10 high-quality stocks for investors hunting long-term winners

This selection of highly profitable, cash generative companies are well worth investigating.

19th February 2020 09:00

by Jack Brumby from Stockopedia

This selection of highly profitable, cash generative companies are well worth investigating.

In September last year, Nick Train of asset management firm Lindsell Train commented in his UK Equity Fund report to shareholders:

“Broadly, September in the UK stock market saw a sell-off in international “growth” stocks – after an amazing run, lasting years in some cases - and a rally in domestic “value” stocks.”

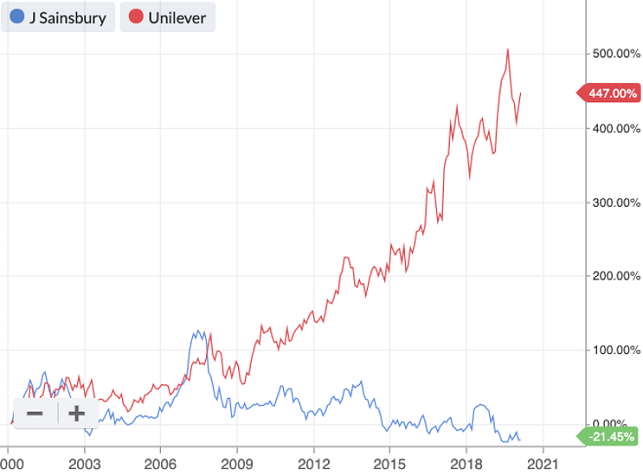

I’ve seen similar comments about this “rotation into value” in recent months. Certainly, there are high margin quality companies today that generate lots of free cash flow but look expensive - Unilever (LSE:ULVR) for example - and low margin, capital intensive value shares that look cheap, such as J Sainsbury (LSE:SBRY).

But if we take the share price performance of those two companies since 2015, we see a startling divergence in performance.

As of early February 2015

| Name | Forecast PE Ratio | ROCE | Value Rank | Quality Rank | Share price (p) |

|---|---|---|---|---|---|

| Unilever | 20.8 | 28.1 | 34 | 80 | 2,802 |

| J Sainsbury | 11.3 | 2.97 | 91 | 37 | 262.9 |

As of early February 2020

| Name | Forecast PE Ratio | ROCE | Value Rank | Quality Rank | Share price (p) | Share price change |

|---|---|---|---|---|---|---|

| Unilever | 20.1 | 19.9 | 31 | 83 | 4,689 | +67% |

| J Sainsbury | 10.3 | 3.2 | 81 | 13 | 202 | -23% |

Throughout this period, Unilever has remained much more expensive based on relative valuation ratios (summed up in the Value Rank). But its ability to consistently generate high returns on capital shows it to be a much more valuable company. The longer you leave it, the more pronounced this effect becomes.

If you look at the two companies’ share price performances side by side over two decades, the results are even more striking:

Source: Stockopedia Past performance is not a guide to future performance

Of course, these are just two stocks and any other two might tell a different story. But it’s still a powerful illustration of the perks of long-term quality investing.

The art of buying quality

Markets are not perfect, but neither are they completely inefficient. Most stocks with cheap valuations are priced that way because they are poor businesses. Conversely, some superficially expensive stocks are in fact cheap if you think of intrinsic value as the sum of future discounted cash flows.

It makes sense then, when Buffett says: “time is the friend of the wonderful business, the enemy of the mediocre”. You begin to see how powerful simply screening for companies that have strong long term returns on capital can be.

One of the biggest advocates for this style of investing is Terry Smith, who runs the fund management firm Fundsmith. In his own words, the Fundsmith style of investing is to:

- Buy good companies

- Don’t overpay

- Do nothing

“Good” companies tend to share some characteristics, namely: high long-term returns on capital and profit margins, strong cash conversion, and modest to no debt with strong interest cover.

Most of them have long term ROCEs and five-year ROEs comfortably above 20%. Their business models are also highly cash generative, with an impressive percentage of revenue translating into free cash flow.

Underlying these financial metrics might be less quantifiable strategic advantages, such as: a strong commitment to product innovation and R&D spend, strong brands, control of distribution, good market share, a well invested operating base, efficient capital expenditure and value-enhancing acquisitions.

A screen for quality compounder candidates

Applying a screen based on these criteria yields a selection of highly profitable, cash generative companies worth investigating.

The screen has the following rules:

- A combined Quality/Momentum Rank (good quality, improving shares) of above 75/100

- Five-year gross margin above 40%

- Five-year operating margin above 10%

- Long term return on capital employed greater than 15%

- Five-year return on equity above 20%

- Trailing twelve-month free cash flow to sales above 10%

Sorting the results by QM Rank, here are the top 10 candidates:

| Name | FCF / Sales % | Gross Margin % 5Y AVG | Op Margin % 5y Avg | ROE % 5y Avg | ROCE % Long Term Avg | Quality / Momentum Rank |

|---|---|---|---|---|---|---|

| M Winkworth (LSE:WINK) | 25.4 | 76 | 27.2 | 25.7 | 32.3 | 99 |

| The Property Franchise Group (LSE:TPFG) | 39.3 | 92.2 | 39 | 27.6 | 22.2 | 99 |

| Quartix Holdings (LSE:QTX) | 23.2 | 62.8 | 30.1 | 36.3 | 39.5 | 99 |

| Gamma Communications (LSE:GAMA) | 10.7 | 43.5 | 10.2 | 25.7 | 26.3 | 99 |

| Games Workshop (LSE:GAW) | 22.1 | 69.4 | 23.5 | 49.6 | 50.4 | 99 |

| Liontrust AM (LSE:LIO) | 15.9 | 95.1 | 18.4 | 27.9 | 28.7 | 98 |

| Focusrite (LSE:TUNE) | 10.6 | 40.3 | 14.3 | 29.1 | 30.3 | 98 |

| IG Group (LSE:IGG) | 38.7 | 93.2 | 41.7 | 24.1 | 29.5 | 98 |

| Medica (LSE:MGP) | 11.5 | 49.8 | 22 | 48 | 15.3 | 97 |

| dotDigital (LSE:DOTD) | 14.6 | 87.9 | 24.4 | 26.8 | 25.7 | 97 |

The results pick up stocks right across the market cap range, from two residential real estate agencies - M Winkworth (LSE:WINK) and Property Franchise (LSE:TPFG), through to large-caps like Games Workshop (LSE:GAW) and IG Group (LSE:IGG).

These companies share some of the traits of big, compounding successes of the past. While economic moats are notoriously tricky to pin down, screening for long-term above-average profit margins and return on capital figures might be the best way of honing in on likely candidates.

Focusing on things like long-term returns on capital allows us to take advantage of a unique property of equities: the fact that a portion of your return is automatically reinvested in the company. It is this fact that creates the possibility of compounding investment.

As for that rotation into value, I’m with Warren Buffett when he says: “It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.