Buy this solid $200bn stock when it does this

This big hitter faces headwinds, but profits are holding up, it’s generating lots of cash and the shares have risen since overseas investing expert Rodney Hobson tipped them this summer. He also updates his view of the big American oil companies.

11th October 2023 09:23

by Rodney Hobson from interactive investor

It has been a tough few months for Accenture (NYSE:ACN) but we cannot say we were not warned by management earlier this summer. The American-Irish consultancy and IT provider still has excellent long-term potential for investors who are prepared to be patient.

Results for the three months to the end of August, the final quarter of Accenture’s financial year, showed revenue up 4% year on year to $16 billion. That’s not a bad result given that the strength of the dollar chopped the growth figure in half, but a little short of analysts’ forecasts. However, adjusted earnings per share improved by a very respectable 14%, which was better than expected.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Health and public services fared best of the five major markets that the group serves, probably because work in this sector continues unrelenting even in tougher economic times. Other sectors such as communications, media and financial services are more at the mercy of discretionary spending and slower decision making.

Chief executive Julie Sweet admits that the headwinds will continue into the current financial year to next August. Although she expects revenue to rise by up to 5%, that will be down on the 8% growth seen over the past 12 months and will be provided mainly, perhaps entirely, by acquisitions. Organic growth could well be zero.

The reason why profits are holding up is that Accenture has very sensibly cut costs to protect margins. The impact has been admittedly brutal, with 19,000 employees, 2.5% of the workforce, sacked and 13,000 additional jobs automated, with workers being taught new skills and switched to other jobs where possible. Operating margins thus improved by about 15% over the past financial year and will probably do the same in the current year.

More good news is that $9 billion was generated in free cash flow in the past year, including $3.2 billion in the latest quarter. Nearly half the annual total was spent on share buybacks and $2.8 billion on dividends, with the payout raised by 15% in the latest quarter. There should be a similar huge cash flow over the current year and even more will be spent on buybacks. Expect an increase in the dividend as well, although that may have to wait until next September.

- Birkenstock IPO: will investors hotfoot it after the shares?

- The high-tech, green Asia of the future is under construction

- Market snapshot: a turnaround and now more turmoil

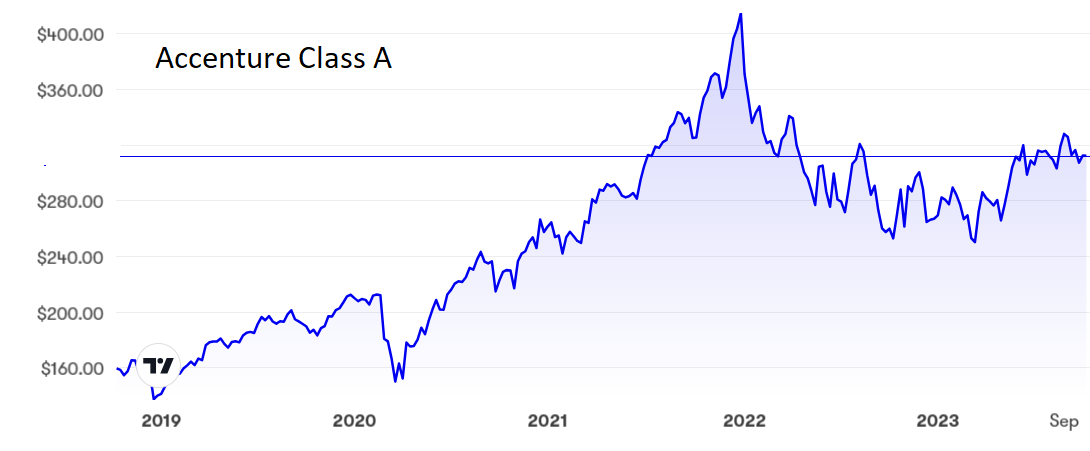

The shares got caught up in the post-pandemic surge among tech stocks and peaked at an unrealistic $400 at the end of 2021. Then came an overcorrection to around $250 before they settled just above $300. The price/earnings ratio is still demanding at 29, while the yield is only 1.4% despite the dividend increases.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I suggested three months ago that there was a solid floor around $250. In fact, the floor now seems to have been established at $300. On the debit side, the shares are not likely to break above $325 until there is more positive news on revenue.

Existing shareholders should certainly hold on. The case for buying has become less strong but if the opportunity to get in below $305 comes round again, take it.

Update: The turmoil in Israel, with fears that oil and gas supplies from the Middle East could be disrupted, has had an inevitable impact on energy shares. The price of Brent crude oil, which had been weakening of late, surged by $4 to $88 a barrel, and hopes of a rapprochement between Saudi Arabia and Israel have been scuppered, along with the expectation that the Saudis would increase their output of crude.

Exxon Mobil Corp (NYSE:XOM) gained $3 to $111 and Chevron Corp (NYSE:CVX) $5 to $166 on the day after Hamas launched its attack from Gaza, but they may already be easing back. I repeat my advice of 2 August for shareholders to stay in and keep collecting the dividends.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.