

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Rebel Rebel

William Heathcoat Amory, Founder, Kepler Trust Intelligence

There are more than 26,000 investment funds available to UK investors today, yet the average UK investor has just six funds of any kind in their investment portfolio.

Clearly, then, investors must be filtering out a lot of potential investments before they make a decision, and an obvious way to do this is by choosing an appropriate sector - but here too, there is a somewhat daunting range to choose from. The AIC announced yesterday an "overhaul" of its sectors, in order that they are as "clear and helpful as possible" for investors, and there are now more than fifty of them to choose from.

In our view, this move by the AIC recognises that investors are using labels to search for funds - and the more granular those labels are, the more likely investors are to find them useful; so full marks for effort. But examination of the 300 trusts that now sit in those sectors highlights a challenge which still remains; however refined a sector label is - many trusts don't sit easily among their peers.

This presents a problem. Filtering funds by sector helps see the wood for the trees, which is essential given the great 'taiga' we face as investors seeking one tree among 26,000. But it also means many investors routinely overlook great funds just because they sit in the 'wrong sector'. The only way to really work out where these trusts are is hard graft - real analysis at a fund level.

The good news is that, for investors who have the time to search for them, trusts like this often trade on a wider discount than might otherwise be the case, presenting an opportunity. The even better news is that we've done the legwork to find eight of them, so you don't have to.

Filtering for funds

Often, the best way to pick a fund is from the bottom up. You know the manager, trust and understand their character and investment process, and are happy to have them invest your (or your clients) capital for the long term.

For most people though, selecting a fund or trust is more often done using a top-down process. It is a process of filtering. Trying to match objectives with a fund or trust requires an investor to look at the various characteristics of the many competing funds available. In practical terms, this means using various inputs derived from a database (such as the very helpful AIC website) to narrow down the search. There are many, many factors to consider, but those that fail to meet your initial filter are obviously rejected, in favour of a shortlist, and this is where the real analysis starts - we would tentatively suggest inputs into the filter could (or should) be:

• Size

• Track record

• Discount to NAV

• Yield

• Portfolio exposure (asset class, geography, market capitalisation)

In our view, and contrary to popular opinion, the following should NEVER form part of the initial filter:

• Cost

• Sector

Unfortunately, both of these "inputs" often form the very first filter for many investors. In our view, this means they are often unwittingly missing out on many very fine opportunities.

Passives are on the rise. The sole differentiator between passive funds is price. As a result, investors have got used to closely linking an input (the cost of a fund) and the output (net of fees returns), with the implication that the former is a close determinant of the latter. We hope to delve deeper into whether this assumption applies to actively managed funds at a point in the not too distant future.

However, the other "banned" input into a fund selection process – the designated "sector" that a trust sits in – sometimes causes investors to overlook very interesting idiosyncratic funds, just because the sector they are labelled as doesn't necessarily reflect accurately what exposure the trust offers. In such a scenario, a fund can look very poor on a relative basis in terms of the historic returns, or cost or volatility, or indeed any other filtering metric used to arrive at a short list.

In our view, investment trusts are more open to idiosyncrasies, and therefore more open to being overlooked – often for a very long time. That is part of the joy of the sector, where investment trust boards – with their independence and fiduciary duties to shareholders - are ultimately deciding who should manage their pool of assets. In our experience, these "eccentrics" exist as much within the big asset management firms with a stable of investment trusts, as those that stand on their own.

Certainly, with an ever-increasing march towards "model portfolios" and a "painting by numbers" approach to assembling a portfolio of funds, it is refreshing that there do exist investment trusts that regard "tracking error" as more appropriately used at Kwikfit, rather than as a yardstick to measure portfolio risk.

