Bargain Hunter: 13 eye-catching investment trust discounts

8th August 2022 15:22

by Kyle Caldwell from interactive investor

We highlight investment trusts with the biggest gap between their current discount and their five-year average.

Investment trust bargains are back, with the average discount moving from a lowly 2.2% at the start of this year to 7.4% today.

Prior to the strong month for stock markets in July, that average discount figure was even wider, hitting a 12-month peak of above 10%. To put today’s discount levels into context, figures from analyst Winterflood show that over the last 10 years discounts have averaged 4.7%, ranging between 0.6% and 21.3%.

In short, the rise in discounts is down to investment trusts having their worst first half of a year in more than 30 years. Over this period, most stock markets were in negative territory, with Russia’s invasion of Ukraine, rising inflation and increases in interest rates all contributing to negative investor sentiment.

Explore our: ii Super 60 Investments | Top Investment Trusts | Transferring an Investment Account

Overall, investment trusts have fared worse than open-ended funds so far in 2022, due to “gearing”, which leads to greater losses per share when share prices fall. Over the long term, gearing can turbocharge returns.

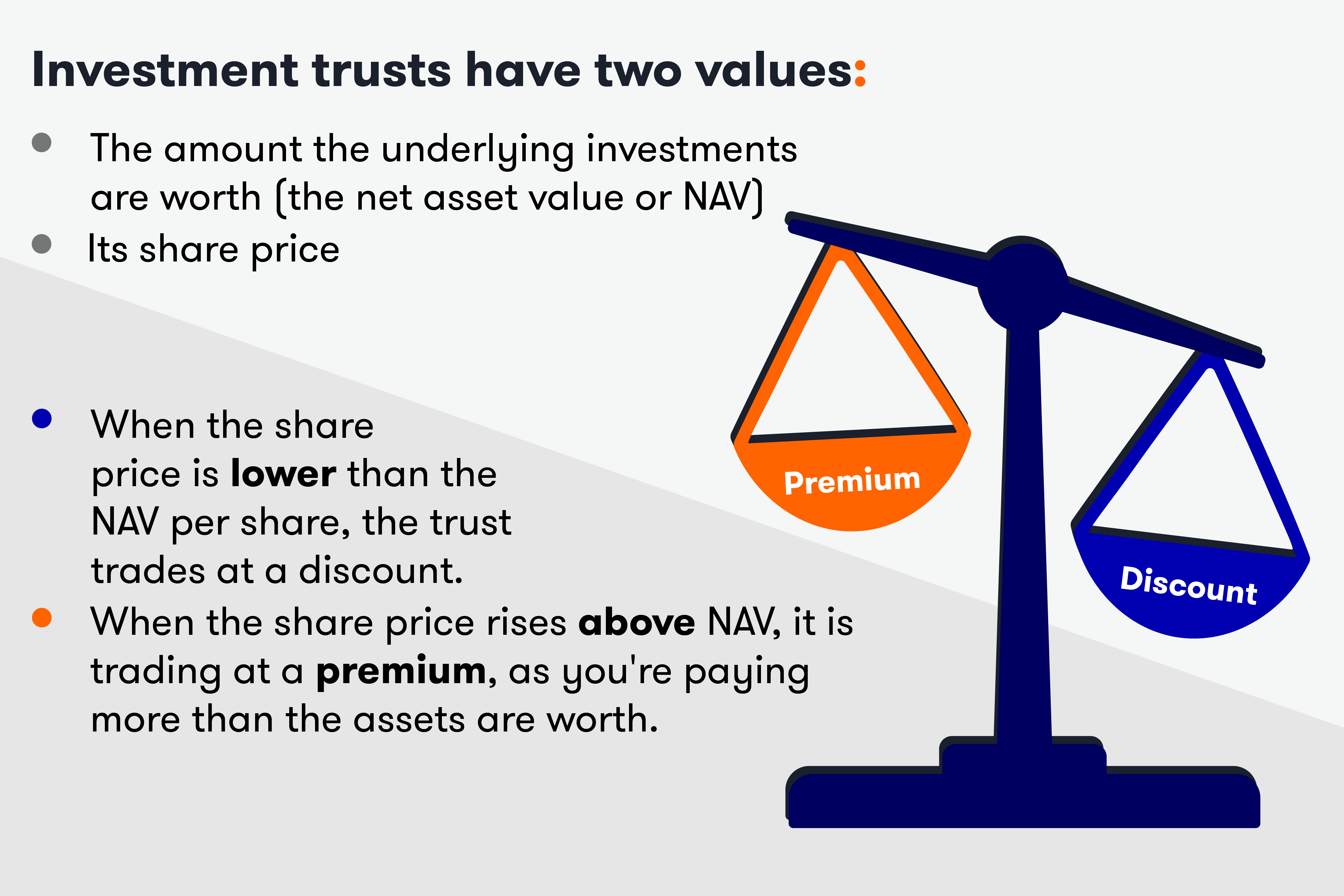

Discounts can work in investors’ favour, but it is important to think long term and to be patient. If you buy at the right time, resulting in a high discount falling to a low one, or even moving to a premium, the share price return will be boosted.

Our investment trust Bargain Hunter column usually scours the market for investment trusts trading above their one-year average discount figure. But given that discounts have risen notably, dozens of trusts are looking potentially cheap on this measure.

