AIM ISAs are 10 years old: these shares are the big winners

4th August 2023 15:21

by Andrew Hore from interactive investor

It’s a decade since AIM shares were first eligible for inclusion in ISAs. A lot has happened since. Award-winning AIM writer Andrew Hore looks at an eventful period and amazing stock performance.

The tenth anniversary of the inclusion of AIM-quoted shares in Individual Savings Accounts (ISAs) falls on 5 August. This was a significant event because it made AIM shares even more attractive to longer-term investors. AIM shares already had tax benefits, the most significant of which is business property relief. This enables investors who hold eligible AIM shares for more than two years to pass them on to beneficiaries on their death without incurring inheritance tax (IHT) charges.

- Invest with ii: Open a Stocks & Shares ISA | What is a Stocks & Shares ISA? | ISA Offers & Cashback

Those AIM shares not eligible for IHT relief became more attractive to investors when there was the potential to own them in an ISA, which meant they would not be subject to tax on dividends and capital gains.

ISA eligibility boosts AIM’s popularity

There was certainly an immediate upturn in trading after AIM shares became eligible for ISAs. The value of trades on 5 August 2013 was £123.3 million, nearly £50 million above the previous day’s level. On 5 August 2014 the value of trades was £116.8 million. Daily numbers can vary substantially, but it is an indication of how ISAs appear to have increased interest in AIM shares.

Some AIM companies listed on overseas stock markets had already been eligible for ISAs, but most of the companies were not. Market conditions may have played a part in the higher trading levels but there does appear to have been an ISA boost.

For the first 12 months, the average daily number of trades in each month was higher than the corresponding period in the previous year. The level of trading in early 2013 was much lower than in the same period of 2012. Even comparing each month between January and July in 2014 with the same months in 2012, there is only one month where there is not an improvement. The same trends are true in terms of average daily trade volumes.

Since then, the average daily trades peaked at 80,267 in 2021 and, even though trading has been relatively weak recently, the average for 2023 up until June was 44,321.

The number of companies on AIM was still more than 1,000 when the changes to ISA eligibility were made. Since then, the number has fallen to less than 800, although the current market capitalisation of AIM is higher.

One of the signs of the improvement in trading volumes after the ISA rule change was the 57% increase in the underlying operating profit of market maker Winterflood Securities to £26.6 million in the year to July 2014. The market maker trades in non-AIM companies as well, but AIM makes up a significant part of its business. In the results of its holding company Close Brothers Group (LSE:CBG), it was stated that the improvement was helped by greater trading in AIM and other less liquid smaller quoted companies. Income per trade increased from £6.33 to £6.81. Winterflood added that the improvement in income per trade is “principally due to a change in mix towards more profitable AIM trading”.

Contrast that to the latest trading from Winterflood, where the 2022-23 operating profit forecast is £3 million, with only a small profit contribution in the second half. This slump in profitability is down to the lack of trading on AIM.

