Benstead on Bonds: these lower-risk funds are best income opportunity

An inverted yield curve means that bonds maturing soon offer some of the highest incomes – all with less price volatility.

10th April 2024 10:27

by Sam Benstead from interactive investor

In the world of fixed income, bonds with longer timelines until maturity generally yield more. This is to compensate investors for the added inflation risk and default risk due to a longer lending period.

Invest with ii: How Bonds & Gilts work | Tax Rules for Bonds & Gilts | Open a SIPP

Longer bonds also have higher “duration”, which is the sensitivity to interest rates, meaning that investors owning a portfolio of longer-dated bonds can see big swings in their value due to interest rate changes. The extra yield therefore comes with extra risk.

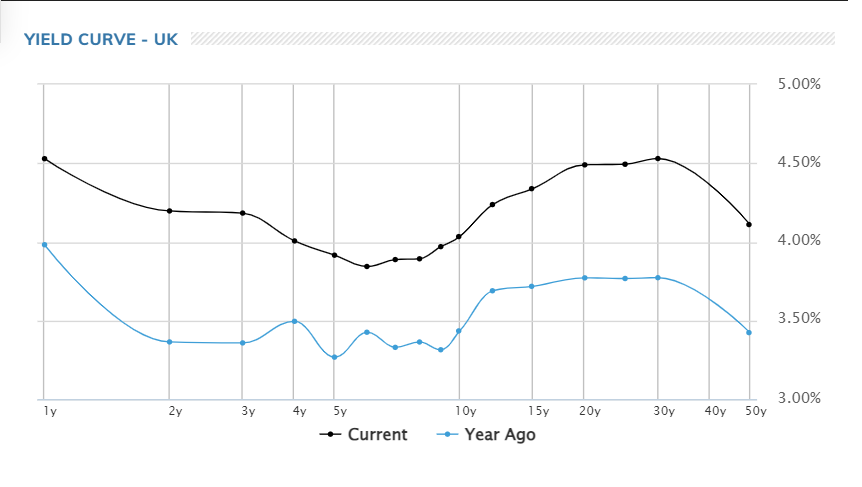

This is the “normal” scenario for bonds, where the yield curve is upwards sloping. The yield curve plots the yields of bonds with different maturities on a chart. The shortest bonds at the beginning generally have the lowest yields, with the longer bonds at the end of the chart having the highest yields, creating a line from bottom left to top right.

- Bond Watch: the gilt attracting more cash than any other investment

- Everything you need to know about investing in gilts

However, there is currently a wobbly yield curve, with some of the shortest bonds yielding more than the longest ones, and those maturing in the medium term, from three to 10 years away, yielding the least. The inverted yield curve reflects expectations that interest rates and inflation are still high today, but the medium-term outlook is for lower rates and stable inflation. This is what the yield curve for gilts currently looks like.

Source: Market Watch, 9 April 2024.

This is also reflected in corporate bonds. Currently some of the highest-yielding investment grade sterling bond funds are investing in bonds maturing soon – a more stable part of the fixed income world, which is particularly useful for bond investors looking for income while cutting back on risk.

Data from FE Analytics shows that abrdn Short Dated Corporate yields 5.4%, while Royal London Sustainable Short Duration Corporate Bond and M&G Short Dated Corporate yield 5.29%.

Money market funds, which invest in bonds about to mature to achieve a “cash-like” return, also yield a lot at the moment. The top income payers are Premier Miton UK Money Market (5.77% yield); abrdn Sterling Money Market (5.5%) and Royal London Short Term Money Market (5.25%).

The highest yielding out of all the sterling corporate bond funds currently are Man GLG Sterling Corporate Bond (6.49%) and Liontrust Sustainable Future Monthly Income Bond (5.7%).

These are the income yields on the portfolios – an annualised measure of the income paid out over the past 12 months.

- Bond Watch: the low-risk, high-yield bond funds

- Benstead on Bonds: why gilt auction access is a win for small investors

Income paid out is not the only reflection of the value of a bond’s portfolio or how much risk it is taking. A fund factsheet will also have a yield-to-maturity figure, which is the total return for the bonds if held to maturity and the principal amount is returned.

Why short bonds yield more

So, why are shorter maturity bonds yielding so much at the moment? Mickael Benhaim, head of fixed income investment strategy/solutions at Pictet Asset Management, told me that it is all about inflation and what central banks will do next.

He said: “We are coming back from a very inverted curve. Interest rates shot up to fight surging inflation – leading to a surge in the front end of the curve. Faster economic growth equals more inversion and steeping happens when you get slower growth. There was a growth uptick following Covid, but now we going to more normal levels.”

However, because central banks are deemed “credible” by investors, meaning that they are trusted to bring inflation to target in the future, this allows for interest rate cuts in the future, which means that medium-length bonds yield less currently than shorter ones.

Benhaim explains: “The longer-term part of the curve signals lower rates as inflation comes down. This creates short-term higher rates, but a natural equilibrium – which will be a mild positive slope – is in the price of bonds.”

He thinks that the last mile of inflation will be the hardest – to get down to 2% from 3%, which may require central banks to have a higher for longer stance, which will keep bond yields high for shorter bonds. However, when interest rate cuts happen this will cause the front end of the curve to adjust, leading to a more normal-looking yield curve, according to Benhaim.

Why shorter bonds are safer

Investors get more protection from rising interest rates if they own shorter bonds. However, if there is a bond market rally – driven by lower rates – then they will have lower capital gains than other bonds.

A big economic slowdown would lead to this, causing longer bonds to rally more than shorter ones. This is the diversification benefit of bonds – in times of economic stress they should move in the opposite direction to equities.

Benhaim says that for retail investors, if they own a spread of assets, adding longer bonds could be a good insurance policy in case there is a recession.

“Bond valuations recovered to good yields and now therefore have a negative correlation with risky assets. That protection is back and I am quite confident of this – so when we have an equity-market shock then bonds act as a buffer,” he said.

- Pros name five UK shares Warren Buffett might put in his ISA

- Nvidia and Scottish Mortgage made me an ISA millionaire, but now I back these funds too

However, Benhaim says that shorter bonds have high yields, so investors just looking for income are well served there.

Investors are also beginning to expect fewer rate cuts, which is good news for shorter bonds as yields in this part of the curve will remain high.

Iain Stealey, international chief investment officer for fixed income at JP Morgan Asset Management, says that the US Federal Reserve has made it clear that it wants to cut. However, given the strength of economic data so far this year, he says a deep cutting cycle is looking unlikely unless there is a collapse in economic growth, which the data is not currently suggesting.

Stealey says: “While inflation has come down significantly, there are tentative signs that it is not falling fast enough to allow the US central bank to cut rates as soon, or by as much, as investors had previously expected.

“In the meantime, fixed income continues to provide optionality for investors, whether as a recession hedge or simply for attractive income.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.