AIM stocks, elections and what to expect after 4 July

Award-winning AIM writer Andrew Hore investigates how the AIM market has performed at general election time, and uncovers reasons to believe there could be a significant upturn once a winner is announced.

24th May 2024 15:04

by Andrew Hore from interactive investor

There have been signs of improvement in AIM this year, but continued uncertainty has held back the recovery of the London stock market. Part of that uncertainty was when the general election would be held. Rishi Sunak’s decision to hold the election on 4 July could help AIM’s recovery to accelerate whoever wins.

There was certainly a bounce-back after the December 2019 general election, but that was for different reasons, more related to the exit from the EU and how/whether it would happen.

- Learn with ii: How to Buy Shares| Top UK Shares | Cashback Offers

The current uncertainty is more to do with the economy and the timing of a sustained recovery. Although recent economic figures, such as lower inflation and GDP growth, have appeared positive it is still unclear if this is something that will continue.

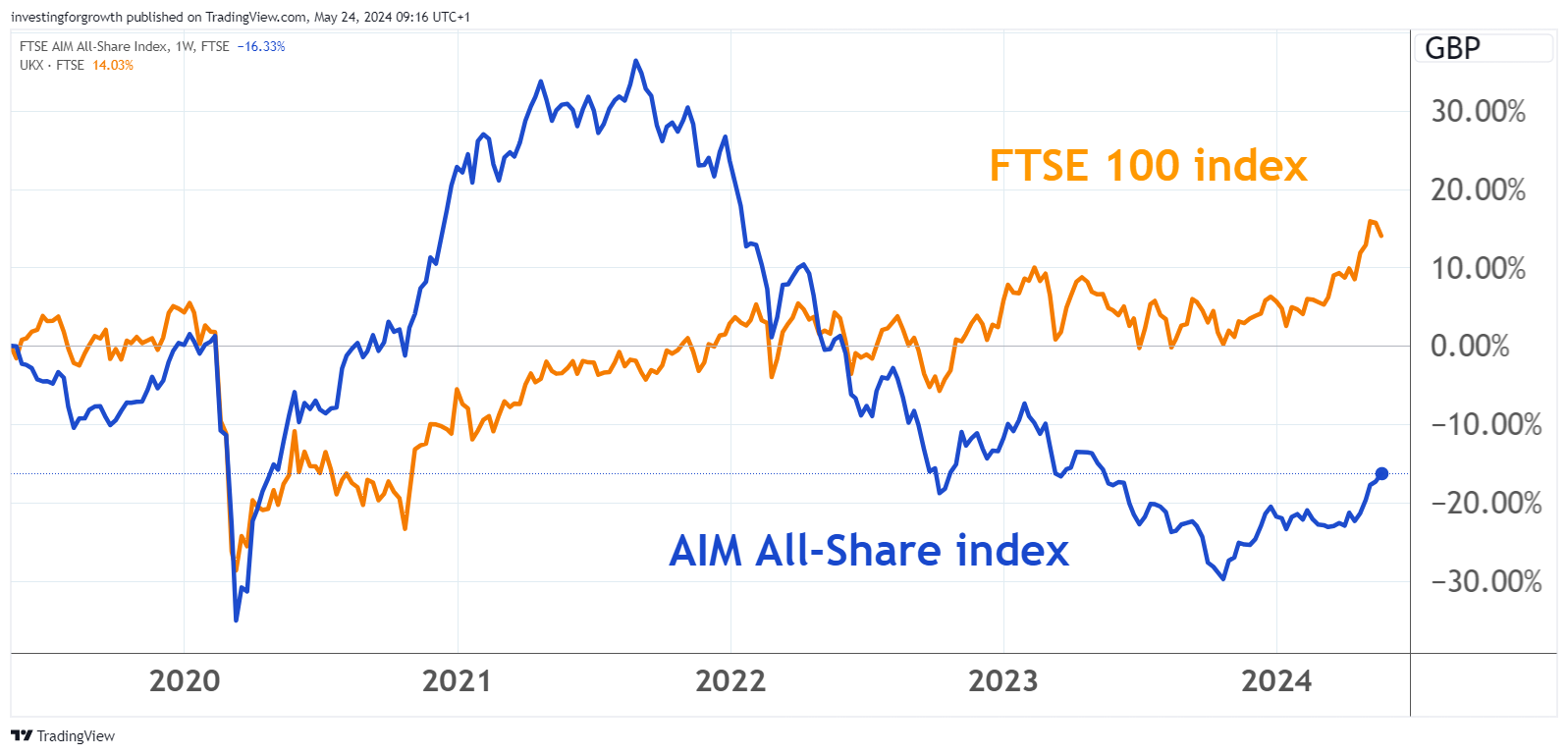

The FTSE 100 index has been on an upward trend for a while and AIM has been underperforming. That underperformance has narrowed in recent months, but there is still a lot of catching up to do.

Source: TradingView. Past performance is not a guide to future performance.

In the two days after the announcement of the general election, the FTSE 100 had slipped 0.8%, while the AIM All-Share index is a fraction lower. AIM is 5.1% ahead this year, but the FTSE 100 is 7.4% higher.

This is the first July general election since 1945 when the Second World War was coming to an end in the Pacific. There have been plenty of elections in June, though, so it is not a great deal different. Of course, AIM was not around in 1945.

