Costco: a stock you might want to own in bulk

Members adore Costco's stores and investors love its returns. In this analysis, Theodora Lee Joseph breaks down its no-fuss, savvy business model – and takes a hard look at its stock.

8th November 2024 09:04

by Theodora Lee Joseph from Finimize

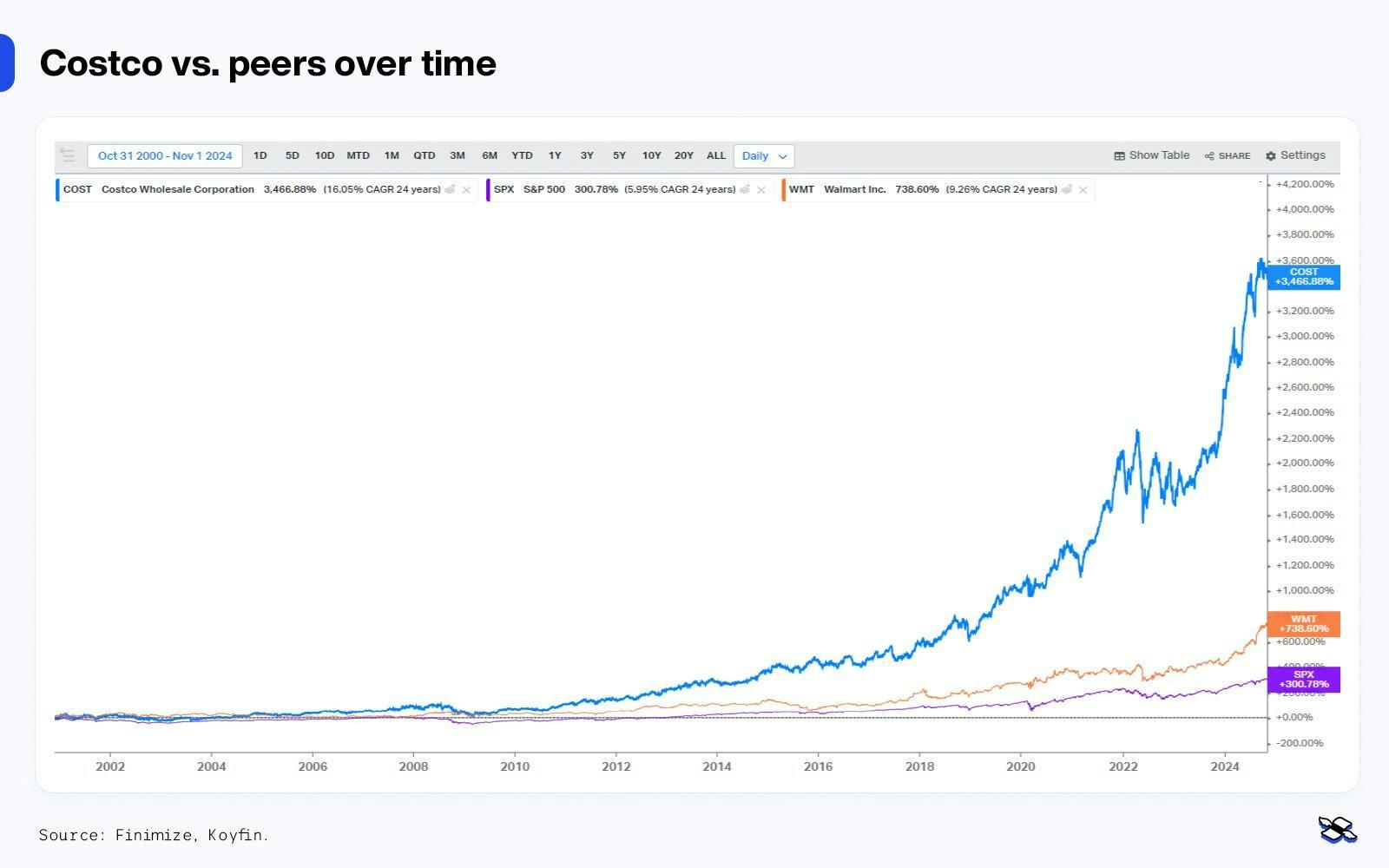

Imagine snagging Costco Wholesale Corp (NASDAQ:COST)’s stock back in 2000 and watching your investment grow 30 times over in less than 25 years. When we think of “multi-baggers”, grocery stores aren’t the first thing to spring to mind – it’s usually trailblazing tech firms like Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT)t, and NVIDIA Corp (NASDAQ:NVDA). But great investments don’t always hinge on innovations or complex business models. Sometimes the best companies thrive by keeping things simple – and Costco is a perfect example.

In this analysis, I’ll explain the firm’s no-fuss, clever business model and show why high-quality firms like this tend to grow in value over time. I’ll also walk through how to assess a resilient compounding stock like Costco, checking out what’s already priced in and what it means for today’s investors.

Costco (blue line), Walmart (orange), and the S&P 500’s (purple) total return over the last decade. Source: Finimize, Koyfin.

Thesis

- The simplicity of Costco’s business model – selling bulk goods at low markups while drawing membership fees – has created a stable, profitable chain with a loyal customer base and high renewal rates.

- The firm’s disciplined approach to expansion – which focuses on selective locations and efficient operations – reinforces its cost advantages, operational scale, and customer loyalty.

- Costco's stock commands a premium, thanks to the predictable nature of its membership revenues, resilient growth rates, and consistent earnings performance. This valuation suggests that investors value the company’s reliable cash flows and strong customer loyalty.

- There is a potential upside to growth from Costco’s recent membership fee increase and card-sharing crackdown.

- Costco’s emphasis on good service, low prices, and customer loyalty has made it a long-term investment with compounding potential.

