Diversify your income stream with these four generous payers

1st February 2023 09:32

by Rodney Hobson from interactive investor

There are some great opportunities to spread your risk and generate dividend income from huge companies abroad. Our overseas investing expert discusses the merits of these giants.

Results from American companies are starting to flood in after US banks got 2023 off to a mixed start. Figures that followed from a range of companies suggest there are plenty of obstacles to bear in mind as investors look for New Year opportunities.

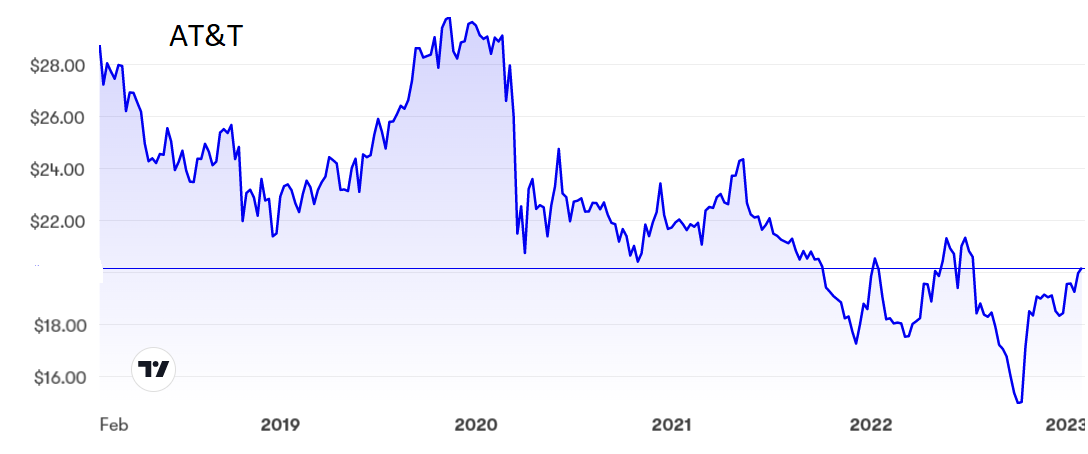

Telecoms group AT&T Inc (NYSE:T) spoiled the mood by recording a series of one-off financial hits from higher interest rates, goodwill writedowns and scrapping equipment that was no longer needed. These totalled a massive $26.75 billion, which rather smacks of excessive carelessness.

This caused a $23.2 billion loss in the fourth quarter, but more worrying is that even without the hit, profits would still have been down on the $5.4 billion recorded in the same quarter of 2021. Revenue was up a mere 0.8% from the previous year.

- Invest with ii: Trade US Stocks & Shares | US Earnings Season | Open a Trading Account

The quarter was a little better on the whole than the performance earlier in the year, but it still left revenue for the whole of 2022 down 9.9% at $120.7 billion, and a net loss of $7 billion compared with a profit of $21.5 billion in 2021.

Even after allowing for distortions caused by the spinning off of entertainment conglomerate WarnerMedia into Warner Bros.Discovery Inc Ordinary Shares - Class A (NASDAQ:WBD), one is entitled to feel that chief executive John Sankey was putting on a brave face by referring to surpassing profitability targets and durable growth. He has a lot to prove, starting with delivering a minimum 4% growth in wireless service revenue and 5% in broadband this year.

AT&T shares began a long, downward slide early in 2020 but have been on a recovery path since last October to stand just above $20, where the yield is quite juicy at 5.5%. Rival Verizon Communications Inc (NYSE:VZ), whose results were covered in detail by Keith Bowman ii view: Verizon’s 2023 profit prediction disappoints has a higher yield at 6.3% and a lowly price/earnings (PE) ratio of 8.1.

Source: interactive investor. Past performance is not a guide to future performance.

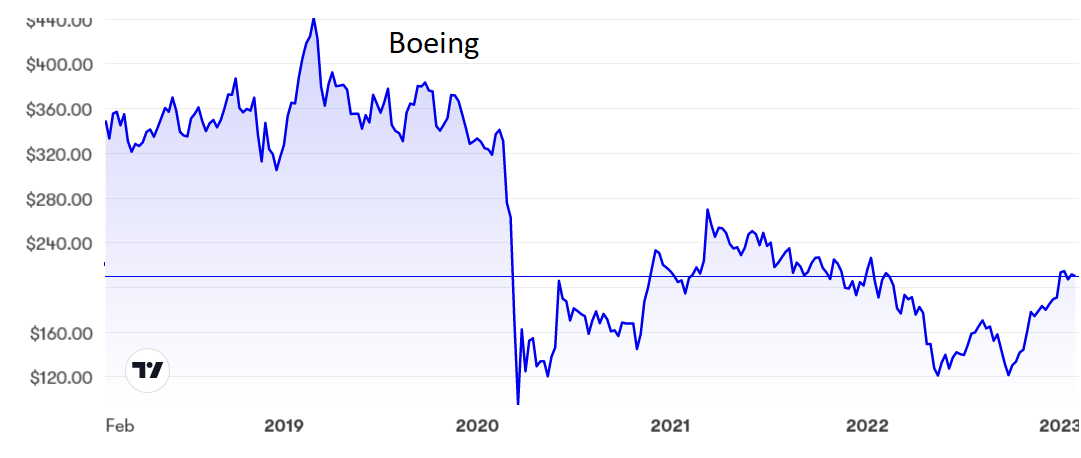

Boeing Co (NYSE:BA) should be taking off post-pandemic but still seems to be hitting headwinds. Although it reported substantially higher revenue in the fourth quarter, up 35% to just under $20 billion, it still produced a net loss, albeit one that shrunk by 85% to $663 million. That left the full year with revenue 6.9% higher but a slightly larger net loss than for the whole of 2021.

