Are these trusts trading on discounts future bargains?

24th March 2023 14:00

by Alan Ray from Kepler Trust Intelligence

Kepler Trust Intelligence highlights sectors with structural discounts that are worth watching.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Quite early in our careers, we had a defining conversation about the reason for investment trust discounts. The gum-chewing, gilet-clad veteran market maker says to us “mate, it’s because there are no buyers, right?”. Market making can be a very stressful job that requires the individual to live very much in the present and this beautifully succinct summary is the kind of straight-to-the-point characteristic one needs as a go-getting market maker. Being slightly more prone to day-dreaming, we can’t help but imagine how it would be if BBC Radio 4’s Today programme got a market maker to host the business section. We would all learn an awful lot in a very short space of time about how markets work.

- Invest with ii: Trade Investment Trusts | Cashback Offers | Open a Trading Account

At this point, anyone nervously twitching in front of their Bloomberg screen should relax. We aren’t here to talk about z-scores and short-term discount volatility caused by the current market volatility. No, we’re taking a step back and looking at what we think of as systemic discounts, where we can not only understand the reason for their existence, but also see why they are overdone and, in time, might start to unwind. To our minds, if one wants to be a contrarian, one first needs to understand what one is contradicting. In many ways, investing in discounts is a naturally contrarian thing to do.

So, with that very succinct root cause of discounts now defined, let’s think briefly about the structure of the investment trust sector as a possible explanation for some of today’s discounts. Investment trust aficionados love a bit of history and we all know that it’s over 150 years old and that there are approximately 375 companies with over £260 billion of assets. But we perhaps don’t think as much about the fact that approximately half that money is new money raised in the last 20 years or so, meaning that the sector is a long way from being the dusty corner of the market that it was thought of years ago.

There are a couple of other things to take away from that statement. First, there are many investors prepared to pay a premium to net asset value (new money is, except in very rare circumstances, raised at a premium to net asset value) and second, there is lot of institutional money that wants to own certain types of investment trusts. While things are changing, there are structural reasons why most new money raised for investment trusts comes from institutions and so it’s reasonable to conclude that most new money comes from professionally-managed sources. We also know this is true because investment trust share registers are public documents, so we can see where the money comes from by looking at them. It’s probably already obvious to readers where we are going with all of this sector-wise, so let’s just be clear that we are essentially referring to real and alternative asset investment trusts, by a very large margin the most successful group of investment trusts, in terms of capital-raising over the last two decades.

This leads us to one of the recent root causes of the ‘no buyers’ problem that is causing some discounts. A lot of the institutional investors who have done the heavy lifting in the last 20 years themselves manage open-ended funds. Morningstar provides us with very useful data on open-ended fund flows. We can see from that data that many of the big buyers of investment trusts have seen a pause or a reversal in their fund flows after a long period when money was regularly flowing in. Not only that, but many of these investors are so-called multi-asset investors, who look at a broad range of assets beyond investment trusts. Even if those investors aren’t suffering redemptions from their funds, there are new choices, thrown up by rising interest rates, to make about the relative value of, for example, corporate bonds versus an alternative income investment trust. In fact, corporate bond funds were, according to Morningstar’s data, overwhelming the destination of new money in 2022.

The above is, of course, a simplification of a series of interlinked factors, each one potentially both a cause and an effect. But the simplification still works: buyers haven’t got the money they once had in order to support investment trust share prices. The other piece of the puzzle is interest rates, which brings us back to the point; how can you be a contrarian unless you understand the opposing argument? In this case, the argument is pretty simple and we agree with it, which perhaps makes us less contrary than we thought. Interest rates are a fundamental input into any valuation model and changes in interest rates, therefore, cause changes in valuations. How this affects the value of equity in a trading company is relatively complicated, but a fund manager who owns a portfolio of alternative or real asset investment trusts where there are very explicit links to interest rates, is quite rightly questioning whether they should be selling them and substituting something else. It’s the job of an active fund manager to ask questions and, if necessary, act upon the answers.