Risks

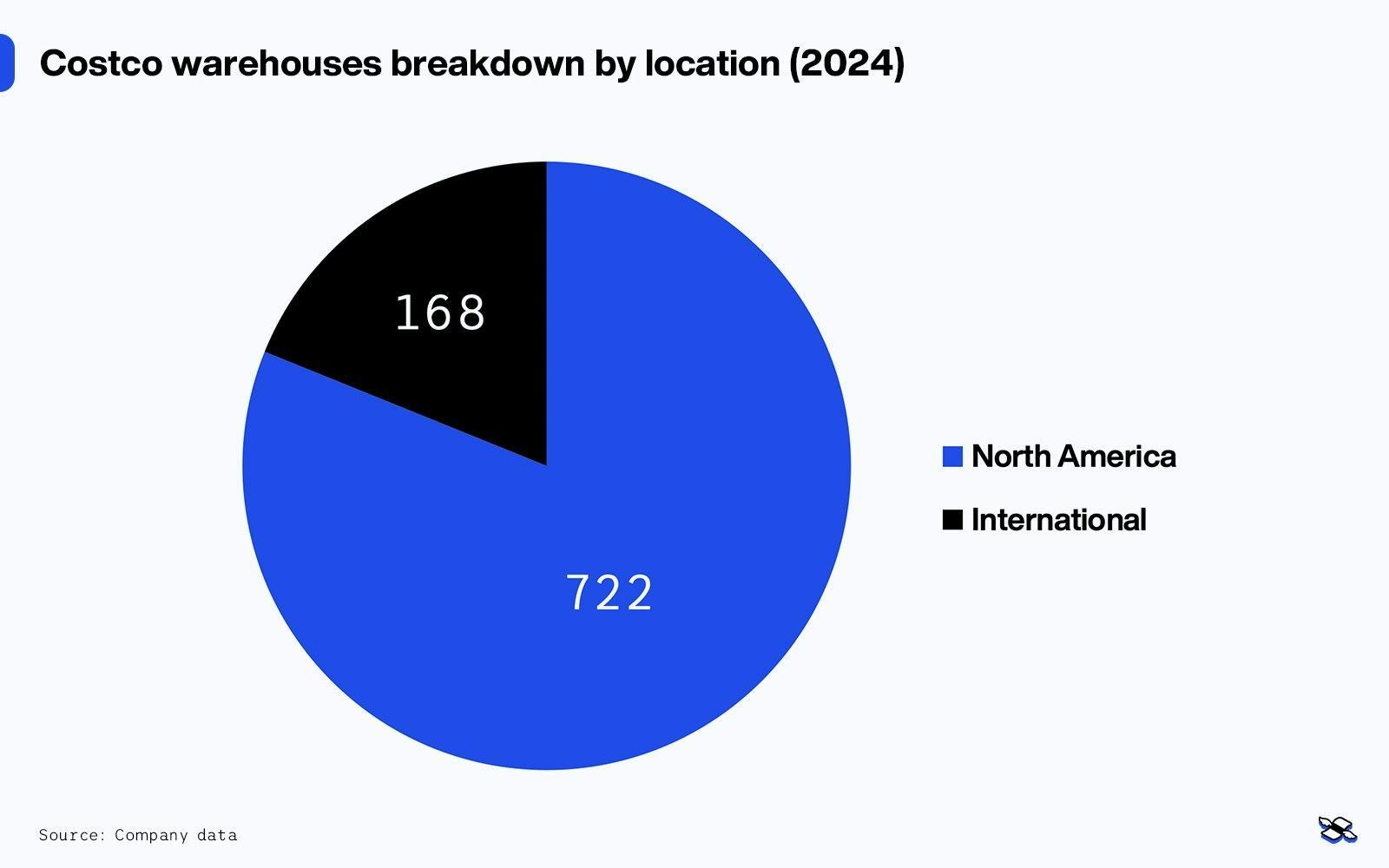

- With most of its revenue concentrated in North America, Costco is vulnerable to changes in the region’s economic conditions or consumer spending patterns. The firm’s ongoing efforts to expand globally haven’t really diversified its revenue base.

- Costco currently trades at a high 50x forward price-to-earnings (P/E) ratio, and has seen some big valuation increases in recent years. That premium requires continued strong performance and market optimism: a slip in expected growth could put downward pressure on its stock price.

- Costco’s short inventory cycle is beneficial for freshness and cost management, but it could expose the company to supply chain disruptions. And though the firm sources most of its products locally, any new tariffs could pressure its bottom line. That said, Costco is one of the companies that’s best placed to weather that kind of upset.

- Unlike many of its retail rivals, Costco has a relatively low e-commerce presence, which limits its reach among online-shopping fans. And expanding its web platform would require a huge investment in logistics, technology, and warehousing infrastructure, which could strain its traditionally low-margin model.

This is a new type of Finimize analysis: detailed research into a single company’s stock, aimed at helping you evaluate a potential opportunity. Let us know your thoughts, and what you’d like to see next.

So, what is Costco’s business model?

In order to understand what makes a company great, you first need to understand its business model (i.e. how it makes money).

Costco runs a distinct and simple retail model focused on members-only access to its big-box stores, where it sells goods in bulk at low prices. And though Costco has grocery and houseware rivals across North America, where most of its stores are located, its approach gives it a major edge.

Costco warehouse locations in 2024. The firm’s revenues are predominantly based in North America. Source: Company data.

Here’s what sets it apart:

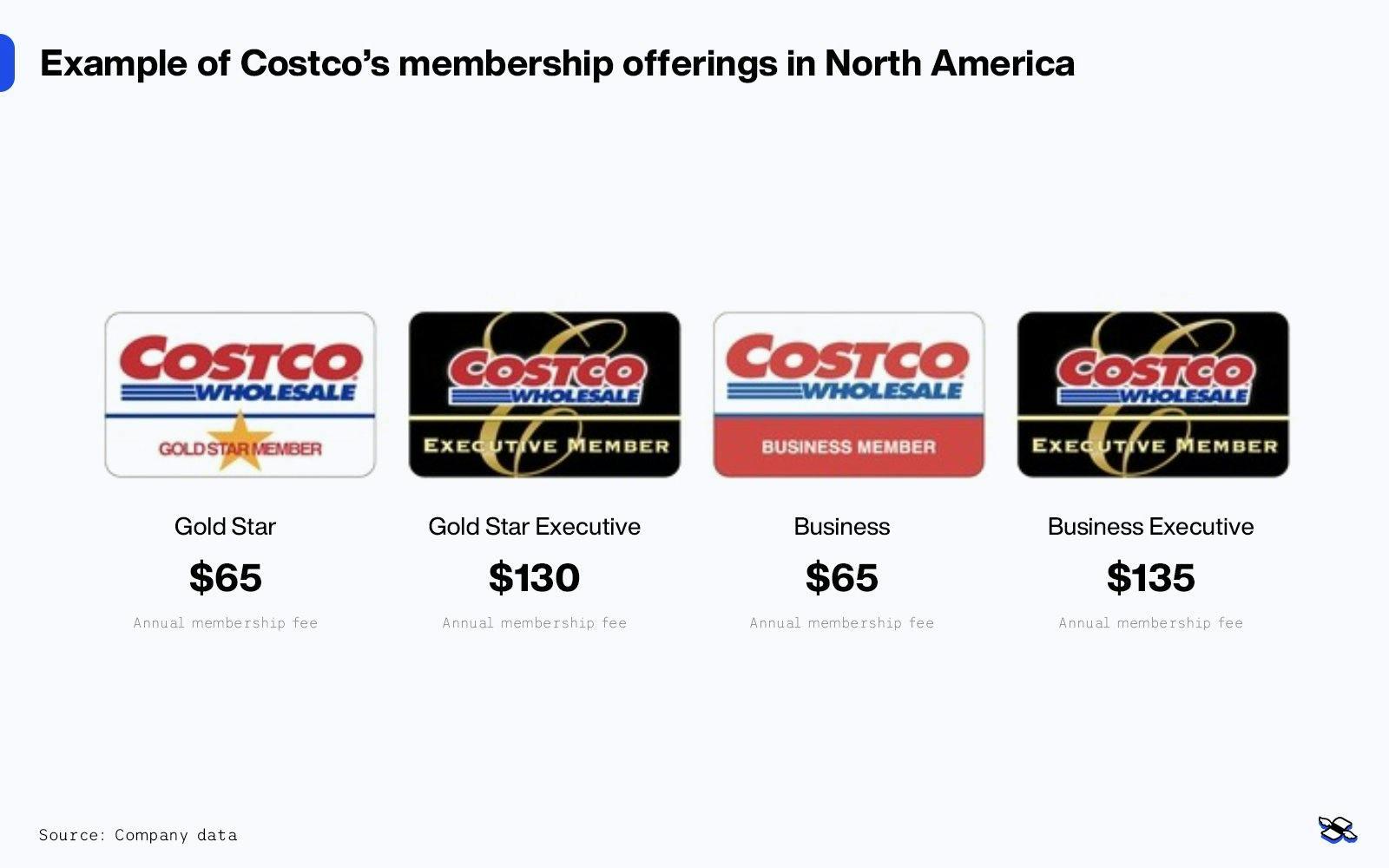

Its membership structure. Costco’s business revolves around memberships, which grant customers yearlong access to its stores for an upfront fee. In short, you have to pay for the privilege of shopping at Costco. And this membership fee isn’t some little side benefit for the firm: it’s a central part of the profit model.

Example of Costco’s membership offerings in North America. Source: Company data.