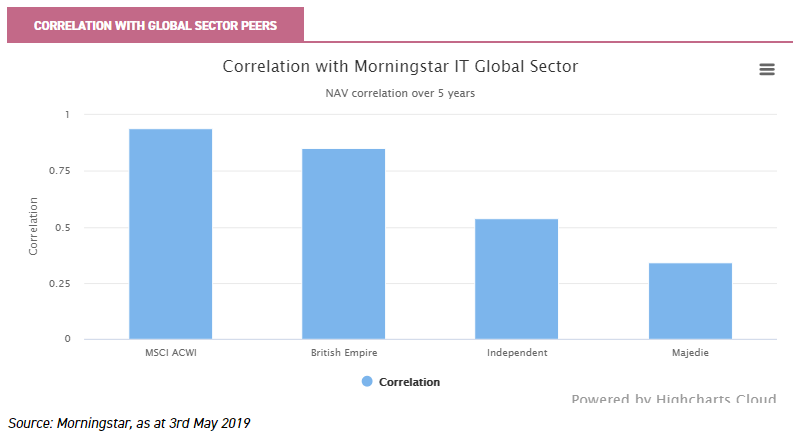

Clearly, identifying misfits in sectors requires a degree of qualitative work. However, we have identified several trusts, within the Global, Flexible, UK Smaller Company and UK All Company sectors which in our view are possibly hidden in their respective sector's rough, compared to their peers which sit more on the clipped grass of the investment trust fairway.

Global Sector

The Global peer group, as one might imagine, has a wide variety of strategies within it. However, in our view there are at least three trusts which really stand apart from the peer group – the majority of which typically invest directly into equities all around the world.

Independent Investment Trust (LSE:IIT) is one of the more glaring misfits in the Global sector, as highlighted in the correlation analysis chart above. IIT has a mandate to invest all around the world, but historically has chosen to invest the bulk of its assets in the UK – with a particular focus on UK growth companies.

During much of 2018, it stood out from its Global peers because of the very hefty premium rating that the shares traded – thanks to its retail following and the tightly-held nature of the shares. IIT is managed by Max Ward, a highly experienced investor who has delivered spectacular returns over time.

Despite his protestations, we understand the AIC has insisted the trust be transferred soon to the UK All Share sector. Max believes that this will mean investors might wrongly assume the UK focus will remain forever. However, in the meantime, we believe it may at the margin enable more investors to find their way to Max's door and help narrow the discount that has widened out following the volatility in markets and the trust's NAV in Q4 2018.

Another trust, truly global this time but which trades on a significant discount relative to Global investment trust peers, is Majedie Investments (LSE:MAJE). Majedie gets its investment exposure through various funds managed by Majedie Asset Management (MAM), but also has a 17% stake in the company (which is a private, unlisted company), most recently valued at £59.8 million.

The performance of the trust has lagged peers in the sharply rising market, which is possibly the reason for the discount. But their underperformance of the peer group fundamentally misunderstands the underlying investments, of which at least 45% is not directly exposed to equities – the stake in MAM, as well as the 15% allocation to the very popular Majedie Tortoise fund.

The trust trades on a discount to NAV of 14%, a significant discount to the average discount in the Global peer group of 2.1%. We hope to be meeting the managers soon for a full update on the trust. Please click here if you would like an email alert when we have published the note…

British Empire Trust (LSE:BTEM) has a very long history as a specialist "value" investment vehicle. Over the course of its history, the managers have always aimed to exploit their niche expertise in identifying asset backed companies which are trading at well below the manager's estimate of intrinsic value.

Joe Bauernfreund took sole responsibility for the portfolio in October 2015, since when he has significantly concentrated the portfolio, and tried to focus more on ideas which have an identifiable catalyst for a discount to narrow – a move which so far has delivered a tangible improvement to performance.

The idiosyncratic nature of the strategy mean that its fortunes can diverge significantly from global markets, and in fact pigeon-holing the trust is sometimes difficult. Importantly, the trust has very different return drivers from many of its peers – particularly its lack of exposure to the US, which many Global peers have hefty allocations to. The discount of 9.1% remains wide both in absolute terms, but also relative to other global trusts now trading close to par.

