This company’s valuation is an insult

Despite good prospects, this successful business is grossly undervalued, believes overseas investing expert Rodney Hobson. He’s also spotted two other buying opportunities.

12th June 2024 08:46

by Rodney Hobson from interactive investor

The continued resilience of the United States economy is a mixed blessing for housebuilders. While it means that interest rates, including those for mortgages, are likely to remain high, the more people that are in work, the more people who can afford to buy a home. Among latest figures is an upbeat report on the employment market, with more jobs being added than expected.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

D.R. Horton Inc (NYSE:DHI)is based in Texas and is one of America’s leading national housebuilders spread across 33 states. It sells more homes than any other builder in the country. It concentrates mainly on starter homes and those that appeal to buyers who have got a foot on the housing ladder and are seeking to move up a rung.

Figures for the three months to March, Horton’s second quarter, were impressive, with revenue up year on year from just under $8 billion to $9.1 billion and attributable net income from $942 million to $1.17 billion. In both cases the improvement was better than in the previous quarter.

The company says that despite high inflation and mortgage interest rates, demand for new homes has remained solid, with net sales orders increasing 46% from the first quarter and 14% from the same quarter last year. That is encouraging given that US interest rates are unlikely to fall soon, or to fall rapidly.

Supply chain disruptions affecting building materials and tightness in the labour market, which had held back all American housebuilders in recent years, have largely disappeared and the time taken from buying plots to selling finished houses is now back to normal.

Horton admits it is having to use incentives and price reductions to keep sales flowing but it takes comfort from the fact that the supply of affordable housing is limited while demand remains strong.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Global outlook for 2024: updated forecasts for S&P and UK

- Apple's record rally and an important day for stock market

Horton’s next figures will be released on 18 July, and they may well show a slight fall in earnings per share compared with the same quarter last year and a very tiny slippage in revenue to $9.7 billion. This will not alter the fact that the general trend is positive.

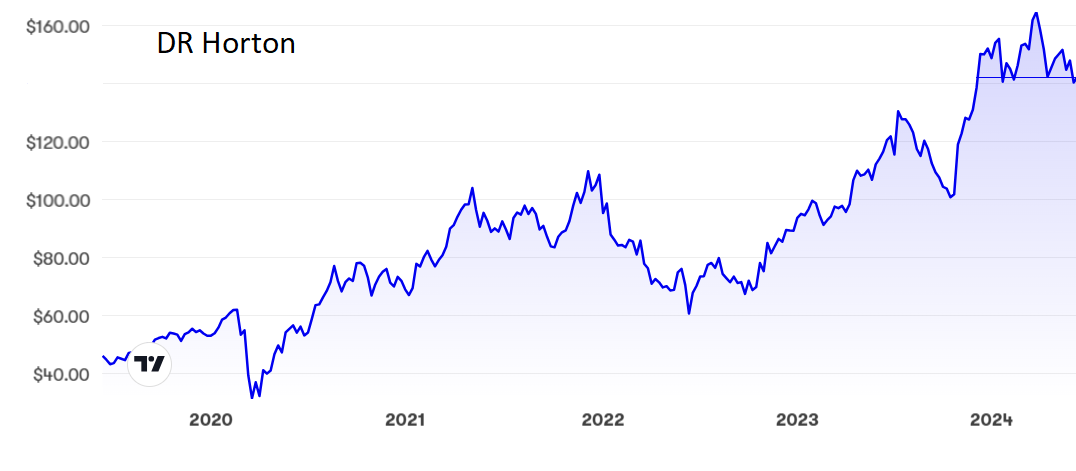

Horton shares have risen from $40 in the pandemic to $140 now. Nonetheless analysts think that $165 is achievable before the year is out. At current levels the yield is an admittedly miserly 0.8% but the price/earnings (PE) ratio is just under 10, an insult to a company with such good prospects.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I rated DR Horton as a buy at $71.50 two years ago but advised taking profits after the shares had more than doubled to top $150 in March. Now they have slipped back they are a buy again. Consider taking profits if they go above $160.

Update: I have long been a fan of electricity company Duke Energy Corp (NYSE:DUK) and the continued resilience of the United States economy has entrenched that view. The more work that is being done, the more is consumed at work and at home. Having highlighted the shares at much lower levels in late 2020, I last tipped Duke at $98 in November 2022, saying they remained a buy below $100. They now stand at $102, where the PE is an acceptable 18.4 while the yield is better than for most American stocks at 4%. Still a buy below the recent peak of just under $105.

- Global dividends at record high, but which funds top the charts?

- US government debt is a ticking time bomb

- GameStop among 10 hottest ISA shares

It is a rather different story at Evergy Inc (NASDAQ:EVRG), which I tipped at $65 and again at $68. Alas, the shares have slipped back to $52, where the PE and yield are similar to those at Duke. At the risk of suggesting you throw good money after bad, I think the current level will prove to be a floor so I repeat my buy recommendation.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.