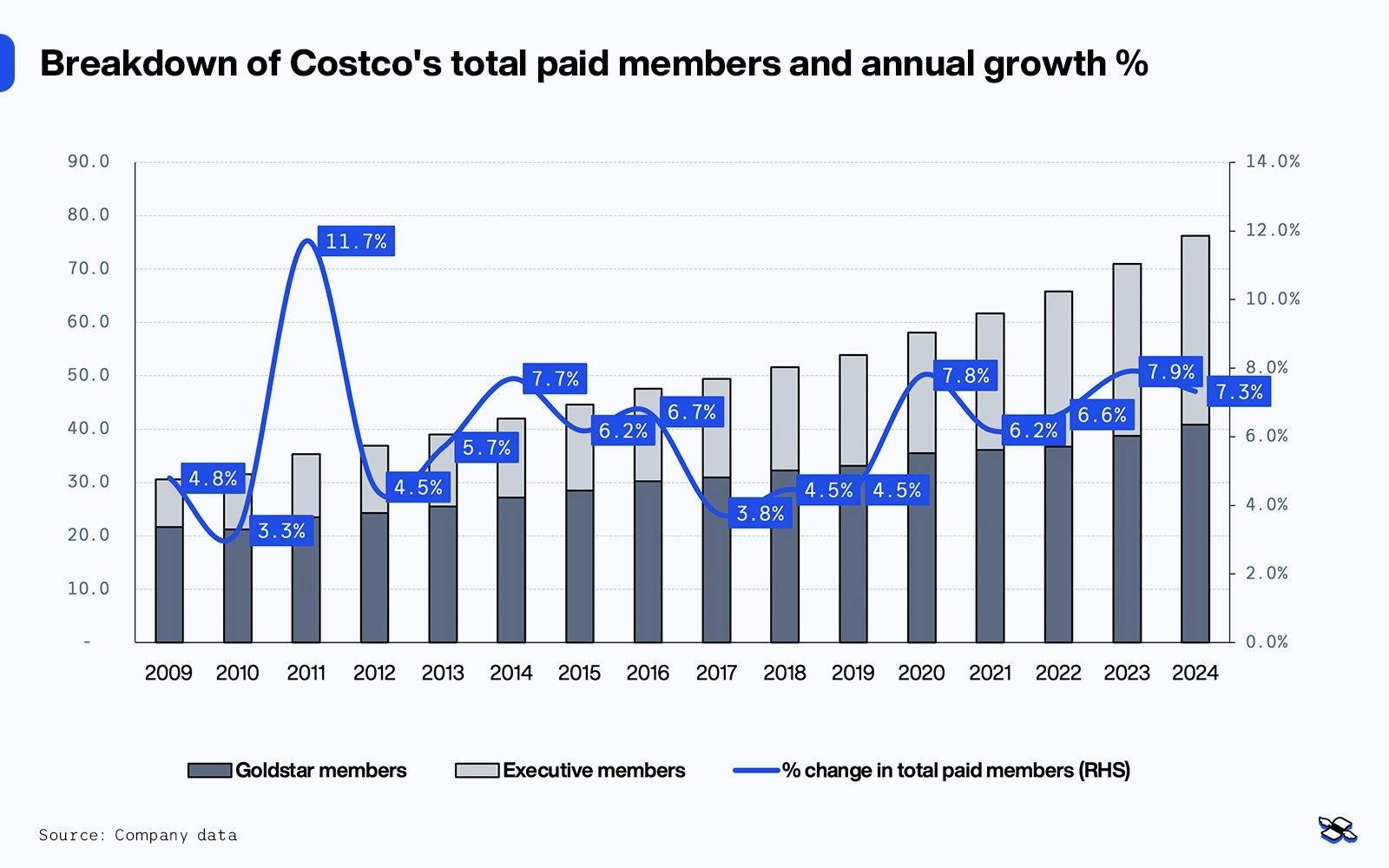

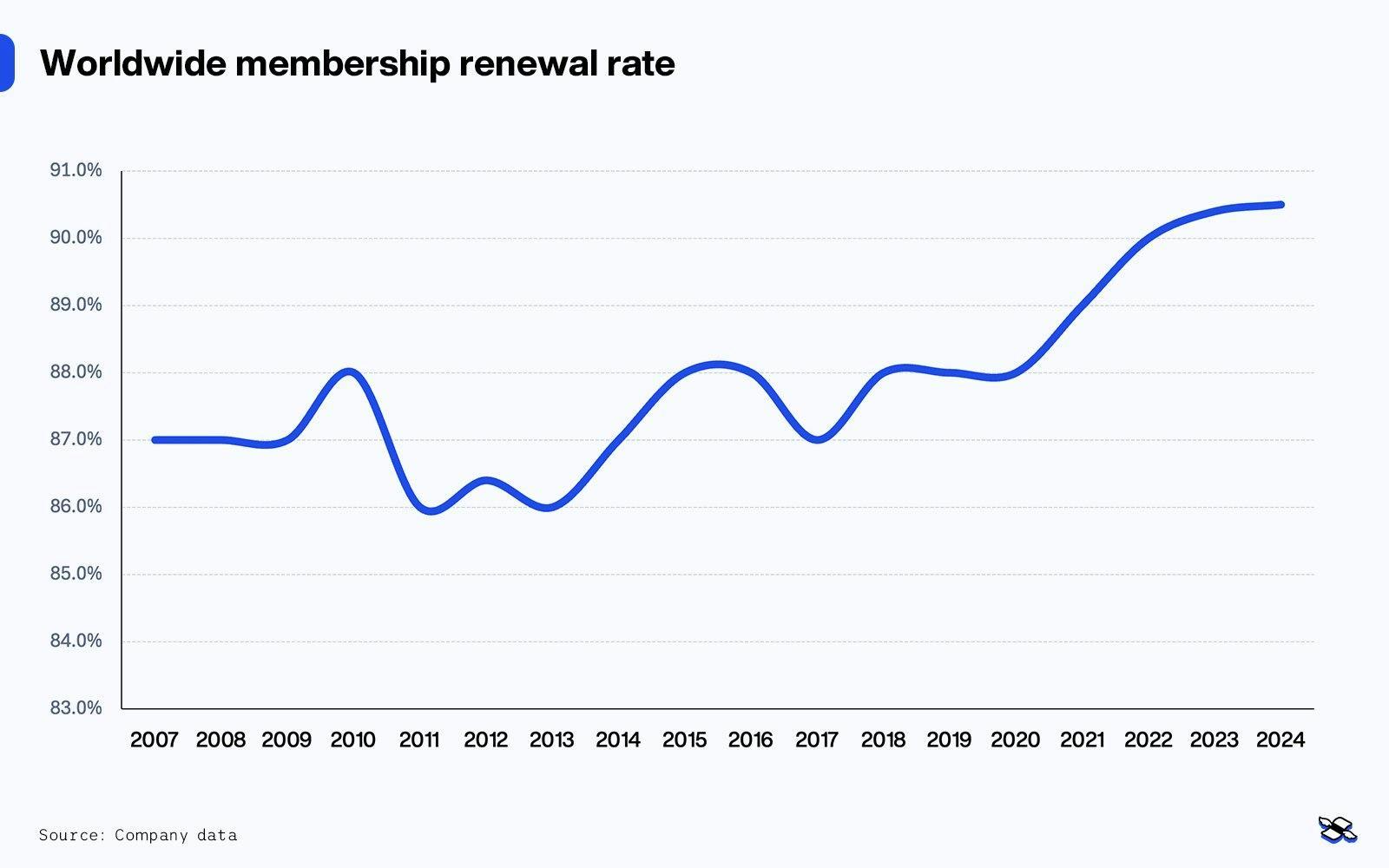

While many retailers focus on product markups for profit, Costco mostly relies on the steady revenue from its memberships. Customers are incentivized to shop often (and spend freely) to make the most of the investment and earn money back. This fee-based model has created a committed customer base with a stunning renewal rate that’s consistently around 90%. What’s more, the company has also seen an average of 6.2% annual growth in total paid members since 2009.

Breakdown of Costco’s total paid members by year and annual % growth (RHS). Source: Company data.

Costco has consistently improved its membership renewal rate over time. Worldwide membership renewal rate from 2017. Source: Company data.

Bulk sales and limited selection. Unlike traditional supermarkets with aisles and aisles of options, Costco keeps its selection intentionally limited. It offers fewer than 4,000 items compared to tens of thousands at other retailers. This limited stock-keeping unit (SKU) strategy allows Costco to make high-volume purchases of fewer products, with better pricing from suppliers and lower logistical costs. Bulk buying ensures Costco’s customers get the best deals on huge quantities, which saves money and fuels repeat visits from members who see value in stocking up.

