UK Spring Budget: pension changes from 6 April 2023.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

What does the Budget mean for you

In the 2023 Budget the Chancellor of the Exchequer announced some significant changes to pension allowances that are designed to encourage people approaching retirement to work longer and people that have retired recently to consider returning to work.

It is important to understand how the changes could impact you and that they will only start to take effect from the 6th April 2023. We also recommend seeking advice form a suitably qualified advisor before making any decisions.

Annual Allowance

The Annual Allowance is the maximum amount of money that can be contributed to a pension each tax year and benefit from tax relief.

The Annual Allowance will now rise from £40,000 to £60,000 on 6 April 2023.

This means that each year an additional £20,000 can be contributed to a pension and benefit from tax relief.

Read more about how tax relief and how the current annual allowance works with ii.

Money Purchase Annual Allowance

The Money Purchase Annual Allowance (MPAA) is a reduced Annual Allowance that applies to anyone that has used a pension to withdraw taxable income, for example using drawdown or UFPLS. It does not apply if you have only taken tax-free cash.

The Money Purchase Annual Allowance will now rise from £4,000 to £10,000 on 6 April 2023.

This means that each year an additional £6,000 can be contributed to a pension and benefit from Tax Relief.

Learn more about the current Money Purchase Annual Allowance (MPAA) with ii.

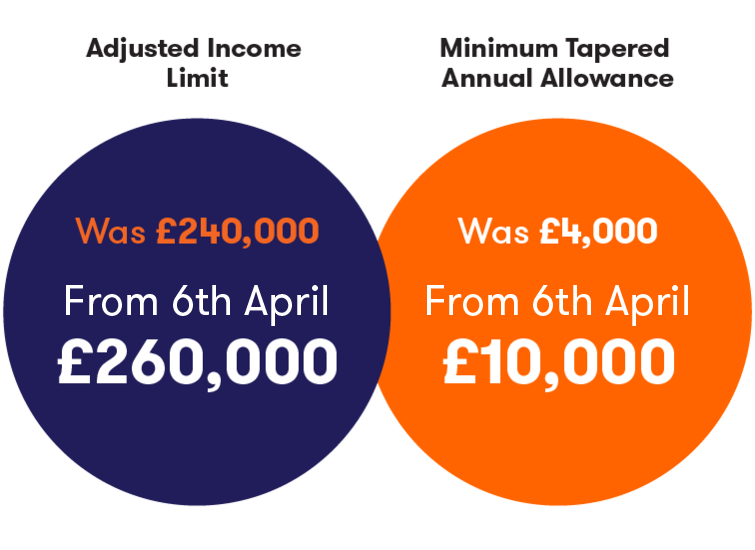

Tapered Annual Allowance

The Tapered Annual Allowance is designed to reduce the amount of Tax Relief high earners can receive from pension contributions. When earnings exceed £240,000 the Annual Allowance is gradually reduced / tapered to a minimum of £4,000.

From 6 April 2023 the minimum Tapered Annual Allowance will rise from £4,000 to £10,000 and the Adjusted Income Limit will rise from £240,000 to £260,000.

This means that high earners will be able to receive tax relief on a minimum of £10,000 pension contribution and depending upon their income possibly more.

Learn more about the current Tapered Annual Allowance with ii.

Lifetime Allowance & 25% Tax-Free Lump Sum

The Lifetime Allowance (LTA) is the maximum amount you can build up in pension savings and still receive the full tax benefits of a pension. The current Lifetime Allowance is £1,073,100.

If the LTA is exceeded a tax charge is made. This happens when the total value withdrawn, or designated for withdrawal - such as moving to a Drawdown pot, exceeds the LTA or when a 75th birthday is reached.

The Lifetime Allowance tax charges will be removed from 6 April 2023 and the Lifetime Allowance abolished via a future Finance Bill from the 2024/25 tax year.

As part of this announcement the maximum amount that can be taken from a pension as Tax-Free Lump Sums was not changed and this will remain 25% of the current LTA.

This means that from 6th April 2023 the government intend to let pensions grow to any value and not be subject to an LTA Tax Charge. The maximum that can be withdrawn as Tax-Free Lump Sums will be limited to £268,275 (25% of the current LTA), except where protections apply - which can allow entitlement to a higher tax-free amounts to be maintained.

It is important to understand that although no LTA tax charges will apply from 6 April 2023, any withdrawal over the current LTA will still be subject to tax at the normal marginal rate and based on the full value of the withdrawal.

| Tax year 2022/23 | Tax year 2023/24 onwards | |

|---|---|---|

| Lifetime Allowance | £1,073,100* | Abolished** |

| Maximum value of all Tax-Free Lump Sums | £268,275* | £268,275* |

* Higher entitlements are available via LTA Protections.

** In the 2023/24 Tax Year the LTA will be effectively abolished by the removal of the LTA Tax Charge, complete removal via new legislation will take place before the start of the 2024/25 Tax Year.

Learn more about the current Lifetime Allowance and Tax-Free Lump Sums with ii.

How can Pension Wise help?

If you have a defined contribution pension scheme and are 50 or over, then you can access free, impartial guidance on your pension options by booking a face to face or telephone appointment with Pension Wise, a service from MoneyHelper.

If you are under 50, you can still access free, impartial help and information about your pensions from MoneyHelper.