Data watch: UK rates and American confidence

30th October 2017 11:47

by Emil Ahmad from interactive investor

US

Last Tuesday's US Manufacturing PMI provided food for thought. Wall Street reacted positively to the index hitting a nine-month high, its 54.5 reading indicative of an expanding sector. Although this exceeded forecasts by 1 point, it failed to ignite a greenback rally.

The Services PMI figure was also similarly upbeat, providing additional market optimism, driven by an improvement in the domestic economy and higher levels of client expenditure. Considering this second fastest expansion rate since Q4 2015, IHS Markit noted that the positive backdrop showed “…that private sector firms are gearing up for sustained growth in coming months.”

Durable Goods Orders (MoM) received a significant boost on Wednesday as they beat September forecasts and heightened manufacturing sector bullishness, and Core Durable Goods Orders came in 0.2% above expectations.

It would appear that the housing recovery is once again in the ascendancy, with the Commerce Department reporting the annual pace of New Home Sales rose to 667,000, obliterating the 555,000 estimate. This soaring market is enjoying an 18.9% month-on-month rise, with an annual expansion of 17% similarly encouraging.

All attention Friday turned to the Q3 GDP release, as the annualised growth rate of 3% over the period beat forecasts by 0.5%, despite two hurricanes.

UK

The CBI Industrial Trends Survey (Orders) pointed towards a lower level of business optimism. As manufacturing growth weakened in the three months to October, demand for domestic and export orders is diminishing. With Brexit uncertainty weighing heavily on the sector, investment intentions for the forthcoming year became increasingly subdued. However, investment in training and innovation remained on firmer ground.

Wednesday provided the focal point of the week's economic calendar, with GDP (QoQ) (Q3) moving 0.4% higher over the period. The Brexit effect ensures the UK lags well behind the Eurozone's decade-high growth rate of 2.2%. A lack of progress in the EU divorce negotiations could further stall corporate investment in the coming months. The government maintained its positive rhetoric, as Chancellor Philip Hammond stated that this GDP growth characterised a "…resilient economy which is supporting a record number of people in employment."

Two key releases for the week beginning 23rd October

UK

Thursday 2nd November: Bank of England interest rate decision

This vote on where to set the Bank's base rate of interest is arguably the most important event on the economic calendar. This decision rests with the Bank's Monetary Policy Committee (MPC), tasked with assessing which rate of interest will best meet the inflation target (2%).

The MPC consists of nine members, specifically the Governor, the three Deputy Governors for Monetary Policy, Financial Stability and Markets & Banking, the Bank's Chief Economist and four external members chosen directly by the Chancellor.

The four independent members ensure that the MPC is the beneficiary of a comprehensive knowledge base not limited to central bank expertise.

It would be difficult to overstate the importance of interest rate policy on the economy. The primary objective of setting interest rates is to keep the supply and demand of goods and services in approximate equilibrium. By influencing economic activity in this manner, the Bank's inflation target should be attainable. If demand exceeds supply, prices and therefore inflation will typically rise. The converse is true when there is oversupply as inflationary pressures normally drop.

A change in base rate will fundamentally influence borrowing and lending rates offered by commercial financial institutions and by extension, consumption expenditure.

Lower interest rates stimulate spending as they are better for borrowers than savers. By reducing savings income and interest payments on debt, lower rates have implications for individual and corporate cash flows. Borrowers have a higher propensity to spend excess funds than lenders, which translates to higher levels of aggregate spending in the economy. The above scenario is reversed when interest rates are raised.

A change in the base rate affects all aspects of the economy. Here are a few key examples:-

• A rate rise makes sterling more attractive for overseas investors relative to other currencies. The subsequent inflows should strengthen sterling, thus helping importers and making exporters less competitive.

• Interest rate policy can affect spending habits and economic activity. This will filter through to employment and affect wage costs, as it fundamentally effects supply and demand. Potential wages increases will be majorly influenced by employers' expectations of inflation.

• Producers' costs will be effected through wage changes and charges associated with factors of production. These cost changes will ultimately rest with the end user – the consumer.

• FX traders will pay close attention to rate changes, as short term interest rates are the primary driver of currency movements.