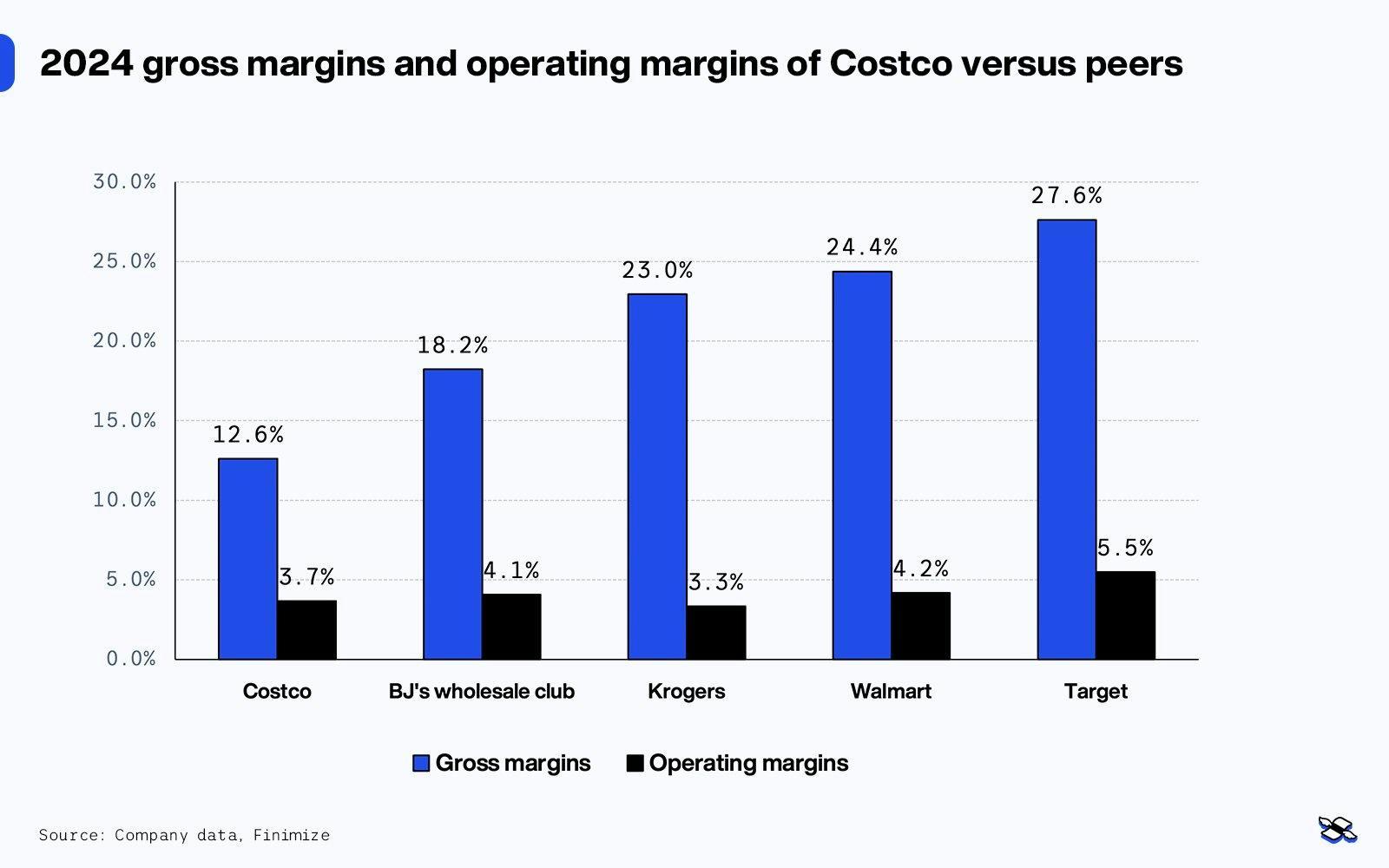

Profit through membership, not markups. This is where the firm sets itself apart: rather than heavily marking up products, Costco sells near “cost” prices. And it follows certain pricing limits – no brand-name item is marked up more than 14%, and its private-label Kirkland Signature brand is capped at 15%. This low mark-up strategy is reflected in Costco’s industry-leading low gross margin. Yet, despite its slim gross margin, Costco achieves strong operating margins comparable to competitors, thanks to its impressive efficiencies – particularly in keeping sales, general, and administrative (SG&A) expenses low.

2024 gross margins and operating margins of Costco vs peers. Source: Company data, Finimize.

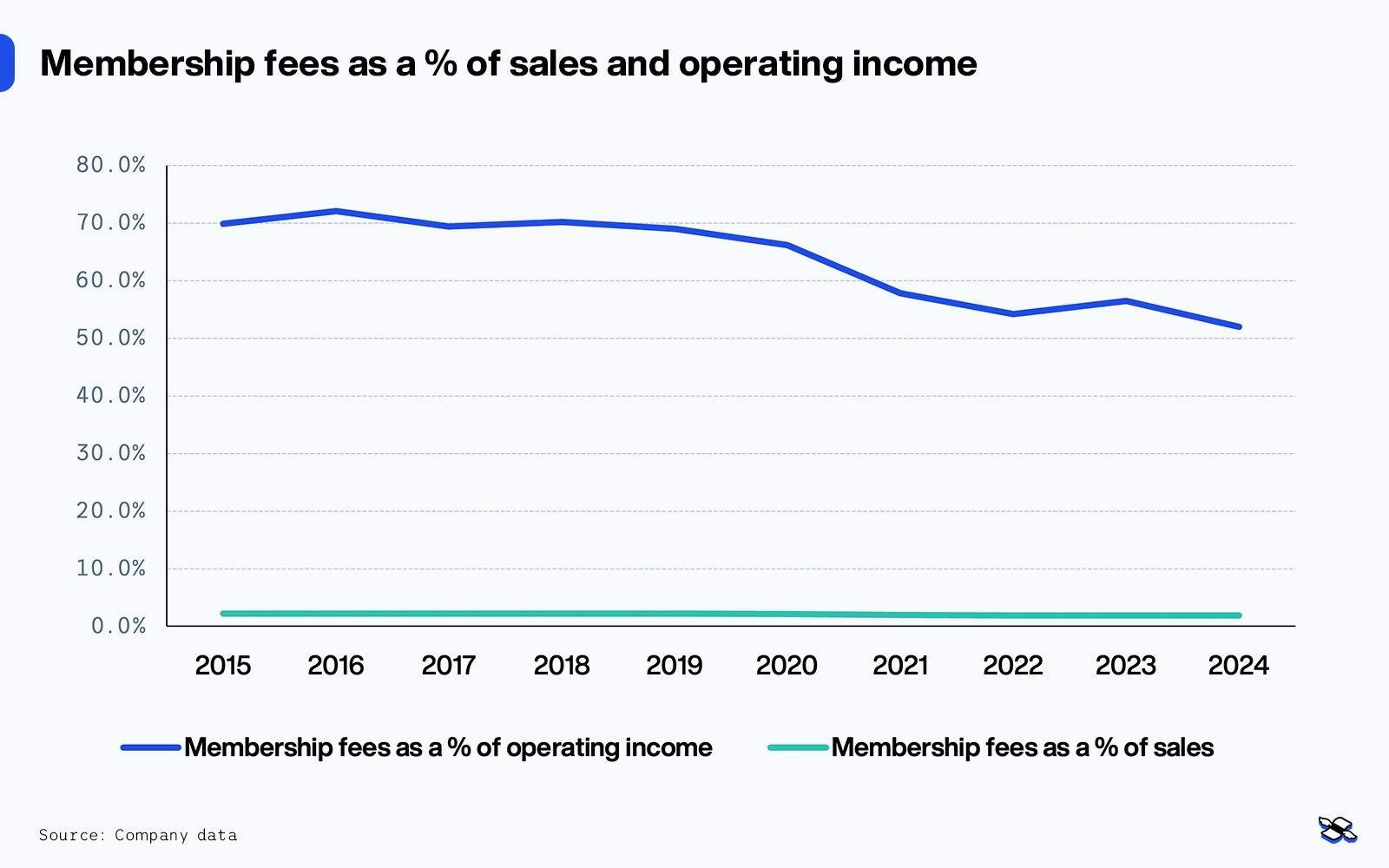

This “selling at cost” approach ensures customers find consistently low prices. But because these sales generate minimal profit, Costco relies on membership fees as a primary income source, with these dues accounting for a significant part of its operating income. Member income is almost pure profit because it involves minimal costs and does not depend on sales volumes or costs of goods sold. In fact, membership fees totaled roughly 2% of Costco’s fiscal year 2024 sales but made up more than half of its operating income. This means Costco’s success is less tied to high product margins and more to adding new members and keeping current ones happy.

Membership fees make up a minuscule proportion of sales but contribute up to half of Costco’s operating income. Membership fees as a % of sales and operating income over time. Source: Company data.

In a nutshell, the business model is about volume over margins, simplicity over choice, and loyalty over one-time sales. It’s a unique approach in retail and a big reason for Costco’s consistent success.

What is Costco worth then?

Some people say there’s never a good time to buy a great company. Great companies command a premium for a reason. That’s true for Costco: it currently trades at a significant 50x 12-month forward price-to-earnings (P/E) ratio, with its valuation multiple seeing considerable expansion over the past decade.

