Raspberry Pi Holdings plc Share Offer

This offer is now closed for applications through interactive investor

Result of Offer

Raspberry Pi Holdings plc (RPI) has announced the successful pricing of its initial public offering (IPO)

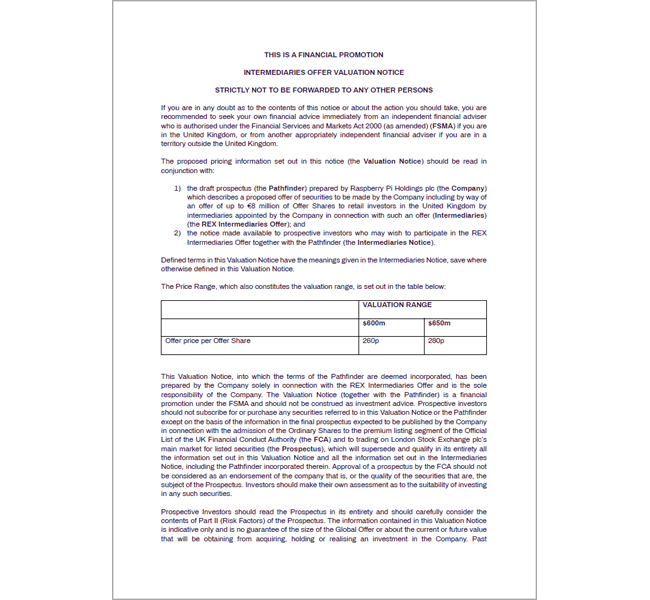

The Offer Price has been set at 280 pence per Ordinary Share, equating to a market capitalisation of approximately £541.6 million at the commencement of conditional dealings.

59,288,752 Ordinary Shares were sold in the Global Offer. 2,421,921 were issued to intermediaries via the REX Intermediaries Offer at the Offer Price, raising approximately £6.8 million.

On Admission, the Company's issued share capital will be 193,415,715 Ordinary Shares.

The REX Intermediaries Offer has been materially oversubscribed, with orders received exceeding the €8m limit.

Allocations were capped at 365 shares per applicant (£1,022), applications below this amount have been allocated in full (rounded down to the nearest whole share), orders above this amount were scaled back to 365 shares.

Share allocations and uninvested cash are being credited today (Tuesday 11 June 2024). Confirmation of allocations will be sent once the shares and refunds are showing on accounts.

Please note the allocation policy was set by RPI and not Interactive Investor.

Offer period

- The Offer Period for the Raspberry Pi Holdings plc Share Offer closed at 10am on Monday 10 June 2024.

Trading starts

- A period of conditional dealing is expected to commence at 8am on Tuesday 11 June 2024.

- When admitted to trading, Raspberry Pi Holdings plc Shares will be registered with SEDOL (Stock Exchange Daily Official List) number BS3DYQ5 and trade under the symbol "RPI".

- Unconditional dealing is expected to commence at 8am on Friday 14 June 2024.

- During the conditional dealing period Raspberry Pi Holdings plc shares allocated to an ISA or SIPP can be sold but additional shares cannot be bought in these accounts until the shares are trading unconditionally.

- If you buy or sell Raspberry Pi Holdings plc Shares after admission the relevant share dealing rate will apply.

Eben Upton, CEO of Raspberry Pi, commented:

"The quality of the interactions during the marketing process has underlined our belief that London has the right calibre and sophistication of investor to support growing, ambitious technology businesses such as Raspberry Pi. The reaction that we have received is a reflection of the world-class team that we have assembled and the strength of the loyal community with whom we have grown.

"Welcoming new shareholders alongside our existing ones brings with it a great responsibility, and one that we accept willingly, as we continue on our mission to make high-performance, low-cost computing accessible to everyone."

Key information

| Offer Price: | 280p |

| Minimum investment: | £250 (multiples of £1 thereafter) |

| Maximum investment: | £200,000 |

| Stock ticker: | RPI |

| SEDOL: | BS3DYQ5 |

Expected timetable

| Offer open: | 3 June 2024 |

| Offer close: | 10 June 2024 (10am) |

| Result announced: | 11 June 2024 |

| Conditional dealing starts: | 11 June 2024 (8am) |

| Unconditional dealing starts: | 14 June 2024 (8am) |

The key dates for the offer are indicative only and subject to change without notice.

Offer documents

This website is issued by, and is the sole responsibility of, Interactive Investor Services Limited. This website is an advertisement and not a Prospectus. Any application to participate in the REX Retail Offer can and will only be made on the basis of the Pathfinder Prospectus (together with the Final Prospectus to be published in due course and any supplements thereto), available from the Peel Hunt Portal

Interactive Investor Services Limited uses the Raspberry Pi Holdings plc Pathfinder Prospectus in accordance with the Company's consent and the conditions set out in the Raspberry Pi Holdings plc Pathfinder Prospectus.

Investing in IPOs carries a high degree of risk. If you are unsure of the suitability of an investment please seek Financial Advice. You are not guaranteed to make a profit, the value of your investments can go down as well as up. You may not get back all the money you invest. Any notification of an IPO on our website is not an endorsement of the issue, nor is it solicitation for interest in the issue. Investment in the Company should not be regarded as short-term in nature. You should consider carefully all of the information set out in the Offer documents, including all the risks attached to investing in the Company before you apply.

"Raspberry Pi Holdings plc" and the Raspberry Pi Holdings plc logo are reproduced by kind permission of Raspberry Pi Holdings plc. All rights reserved.

This announcement has been published by Interactive Investor Services Limited.

This announcement has been prepared and is the sole responsibility of Interactive Investor Services Limited of 201 Deansgate, Manchester, M3 3NW, which is an authorised person for the purposes of the Financial Services and Markets Act 2000.