8 quality growth shares trading at cheaper prices

3rd May 2023 13:54

by Ben Hobson from interactive investor

Worries about how a possible recession might impact company earnings has dragged on share prices for months. But stock screen expert Ben Hobson has found contrarian opportunities amid the economic gloom.

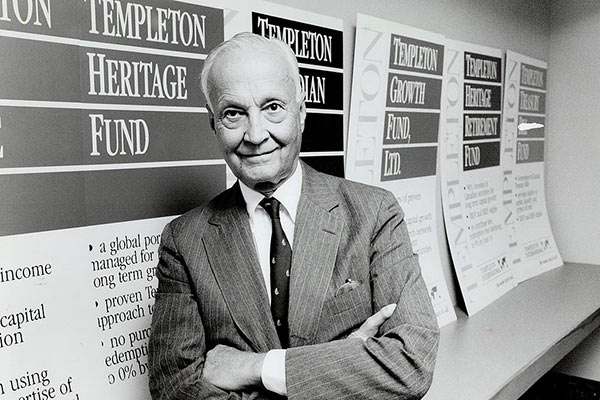

When it comes to finding reasons to be cheerful in a crisis, you’d be hard-pressed to do better than take the approach of Sir John Templeton.

Sir John, pictured below, made his name (and his fortune) as a contrarian investor who literally looked anywhere in the search for cheaply priced value stocks. He famously said: “Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

While equity market conditions have not exactly been hugely pessimistic over the past year, they have been much more challenging than we’ve been used to for some time.

Rising inflation has led central bankers into a high stakes balancing act between raising interest rates without triggering a painful recession.

Early casualties of what have been the sharpest rate hikes in living memory have been regional US banks, such as Silicon Valley Bank, Signature Bank and First Republic.

- 10 small-cap growth shares at cheap prices

- Insider: betting on a FTSE 250 bargain and FTSE 100 growth play

Another likely casualty of recessionary pressures and a slowdown in economic activity is company profits. For some time now, economists have complained that analyst earnings forecasts are far too optimistic in the face of what could be a damaging recession.

In a way, the slow reaction from analysts is understandable. After years of seeing thriving companies meet and beat their profit forecasts, analysts have been reluctant to lower their expectations. And given that some companies are better than others at withstanding economic headwinds, it’s far from clear who the losers and winners will be.

In search of mispriced shares

With some kind of economic slowdown likely in the months ahead, Sir John’s strategy of finding under-priced shares in the expectation of a re-rating further down the line, could be worth exploring. His approach looks for three key features:

#1. Value. Quoted companies are generally valued based on what they ‘earn’ or what they ‘own’, so a simple price-to-earnings (PE) or price-to-book ratio is at the heart of Sir John’s strategy. Comparing the current PE to the company’s five-year PE can help identify whether it is trading at a below-average valuation.

#2. Growth. Growth and value are often seen as very different priorities in investing. Modern value strategies tend to focus on current (known) earnings rather than expectations and extrapolations. But Sir John was keen to see evidence of earnings growing year-on-year, and forecasts predicting that the growth will continue - even at a low level.

#3. Quality. Pricing power and financial flexibility are two important quality traits to consider when faced with an economic slowdown. Companies with high profit margins and returns on capital can be better placed to protect their profits. Likewise, low or no debt is desirable because it leaves companies with more financial freedom to protect themselves and grow.

Here are some of the shares in the FTSE All-Share index that currently pass these rules:

Name | Market Cap (£m) | PE ratio | PE 5y average | EPS 5y % growth (ann) | Forecast EPS growth (%) | Operating margin (%) | Industry |

336 | 14.7 | 15.1 | 7.2 | 17.4 | 21.0 | Consumer Disc | |

2,798 | 25.6 | 25.7 | 3.9 | 13.7 | 22.3 | Industrials | |

1,540 | 30.1 | 36.2 | 32.0 | 12.3 | 14.2 | Technology | |

5,400 | 14.6 | 16.8 | 3.6 | 9.5 | 11.9 | Consumer Disc | |

9,890 | 26.5 | 35.1 | 9.3 | 9.3 | 68.8 | Real Estate | |

3,779 | 23.3 | 29.9 | 6.0 | 8.7 | 60.3 | Real Estate | |

754 | 18.5 | 28.6 | 2.7 | 7.0 | 15.8 | Industrials | |

4,735 | 24.4 | 33.4 | 7.9 | 3.8 | 73.8 | Real Estate |

Data: SharePad.

When you are comparing measures like the PE ratio and operating margins, it’s often best to do it between companies in similar industries, which can make the comparison more meaningful.

Note that in this list the real estate investment trusts (REITs) Segro (LSE:SGRO) (industrial warehousing) and UNITE Group (LSE:UTG) (student accommodation) both have exceptional operating margins, but REITs are slightly different to regular businesses. The other real estate industry company in the table is Rightmove (LSE:RMV), which operates in online property sales, and it has also got very high margins because overheads are comparatively low.

Value-wise, the PE ratios here are generally above 20x, so they may not currently offer the kind of ‘cheapness’ a value investor would really want. That is likely to be because these firms have solid earnings growth trends and forecasts, and good quality traits.

That said, there are certainly some interesting differences between the current and five-year PEs - especially in information and technology. Pearson (LSE:PSON), the education business, has seen its shares move sharply this week, and it now trades on a PE of 14.6.

- Investors pile into Pearson after AI causes crash

- Shares for the future: how I would set up a new portfolio step by step

Kainos Group (LSE:KNOS), an IT consultancy, has seen its shares struggle to maintain momentum over the past 18 months, taking it to a /E of 30.1x. And FDM Group (Holdings) (LSE:FDM), another IT consultancy, has also seen its share price come under pressure, slicing its PE to 18.5x from an average of 28.6x.

Taking a contrarian view of the market

Digging around for market mispricing and shares that have been unfairly sold-off is a contrarian tactic that demands careful research. With economic uncertainties playing havoc with analyst forecasts and raising the risk of unpredictable setbacks, value hunting can be a risky approach.

But for investors like Sir John Templeton, the periodic swings between maximum optimism and pessimism presented an ideal chance to buy shares at attractive levels. A focus on cheaper prices in shares with strong growth trends and solid financial flexibility could be a useful checklist as the future direction of the economy becomes clearer.

Ben Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.