Are Indian stocks still worth buying?

Indian stocks are hot right now. But is the market overly optimistic? Here are four reasons why we think valuations can be justified.

18th October 2024 12:20

by James Thom from Aberdeen

Investors have been captivated by India. It’s easy to see why – strong demographics; a long runway for growth; companies that reliably compound earnings. Add to this mix a geopolitical landscape which has shifted investor interest away from China, and you have a compelling investment proposition.

Here’s the problem though – it’s a popular trade. Back in the 1980s when we started investing in Indian stocks, it was a struggle to get people interested. But what was once contrarian has become mainstream.

For example, India’s weighting in the influential MSCI All Country Asia-Pacific ex Japan Index has doubled to more than 18% from just under 9% since the end of 2020. Index rebalancing has helped attract billions of dollars controlled by international investors into the domestic stock market. Chances are, we’re just getting warmed up.

‘What about valuations?’

This is the one question that I hear again and again during investor meetings. Have Indian equities risen too far and too fast? Are they victims of their own success?

Most investors in Indian stocks are investing for the long term, which is a good thing. They are buying into the growth potential of the world’s fastest-growing major economy, one that is reaping the benefits of major reforms launched a decade ago.

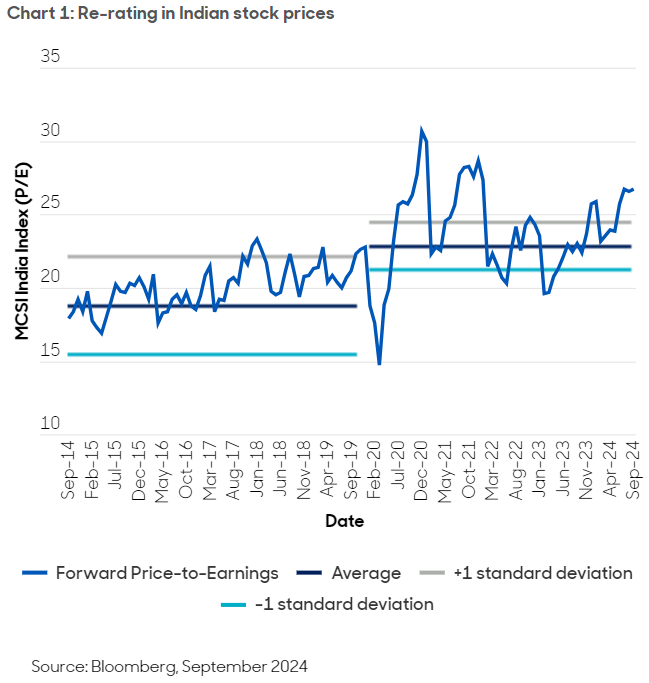

Yes, we’ve seen a re-rating of stock prices, as many investors start to believe equity valuations should be higher on a sustained basis. There’s no doubt the Indian market isn’t cheap. In fact, regulators had to intervene when speculative interest in smaller companies got too intense.

That said, given the bigger picture, we think prices at these levels can be justified.

What do valuations look like?

So why are some investors getting nervous?

The strong get stronger. Indian stocks have always been more expensive than their emerging market peers. The MSCI India Index has, on average, traded at 21.8 times earnings over the past decade. During the same period, the MSCI Emerging Markets Index traded at 11.9 times earnings [1]. This ‘premium’ has only increased since Covid as the effects of reforms have fed through into equity markets.

A higher base. There’s much greater visibility over high-quality corporate earnings in India. The MSCI India Index is trading at some 26 times 2024 earnings forecasts – above recent average valuations (See Chart 1). Since 2020, average valuations have risen to some 23 times earnings, from around 20 times. For comparison, the Nifty 50 Index is trading at 22 times 2024 earnings forecasts [2].

Are stock prices too high?

We don’t think so as these valuations are justified for four reasons:

The macro backdrop is healthier and will remain supportive. India’s foreign exchange reserves are now at record highs, thanks to conservative policies [3]. This helps mitigate currency risk and the country’s traditional vulnerability to commodity price shocks. India’s fiscal deficit is set to fall below 5% in 2025, supported by a structural uplift in tax revenues. Inflation, at less than 5%, is well under control. Much of the credit for that goes to the Reserve Bank of India.

India’s economy is more efficient and continues to improve. Higher tax revenues mean the government has been able to spend on upgrading power infrastructure, renewable energy, rail, roads and public transport. It’s now much easier to do business in India and to move goods and people between states. Even commuting within cities has become easier for many millions of people.

Corporate India is in better shape. Companies are more efficient, less indebted and growing faster. It is also easier for them to raise capital. Economic growth is translating into corporate earnings – there has been a step change in the speed of earnings-per-share growth. Indian equities are now priced to deliver earnings growth in the mid-teens [4].

The stock market is more attractive and supported by domestic investors. Domestic flows have accelerated and show no signs of stopping [5]. For example, monthly saving plans and employer pension schemes have grown, providing structural support to the market. Equities form less than 6% of household wealth (compared to 22% in the US). India’s equity market capitalisation is well on the way to hitting US$10 trillion (it’s currently around US$5.5 trillion). Meanwhile, India’s weighting in emerging market and Asia funds remains relatively modest for the size of the economy.

Final thoughts

India is going through a major economic transformation -- one that could easily rival the changes we’ve seen in China over the past two decades.

That said, a big difference between the two markets is that in India, economic growth is better reflected in corporate earnings and in stock market performance.

For years we’ve followed plenty of quality companies in this market and we know that quality companies nearly always command a premium.

Should you be worried about valuations? I’d be lying if I said I haven’t been concerned about the prices that some companies are trading at. That’s why you need to be selective.

But we looked at price returns for the MSCI India Index over the past two decades. An investor who had bought at the top of each cycle with a passive buy-and-hold strategy would still have made money [6].

With an active strategy, better timing and more patience, her returns would have been even better because the index has risen some 1,927% since the start of 2003.

- Bloomberg, September 2024

- Bloomberg, September 2024

- Bank of America, August 2024

- Bloomberg, Jefferies, February 2024

- Avendus Spark Research, June 2024

- Bloomberg, September 2024

James Thom is Senior Investment Director at abrdn, Asian Equities

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.