All of this leads us to the conclusion that, while on the one hand we agree with the basic thrust of the argument behind more negative sentiment, there is a structural reason why that negativity has led to overreactions in share price terms. It must be enormously frustrating for a fund manager to watch a long-term investment trust holding move to a discount that more than compensates for that fund manager’s revised lower expectations, but because there is no money available, they can only watch as the discount continues to widen. The fact that they then have to read articles saying how cheap it is must be doubly frustrating.

But wait, there’s more…

In a moment, we will come to the sectors where we think discounts are explained by the above argument. But before we do, let’s turn another negative into a positive and think about that twenty-year period of very predictable capital-raising. It has created its own industry of investment trust management businesses built on the key assumption that new capital can be raised on a predictable schedule, in order to fund new acquisitions. That assumption is on hold for now as prices drift to a discount. One should not underestimate the enormous time and effort that goes into creating a pipeline of alternative assets, both in terms of identifying them in the first place and then performing all the necessary due diligence. There are no third-party analyst notes to read on a private real asset, so all the analysis must be done from scratch.

There is a whole ecosystem built up around this and it’s not that easy to hold this process up and ask everyone to wait. As a result, we think there is an enormous amount of pent-up demand for new capital which, at the time of writing in Q1 2023, seems unlikely to come from raising new money in the public market. This is bound to lead to frustration and we have no doubt that many alternative asset investment trusts will be actively looking at options to raise capital through private markets, where there is still access to capital. Raising capital privately alongside public capital, as long as proper conflicts’ policies are written and enforced, is totally fine and may indeed be for the benefit of the shareholders of a public investment trust. This is because it means their manager can carry on participating in deal flow, even while they are on hold in terms of raising new public equity. The direct analogy is that many equity investment trust managers also run an open-ended fund that does much the same thing, with standard policies in place to ensure that each fund is treated equally. But we can also envisage frustration spilling over into corporate activity. There’s an old saying in the investment trust sector about turkeys not voting for Christmas but, in this case, we aren’t talking about turkeys, but rather about very ambitious investment trusts frustrated by the lack of capital available through public markets. A climate where some supply is taken out the market, at a premium to the value the market currently places on that supply, could be very positive for discounts, generally.

These lead us to summarise the four key sectors where we think there are systemic discounts that are explicable, where we don’t necessarily disagree with those discounts, but where we can see a path to discounts recovering. In most cases, the investors will be paid to wait by dividends. Regular Kepler readers might not be surprised by much of this, but we aim to be consistent and, as we said at the top, z-scores and short-term trades aren’t the topic for today.