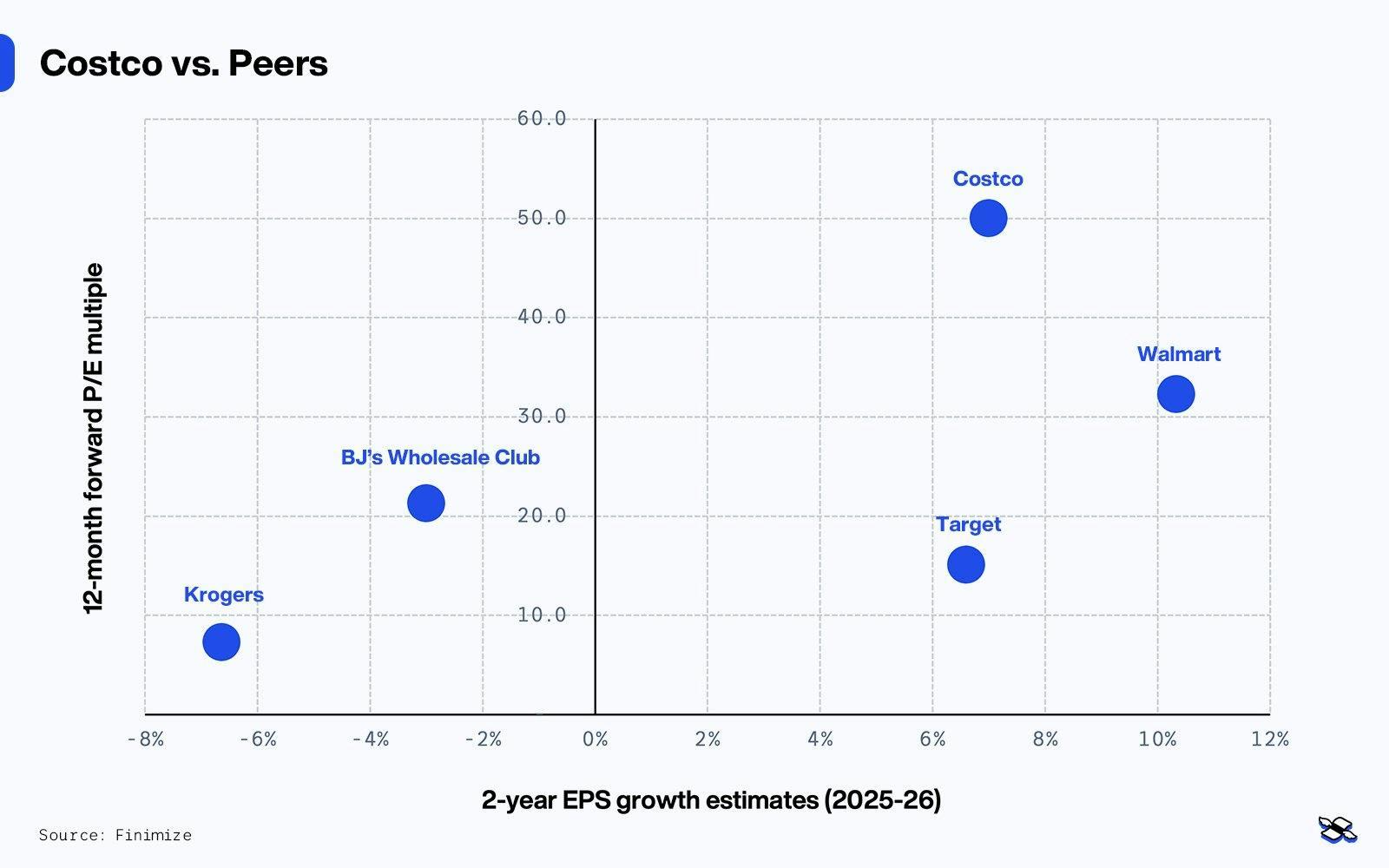

Costco’s growth comes at a premium, for good reason. This scatter chart shows Costco and closest peers, across its 12-month forward P/E multiple and its 2-year EPS growth estimates. Source: Koyfin.

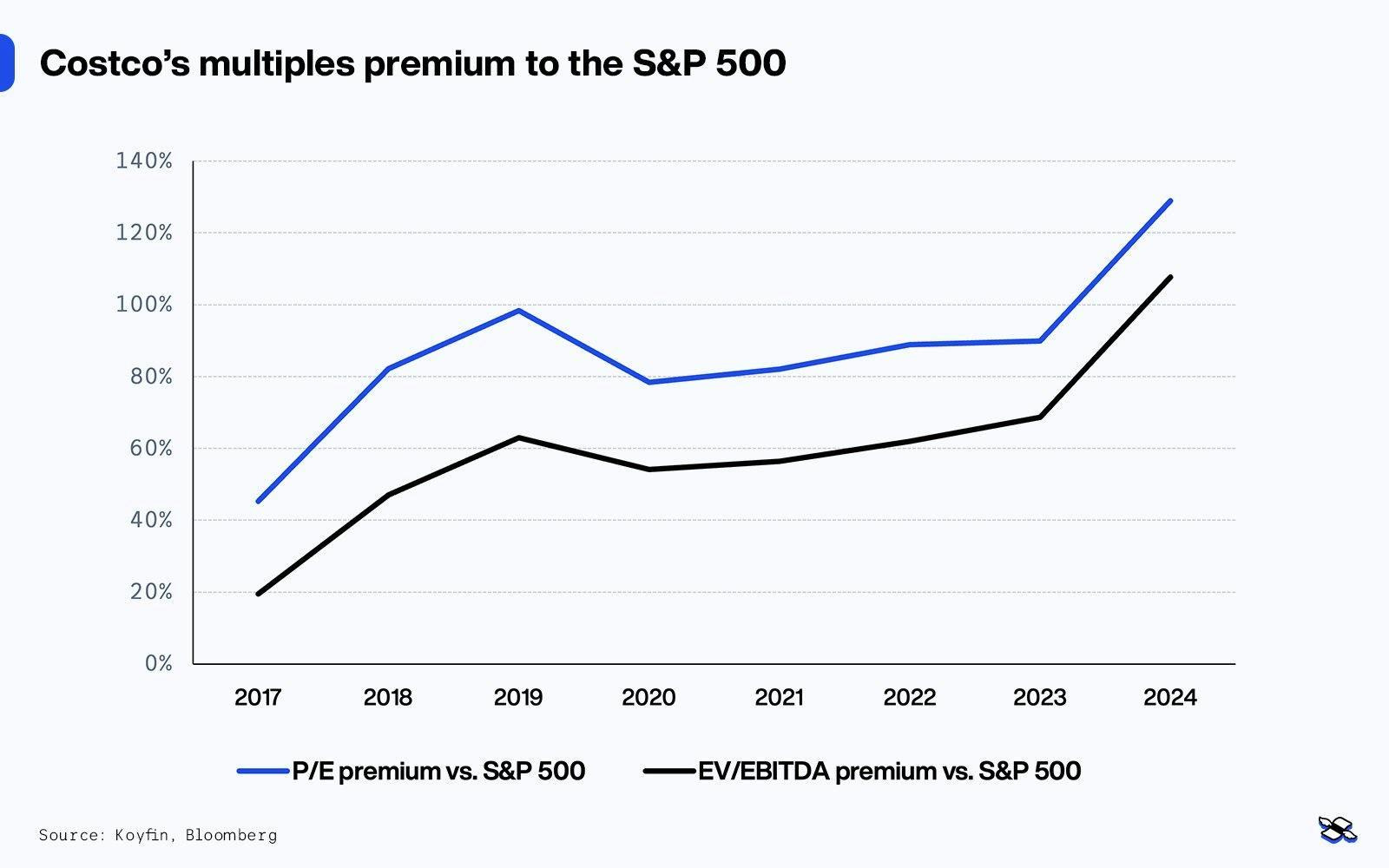

Costco’s multiples premium to the S&P 500 has only expanded over time. Costco’s P/E and enterprise value – that’s enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) relative to the S&P 500 over time. Source: Koyfin, Bloomberg.

Even after adjusting for the broader S&P 500’s valuation increase, Costco’s relative premium has widened by nearly 50% compared to its historical premium since 2018. And that’s without any major shifts in its business model or environment. Still, the pace of this valuation expansion is concerning, as it suggests expectations are being raised to potentially unsustainable levels for the company’s performance over the next five years.

