Beta funds the "smart" choice for UK investors

24th April 2014 11:33

by David Prosser from interactive investor

First came the active funds, run by expensive managers whose results have not always justified their high charges. Then came the low-cost index trackers, which pitch passive management as the antidote to this rip-off, but have faced attack themselves for blindly exposing investors to losses during market downturns. Now we have the smart beta phenomenon, led by managers who claim they take a more scientific approach to investment, that offers the best of both active and passive strategies.

Their arguments are finding favour. A recent survey of 300 investment institutions conducted by State Street Global Advisers suggests 42% are already using smart beta strategies, while a further 24% intend to do so over the next three years. Fund manager BlackRock says that of the $210 billion (£126 billion) invested globally in exchange traded products - mostly exchange traded funds (ETFs) - during the first 11 months of 2013, almost a third, $61 billion, went into smart beta vehicles.

That represents more than just a passing fad, but it’s fair to say interest in smart beta has so far been concentrated in the US - accounting for 71% of the fund flows identified by BlackRock - and remains mostly the preserve of institutional investors.

Should retail investors follow their lead? Well, the first step is to get to grips with what smart beta actually means. Essentially, these funds are index trackers. But while passive funds have traditionally tracked familiar indices - the FTSE 100 or S&P 500, say - by replicating the exact weighting of each stock in the index in their own portfolios, smart beta funds create their own benchmarks to track.

There is a range of smart beta strategies on offer. Low volatility funds, for example, aim for a benchmark consisting of stocks with a track record of generating relatively small variations in performance - maybe the 80 least volatile stocks in the FTSE 100. Alternatively, some funds focus on dividends, creating benchmarks that target companies with a strong record of paying rising incomes to shareholders. Others devise "fundamental" indices, which select stocks using scoring systems that filter on criteria such as book value or earnings growth.

Beyond passive

Devising these formulae for benchmarks is an active investment strategy, but thereafter the fund passively tracks the index created. And the fact that smart beta sits somewhere between passive and active styles of investment is precisely its appeal, argues Peter Lawery, a fund manager at Jupiter Asset Management.

"Traditional passive strategies typically take no account of the business cycle, the credit cycle, seasonality or the interest rate cycle, but all of these are observable and portfolios can be tilted to exploit or avoid them," he says. "If you own a FTSE 100 tracker, you get what you are given, and a rise in interest rates for instance, which is like bubonic plague to heavily indebted companies, is just tough luck."

In other words, passive funds often have no choice but to take positions in companies that plain common sense would suggest they avoid. "Smart beta funds, however, are not quite so dumb," Lawery adds. "They track specialist indices that are themselves created to avoid many of these pitfalls; that selectivity means they do not tend to defy common sense."

The million-dollar question is whether the approach works. Philip Bailey, an investment consultant at wealth manager Proviso Chartered Financial Planners, thinks it does. Proviso began putting client money into smart beta funds in March, having decided that the track record of the funds it chose - the First Trust AlphaDEX range - justified the switch. "Our investment process is based on asset allocation and we've always used passive funds to deliver that allocation because they're the best way to replicate exactly the index exposures we’re looking for," Bailey explains.

"We need funds that can deliver a highly correlated return relative to the underlying asset class, and our analysis suggests smart beta funds do that with greater exposure to the upside." In other words, the funds track markets and asset classes up and down, but produce better returns than conventional passive vehicles doing the same.

How to invest in the smart beta phenomenon?

Most smart beta vehicles are set up as exchange traded funds, and there are a growing number available to UK investors.

Both Martin Bamford and John Ditchfield suggest the as a good introduction: the fund aims to track the performance of the 50 highest-yielding stocks in the FTSE 350 index, excluding investment trusts. is another option.

Alternatively, Philip Bailey suggests First Trust’s range of AlphaDEX ETFs, which track indices selected on the basis of a number of fundamental criteria, including sales performance and financial ratios such as book value to price and return on assets.

The funds have a good long-term record in the US, but have only recently become available to UK investors. operates on a similar basis but has been established longer here.

Finally, in the low volatility universe of smart beta funds, ETF providers include SPDR, Ossiam and iShares, all of which offer products in the UK.

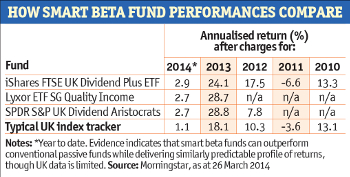

It is difficult to be definitive on performance - partly because there are so many variations on the theme, but also because organisations such as the Investment Management Association have yet to produce sector classifications that enable like-for-like comparisons.

However, academic research suggests smart beta funds have, at least in the past, consistently outperformed traditional passive vehicles; and that also means they’ve tended to beat the average actively managed fund.

Higher prices

In a study published in February by the EDHEC Risk Institute, the outperformance identified was significant. It reported "excess annual performance over broad cap-weighted indices ranging from 1.54% to 3.00% since inception [in 2002] for the developed universe".

It's worth noting, however, that smart beta strategies do come at a higher price, with annual expenses of around 0.65% typical in the industry, compared to below 0.5% for traditional passive investments.

Robert Lockie, an investment manager at Bloomsbury True Wealth, argues: "The drawback of using an index that is not constructed on a capitalisation basis is that the costs of maintaining the weights can be significant and this can erode any excess return gained."

Lockie also observes that smart beta outperformance may simply reflect the fact that the benchmarks devised by managers have a natural weighting towards value stocks - which tend to outperform growth stocks, probably because they are riskier.

That's not to say, however, that there is anything wrong with the smart beta approach, for those who understand what they are buying - but it may just be a new name for an investment technique that some have been using for many years.

Nevertheless, the growing range of smart beta options does give investors a way to access a proposition that may appeal for different reasons. At Proviso, for example, Bailey says: "We feel very comfortable that smart beta funds will perform very predictably relative to their index."

At Barchester Green Investment, meanwhile, director John Ditchfield says: "We're now using smart beta funds to reduce charges and over-reliance on managers."

However, some advisers think retail investors will take more convincing before they follow the lead of institutions with the time and resources to monitor the performance of their new holdings. Martin Bamford, managing director of IFA Informed Choice, adds: "I can see a time when smart beta funds become a much more fashionable choice with retail investors, but probably not in the near future."