A buying opportunity for fans of high yielding recovery stocks

21st June 2023 08:49

by Rodney Hobson from interactive investor

Shares are down 20% in the past year at prices not seen since the end of 2012, but overseas investing expert Rodney Hobson thinks this could be a great stock for contrarian investors.

The performance at diversified multinational conglomerate 3M Co (NYSE:MMM) has been a disappointment since the pandemic eased. The shares could at last be on the turn, opening up a possible buying opportunity for those seeking recovery stocks.

While 3M had a good pandemic, with hand sanitisers and safety glasses in particular in great demand throughout most of 2021, it was already clear by the end of that year that life was becoming tougher. While the bubble did not actually burst, it did become somewhat deflated.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Despite promises that 3M, which specialises in worker safety, healthcare and consumer goods, would concentrate on the parts of the business that offered most promise, sales have continued to slide. In the first quarter of 2023, the latest for which figures are available, sales fell 9% to $8 billion. Although that was partly due to disposals, organic sales were down 4.9% mainly because of a fall in sales of disposable respirators after the end of the pandemic. Covid-19 continues to cast a long shadow, as does 3M’s withdrawal from Russia after its invasion of Ukraine.

The company’s answer is aggressive reorganisation, which causes upheaval and cost cutting, and always costs money in the short term to fund redundancies. It announced a cut of 2,500 manufacturing jobs in January and has since followed up with a further 6,000 reduction. Combined, this should eventually save $700-900 million a year.

Shareholders can expect continuing tweaks to 3M’s portfolio, the latest being the sale for $70 million of a small Italy-based company making local anaesthetics, syringes and needles.

One imponderable is that a number of lawsuits hang over 3M, in the unrelated fields of chemicals and military ear plugs. Lawsuits in the US tend to be lengthy and expensive but there are indications that chemicals at least could soon reach a favourable conclusion. Expect an upward lurch in the share price if that happens.

- The new US fund that spices up our growth exposure

- These software stocks could benefit most from the AI wave

Optimism persists at 3M. A continued improvement in supply chains has emboldened it to reaffirm its expectations for the full year, with adjusted earnings per share coming in at $8.50-9.00, accompanied by strong positive cash flow.

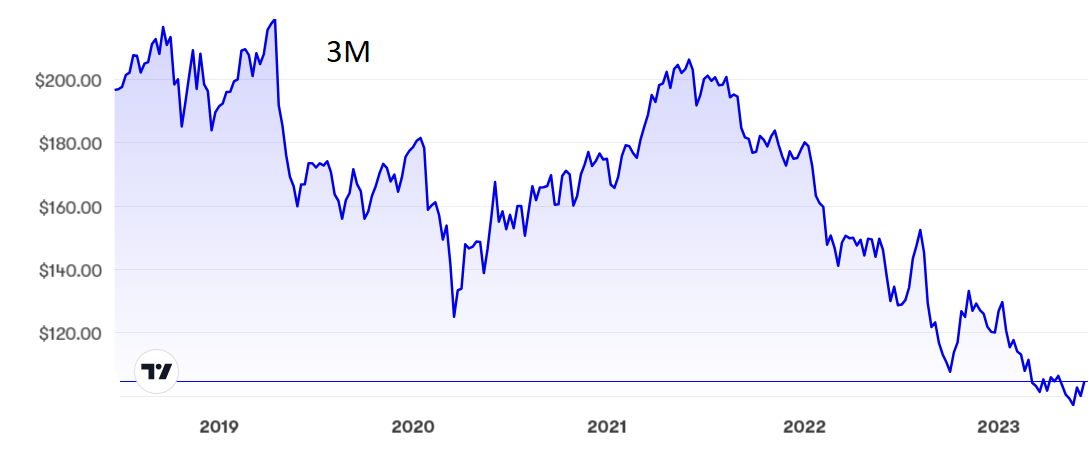

The trajectory of the shares has followed the pattern of changing fortunes. They recovered well from a low of $125 during the pandemic-induced stock market crash in 2020 to a peak above $200 before the end of the following year, but a relentless slide since took them below $100.

Source: interactive investor. Past performance is not a guide to future performance.

They are now showing some early signs of recovery and are back to $102, where the price/earnings ratio is unchallenging at 10.8 and the yield is well above the norm for American stocks at 5.72%. It is worth noting that 3M has raised its dividend every year for 65 years and, while there could be a pause in that progressive policy, it is highly unlikely that there will be a reduction in the payout any time soon.

- S&P 500 in bull market, but here’s why fund investors have missed out

- Have the big super-trends for the next decade changed since Covid?

Hobson’s choice: This company has been a major disappointment over the past 18 months. I first recommended the shares at $167 during the pandemic and was delighted to see them top $200 subsequently. Alas, in February last year, when the shares were back at $167, I made the mistake of arguing that the worst of the slide was over. It certainly was not.

However, at the risk of making the same mistake twice, I repeat the buy recommendation at a somewhat lower level. The decent yield is a continuing consolation even if, as is likely, the shares take a long time to return to former glories. The diversity of 3M’s products should see it through the short-term headwinds, and this could be a great stock for contrarian investors. If you are averse to risk, though, this is probably not one for you.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.