UK Smaller Companies Sector

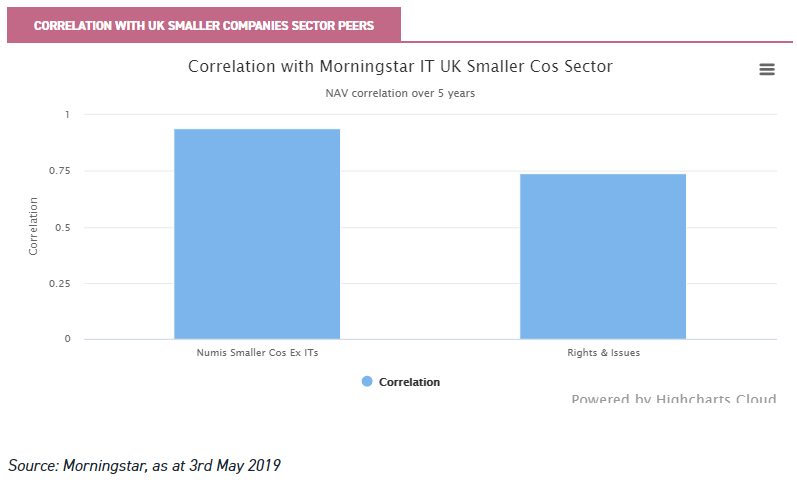

The UK Smaller Companies sector displays a rich tapestry of funds, with a wide variety of approaches to generating returns from "smaller" companies in the UK.

Arguably two funds remain in the shadows for most investors within this space – one intentionally (Rights & Issues Investment Trust (LSE:RIII), whose manager and board purposefully eschew the limelight despite a stellar track record of performance), and one (Aberforth Split Level Income (LSE:ASIT)) thanks to it having two share classes, which in some cases means that it isn't included in the UK Smaller Companies peer group.

The ordinary shares are relatively highly geared, which means that the risks to investors are there. However, Chelverton UK Dividend Trust (LSE:SDV) and Acorn Income Fund (LSE:AIF) both suffer the same fate of relative obscurity - being included in the UK Equity Income and the UK Equity and Bond Income sectors respectively, despite all three investing the large majority of their assets in UK small caps for a high income.

Rights & Issues is a self-managed UK smaller companies trust. Simon Knott, the manager, has been at the helm for 35 years, and is a traditional buy and hold investor, with a value tilt. He runs the portfolio in a highly concentrated manner, with the top 10 holdings accounting for 87% of the portfolio.

Simon takes a low-turnover approach and tends to focus at the very bottom end of the market cap spectrum. His main aim is to buy companies with strong balance sheets, attractive dividend yields and are trading a discount to what he deems to the business'intrinsic value.

The trust has been the best performing member of the AIC UK Smaller Companies over 10 and 20 years to 23 April 2019. However, its returns and outperformance have been equally as strong over more recent time frames. Despite the very strong NAV track record, the discount has been persistent. The newly tightened discount control mechanism (targeting a discount of 8%), provides reassurance to investors.

Having managed the portfolio for 35 years, Simon is nearing retirement age and (so far) we understand that there are no succession plans in place. We understand that the board has indicated that it is not its intention to liquidate the trust before mid-2021.

Aberforth Split Level Income (LSE:ASIT) is a high yielding smaller companies fund with a disciplined value approach, offering a historic yield of 4.9%. This is the highest natural yield on offer from a pure smaller companies trust.

Being contrarian and value investors, the managers have built up an overweight to UK domestic stocks on a bottom-up basis. They are also biased to the small end of the market and do not buy AIM stocks, meaning the exposures are different from the average smaller companies fund.

The company has structural gearing in the form of zero dividend preference shares (ZDPs), which means that the ordinary shares are 28% geared, considerably higher than most smaller company trust peers, most of which do not have any gearing at all. The Aberforth approach, the income mandate and the company’s structure mean that ASLIT is highly differentiated to its peers.

Perhaps thanks to general Brexit induced risk aversion, the current discount of 11.6% is wider than the sector average of 8.5%.

UK All Companies Sector

The UK All Companies sector is by definition a hotchpotch of trusts, which have a high degree of flexibility to invest across the UK market capitalisation spectrum. Within this there is a fair degree of variety, with the very high profile Woodford Patient Capital (LSE:WPCT), as well as the much less well known Sanditon Investment Trust (LSE:SIT).

Also on the margins is Aurora Investment Trust (LSE:ARR), which has been growing rapidly since management was handed to Phoenix Asset Management in January 2016. The trust has a highly-concentrated portfolio of UK-listed companies run with a clear bottom-up, value style.

Phoenix interpret the work of Warren Buffett, and look to buy companies at valuations which they think are fundamentally undervalued by the market. They are both classic "value" investors, but also aim to work with some companies in the portfolio actively to help engineer a turnaround. They place great emphasis on doing their own homework on businesses, including meeting company management, customers and competitors and aim to own companies that are deeply out of favour.