This is the eighth general election since AIM launched in 1995. The FTSE AIM All Share has been calculated back to the beginning of the junior market, even though it has only been up and running for around two decades. At the time of the first of those general elections, in May 1997, AIM was still less than two years old and was building up the number of companies on it.

Following the most recent five elections, AIM has ended that year higher than at the beginning of the year. However, it ended the year higher than the day prior to the announcement in four out of these five years, with 2015 being the outlier when there was a fall of less than 2%.

The same trends are true of the FTSE 100, although there was a much sharper post-election decline in 2015 and, unlike AIM, there was also a decline for the full year.

- Four AIM shares that are potential bid targets

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

In 2010, there was a 2.4% decline in AIM on the day after the election because of the continued uncertainty about how a government would be formed. That did not stop a 36.4% gain from the election day to the end of the year.

AIM has outperformed the FTSE 100 after each of the last four elections. The only one of those elections where it did not outperform over the year as a whole was 2019 where the pre-election underperformance was reduced significantly in a matter of days, and the rise over the year of 11.6% was only slightly lower than the gain of 12.1% for the FTSE 100.

Gains by AIM in the past five election years range from 4% in 2005 to 42.9% in 2010, despite that initial uncertainty. There was a 37.6% decline in 2001, but that is more down to a continuation of the decline after the peak of the internet share boom in 2000 and the weak economy.

Will optimism return after the election?

There are reasons to believe that there could be a significant upturn in the fortunes of AIM after 4 July. The junior market has been depressed for nearly three years. Having said that, there has been a rise of around one-fifth since last October, but it does not feel like the market is strong and the negative sentiment continues.

There are still plenty of companies choosing to leave AIM, complaining of the cost, lack of liquidity and difficulty in raising cash. Some have tapped the market for cash once too often and have not made progress. There is also a lack of new blood on the market and the spin-off of Green House Capital is not happening as previously planned.

There have been some failures as well, including some companies that joined AIM after 2020. Some of that is due to what was happening on the market at the time. Alternative energy and clean-tech companies, such as ITM Power (LSE:ITM), were peaking three years ago. This led to companies involved in that sector floating - possibly too early.

Because they were early stage businesses, they required more than one fundraising to keep them going. Battery developer AMTE Power and electric motor technology developer Saietta burned through the cash they raised on flotation and subsequently and could not raise additional funds.

- Stockwatch: what now after ISA tip’s 70% profit in two months?

- Insider: boardroom buying at AIM company with royal approval

However, recent new admissions have done well. Helium explorer Helix Exploration (LSE:HEX) has risen by 75% since joining on 9 April. European Green Transition (LSE:EGT) is 69% higher since 8 April. Both companies floated at 10p. This shows that there is an appetite among investors for new opportunities, although these are more speculative investments.

Even so, there is a lack of visible pipeline of AIM new admissions. Advisers talk about having potential new entrants, but they are holding back because of the poor sentiment and inability to achieve the valuations that they want.

The undervaluation of companies is indicated by merger activity. Tissue producer Accrol Group Holdings (LSE:ACRL) and self-storage sites operator Lok'n Store Group (LSE:LOK) are two recent bid targets. Portuguese pulp and paper company Navigator Paper had to increase its original bid for Accrol by 1p/share to 39p/share, even though the board recommended the initial bid. This suggests that institutional investors are aware that valuations are lower than they should be, and they do not want bidders to underpay.

This bid activity has probably already helped AIM to recover, but there should be more to go for. There are still plenty of profit warnings, though, and share prices can be hammered for even mild shortfalls.

For example, scientific instruments manufacturer Judges Scientific (LSE:JDG) is one of the best performers on AIM and it was near an all-time high prior to its AGM statement. Management warned that trading is subdued, particularly against tough comparators last year. Even so, WH Ireland still expects a full year pre-tax profit of £33.8 million, assuming a stronger second half. The share price fell by more than 8% on the day, although it has clawed back some of the loss.

Election winners and losers

It is still too early to assess ways that a win for either party will affect AIM or specific sectors. There will be a better understanding when the manifestos are published, but that is not likely to happen for a couple of weeks.

Although the Labour Party appears to have watered down its commitments on carbon reduction and other climate-related policies, it is still expected to be more focused on this than the Conservatives.

Mitesh Dhanak, chief executive and founder of energy and water efficiency services provider Eneraqua Technologies Ordinary Shares (LSE:ETP), says that he has met representatives of the Labour Party, and he believes that they will offer additional incentives for capital investment in energy efficiency projects.

- Stockwatch: a buy after strongest numbers this results season?

- How to invest ahead of the general election

That would be good news for Eneraqua Technologies because it has been hit by delays to local government contracts that led it to fall into loss in the year to January 2024. A return to profit is anticipated this year, but the improvement could be accelerated by a Labour government.

Despite the recent uptick in AIM performance, confidence has not returned. A more certain outlook for the UK may help to instil that confidence. A Labour government appears likely right now, but it cannot be counted on. Even if it wins, it may not gain a clear majority. That could lead to a short-term market decline just like in 2010.

If or when the next government is decided, there should be a period of positivity in the market given a major uncertainty will have been removed. That should make public and private sector organisations more confident in making decisions on new contracts and projects. That would help some AIM companies achieve their forecasts or provide opportunities for upgrades.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.