A $1trillion market and 4% dividend yield: buy, hold or sell?

6th July 2022 08:47

by Rodney Hobson from interactive investor

After falling nearly a third this year, these shares factor in a lot of bad news. The downside risk now appears to be limited, believes our overseas investing expert.

We have got so used to the idea of chips with everything – computers, cars, washing machines, the list goes on – that notions of a fall in sales seem hard to countenance. Yet fears over short-term demand for semiconductors have hit shares in their makers hard so far this year. We are reaching the point where forward-looking investors could consider an early move ahead of a likely recovery.

After months of hearing about the shortage of semiconductors and supply chain problems, investors could have been forgiven for assuming that demand would continue to outstrip supply indefinitely.

Possible recession in the United States, Europe and the UK, caused by rampant inflation coinciding with a sharp rise in interest rates, has put that notion on hold.

- Ask ii...what are the pros and cons of investing in a US company?

- How you can own three great businesses for the price of one

- Want to buy and sell international shares? It’s easy to do. Here’s how

Spending by American consumers, which was bouncing back strongly, now seems to be running out of steam even though figures for May, the latest available, showed a year-on-year rise of 4.7% in the core personal consumption expenditures index. The reason is that consumer spending is being switched to food and energy and away from discretionary items.

As consumers increasingly feel the pinch, necessities will increasingly take priority over the kind of goods that use computer chips.

The largest computer chip maker in the world, and probably the best known name in the business, is Intel Corp (NASDAQ:INTC). It more than doubled its profits in the first quarter of 2022 to 2 April, with net income up from $3.36 billion to $8.11 billion. Unfortunately, $4.32 billion of the improvement came from gains on equity investments, leaving the genuine business improvement rather thin, though still positive.

Revenue dropped 7% to $18.35 billion. Some parts of the business actually produced record revenue while other sections slipped back, but that is one of the strengths of Intel: it has such a wide spread of products and clients that it can survive setbacks.

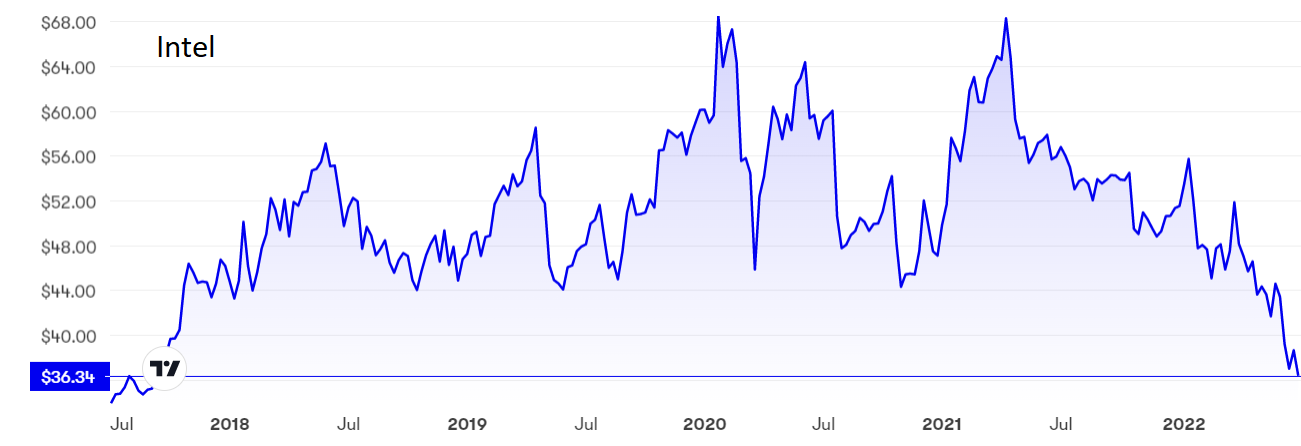

Source: interactive investor. Past performance is not a guide to future performance.

Figures for the second quarter are likely to be uninspiring, with revenue static and earnings per share of only 50 cents, roughly half the level of recent quarters. Intel is counting on a pick-up in the second half of the year and is sticking to its guidance of earnings per share at $4.19 and revenue at $76 billion.

Chief executive Pat Gelsinger reckons the market for semiconductors is potentially worth $1 trillion. He plans to expand manufacturing capacity in the US and to spend $80 billion on research and manufacturing facilities in Europe to meet demand and create a more balanced and resilient global supply chain.

He is also willing to spend on selective acquisitions. This year Intel has paid $5.4 billion in cash from the balance sheet for Israel-based semiconductor company Tower Semiconductor to expand manufacturing capacity and its global reach, a move that will immediately boost earnings per share. It has also bought another Israel-based software provider Granulate Cloud Solutions and plans to scale up Granulate’s production.

- The investments that will keep growing – even during a recession

- US stocks enter bear market, but there’s a silver lining for funds

Intel shares have been in a tailspin since April last year and at around $36 they are only just above half the level they enjoyed at their peak. They are now back to where they were almost five years ago.

The price/earnings ratio is down to only 6, which allows for an awfully big shortfall in earnings over the current year. The yield is 3.92%, high enough to allow some leeway even if Intel unexpectedly decides to cut back on the payout to preserve cash to plough into the business.

Hobson’s choice: The shares are a buy below $38, with a target of £44. There is a risk that buyers will be trying to catch a falling knife – I confess I thought that $55 was a good buying point in January last year, failing to foresee the turmoil that has followed over the past 18 months – but the downside risk should now be limited to $34, and the dividend offers some compensation. There will be a recovery in the longer term.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.