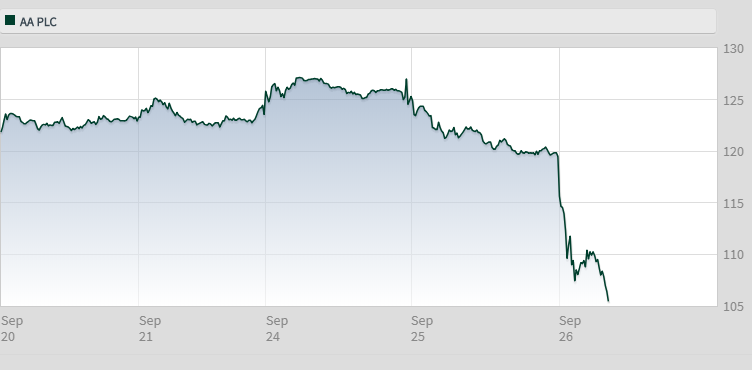

AA in a hole after 12% crash

26th September 2018 11:09

by Richard Hunter from interactive investor

A recovery at AA appears to have veered off the road, and interactive investor's head of markets Richard Hunter says there are more questions than answers following these results.

AA itself has needed some assistance in the recent past and this half-year update shows signs of slow but steady progress.

In terms of its balance sheet, the refinancing which it has organised and the notable reduction in the pension deficit are positive, although net debt remains stubbornly high at some £2.7 billion.

The previously announced difficulties arising from a severe bout of cold weather, which led to a 15-year high in the number of breakdowns, led to a sharp increase in costs. As such, operating profit has fallen 35%, whilst the earnings per share metric has slumped 64%.

Another casualty of the recovery plan has been the dividend reduction which, whilst prudent, removes the incentive for investors who are not being paid to wait as the transformation unfolds.

More positively, there was a slight increase in revenues and the 7% increase in motor policies within the Insurance division is a welcome development. Full-year profit guidance has been confirmed and the new management team will be given some time to implement the changes to the business which are so clearly required.

Further out, and as AA returns to profit, the difficult decisions which are currently being undertaken could well bear fruit. In the meantime, the stock remains one which for the moment provides more questions than answers.

Source: interactive investor Past performance is not a guide to future performance

Perhaps unsurprisingly, the share price has seen a rollercoaster ride. The initial float price of 250p in June 2014 (let alone the subsequent high of 432p in March 2015) is a distant memory and the last year has provided further volatility, during which time the shares have fallen 29%, as compared to a 5% hike in the wider FTSE 250.

Within that timeframe, the shares have spiked 49% over the last six months, which is indicative of the progress the company is attempting to deliver. In all, however, opinion is fairly evenly split on recovery prospects, with the market consensus of the shares continuing to come in at a 'hold'.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.