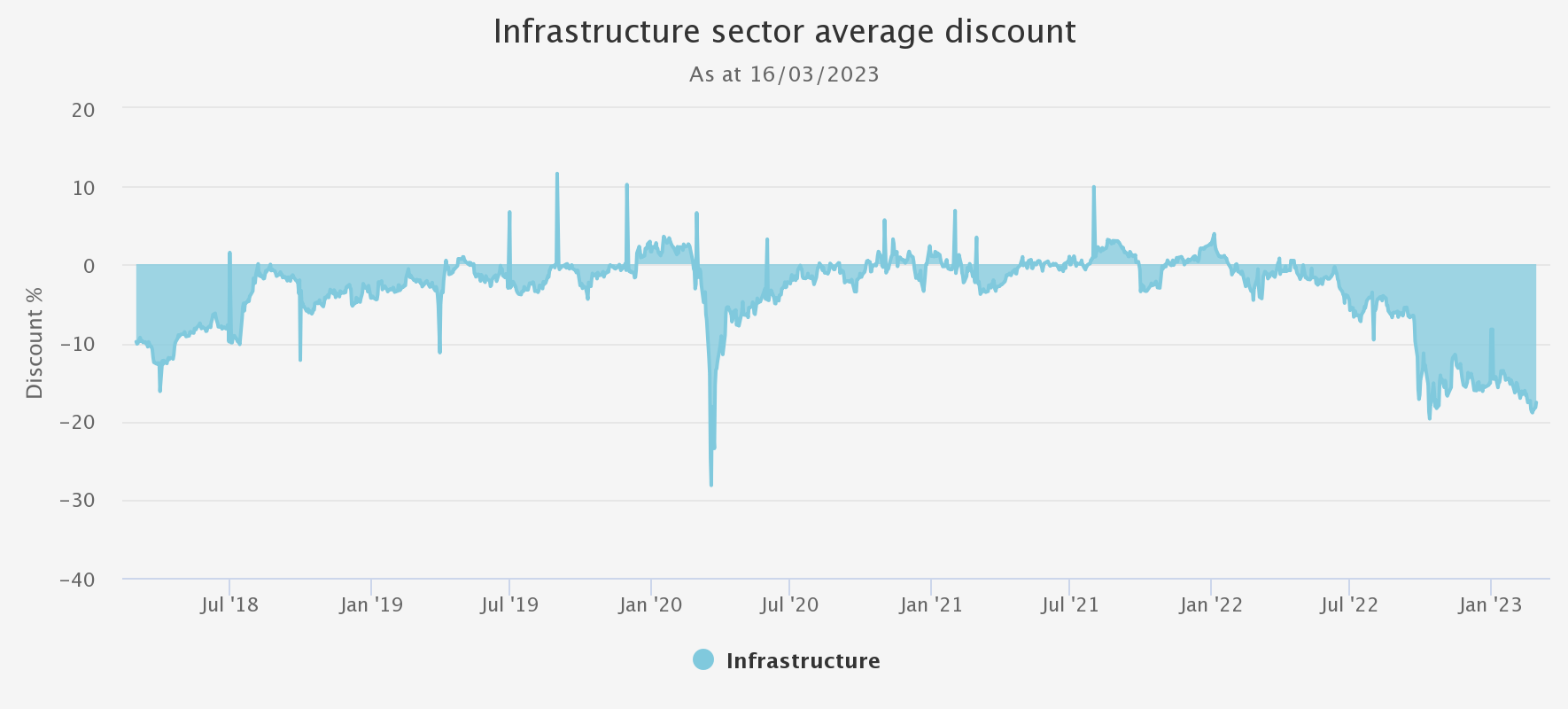

Infrastructure

Compared to other sectors, the infrastructure sector has been relatively unaffected, but nevertheless, prices have been weak and a sector discount has crept in as capital has dried up. Trusts such as HICL Infrastructure (LSE:HICL)and BBGI Global Infrastructure (LSE:BBGI)remain core holdings for many investors, have broadly diversified assets and have at least partial inflation protection written in to their contractual revenue streams. Both these trusts yield more than 5%, as they now trade at low single-digit discounts. In time, as the structural issues discussed above work through the system, we think those ratings are likely to improve. In the meantime, investors are paid to wait by means of the attractive dividend yields.

FIVE-YEAR SECTOR AVERAGE DISCOUNT %

Source: Morningstar. Past performance is not a guide to future performance.

