Bank of England holds rates steady despite hitting inflation target

Elevated wage growth and stubborn services inflation mean looser monetary policy must wait. Craig Rickman explains why policymakers refuse to budge.

20th June 2024 13:10

by Craig Rickman from interactive investor

The news that inflation has hit the Bank of England’s 2% target for the first time in three years was not enough to persuade policymakers that the time is ripe to cut interest rates.

The Bank’s Monetary Policy Committee (MPC) today voted by a majority of 7 to 2 to maintain the Bank Rate at 5.25% for the seventh consecutive time, as widely expected.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

This is the same vote split as when the MPC last met in May, with the two outliers preferring a 0.25 percentage point reduction to 5%.

Laying out its reasoning, the Bank said: “The restrictive stance of monetary policy is weighing on activity in the real economy, is leading to a looser labour market and is bearing down on inflationary pressures. Key indicators of inflation persistence have continued to moderate, although they remain elevated.”

While we will have to wait six weeks for the next interest rate decision, inflation’s journey back to 2% marks a significant milestone in the UK’s battle to curb price rises - a saga that’s endured for almost three years. What’s more, core inflation, which strips out food and energy prices, eased from 3.9% to 3.5 - its lowest level since October 2021.

The consumer prices index (CPI), the UK’s main measure of inflation, hit a 40-year high of 11.1% in October 2022 and was a heady 8.7% this time last year. But since the final third of 2023 price rises have eased significantly. The UK now has the second-lowest rate of inflation in the G7 behind Italy.

As such, the Bank’s decision to yet again leave rates unchanged poses several questions. The US Federal Reserve (Fed) last week may have held borrowing costs for the seventh successive time, but other central banks, including the European Central Bank (ECB), have started to act.

Why has the ECB cut before the UK?

Policymakers across Europe have begun to loosen up monetary policy. Central banks in Switzerland, Sweden and most recently the ECB have already started to cut rates. Yet rate setters in the UK and US continue to tread carefully.

Even though inflation in the euro area is higher than the UK, the ECB has beaten the Bank to the punch.

After nine consecutive holds, the ECB on 6 June reduced its key interest rate for the first time in five years. Policymakers delivered a hawkish cut from 4% to 3.75%, after inflation eased from 2.6% to 2.4% in May.

- Election manifestos 2024: the impact on your personal finances

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

ECB President Christine Lagarde (pictured below) said: “We decided to cut because overall our confidence in the path ahead has been increasing over the last months.”

Lagarde stressed that the move was a “moderation in the level of restriction” and that the ECB will continue to monitor the data to see if further loosening is required.

So, unless inflation continues to soften in the eurozone, there is every chance a series of holds could follow.

“Our interest rate decisions will be based on our assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. We are not pre-committing to a particular rate path,” Lagarde said.

What’s delaying UK rate cuts?

Inflation may have eased to the Bank’s target level, but Governor Andrew Bailey has repeatedly stressed that he wants to see strong evidence that it will stay there. However, in the run-up to the Bank’s decision today, some argued that rate cuts are desperately needed.

The Unite union said yesterday: “Falling inflation doesn’t mean falling prices. The worst cost-of-living crisis in generations is still dragging on.

“We need action from the Bank of England on Thursday to begin lowering interest rates and relieve the pressure on hard-pressed homeowners.”

Needless to say, Unite didn’t get its wish. Homeowners have felt a tight pinch since rates began to rise, as borrowing rates have followed suit.

Mortgage deals continue to be volatile, as lenders struggle to price things accurately with the future path of interest rates still deeply uncertain.

Inflation continues to pose a headache for the Bank, despite the headline figure hitting target. A sticking point is the stubbornness of services inflation, which at 5.7% remains toppy, and it came in hotter in May than the Bank’s 5.3% forecast.

But perhaps the biggest problem facing policymakers is the pace of wage rises. Between January and March this year pay growth in the private sector nudged down from 6.0% to 5.9%, while in the public sector it has increased from 6.1% to 6.3%.

Meanwhile, the manufacturing sector and the finance and business services sector saw annual regular wages grow at 6.8%. While pay growth is marginally easing, it is still far outstripping inflation. And with inflation falling sharply the gap here continues to widen. This is something the Bank is weary of and may delay the arrival of rate cuts.