- Funds Fan: Scottish Mortgage, bonds are back, and China's a buy

- Expert investment tips from £50 to £50,000

- Discount Delver: the 10 cheapest trusts on 5 August 2022

With this in mind, we asked analyst QuotedData to find the investment trusts trading on the biggest discount compared to their five-year average discount. The table below highlights 15 trusts, ranked in order of the biggest percentage point difference on this measure. Thirteen of the 15 are trading on discounts, meaning their share price is less than the underlying investments – the net asset value (NAV) – are worth.

As we regularly point out, a trust trading on a discount is not necessarily a buying opportunity. There’s likely a good reason why the trust is cheap, such as subdued short- or long-term performance, or poor investor sentiment towards how it invests.

For example, in the case of Amedeo Air Four Plus (LSE:AA4), which tops the table below, the high discount is owing to the airline industry being hit hard by the Covid-19 pandemic.

Therefore, it is important for investors to carry out their own due diligence to assess why a trust is trading on such a big discount. Then, it is a case of taking a view on whether the prospects for the trusts will improve, which could then lower the discount.

James Carthew, head of investment company research at QuotedData, is seeing value among the private equity sector. Four trusts feature in the table: Apax Global Alpha (LSE:APAX), CT Private Equity Trust (LSE:CTPE), HarbourVest Global Private Equity (LSE:HVPE) and Pantheon International (LSE:PIN).

Such trusts invest in growth companies, which are no longer the flavour of the month, given the tightening in monetary policy. High inflation and interest rate rises devalue the future earnings of growth companies.

Such companies have seen their share prices fall heavily in 2022. Following this, investors are fearful that private companies have also seen big markdowns in their value.

Given that private equity trusts tend to update their NAVs only once a quarter, investors are sceptical that the current NAVs reflect reality.

Carthew argues that the valuations on unlisted companies are conservative relative to comparable listed companies that operate in the same sector or industry.

Carthew said: “I struggle to fathom the logic for private equity being out of favour. Yes, NAVs will likely fall, but most will fall by less than equivalent listed equity markets.”

Ewan Lovett-Turner of Numis, the analyst, also has the sector down as a buy. He points out that private equity trusts are more resilient in the face of economic stress than is widely believed.

Lovett-Turner says: “Most listed private equity trusts now focus on businesses with recurring or sticky revenues, in sectors with positive growth dynamics regardless of the economic cycle.”

- The 10 most-popular investment trusts: July 2022

- Don't be shy, ask ii...why do some trusts always trade on a discount?

- What should I do when a fund or trust falls out for form?

However, it is important for investors to do their homework. Simon Elliott, at analyst Winterflood, points out the importance of “differentiating between those private equity funds that are focused on dependable/proven growth...and those with a higher weighting to more speculative growth plays that have yet to deliver profits”.

Over the past five years, two of the trusts in the table below, Lindsell Train (LSE:LTI) and Syncona (LSE:SYNC), have commanded a very high premium, but they are now trading closer to their NAVs. For investors who bought when the premiums were high, the decline will have hurt returns.

High premiums do not tend to be sustainable over the long term. When conditions change, such as when investors become more cautious, premiums can fall and can turn into a discount.

Cheap trusts compared to their five-year discount average

| Investment trust | AIC* sector | Discount (%) at start of August | 5-year average discount (%) | Difference (%) |

|---|---|---|---|---|

| Amedeo Air Four Plus (LSE:AA4) | Leasing | -63.7 | -32.3 | -31.4 |

| Macau Property Opportunities (LSE:MPO) | Property - Rest of World | -70 | -46.7 | -23.3 |

| EJF Investments (LSE:EJFI) | Debt - Structured Finance | -35.1 | -12.9 | -22.2 |

| Pantheon International (LSE:PIN) | Private Equity | -42.8 | -21.7 | -21.1 |

| Schroder UK Public Private Trust (LSE:SUPP) | Growth Capital | -45.2 | -24.3 | -20.9 |

| UK Commercial Property REIT (LSE:UKCM) | Property - UK Commercial | -31.9 | -11.9 | -20 |

| Civitas Social Housing (LSE:CSH) | Property - UK Residential | -25.9 | -6.1 | -19.8 |

| Geiger Counter (LSE:GCL) | Commodities & Natural Resources | -13.2 | 6.5 (premium) | -19.7 |

| Ground Rents Income Fund (LSE:GRIO) | Property - UK Residential | -39.5 | -21.3 | -18.2 |

| Lindsell Train (LSE:LTI) | Global | 6.5 (premium) | 24.2 (premium) | -17.7 |

| HarbourVest Global Private Equity (LSE:HVPE) | Private Equity | -39.9 | -22.4 | -17.5 |

| Syncona (LSE:SYNC) | Biotechnology & Healthcare | 1.9 (premium) | 19.1 (premium) | -17.2 |

| abrdn Property Income Trust (LSE:API) | Property - UK Commercial | -26.4 | -9.2 | -17.1 |

| CT Private Equity Trust (LSE:CTPE) | Private Equity | -30.2 | -13.7 | -16.6 |

| Apax Global Alpha (LSE:APAX) | Private Equity | -31.5 | -15.2 | -16.3 |

Notes: Data to 1 August, QuotedData. *AIC stands for Association of Investment Companies. Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.