Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you're unsure about investing, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future. Please note images displayed are for illustrative purposes only.

Put your best financial foot forward in 2026.

Join ii today and kick off the year with our special offers:

Offers end 28 February 2026. Terms apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

While most other providers take a percentage of your wealth, we charge a low, flat fee. So you can keep more of what’s rightfully yours.

We’ve been helping people invest for 30 years. Our multi-award-winning range of accounts and expert insights are built on decades of experience.

Our award-winning customer service team is only a phone call away. It’s why over 50% of our customers have been with us for more than 10 years.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). If you’re unsure if a SIPP is right for you, please speak to an authorised financial adviser.

Choose from our range of low-cost, award-winning investment accounts, including our Which? Recommended SIPP.

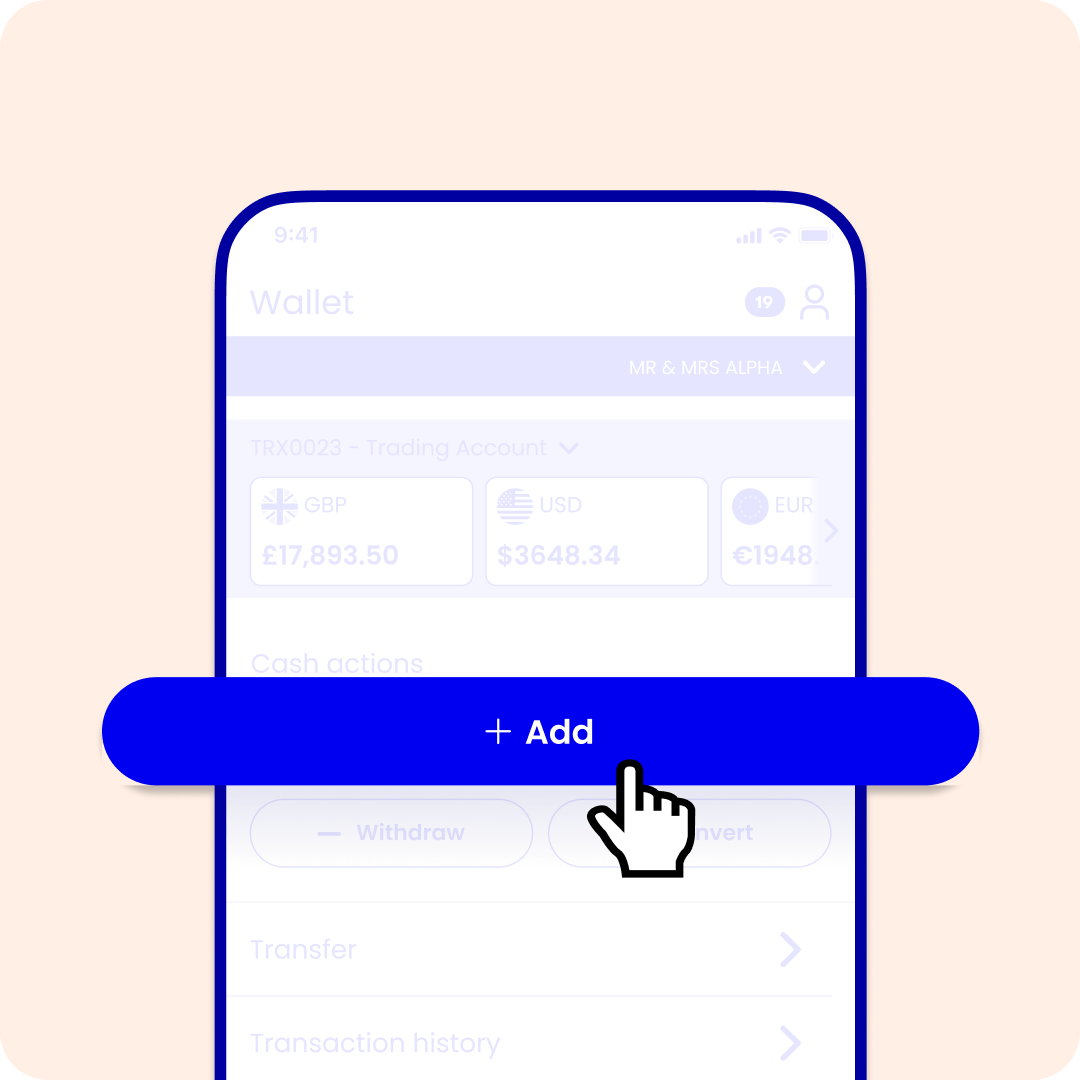

Once your account is open, you’ll be able to add money to it by making a one-off payment or setting up a Direct Debit (minimum of £25 per month). Or you can always transfer an existing account into it.