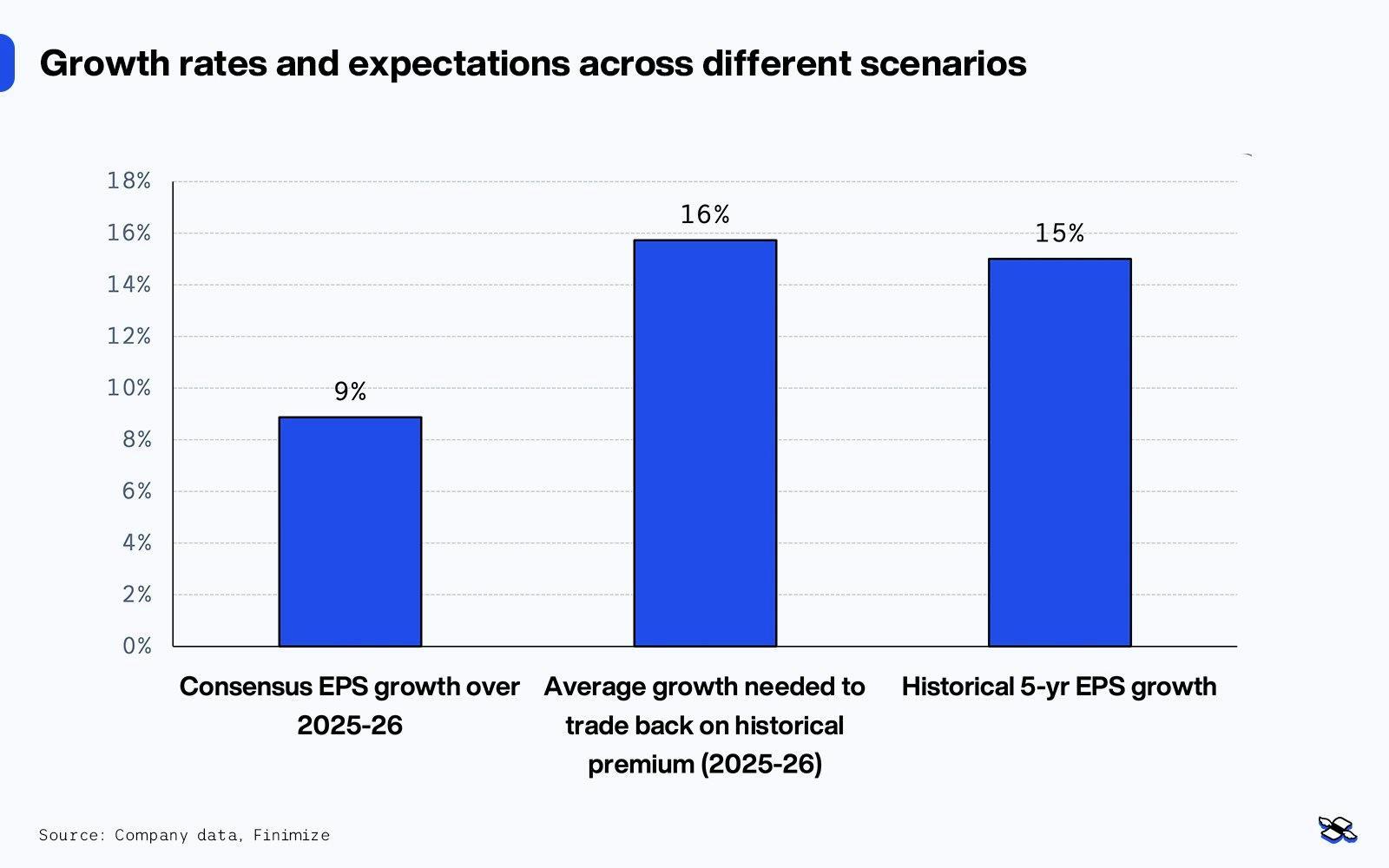

To put this into perspective, Costco would need to achieve earnings per share (EPS) growth of at least 31% next year to return to its historical premium relative to the market of 87%. Since 2017, Costco has averaged around 15% EPS growth, so current valuations suggest that investors anticipate even higher growth next year. Some of this optimism is grounded in recent developments: Costco recently raised its US and Canadian membership fees for the first time since 2017, increasing the basic membership to $65 from $60 and executive membership to $130 from $120 – a nearly 8% price hike that should boost earnings growth in the next two fiscal years. Right now, consensus forecasts project EPS growth of only 7% and 10% for the next two years, leaving room for potential upside.

In addition, Costco has introduced policies to keep outsiders from borrowing cards from their friends or family, requiring membership card scans to enter its North American stores. This change, along with new rules that restrict guest access, has already led to a boom in new memberships, the company says, and the policy rollout is only about halfway complete. Altogether, Costco’s growth outlook for the next two years appears strong, with its historical 15% growth rate seeming attainable – possibly even conservative.

Growth rates and expectations across different scenarios give a hint about what investors are “pricing in” with Costco’s high valuation. Source: Company data, Finimize.

Now, that probably leaves you wondering why companies like Costco trade at such high prices, seeming only to become more valuable over time. And, well, part of the reason for that lies in Costco’s high-quality earnings. Not all growth is valued equally – predictability and consistency matter a lot. With a proven 90% membership renewal rate, nearly half of Costco’s operating income is stable – unlike that of companies in cyclical industries where earnings rely on a seesaw of monthly orders or capital expenditures tied to economic conditions. Costco has consistently grown its EPS each year for the past two decades – with the exception of 2009. The company’s record of annual same-store sales growth since 2000 is matched by only two other retailers in the S&P 500 – O'Reilly Automotive Inc (NASDAQ:ORLY) and The Kroger Co (NYSE:KR).