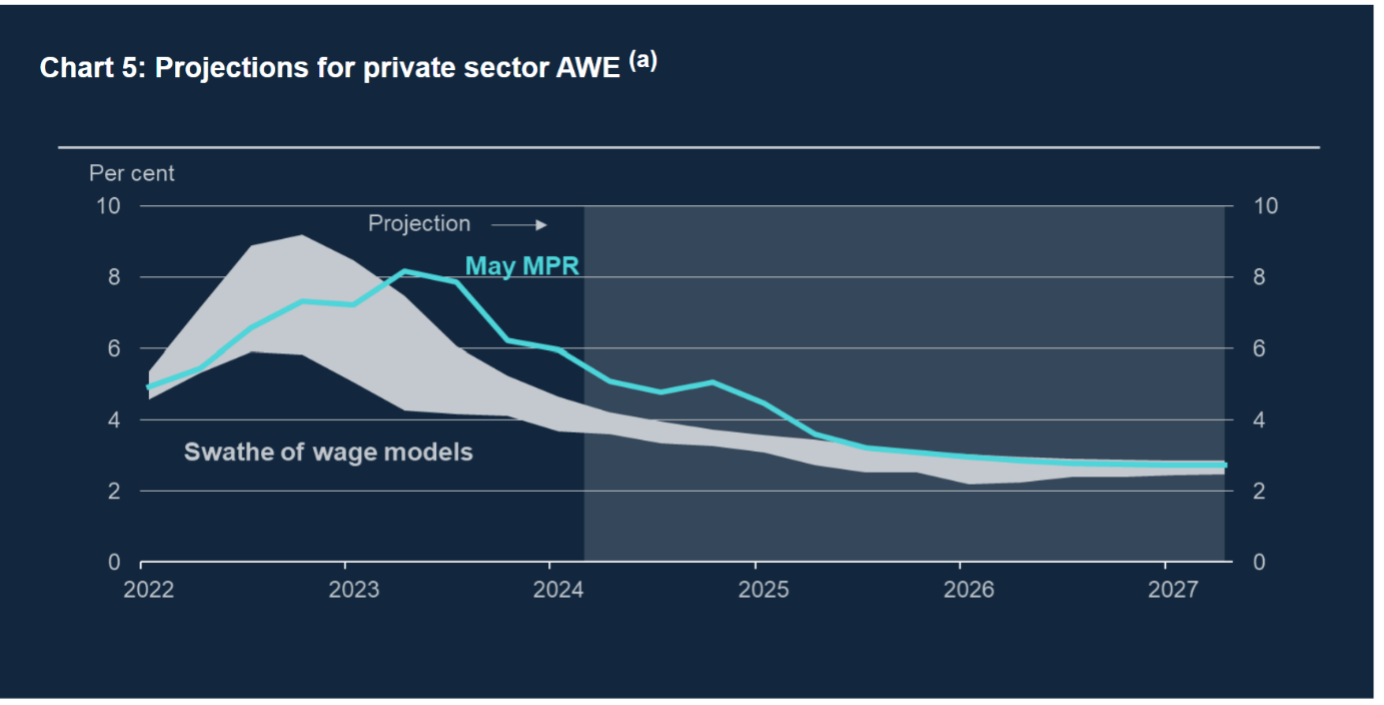

A sharp easing of pay rises isn’t expected to happen anytime soon. The chart below shows the predicted path of average weekly earnings until early 2027.

Source: Bank of England

In a speech on 16 May, Megan Greene, an external member of the Bank’s MPC, said: “Wage growth across all metrics has been elevated for some time, and as I have noted before is a key indicator of domestic inflation persistence.”

Greene added that regular private sector pay growth is expected to “remain elevated at around 5% by the end of the year”.

The MPC fear kickstarting the rate-cutting cycle might add to these pressures, given the close relationship between wages and inflation, as Greene noted: “MPC communications repeatedly emphasise labour market slack, wages and services inflation as key indicators of inflation persistence. These metrics are all closely interlinked.”

Greene added that labour market slack, the shortfall between the work required and work available, is a key driver of wage growth.