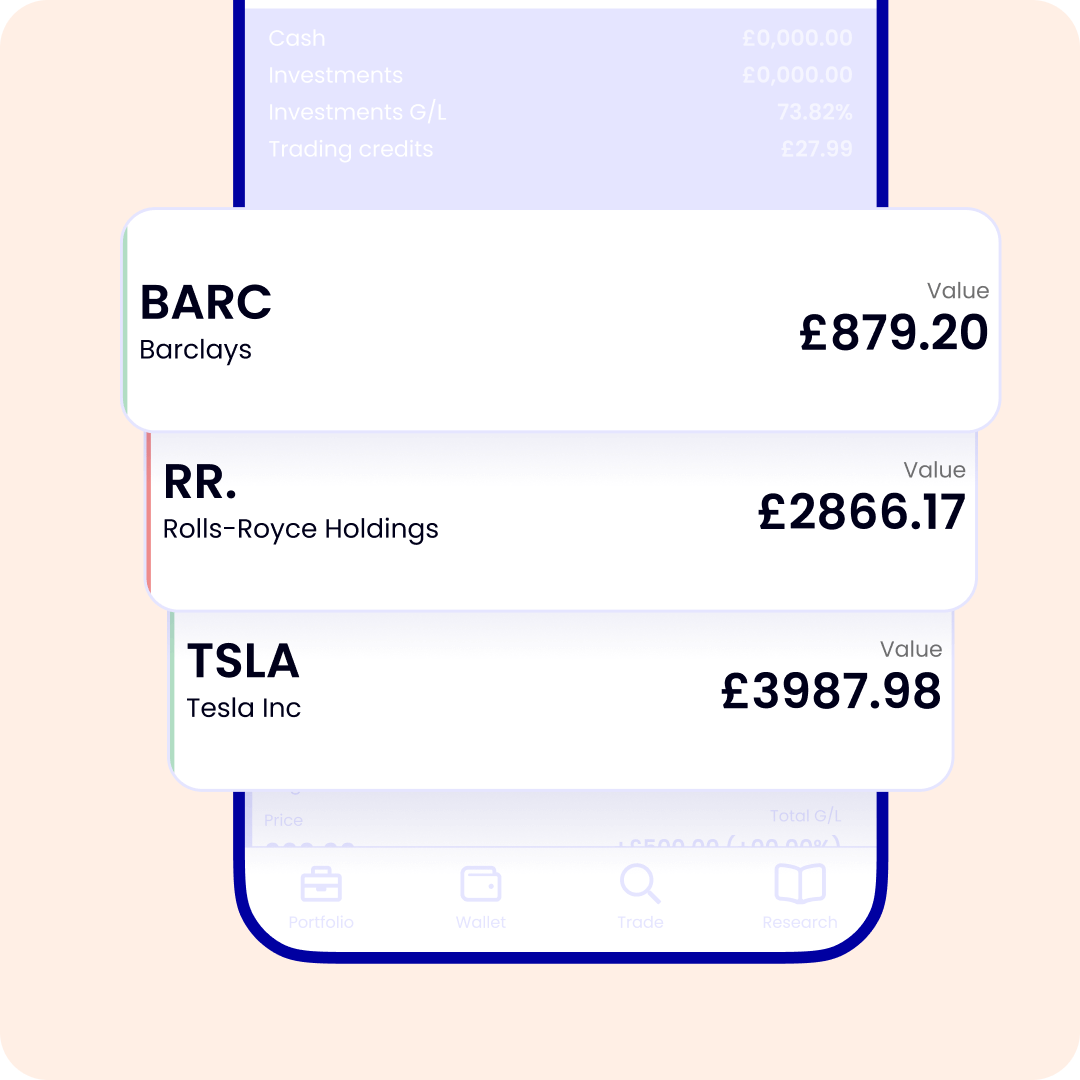

With one of the widest ranges of investments available, you’re spoilt for choice. But if you want some guidance when choosing your investments, you can use our expert picks to help you narrow your search.

Transferring your investments to ii is free, and we make it as straightforward and seamless for you as possible. Get started in three simple steps – just make sure you have your existing account details to hand.

Transferring your investments to ii is free, and we make it as straightforward and seamless for you as possible. Get started in three simple steps – just make sure you have your existing account details to hand.

If you don’t already have an account with ii, open one that suits your investing needs. Opening an account should only take 10 minutes.

You can start your transfer while opening an account. Or, you can log in and transfer at any time. You can complete the process easily online.

Rest easy while we work with your current provider to complete your transfer. Your dedicated ii case handler will keep you updated along the way.

A SIPP is for those wanting to make their own investment decisions when saving for retirement.

As investment values can go down as well as up, the amount you retire with could be worth less than you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028).

Check if you’ll be charged any exit fees and make sure you won't lose any valuable benefits, such as:

This communication isn’t a personal recommendation. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Whatever you’re looking for, we’ve got it covered. Explore our wide range of UK and international investment options.

...and counting.

When you join ii, you’ll be investing with one of the most trusted and experienced investment platforms in the UK. That’s why 50% of our customers have been with us for more than 10 years.