This focus on value is clearly highlighted by the Morningstar style analysis, with zero percent of the portfolio in what they identify as "growth". This is the lowest weighting of any of the UK All Company trusts.

The managers' long-term track record is very strong, but since taking the reins of Aurora, the trust has marginally underperformed relative to the FTSE All Share, although beaten its average peer in the UK All Companies investment trust and open-ended sectors. When Phoenix took over management of the trust, the share price rating significantly improved, and has consistently traded on a premium since then.

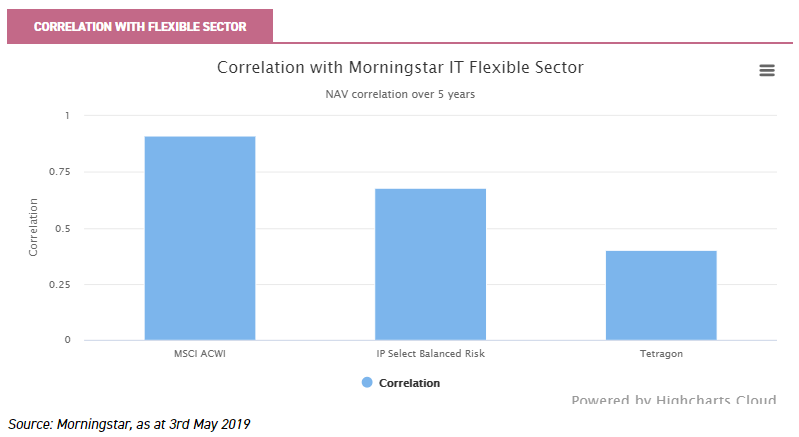

Flexible Sector

The AIC Flexible sector by definition hides a "multitude of sins", with a wide variety of fund aims and objectives within it. As such, funds within the sector can’t easily be compared to others, and each has to be taken on it’s own merit. A lack of homogeneity is something to be celebrated, but the downside is that each fund needs to be properly researched and understood before any investment decisions can be made. Two funds stand out in our view, thanks to their rather complex investment strategies.

Tetragon Financial (LSE:TFG), which might be considered in the same category as RIT Capital (LSE:RCP) in that it employs a diverse range of investment strategies which would be hard for investors to access in the normal course of things, is expected to be relatively defensive compared to world equity markets, and has a number of idiosyncratic private investments in the portfolio.

In contrast to RIT Capital (premium to NAV of 10%), Tetragon trades on a discount of 45%. Tetragon is certainly a complex vehicle, which may have contributed to investors steering clear in the past. The portfolio includes a diverse number of "alternative" strategies, such as those investing in convertible bonds, event driven equity strategies, and bank loans. It also owns stakes in a number of asset management companies (30% of NAV), many of which manage the company's capital.

The variety and the types of strategies should mean that NAV is uncorrelated to equity markets, we believe, which together with the historic return profile (consistent double-digit NAV total returns), if repeated, make this a highly attractive investment. The complications with Tetragon include the corporate governance angle (the shares do not have voting rights), as well as relatively high fees. We hope to provide a full analysis of Tetragon soon.

Invesco Perpetual Select Balanced Risk Allocation (LSE:IVPB), or IBRA, is tiny when compared to most funds in the sector, with net assets of c. £8 million. However, it employs a highly liquid strategy which counts many billions of dollars in AuM in similar mandates. IBRA's objective is to provide an attractive total return in differing economic and inflationary environments, with low correlation to equity and bond markets.

The trust has a benchmark of LIBOR +5% per annum, which has been met over almost all periods, with volatility of around two-thirds of that of equity markets since the strategy was adopted in 2012. In contrast to 'active' total return funds (such as Capital Gearing (LSE:CGT), Ruffer (LSE:RICA, Personal Assets (LSE:PNL) etc.) the managers have a systematic process to shift tactically around an otherwise relatively static long-term allocation to three asset classes: debt securities, equities and commodities.

Over the past three years, IBRA has generally been amongst the better performing of the trusts with low equity correlation. IPBR has achieved these returns with correlation to the MSCI ACWI index of 0.75. The board has a zero-tolerance discount policy, which has successfully prevented the discount from deviating far from the board's target of +/- 2% of NAV, and the shares currently trade on a discount of 0.6%.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.