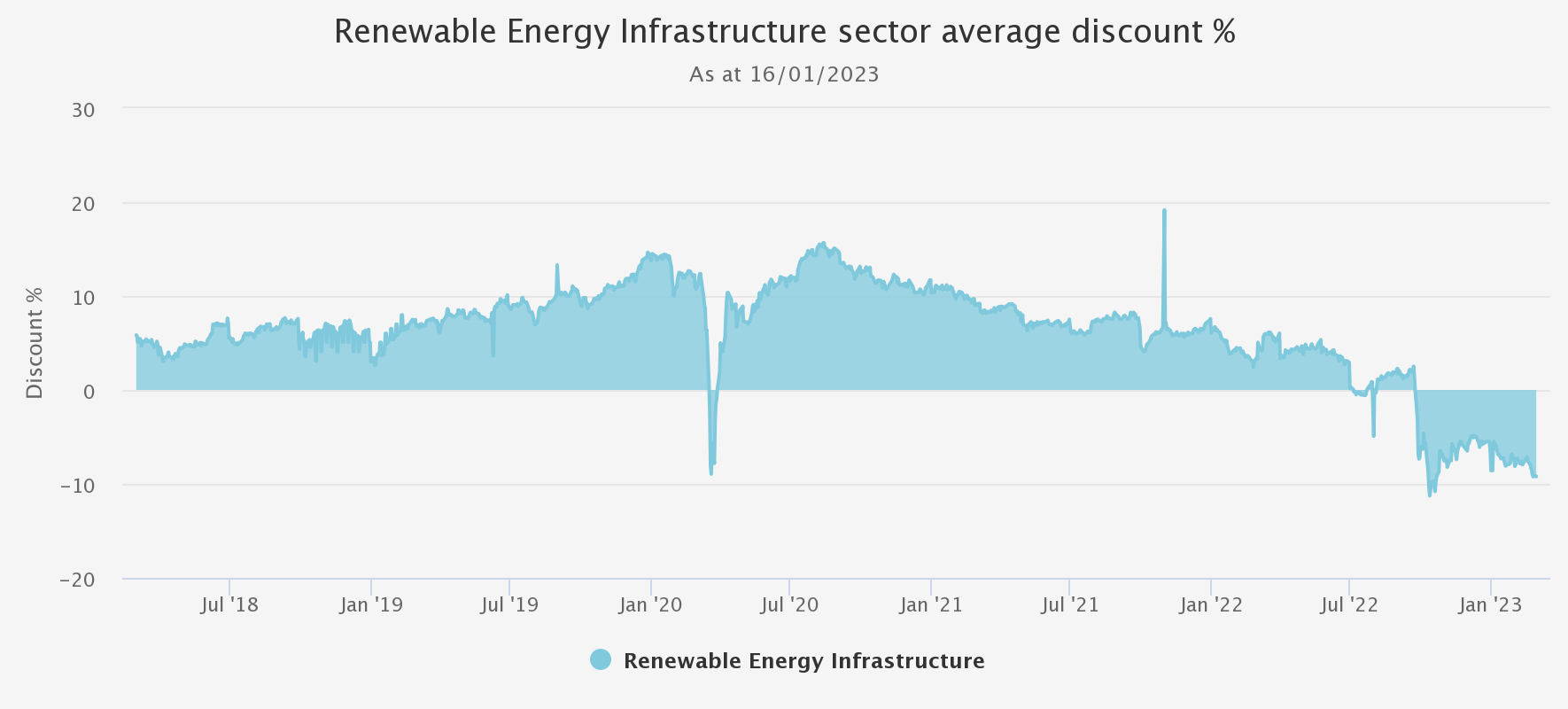

Renewable Energy Infrastructure

We’ve given a reasonable amount of coverage recently to the topic of Renewable Energy Infrastructure, and you can read a recent article here which goes through the reasons why we think this sector should be considered a core sector for any investor. Suffice to say, we believe that investment trusts such as Greencoat UK Wind (LSE:UKW)and TheRenewables Infrastructure Group (LSE:TRIG)offer investors exposure to core UK infrastructure assets that are essential for the energy transition and for energy security. Both are likely to be central investment themes, globally, for many years to come.

FIVE-YEAR SECTOR AVERAGE DISCOUNT %

Source: Morningstar. Past performance is not a guide to future performance.