• The traditional relationship between interest rates and fixed income instruments is one of inverse correlation. This means when interest rates go up, bond prices go down and vice versa.

Although we may not always fully appreciate it, interest rate changes affect us in our day-to-day lives. Consider the following examples:

• A higher base rate is likely to be accompanied by a corresponding increase in interest rates offered by our banks building societies. This is good news for savers but bad news for borrowers, the most obvious example being a potential increase in mortgage payments.

• A hike in interest rates would typically be most beneficial to pensioners as they have the highest cash savings per capita.

• If interest rates rise, property prices may fall as the more prohibitive costs of mortgage financing could reduce demand.

• A tightening monetary cycle will impact equity prices. Some share prices may rise, while others may fall for reasons such as higher corporate financing costs.

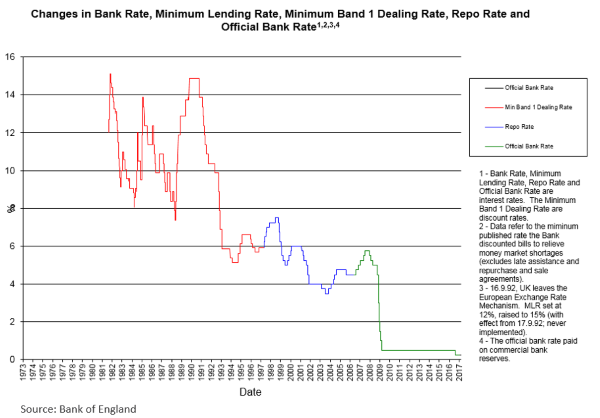

Bank of England base rate chart

The market has priced in a quarter point rate rise in November. This would represent the first increase in the base rate since 2007, when the full ramifications of the financial crisis were starting to be felt. It would seem that the era of ultra-accommodative monetary policy is over, with a rise from the historically low 0.25% rate imminent.

As inflation finally hits 3% and the economy remains on the right side of the contraction-expansion divide, calls for a tightening phase are growing. However, it is important to remember that even if it does increase to 0.5%, this would be consistent with the base rate between 2009-2016. Any increase in rates is likely to be very gradual, as Brexit uncertainty could still tip the UK into recession.

The Bank of England has stated that rates will not return to their pre-crisis levels of approximately 5%. In any case, growth remains weak and many economists believe that a rate hike is not necessary at this point.

US

Tuesday 31st October: Conference Board (CB) Consumer Confidence Index

Although the Federal reserve is also announcing its interest rate decision this week, the CB Consumer Confidence Index is a notable Tuesday release. As the survey name indicates, this assesses the degree of confidence consumers have in the economy. The survey also considers consumers' outlook on present and future business conditions, employment and expected family income.

As consumer consumption drives GDP in developed countries, these surveys are vital indicators of economic activity. Bullish consumers tend to spend more which has positive ramifications for economic growth.

Additional factors to consider about consumer confidence indicators:-

• In addition to reflecting consumers' thoughts about the overall health of the economy, these surveys also act as a measure of confidence about people's income stability.

• Consumer confidence normally has a positive relationship with the economy. In other words, when the economy expands, confidence grows. Conversely, an economy in recession will experience decreasing levels of consumer confidence.

• These indicators can effect different groups within the economy who may amend their plans accordingly.

• Lower levels of confidence and its associated impacts on consumption may lead to inventory reductions in the manufactory sector, less lending by banks and housebuilders may prepare for less construction activity.

• Weakening consumer confidence may lead to the government reassessing fiscal policy as they consider the implications of lower tax revenues.

• In contrast, growing levels of confidence may drive manufacturing activity, hiring rates could pick up and provide a welcome boost to housebuilders and construction as a whole.

The index declined slightly in September to 119.8, down from August's reading of 120.4. Confidence in Texas and Florida decreased significantly after the devastation caused by Hurricanes Harvey and Irma.

Generally, confidence around current conditions is quite positive, indicative of expectations supporting economic growth at its current rate. The outlook for the labour market was more upbeat than August, with expectations for rising hiring rates in the months ahead increasing by almost 3%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.