AIM performance over 10 years

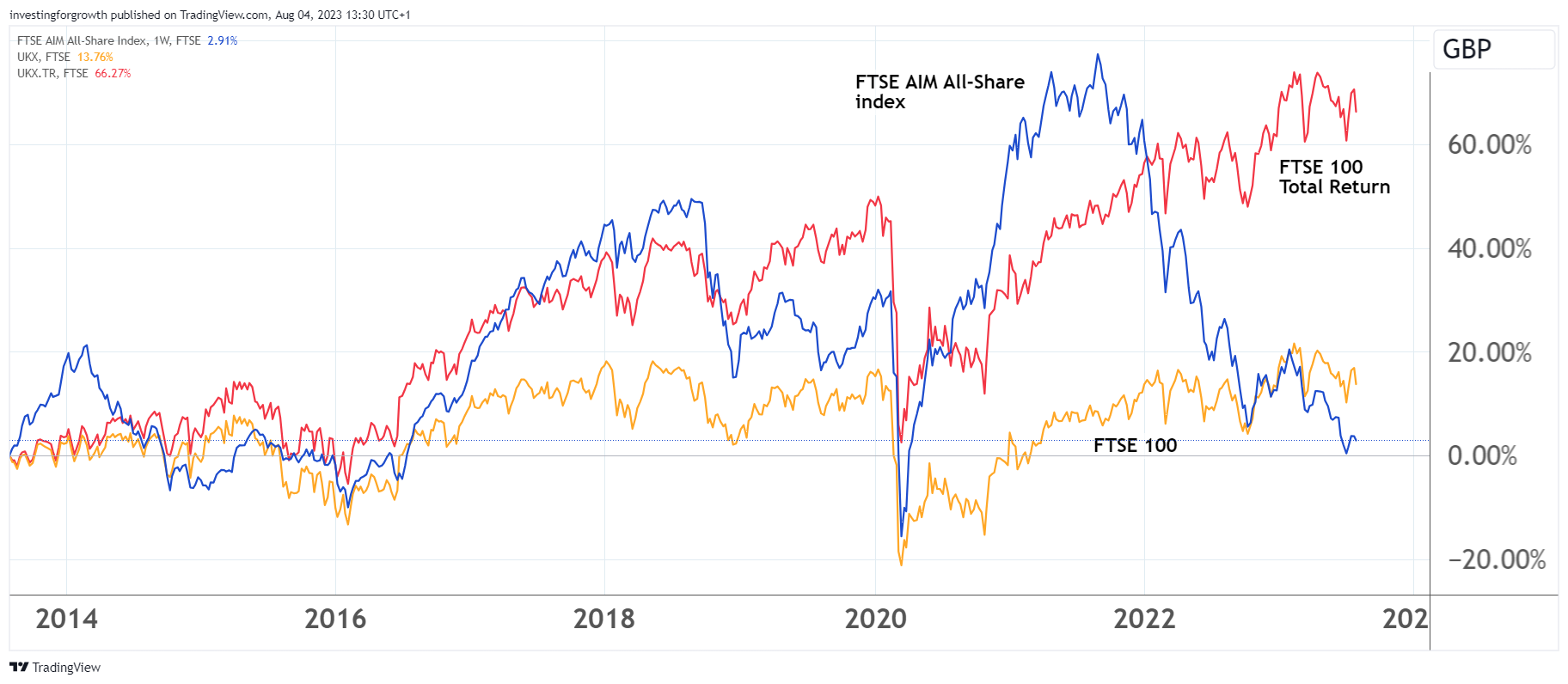

The AIM performance was strong during the first few weeks after the ISA rules change, and by the end of 2013 the FTSE AIM All-Share index had risen by 14%. However, the performance of AIM did weaken during 2014. Since then, AIM has been up and down, and the slump in the past two years means that it is only 3.8% higher over the 10-year period.

But many individual AIM companies have done well during the past decade. As of the end of trading on 3 August there are 110 companies still on AIM where the share price has at least doubled. That is out of 484 companies that have been quoted for the whole decade.

There will be a few of these companies that were listed on the Main Market 10 years ago and have subsequently moved to AIM. There are also companies that have performed well and been taken over or moved to the Main Market, so they are not on the list.

It’s worth remembering that a lot of the top performing companies will likely have done even better, as we’re only measuring performance between two dates.

If performance is measured up to the peak of the FTSE AIM All-Share index on 7 September 2021, then there are some much larger gains. They are generally the same companies as over 10 years, although Eurasia Mining (LSE:EUA) is the third-best performer on this list with a rise of 5,820%. The Russia-focused minerals explorer was hit by sentiment after the Russian invasion of Ukraine and is trying to sell assets, but the share price is still 400% higher over the decade.

Source: TradingView. Past performance is not a guide to future performance.

AIM was more resources sector based 10 years ago, with around one-third of its market capitalisation accounted for by mining and oil companies in early 2013, but the list of the best performers over 10 years offers a wide range of different sectors. Greatland Gold (LSE:GGP) is the only resources company in the top 10 and is the best performer with a 2,470% increase, even though the share price is at less than one-fifth of its high less than three years ago. Between 5 August 2013 and 7 September 2021, Greatland shares rose 6,970% and had been up as much as 13,700%!