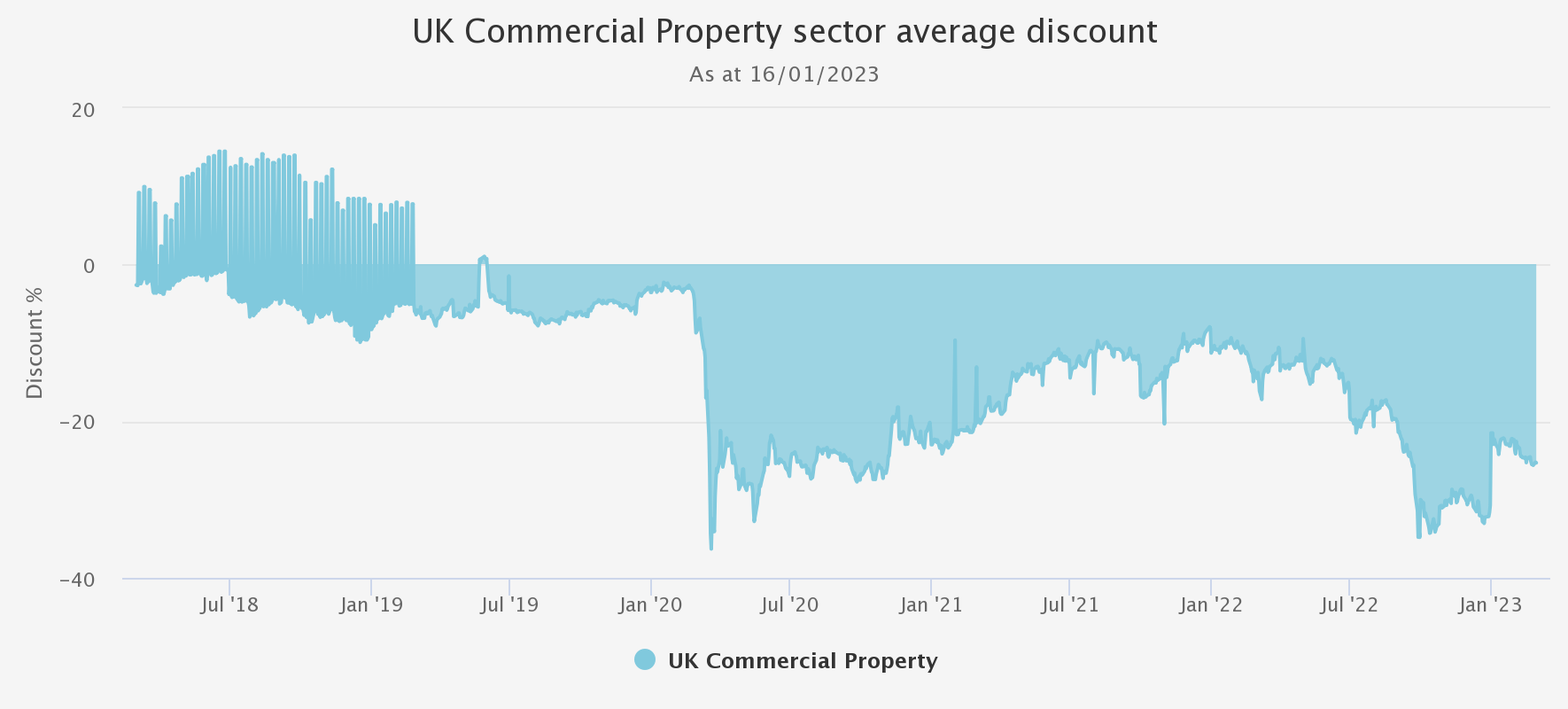

UK Commercial Property

Commercial property is one of those sectors where the stock market has a pretty good track record of calling the top before it makes its way through to valuations. Share prices in the run up to the great financial crisis predicted falls that many property fund managers just couldn’t envisage at the time. We think that last year, property fund managers were generally pretty good at guiding us in what to expect, but the stock market was also quite quick to connect interest rates and property valuations. The chart below shows the sector discount over the last five years.

FIVE-YEAR SECTOR AVERAGE DISCOUNT %

Source: Morningstar. Past performance is not a guide to future performance.

