An American brand I’d still buy shares in

There’s talk that a smaller UK rival is eating into this multinational firm’s profits, but overseas investing expert Rodney Hobson isn’t worried. He also issues an update on Crowdstrike stock.

14th August 2024 08:03

by Rodney Hobson from interactive investor

It was rather a shock to read a newspaper report suggesting that food outlet Greggs (LSE:GRG) could start eating into the fast food market domination of McDonald's Corp (NYSE:MCD), even if only in the UK. However, investors do need to consider whether the Big Mac is starting to shrink after decades of seemingly unstoppable growth.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

McDonald’s has reported a weaker second quarter, as problems in several countries were exacerbated by a deteriorating environment for consumer goods in the United States home market, where more than 40% of sales are made. The US economy has held up so well since Covid that we have rather taken for granted that it will continue to do so.

Total revenue slipped only a fraction of 1% to just under $6.5 billion, but analysts had expected a modest increase. Net profit dropped sharply by 12% to just over $2 billion.

Comparable sales in the US fell 0.7% due to lower customer numbers, partly offset by higher average sales per order. Up to this point, McDonald’s had been remarkably successful in passing on price rises to compensate for inflation in the cost of ingredients. Hopefully, with inflation easing it will not be necessary to raise prices further in the immediate future.

McDonald’s now has different problems to tackle. Sales in France fell markedly for no obvious reason and China was weak, too. More importantly, the Middle East conflicts are having a serious impact, with some customers boycotting the chain because of its heavy presence in Israel.

Of the 40,000 locations that the chain operates in more than 100 countries, 5% are in the Middle East. McDonald’s has bought out its Israeli franchises after the local franchisees offered discounts to Israeli military personnel but the damage, as far as neighbouring Arab nations are concerned, has been done.

All this follows the impact of withdrawing from Russia after the invasion of Ukraine.

- Nvidia share crash: second bite of the cherry or red flag?

- Morgan Stanley says this industry should win when rates fall

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Undaunted, McDonald’s is this year splashing out $2.7 billion on capital expenditure, mainly on opening new restaurants, including 1,000 more in China despite political tensions with the West. It has in the past shown itself as the clear leader in fast food, rolling out new products and handling price rises skilfully so as not to deter customers. It is now coming under increased pressure in various local markets from the likes of Greggs, which seems to have learnt lessons from the rapid spread of McDonald’s and is now applying them more effectively.

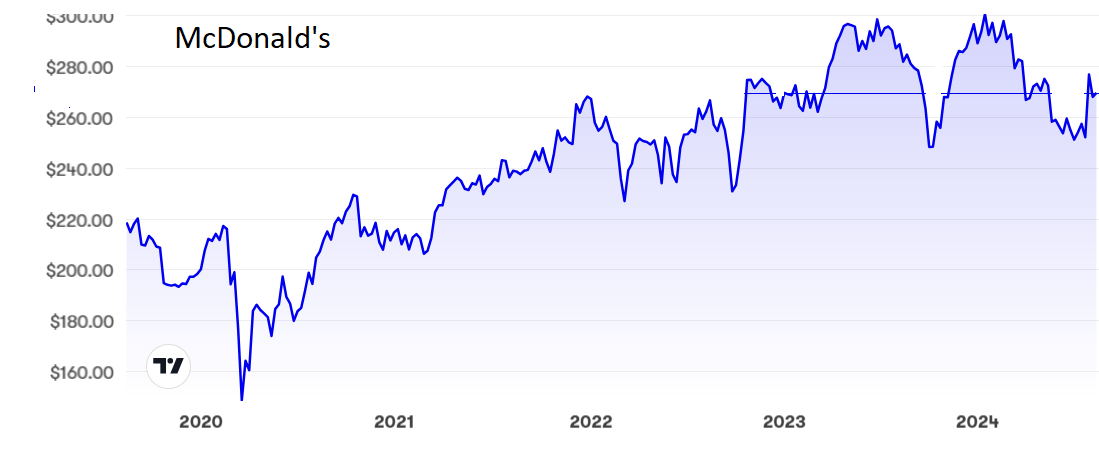

McDonald’s shares hit $300 in January but have been on the slide since, slipping as low as $245 last month ahead of the latest figures. They do seem to have bottomed out, though, having found support around $260 or just below several times.

Source: interactive investor. Past performance is not a guide to future performance.

At the current $270, the price/earnings ratio looks a bit too high at 23.5, even for a company of this quality, given the uncertainty about earnings over the rest of this year, but the yield is some consolation at 2.4%.

Hobson’s choice: I recommended McDonald’s shares at $244 in May 2022 and since then shareholders have enjoyed a small rise in the share price and an increased dividend. I suggested in November that $300 could be broken but that hope will have to be deferred until trading picks up. Nevertheless, and despite the competition, I still rate the shares a buy.

For the record, I own shares in Greggs.

Update: It takes nerves of steel to buy into AI chipmaker CrowdStrike Holdings Inc Class A (NASDAQ:CRWD), but the shares do seem to have bottomed out after the international computer outage last month. I suggested buying at the end of July when the shares were $233 and was a little premature. The bottom came a day or two later at $217 but they are now back above $240. This is a highly volatile stock, but my buy recommendation still stands. Just be ready to get out sharpish if there is any more bad news.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.