Data watch: Services, industrial production, US jobs

4th December 2017 12:21

by Emil Ahmad from interactive investor

UK: the economic week in review

With the EU divorce settlement dominating media headlines, economic releases have taken a back seat. The Bank of England Financial Stability Report provided some positive news. All seven UK lenders passed the 2017 stress tests, representing the first clean sweep since it was introduced in 2014.

The days of shop deflation appear to be behind us, as Wednesday's BRC Shop Price Index release showed. Prices were down by only 0.1% in November, the slowest deflation rate in four years. Mortgage Approvals and Mortgage Lending were both down in October, which could signal the start of a market downturn.

A bright spot in the week was Friday's Manufacturing PMI figure. The survey spiked to 58.2 as new orders saw an upswing, representative of the best growth in four years.

US

New Home Sales smashed forecasts by 60,000 and hit a 10-year high. Another bullish indicator was Tuesday's House Price Index figure, with the indicator reporting a 6.2% advance and rising at the fastest annual rate since June 2014.

Confidence is soaring for US consumers, with the CB Consumer Confidence Index rocketing to 129.5 in November, the best read since 2000. The Richmond Manufacturing Index also hammered forecasts as growth remains "robust".

GDP growth hit a three-year high at a 3.3% annualised rate. Maybe there is yet some life in Trumponomics as this exceeded the President's 3% target. Friday's ISM Manufacturing PMI is still very much in expansionary mode.

UK: the economic week ahead

Tuesday December 5th

Services Purchasing Managers' Index (PMI)

On Tuesday, we will be able to assess the health of sales and employment in the services sector with the monthly CIPS/Markit PMI release. This index reflects the views and outlook of services sector firms across the UK. A reading exceeding 50 is indicative of a sector in expansion whereas the opposite is true of a reading below 50.

Purchasing managers will have access to corporate performance information prior to the publication of 'hard' data. Consequently, these surveys are of great interest to traders and industry officials.

October's read beat market estimates by over 2 points, coming in at 55.6. A pickup in new order growth primarily drove the advance, with the sector enjoying the fastest expansion in activity in six months. Domestic demand and new product launches were also positive drivers, contrasting with job creation hitting a seven-month low. The forecast for November is 55.

The services sector represents around 80% of UK GDP. It's also a leading indicator, a quantifiable economic factor that changes before the economy establishes a new trend.

As countries evolve into developed nations, this is accompanied by a transition from manufacturing to services. This economic transition describes 'tertiarisation', the process developed nations have experienced over the last 100 years.

In 1948, the UK services sector accounted for under 50% of GDP, a stark contrast to today's figure of approximately 80%. The UK has a very high reliance on the services sector in comparison to other G7 nations. While this absolute services sector dominance is shared by the US and France, Germany has a far lower figure (69% OECD estimate in 2014).

We can see just how vital the services sector is to the UK's economic health by considering the last decade. The sector led the UK's economic recovery after the 2008 financial crisis, with output rising above pre-downturn levels in 2012. In contrast, other sectors have struggled massively by comparison with industrial production and manufacturing output remaining below pre-crisis levels in 2017.

Friday December 8th

Industrial Production

At the end of the week, economists will sink their teeth into Industrial Production data. It's collated by the Office of National Statistics and as a sub-sector of manufacturing, specifically focusing on the value of the total inflation-adjusted output of UK factories and mines.

As a vital component of the manufacturing industry as a whole, changes in industrial production are regarded as a major indicator of general sector strength. Higher readings will support sterling whereas lower readings may drive the pound lower.

Despite Brexit headwinds, the sector is weathering the storm for now. Total month-on-month industrial production for September was up 0.7%, the fastest rate of growth since Q1. The 2.5% year-on-year gains presented a similarly upbeat picture, bettering the expected improvement by 0.6%. The monthly rise of 0.7% matched manufacturing production gains, consistent with a cautiously bullish industrywide outlook.