Recent conversations with property fund managers suggest that the biggest valuation declines have happened and that certain sectors within UK commercial property, such as retail warehouses and Grade A offices, are doing well from a rental perspective and perhaps better than investors expected. That said, end of March valuations aren’t too far away now and seem likely to be negative as well. One risk we’ve highlighted previously is that many of the REITs are geared and will need to refinance their debt over the course of the next few years. This may well result in an increase in the interest rate they pay, with negative consequences for dividend cover. If you like, this is an aftershock of the rise in interest rates. Schroder Real Estate (LSE:SREI)’s balance sheet makes for interesting reading in this context, with an average debt maturity of 11 years, with an average interest cost of 2.9%, significantly below the net initial yield of the portfolio. SREI’s dividend is fully-covered and has even seen a modest increase as a result. It's only fair to point out that SREI has gearing that, by real estate standards, isn’t excessive. At just over 50%, calculated using the investment trust gearing methodology, it is higher than the average investment trust and we note that other generalist property funds, such as UK Commercial Property REIT (LSE:UKCM), have more modest gearing of c. 15%.

On the subject of corporate activity, we also note the very recent statement byEdiston Property Investment Company (LSE:EPIC), where the board has called a strategic review, essentially because it believes it will be difficult to raise new capital for the trust and is, therefore, seeking alternative options, such as a sale or merger. This is a trust that has shown itself to be quite strategically adept in selling assets and holding cash at the right time, and we share their frustration.