Like his counterpart at AT&T, chief executive Dave Calhoun remains optimistic in adversity, citing solid growth and “an important year in our recovery.”

- US earnings season - the big dates to watch for

- 2023 Investment Outlook: stock tips, forecasts, predictions and tax changes

There are encouraging signs, particularly a 54% increase in commercial aeroplane deliveries in the latest quarter, but production of the 787 will remain painfully low over the next couple of years.

The shares fell off a cliff at the start of the pandemic but have been recovering of late to reach $213, where they look to be hitting a potential ceiling. There is no dividend and no prospect of one while the company continues to make losses.

Source: interactive investor. Past performance is not a guide to future performance.

The dust is finally settling at chemicals company Dow Inc (NYSE:DOW) which emerged in 2019 after a merger with DuPont and a subsequent splitting of the combined group into three specialised parts. The outcome is, however, somewhat disappointing.

While revenue rose 3.5% to $56.9 billion, higher expenses related mainly to the Russian invasion of Ukraine slashed profit margins from 11% to 8.1%, reducing net income by 27% to $4.6 billion.

Although US inflation is abating, it is still high and will continue to feed through into higher costs, while analysts expect revenue to ease over the next year or two. That is not a good combination.

Dow intends to scrap 2,000 jobs worldwide to save $1 billion a year, although that will mean taking a hit of around $600 million in the first quarter. Less profitable lines will go as Dow seeks to concentrate on markets that offer the best growth prospects. Perhaps the dust hasn’t settled yet after all.

The shares peaked at $70 in mid-2021 and subsequently hit a low of $44 last September before recovering some ground to stand at $59, where the PE is a comparatively lowly 9.2 while the dividend is quite attractive at 4.8%.

Source: interactive investor. Past performance is not a guide to future performance.

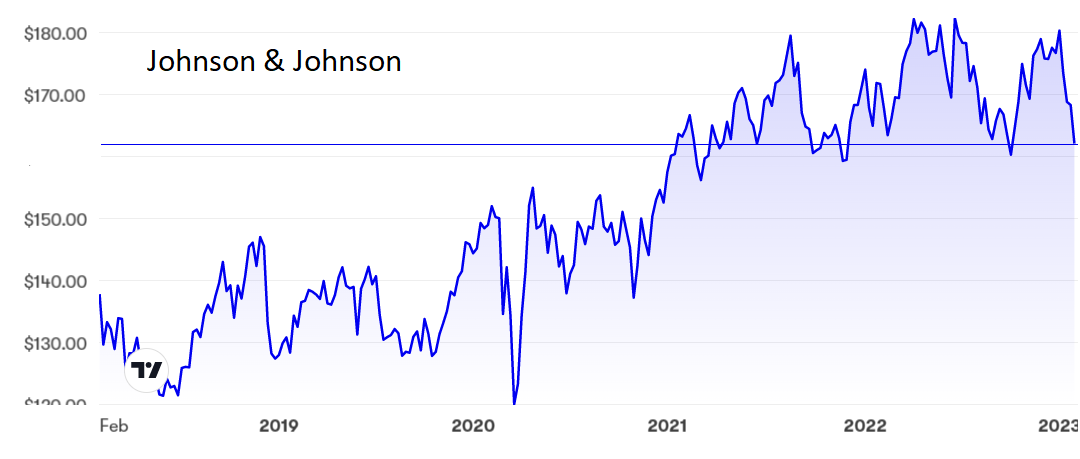

One company that had a good pandemic was pharmaceutical and consumer goods supplier Johnson & Johnson (NYSE:JNJ), and it is no surprise that Covid-19 vaccine sales are tailing off. Add in unfavourable currency movements and a 4.4% sales slippage to $23.7 billion in the three months to 31 December does not look at all bad.

Rather more worrying is that net earnings were down 26% to $3.5 billion, a similar percentage fall as in the previous nine months.

- US results season gives clues about chances of global recession

- Who are the world’s 10 richest women?

This year should be better. Although sales are projected to rise only about 1%, earnings should start to edge higher as well.

The shares trade around $163, just above a support level that has held solid over the past two years. The PE is quite demanding at 24 but there is a decent yield of 2.75%. J&J does have a wide range of products, and with over half its sales being made in the United States it is reasonably protected from exchange rate headwinds.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Although most analysts see Verizon as only a hold, I rate it a buy at its current $41.50 with a short-term target of $45. I prefer it to AT&T, which I rate a hold awaiting better news. However, as I commented in 2021, these are both stocks for dividend seekers and one should not worry too much about short-term share price movements.

Last year I feared that $120 might not hold as a floor for Boeing shares. That view proved to be wildly pessimistic but I still cannot understand the optimism behind the share price rise since the end of September. This looks a good time to take profits.

There are too many uncertainties at Dow to recommend a purchase but those already in will probably want to cling on, taking comfort from the dividend.

I recommended J&J as a buy at $170 three months ago and investors have enjoyed a quarterly dividend since then to make up for the slight slippage in the share price. I stick by my rating.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.