October's figures are anticipated to show a sector maintaining its expansionary phase, albeit at a slower monthly rate of growth. The month-on-month gains are forecast to drop to 0.2%, whereas the annualised reading is expected to surge to 3.7%.

Although the UK's economy is dominated by the services sector, industrial production remains an essential element of GDP and provides significant feedback about overall economic output, irrespective of the business cycle. The industrial sector has expanded over the last 70 years in the UK, growing by an average of 1.4% annually since 1948 (recent ONS report).

Trade Balance

The UK Trade Balance measures the monetary difference between exports and imports over the reporting period. If a country exports more goods and services than it imports, it is said to operate a trade surplus. Conversely, if imports exceed exports, the country runs a trade deficit. GBP can be subject to significant volatility on the back of this release, with an increase in demand for exports likely to be positive for the pound.

The UK is very much in the latter camp and operates a deficit. However, October's figures came in well below expectations, with an actual deficit of £11.25 billion versus a forecast of £12.8 billion. We only need to look at the well-publicised Brexit figures to gain an understanding of our domestic dependence on imports; in 2016 about 43% of total exports went to the EU as compared to a 54% import equivalent.

On a very basic level, a weak pound does not necessarily help our economy in this sense. It may inflate FTSE 100 earnings but it increases import costs for our corporations. These higher input costs may facilitate the need to put expansion and investment plans on hold. Consequently, this can filter through to the employment market and may result in job losses and less new positions being created.

However, it is not necessarily all doom and gloom. A weaker pound makes our exports more competitive and this could help redress the export-import imbalance. Additionally, the subsequent GBP crash has made the UK a more popular tourist destination. Foreign currencies will be worth more in GBP terms and this will increase tourists' purchasing power on our shores. The economy has been benefitting from an influx of tourists and the associated levels of consumption.

Our currency predicament has far wider implications than shopping sprees for visitors. For example, a weaker pound may make corporate investment a more attractive proposition. This could theoretically lead to increased levels of FDI and the takeover of UK companies by foreign entities. However, Brexit and the associated political and economic uncertainty makes this equation far more complex.

US

Friday December 8th

Unemployment Rate

Friday's Unemployment Rate release is the big one this week. Produced by the Bureau of Labor Statistics, this assesses the proportion of the work force which is not presently in employment but is actively seeking opportunities.

An economy in recession will see higher levels of unemployment whereas a tighter labour market is enjoyed in expanding economies. In conjunction with Non-farm Payrolls data, a decrease in the unemployment rate may provide upwards momentum for the dollar. The reverse is true.

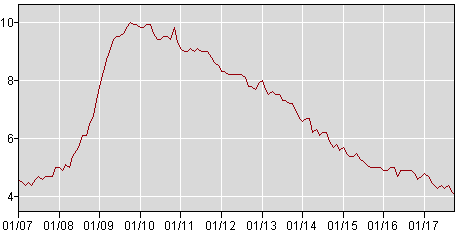

After a contraction in employment levels in September, Non-Farm Payrolls rallied strongly in October despite falling short of expectations, with 261,000 new jobs added to the economy. The unemployment rate dropped to 4.1% in October as the market recovered from September's hurricane headwinds.

There is expected to be little change for November, with estimates pointing towards a 4.2% unemployment rate.

US unemployment rate (source: Bureau of Labor Statistics)

Work provides people with spending power and the ability to consume, which drives most developed nations' GDP growth.

A tighter labour market should ensure skilled workers become a scarcer commodity, causing greater competition for staff. That translates to higher wages, improving individuals' marginal propensity to consume. In developed markets like the US, the more disposable income an individual has, the higher the proportion that will be allocated to personal consumer spending.

Once again, a strong employment market has implications for monetary policy. Low unemployment is usually reflective of an economy in expansion. As GDP growth and inflation normally go hand-in-hand over the long term, the Fed would probably be more hawkish about interest rate rises in this scenario.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.