Greatland Gold’s partner in the Havieron project in Australia is Newcrest Mining, which owns 70% of the joint venture. It is making progress with the project. Greatland Gold has other gold interests, but Havieron is the most advanced.

Steady upward trend for top 10

None of the top 10 is at an all-time high, but they have generally had a steady upward trend over the period. There is a wide range of market capitalisations in the top 10, ranging from IXICO (LSE:IXI) at £7.7 million to market research firm YouGov (LSE:YOU) with a valuation of more than £1.1 billion.

All the top 20 largest companies on AIM that have been around for the full 10-year period – that is 14 companies - have risen. All but three of those, have at least doubled in share price terms and five have risen by at least 10 times.

The best performers tend to have a strong track record. There are companies among them that still have significant growth potential even after their past gains.

Infection control products supplier Tristel (LSE:TSTL) has grown its business internationally and has tended to trade on a high prospective earnings multiple. The share price has risen by 1,250% over 10 years.

The prospects for the company have been enhanced by the news in June that it has received FDA clearance to market Tristel ULT, which is used to disinfect endocavity ultrasound probes and skin surface transducers, in the US. Tristel ULT is quicker and less likely to damage devices than its main US competitor.

Analysts at finnCap believe that one-third of the US market for high level disinfectant ultrasound procedures could equate to $33 million in revenues from the deal with US distributor Parker, plus £7.9 million of royalty income. That could be achieved by 2028. In the year to June 2023, total group revenues are estimated at £34.2 million, and the rest of the business will continue to grow. The prospective 2023-24 multiple of 29, at 357.5p, is relatively high but there is little contribution from the US, which will be more significant in later years.

Company | Sector | Price | Market cap (m) | Share price 5 Aug 2013 to 3 Aug 2023 (%) | Share price 5 Aug 2013 to 7 Sep 2021 (%) |

Basic Resources | 7.05p | £357 | 2,470 | 6,970 | |

Industrial Goods and Services | 1,795p | £412 | 1,630 | 1,490 | |

Financial Services | 572p | £552 | 1,460 | 2,260 | |

Health Care | 20.3p | £10 | 1,410 | 5,860 | |

Media | 950p | £1,112 | 1,340 | 2,010 | |

Financial Services | 513.5p | £681 | 1,330 | 3,320 | |

Consumer Products and Services | 655p | £753 | 1,310 | 2,100 | |

Industrial Goods and Services | 437.5p | £76 | 1,310 | 4,000 | |

Health Care | 357.5p | £169 | 1,250 | 2,160 | |

Health Care | 3,800p | £198 | 1,120 | 1,190 | |

Energy | 241.5p | £926 | 1,000 | 694 | |

Consumer Products and Services | 1,543.5p | £1,223 | 965 | 2,140 | |

Industrial Goods and Services | 9p | £140 | 887 | 2,060 | |

Consumer Products and Services | 2,067p | £1,476 | 871 | 1,050 | |

Financial Services | 1,073p | £2,347 | 840 | 639 | |

Technology | 63p | £62 | 784 | 1,890 | |

Basic Resources | 68p | £179 | 731 | 1,120 | |

Technology | 74.65p | £591 | 688 | 2,280 | |

Technology | 167.5p | £76 | 644 | 633 | |

Media | 601.5p | £598 | 578 | 1,160 | |

Source: SharePad | |||||

Marlowe (LSE:MRL) started out as the cash shell Shellshock and it did not complete its initial acquisition of fire protection and security system services business Swift until 1 April 2016. Since then, it has made a raft of acquisitions, helping to increase the size of the business and raising earnings per share.

Marlowe offers a wide range of compliance, safety and protection services. The latest purchase is ISO auditing and certification provider IMSM for an initial £15.9 million with a further £1.5 million dependent on performance. This broadens the range of governance, risk and compliance services offered. In the year to March 2024, Marlowe is expected to make a pre-tax profit of £57.3 million with growth held back by higher interest costs. At 570p, the shares are trading on 13 times prospective earnings.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.