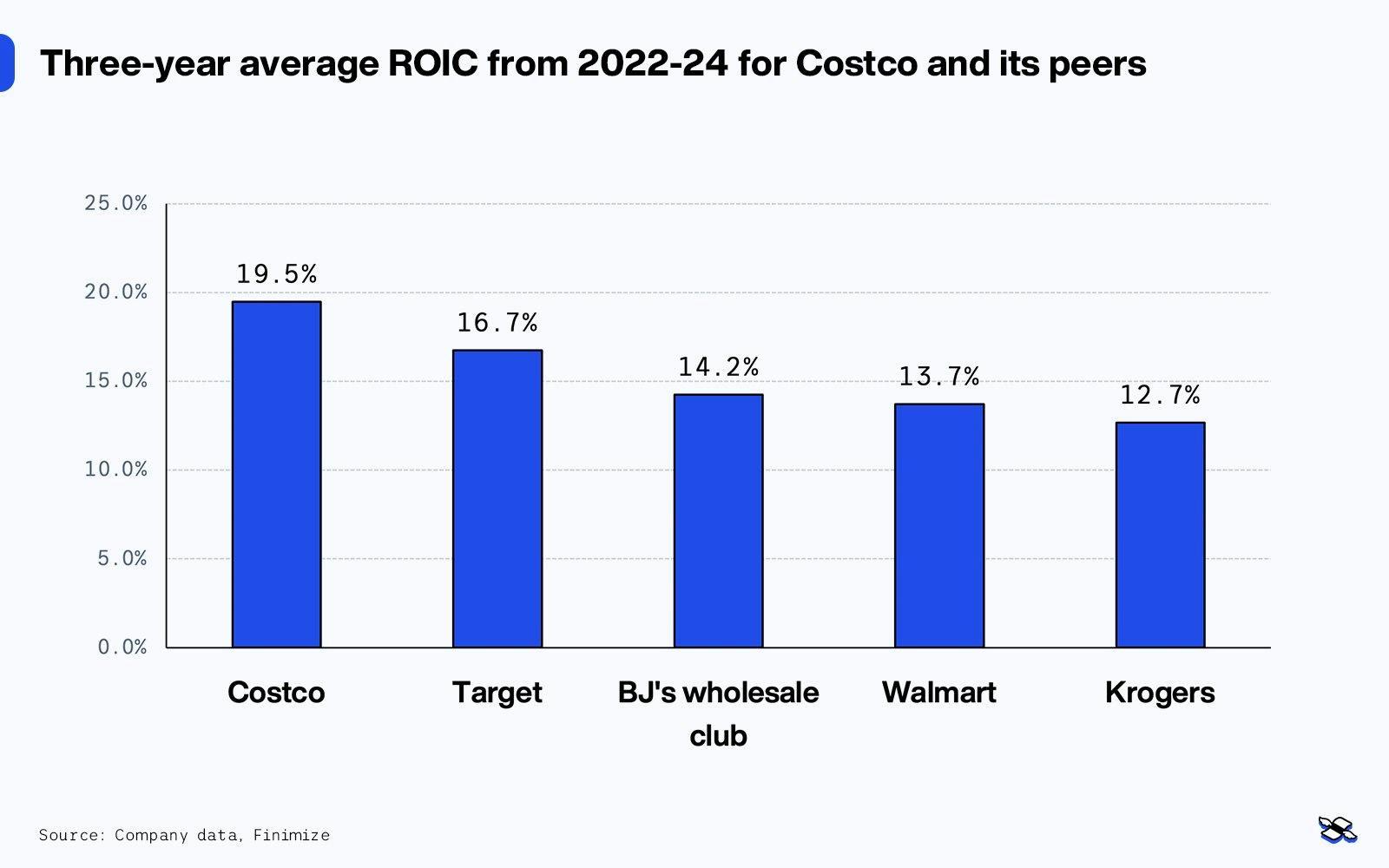

Costco’s industry leading returns explains its valuation premium. Three-year average ROIC from 2022-24 for Costco and its peers. Sources: Finimize, company data.

How does Costco keep ahead of the competition?

Sure, Costco’s stock is pricey, but for good reason: the company has built a near-unassailable competitive edge in cost efficiency and scale that’s hard to replicate. And you can break down that superiority into a few key traits:

It’s got a scale-driven advantage. To go toe-to-toe with Costco, rivals would need to match its scale-driven cost efficiencies – and most can’t. What’s more, Costco’s immense size allows it to negotiate with suppliers for premium discounts and favorable terms. This volume advantage means Costco can buy massive quantities at a lower price per unit – discounts that smaller retailers can’t get. But that’s just one part of its edge.

Call it “quality over quantity”: while traditional stores carry upwards of 30,000 items, Costco stocks around 3,500. This limited product selection lets Costco focus demand on fewer goods, allowing it to order even heftier amounts and secure deeper discounts. The company may be the third-biggest retailer in the US, but on a dollar-per-SKU basis, it ranks as the top buyer for any single supplier – even surpassing Walmart Inc (NYSE:WMT). This gives Costco strong bargaining power to push supplier costs even lower. Fewer SKUs also mean lower handling and inventory costs and a simpler, more efficient supply chain, translating to lower prices on shelves.

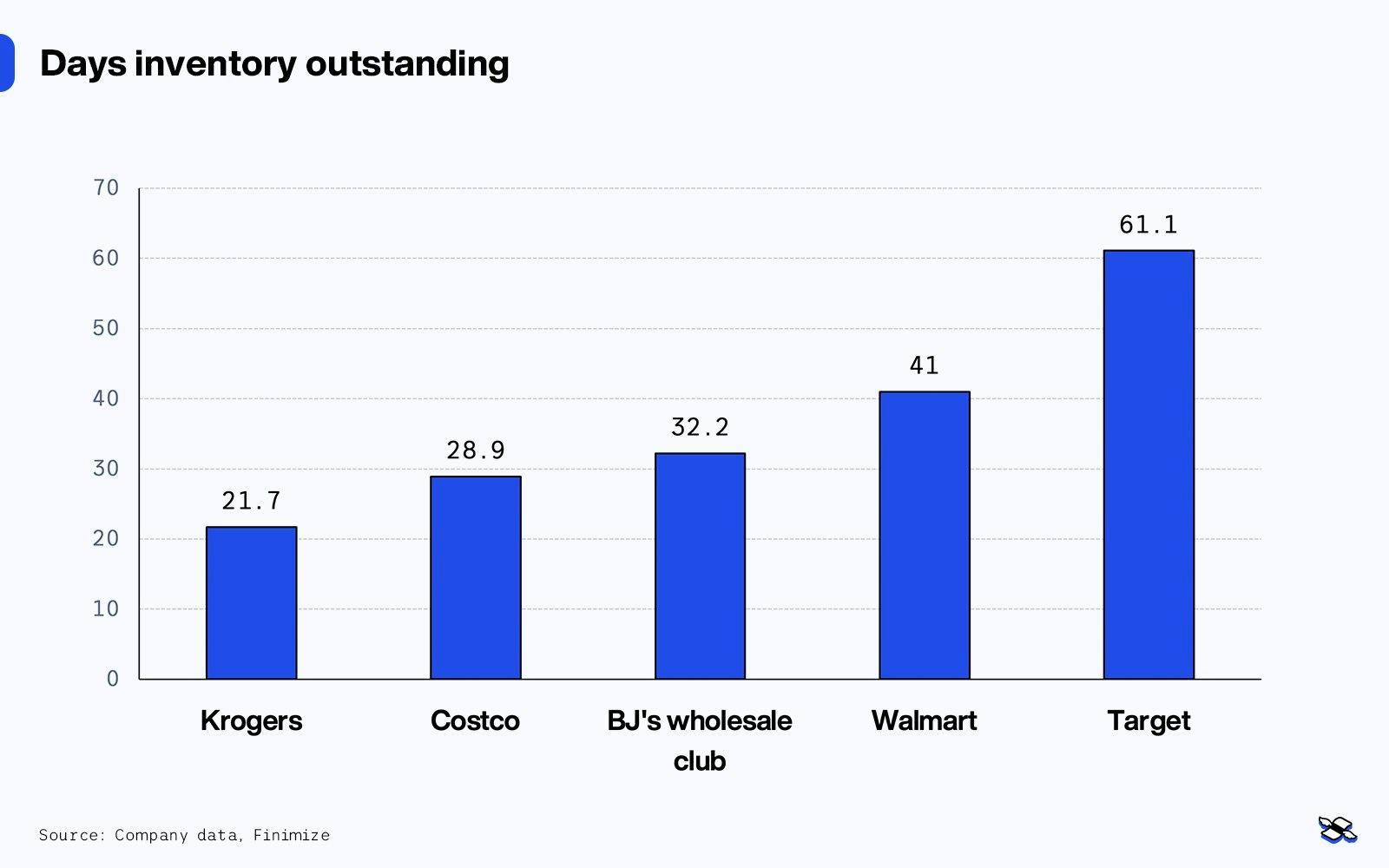

Costco’s scale also allows for quick turnover on its products – its inventory cycle is less than 30 days. And since products move quickly, Costco can pay its suppliers before the month is up, which often secures it an early payment discount. This short cycle also ensures the fresh arrival of new goods and reduced inventory risks, which makes suppliers more willing to offer Costco the best possible terms.

Costco holds inventory on average for fewer days than most of its big rivals. Source: Company data, Finimize

