Best investment trusts for regular savers

We've handed medals to investment trusts with the best returns. Helen Pridham has the winners.

3rd May 2019 15:01

by Helen Pridham from interactive investor

We've handed medals to investment trusts with the best returns for anyone making monthly investments. Helen Pridham has the winners.

There are many reasons why regular savings are a good idea – not least the fact that they enable investors who don't have spare capital to build up a lump sum. A savings plan also provides a good discipline. Aside from those considerations, regular purchase of investment trust shares has real investment benefits.

One key benefit is not having to worry about stockmarket timing. When you are investing a lump sum, you are more likely to hold back if you think the market may plummet. But when you invest regularly, you can actually gain if share prices go down, because of pound-cost averaging.

As Annabel Brodie-Smith, communications director of the Association of Investment Companies (AIC), explains:

"Regular investing means investors buy more shares when prices are low and fewer shares when prices are high, which helps smooth out the highs and lows of markets."

Discounts and premiums

Another way in which regular savings can be beneficial when you are purchasing investment trust shares is that it helps to solve the dilemma of whether to buy a trust whose share price is at a significant discount or premium to its net asset value (NAV). It is easy to be put off by these price deviations.

Indeed, investors are often warned against buying trusts whose share prices are more than around 2-3% above their NAV, however good their performance may be. This is because of the potential for investors to suffer a double loss if a trust’s performance deteriorates and its share price falls from a premium to a discount at the same time.

Buying a trust on a substantial discount is no guarantee of success either. If it narrows it could provide an enhanced return, but there may be a good reason for the discount and it may widen further if a sector continues to be out of favour or a trust's performance continues to lag.

Lump sum investors are particularly vulnerable because they are affected by the discount or premium at the specific points in time at which they buy and sell. Typically, over time, the share prices on most trusts move around, with discounts and premiums widening and narrowing according to investment demand.

Thus, by making regular investments you are spreading your purchases, so any spikes in premiums or discounts will be averaged out across the savings period.

How it works in practice

In theory, the best outcome for regular savers would be for the discount on their chosen trust to widen during the savings period, enabling them to buy a trust's assets more and more cheaply. Then, when they are about to cash in their investment, the share price would rise to a premium. Unfortunately this is unlikely to happen in practice.

Nevertheless, as can be seen with trusts which have won our Medals for Monthly Money, regular savings can be very helpful. For example, the top return overall over the five-year period came from Baillie Gifford Shin Nippon (LSE:BGS), which won gold in the Overseas Smaller Companies category.

Yet if you had been a lump sum investor at the start of the savings period in February 2014, the chances are that you would have shied away from choosing this particular trust because it was standing on a 6% premium to its NAV at the time. In 2014, it was more unusual than it is today for investment trusts to stand on premiums.

However, as a regular saver, you could feel relaxed knowing that you would benefit if the price moved down temporarily. And indeed, soon after the beginning of the savings term in October 2014, the trust's shares started trading at a discount, falling to a maximum discount of 7.9% in March 2015.

After a year of trading at a discount the shares went back to a premium. The premium rose steadily, reaching a maximum of over 13% in December 2017. Since then the premium on BGS has dropped back again to almost the same level that it was at the beginning of the five-year period.

Wary of large discounts

A large discount on a trust can also put lump sum investors off, as it indicates that there may be some problems. Among our medal winners, Fidelity Asian Values (LSE:FAS) was the trust with the highest discount of 11.6% at the beginning of the period. For over two years, the trust's discount remained wide, getting even wider at times; by the end of June 2016 it had increased to over 13%.

Fortunately, thereafter the discount started to narrow but it was not until the fourth quarter of 2018 that the trust started regularly trading at a premium. By the end of the savings term, the trust was trading on a premium of over 4% – an ideal result.

However, the share prices of some of our medal winners remained on a discount to NAV throughout the savings period, which is not uncommon, particularly for trusts pursuing higher risk strategies. In three cases – BlackRock Smaller Companies (LSE:BRSC), Aberdeen Smaller Companies (LSE:ASCI) and Montanaro European Smaller Companies (LSE:MTE) – the discount was wider at the beginning than at the end, although in each case the discount had widened and then narrowed again.

Gold medal winner BlackRock Throgmorton Trust (LSE:THRG), for instance, started the period on a discount of 8%, which widened to 21% before narrowing back to 5.7% at the end of the period.

But premium or discount volatility is not necessary for success either. Finsbury Growth & Income (LSE:FGT), the winner of our gold medal for UK Income, has a strong discount control mechanism, aimed at ensuring that its shares trade between a maximum 5% discount and a modest premium of 2%. Consequently, over the savings period, its shares traded within a 1.5% band above or below NAV.

Providing you have faith in your choice of trust and its manager, it appears to make little difference to your investment success when making regular savings whether it is trading on a discount or a premium, or close to NAV. So, if in doubt, start saving regularly.

Setting up a regular savings plan

In the past, most investment trust groups offered their own regular savings schemes but the number available has diminished considerably in recent years.

The latest to close their schemes are Witan, Baillie Gifford and JPMorgan. There remain just two managers running their own schemes – Aberdeen Standard and BMO. Annabel Brodie-Smith of the AIC explains: "Over several years, there has been a trend to move the administration of saving schemes to platforms. This is because most investors are choosing to hold their investment companies on platforms. These provide greater choice and access to all sorts of investments from different management groups and it’s much more convenient for investors to have all their holdings in one place."

Cost was another factor. As Justin Modray of IFA firm Candid Financial Advice, which runs www.comparefundplatforms.com, points out:

"Servicing small savers was increasingly costly for investment trusts, whereas platforms have the economies of scale."

He points out that several platforms such as interactive investor have reduced dealing costs for monthly savers.

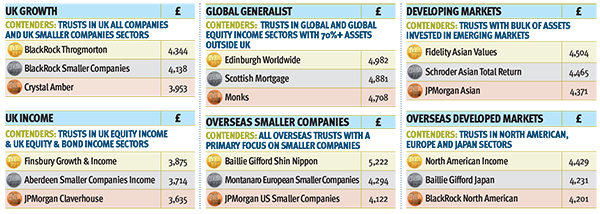

Our 2019 Medals for Monthly Money

Value of £50 invested monthly for five years to 31 January 2019 Please click here to see larger version of table.

Note: Total investment over five years is £3,000. Click here for full methodology. Data source: Association of Investment Companies.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.