Budget 2020: the winners and losers

In chancellor Rishi Sunak’s ‘coronavirus’ Budget, we summarise key points and identify winners …

11th March 2020 15:41

by Nina Kelly from interactive investor

In chancellor Rishi Sunak’s ‘coronavirus’ Budget, we summarise key points and identify winners and losers.

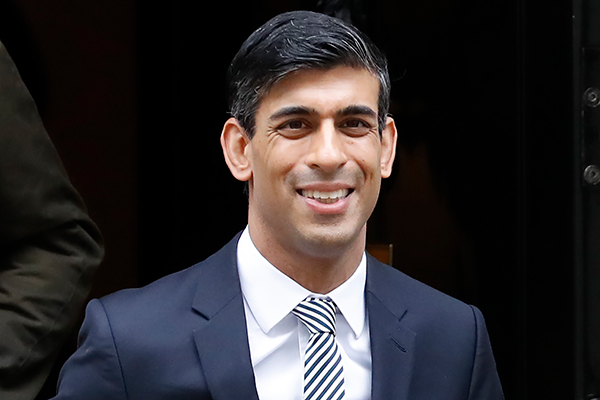

Chancellor Rishi Sunak, who has been in the role for less than a month, unveiled his “coronavirus Budget” during a week in which shares suffered their biggest falls since the 2008 global financial crisis and the Bank of England made an emergency interest rate cut, cutting the base rate from 0.75% to a historic low of 0.25%.

In the first Budget of the new Conservative government, and also the first since the UK left the European Union, the chancellor warned that the coronavirus would have a “temporary” impact on the UK economy, but that the country would come through it.

Ahead of the Budget speech, it was announced that there will £600 billion for infrastructure projects over five years, with the investment going into road, rail, affordable housing, broadband and research. The money will be targeted at every region of the UK, in a “levelling up” aiming to benefit the traditional Labour heartlands that backed Boris Johnson in December’s general election.

Sunak said: "We have listened and will now deliver on our promise to level up the UK, ensuring everyone has the same chances and opportunities in life, wherever they live."

As well as a new chancellor, today’s Budget marks that first time that a woman has chaired the proceedings in the Commons’ history. Dame Eleanor Laing, the first female chairman of ways and means, was elected to the role in January.

The winners

ChildsaversIt didn’t make the chancellor’s televised Budget announcement, but the Junior Isa allowance has been increased from £4,368 to £9,000 a year.

High-earning pension investorsThe chancellor is changing the rules on pensions that have led to some senior NHS doctors opting to retire early or reduce their hours because it is not worth their while working given the punitive pension tax penalties they stand to receive. The pension annual allowance taper will rise so that those earning up to £200,000 will no longer see their pension annual allowance reduced.

Low-paidThe national insurance threshold for employees and the self-employed will rise from £8,632 to £9,500 from April, saving people up to £100 a year. In addition, the Conservatives will raise the National Living Wage to £10.50 an hour by 2024.

MotoristsA £27 billion sum will be invested in roads and motorways, and for the 10th year in a row, fuel duty has been frozen. In good news for owners of electric cars, £500 million will be spent on developing rapid charging hubs, so that motorists are never more than 30 miles away from a place where they can charge their vehicle. In addition, a £2.5 billion fund will be available to fill 50 million potholes around the country.

NHSThe chancellor said that the health service will get “whatever resources it needs” to tackle coronavirus, whether this means “millions or billions of pounds”, as the number of cases in the UK continues to rise. In his Budget speech, he also announced that there will be £6 billion of investment for the NHS, with 50,000 more nurses and 40 new hospitals.

ReadersThe chancellor has abolished the “reading tax”. From 1 December, there will be no VAT to pay on digital publications, including books, newspapers and magazines.

Regional governmentThere was a raft of handouts for the regions of the UK, including an extra £640 million for Scotland, £360 million for Wales, and £210 million for Northern Ireland. The Treasury’s Green Book rules will be reviewed to put regional prosperity at the heart of spending decisions. There will be new Treasury officers for Scotland and Wales, and plans to move 22,000 civil servants outside central London. Sunak also announced his plans for a new economic campus in the North.

Rough sleepers A £650 million package has been put aside to help rough sleepers into permanent accommodation. It is estimated that this will provide an extra 6,000 places for rough sleepers.

Social housingThe Affordable Homes Programme will be extended with a new multi-year settlement of £12 billion.

Whisky drinkersIf you enjoy a wee dram, then this part of the chancellor’s Budget will certainly please you. Sunak said that all alcohol duties will be frozen; he also earmarked £1 million to promote Scottish food and drink overseas, with £10 million to help distilleries go green. The business rate discounts for pubs will rise to £5,000 from £1,000.

Losers

Drivers of red diesel vehiclesThe tax relief for red diesel, used in agriculture and other industries as well as for rail freight, has been abolished for most sectors. However, organisations working in agriculture, fishing, rail and heating industries will still be exempt.

EntrepreneursEntrepreneurs’ relief will be reformed, with the lifetime allowance falling from £10 million to £1 million, although the chancellor claims that 80% of entrepreneurs will be unaffected by this. However, much of the saving will be channelled back to the sector as several entrepreneurial allowances will be increased.

Inheritance taxAlthough it was widely tipped, that this much-hated tax would be reformed, there was no mention of it in the Budget. There have been repeated calls for IHT rules to be simplified.

Social careThere was also no mention of social care in the Budget speech, despite the UK’s ageing population, a shortage of care provision and widespread problems in the funding of long-term care.

Sick migrantsThose who have recently arrived in the UK will have to pay a £624 health surcharge if they want treatment on the NHS.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.