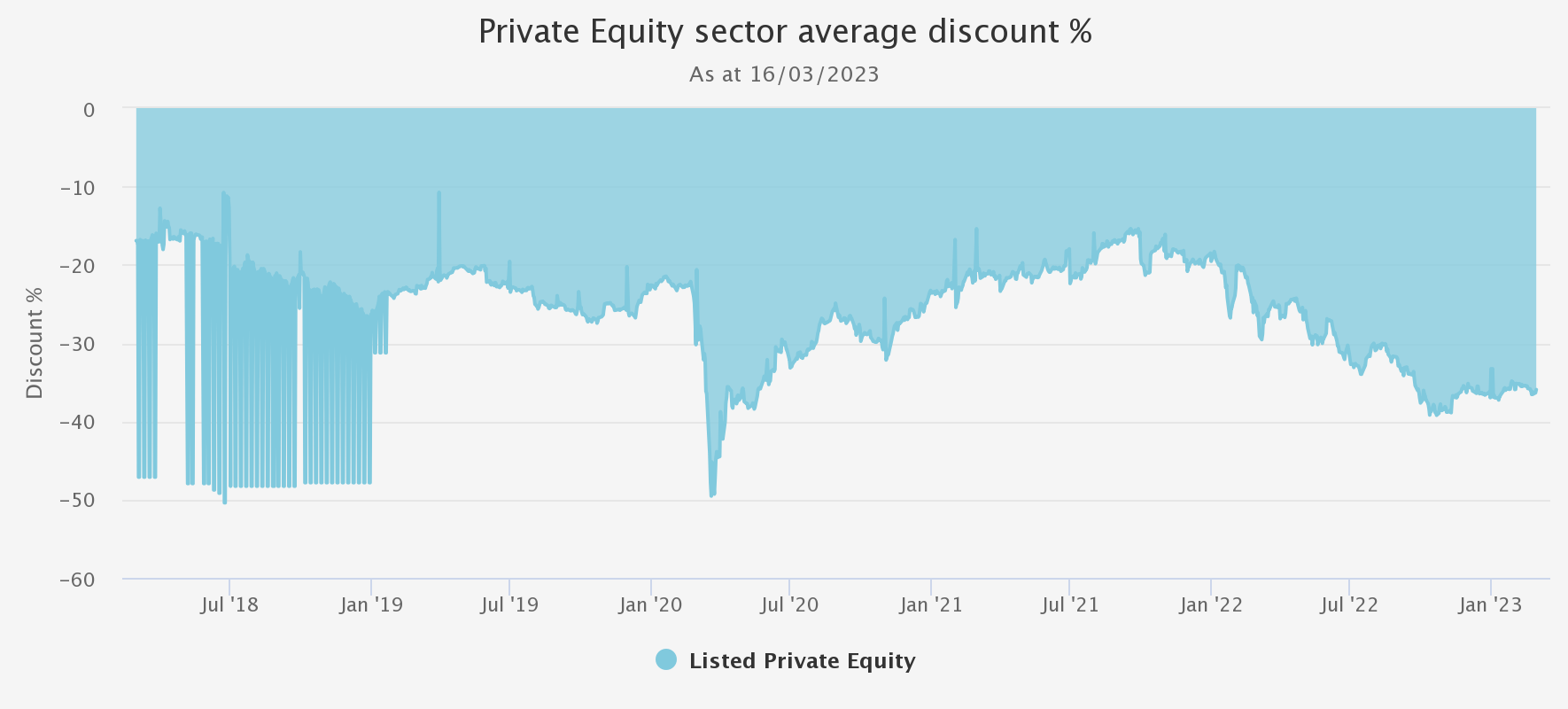

Listed Private Equity

This is a perennial Kepler favourite discount opportunity, so one might say no piece on discounts would be complete without it. Here, the argument that explains large discounts is ‘the stock market has gone down by this much, but private equity values have hardly moved at all’. Twenty-five years ago, it was surprising how accurately one could model the net asset value of a private equity trust by just applying the change in the P/E ratio of the FTSE All-Share Index since the last NAV was published. Not to say that net asset values were not produced carefully and diligently, but there was a very high market correlation with a six-month time lag. This isn’t the same today, in large part because accounting policies for private equity valuations have changed, so that events are incorporated more quickly. What’s always been true is that private equity gravitates towards different sectors than the big macro-driven sectors that can often move stock markets, with banks and large energy companies being two very apposite examples. Both these sectors have had very large impacts on the performance of listed markets in the last year, but are hardly represented at all in private equity.

The big difference between private equity and the other sectors we’ve highlighted above is that the whole industry is built around a seven to 10-year cycle of buying and then selling assets and, in any given year, there will be transactions in both directions, meaning that valuations will quickly either be proved right or wrong. We’ve no doubt that the tougher environment will make for a slowdown in transactions. Of course, interest rates have risen and so has the cost of debt, which is important to private equity. However, no one is talking about an ice age for private equity deals.

Again, though, do we agree with the basic premise that the stock market has placed a discount on the listed private equity funds? Yes, we do. Coming out of an ultra-low interest-rate era with inflation, war and economic slowdown all right in front of us, it seems entirely reasonable to expect private equity risk to rise and for valuations to fall. It’s just a question of degrees and again, for structural reasons, the buyers who can really move share prices are occupied elsewhere.

To be absolutely clear, we are talking about traditional private equity in this context, with investment trusts such as NB Private Equity Partners (LSE:NBPE)orCT Private Equity Trust (LSE:CTPE). Trusts such as these do not have high exposure to venture investments or pre-profitable companies and both pay an attractive yield. Valuations in those types of companies are, by their very nature, more subjective, and due to their pre-profitable nature, they require frequent funding rounds. In a more difficult environment where capital is scarcer, the probability of lower valuations seems much higher to us.

FIVE-YEAR SECTOR AVERAGE DISCOUNT %

Source: Morningstar. Past performance is not a guide to future performance.

Conclusions

There’s absolutely nothing wrong with identifying fleeting discount opportunities which come and go with market volatility, but these can often disappear before one has a chance to act on them. The sector discounts we have identified above are all explicable and we think are unlikely to be fleeting, but in our view, time will fix the structural issues behind them. In the meantime, all these sectors have constituents that offer attractive yields which pay the investor to wait.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.