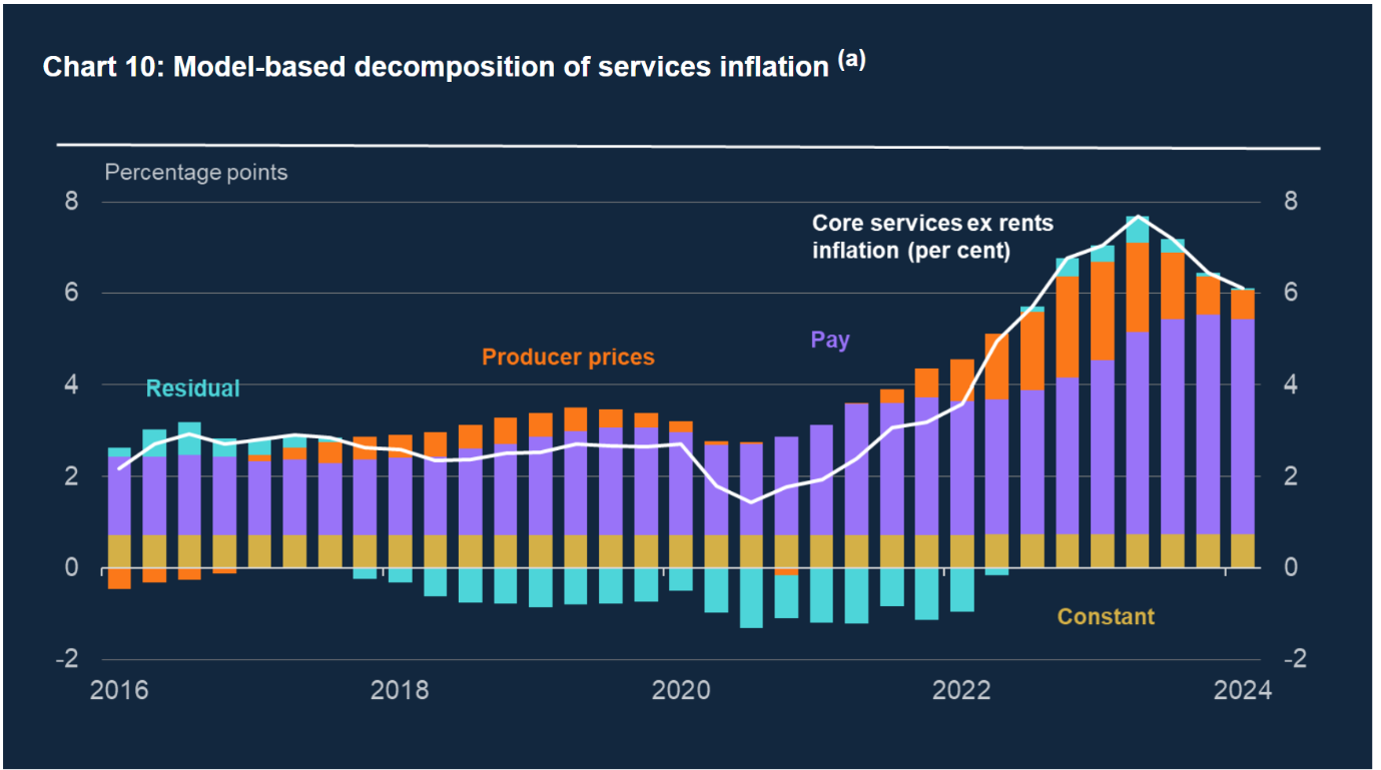

In addition, excess labour hoarding, where companies retain more staff than they need, “may have contributed to labour market tightness and thus wage growth, even as economic activity has softened. Wage growth in turn contributes to services inflation,” according to Greene.

The chart below shows the composition of services inflation since 2016 and illustrates the impact pay is having on the metric’s trajectory. As you can see, it makes up a rather large piece of the pie.

Source: Bank of England

When is the first rate cut expected to arrive?

Well, this is a question many of us have wanted to know the answer to for some time, especially savers and borrowers looking to secure the highest rates or cheapest deals, respectively. But every time rate cuts appear imminent, the needle seems to move.

In response to yesterday’s inflation data, markets predicted a 5% chance of a rate reduction happening today, while the odds of an August cut thinned from 50% to 30%. It’s hard to ignore the general election’s potential impact on today’s decision, with policymakers perhaps cautious to remove politics from the equation.

In the same vein as the ECB, the MPC will keep a close eye on the economic data over the coming weeks. The International Monetary Fund (IMF) last month said the UK should cut rates to 3.5% by the end of 2025, which would require seven reductions of 0.25 percentage points.

As things stand, financial markets are currently pricing in two cuts this year, with the first now likely to arrive in September, although August is not yet off the table.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.