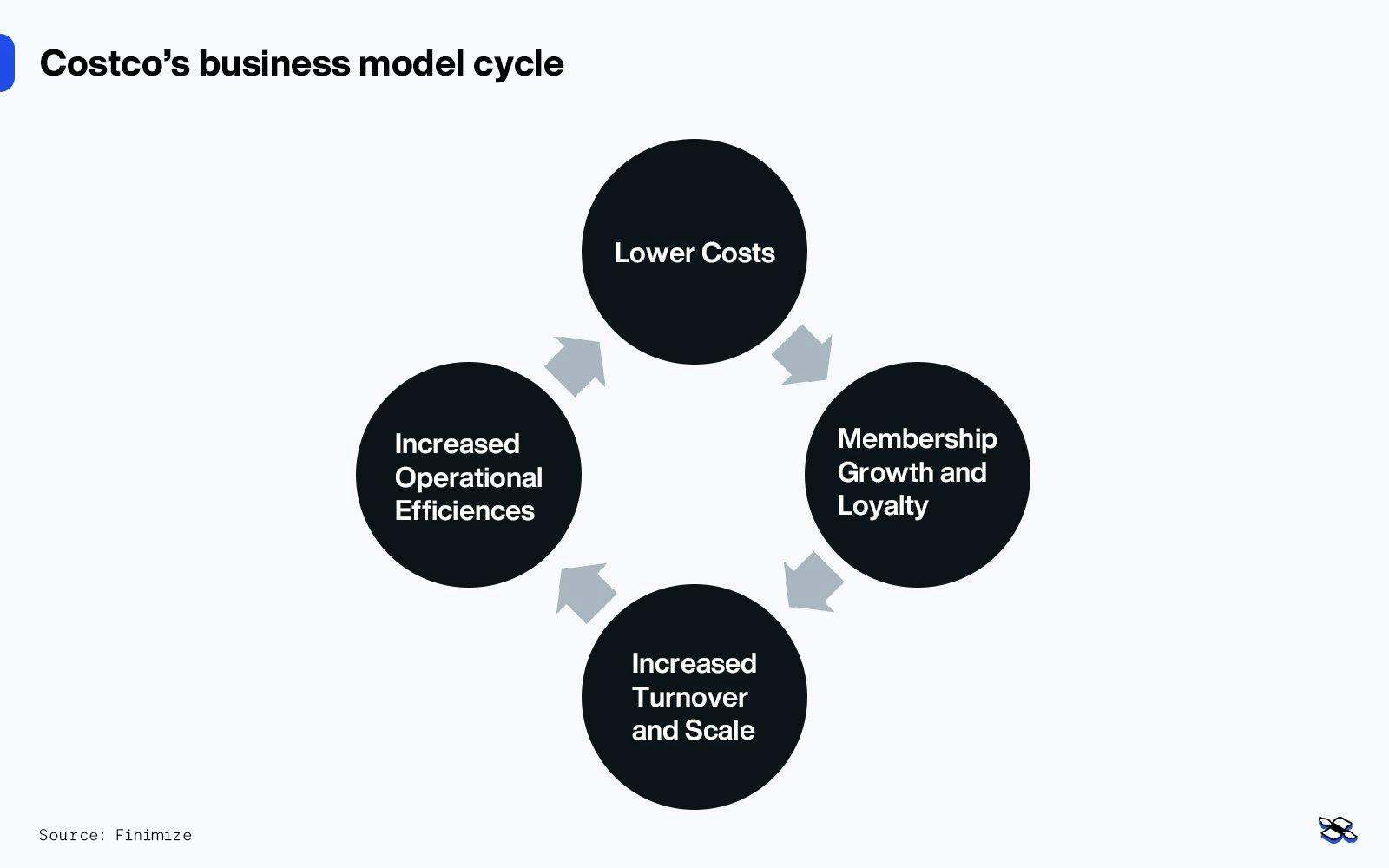

Rather than raising margins, Costco focuses on reinvesting in scale to grow its customer base and boost its member loyalty. This consumer-first strategy further enhances Costco’s muscle, which in turn reinforces its cost advantages. Its approach to new warehouse store openings supports this: the firm has been adding locations without saturating the market or cannibalizing existing sales, with each new store attracting additional customers.

Costco’s business model cycle. Source: Finimize.

Costco’s commitment to employees and customers is another differentiator. The company pays an average of $31 per hour for US hourly workers, about 25% above the national retail average. The policy shrinks turnover and keeps experienced employees in house – with many of them eventually taking on long-term management roles. That culture of loyalty and rewards is mirrored in its customer retention stats, too – creating a cycle of trust that few in the industry match.

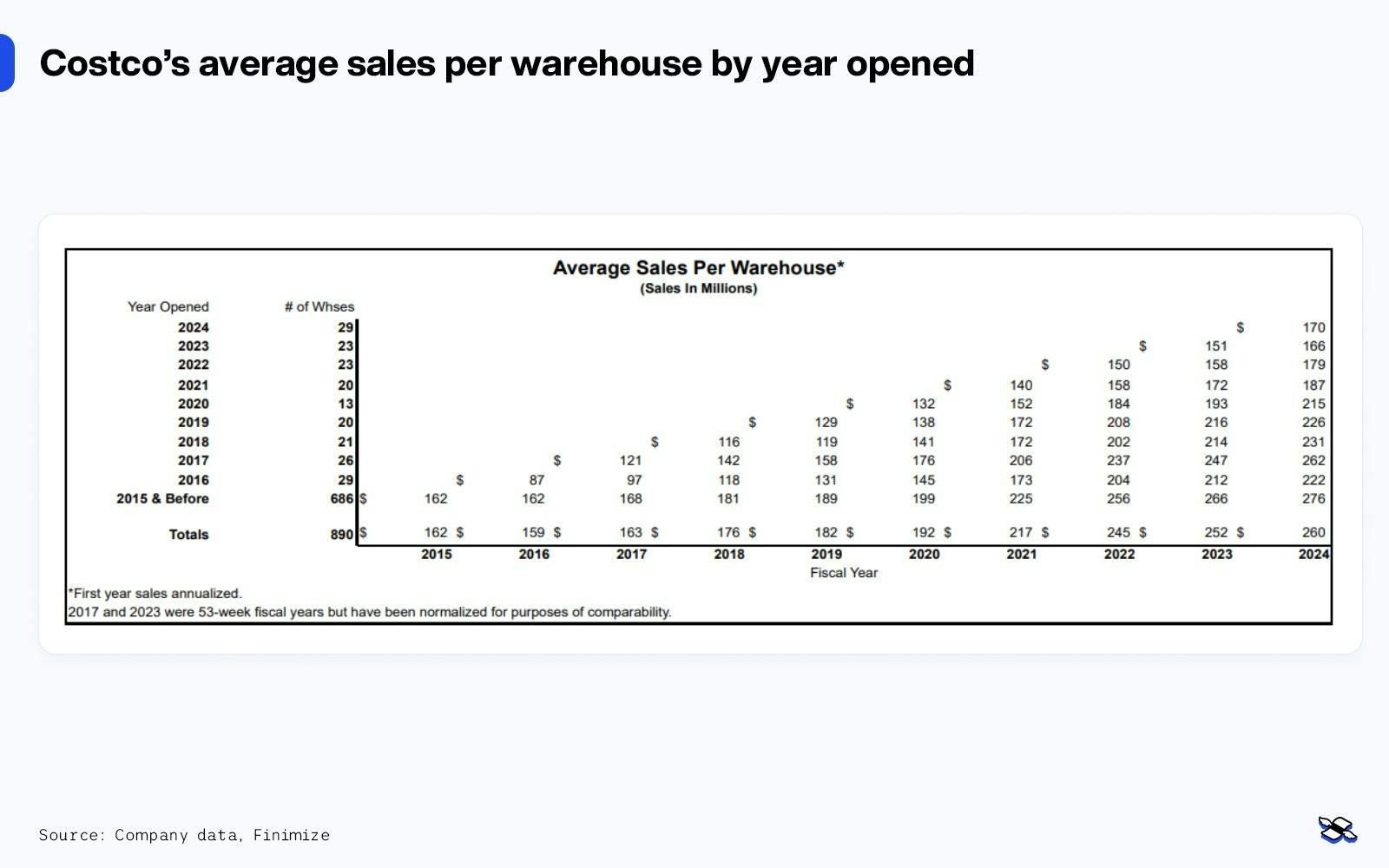

Overall, the firm has taken a disciplined approach to growth, prioritizing sustainability over speed. Almost all warehouse managers are promoted from within, so Costco’s expansion is limited by the pipeline of talent it nurtures in-house. This intentional pace allows Costco to fully maximize existing warehouses, with average sales still continuing to increase even in locations that opened before 2015. It also shows that Costco’s markets are far from saturated, with new warehouses not cannibalizing sales from existing ones. Instead, Costco’s strategy of thoughtful, member-focused expansion manages to drive long-term profitability and reinforce its stronghold in retail.

Old warehouses are still improving in profitability and efficiency – even those that opened a decade ago or longer. Costco’s average sales per warehouse by year opened. Source: Company data, Finimize.

What’s the bulk-sized big takeaway here?

An assortment pack of competitive advantages have allowed Costco to sustain its industry-leading returns on invested capital over time. If you’re hesitant about its high valuation though, it might make sense to hold off and just put the name on your watchlist for a while. Personally, I see Costco as one of those rare companies that you'd want to buy and hold forever. Its reliable, membership-based model and steady growth make it a rock-solid investment over the long term. If you’re like me and value stability and resilience, you could keep an eye out for a more comfortable entry point that will allow you to invest in Costco's compounding potential and enjoy the rewards of a truly enduring business.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.