Impact Healthcare REIT plc Share Offer

This offer is now closed for applications through interactive investor

Result of Issue

The Issue Price has been set at 114 pence per new Ordinary Share.

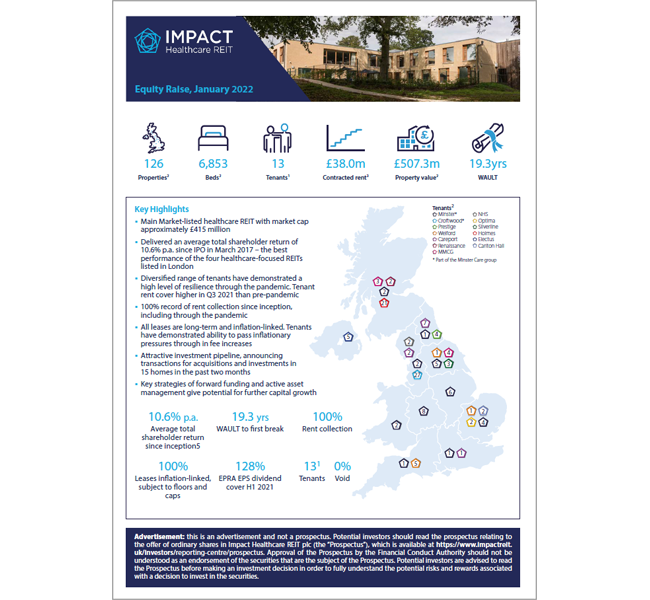

Impact Healthcare REIT plc (IHR) has successfully raised gross proceeds of £40 million, through its Open Offer, Initial Placing, Offer for Subscription and Intermediaries Offer.

Applications have been made for 35,087,720 new Ordinary Shares to be admitted to trading on the London Stock Exchange's main market.

Allocations have been met in full, meaning customers will receive 100% of the amount they applied for rounded down to the nearest whole share.

Share allocations and uninvested cash are being credited today (Thursday 17 February 2022). Confirmation of allocations will be sent once the shares and refunds are showing on accounts.

Please note the allocation policy was set by IHR and not Interactive Investor.

Offer period

- The Offer Period for the Impact Healthcare REIT plc Share Offer closed at 9am on Tuesday 15 February 2022.

Trading starts

- Admission and unconditional dealing in the new Ordinary Shares is expected to commence at 8am on Monday 21 February 2021. There is no conditional dealing period.

- When admitted to trading, the new Ordinary Shares will be registered with SEDOL (Stock Exchange Daily Official List) number BYXVMJ0 and trade under the symbol "IHR".

- If you buy or sell Impact Healthcare REIT plc Shares after admission the relevant share dealing rate will apply.

Rupert Barclay, Chairman of Impact Healthcare REIT plc said:

"On behalf of the Board, I would like to thank our new and existing shareholders for their support in this fundraise. The proceeds raised will assist us in funding in short order a significant proportion of our near-term attractive investment pipeline of standing assets, forward fundings, and asset management capex commitments, which we expect to deliver further attractive inflation-protected income and capital growth for our shareholders.

Our portfolio and sector remain well positioned, with supportive longer-term structural trends including an ageing population and a shortage of the good quality care homes that we invest in, with our tenants continuing to report improved trading conditions. In addition, our tenants and wider sector have an established history of being able to withstand inflationary pressures, whilst our long inflation-linked leases with high calibre tenants provide us with further confidence for the future."

Key information

| Issue price per share: | 114 pence |

| Minimum investment: | £1,000 (multiples of £1 thereafter) |

| Stock ticker: | IHR |

| SEDOL: | BYXVMJ0 |

Expected timetable

| Offer open: | 27 January 2022 |

| Offer close: | 15 February 2022 (9am) |

| Result announced: | 17 February 2022 |

| Unconditional dealing starts: | 21 February 2022 (8am) |

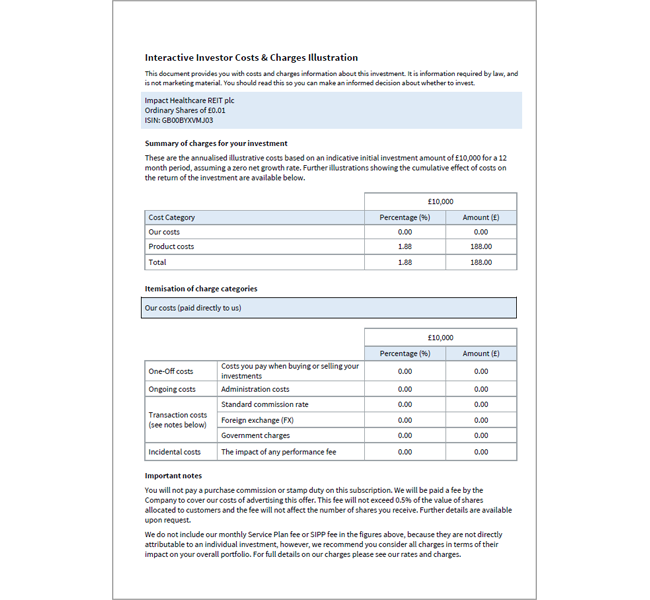

This website is issued by, and is the sole responsibility of, Interactive Investor Services Limited. This website is an advertisement and not a Prospectus. Any application to participate in the Offer can and will only be made on the basis of the Prospectus, together with any supplements thereto.

Interactive Investor Services Limited uses the Impact Healthcare REIT plc Prospectus in accordance with the Company's consent and the conditions set out in the Impact Healthcare REIT plc Prospectus.

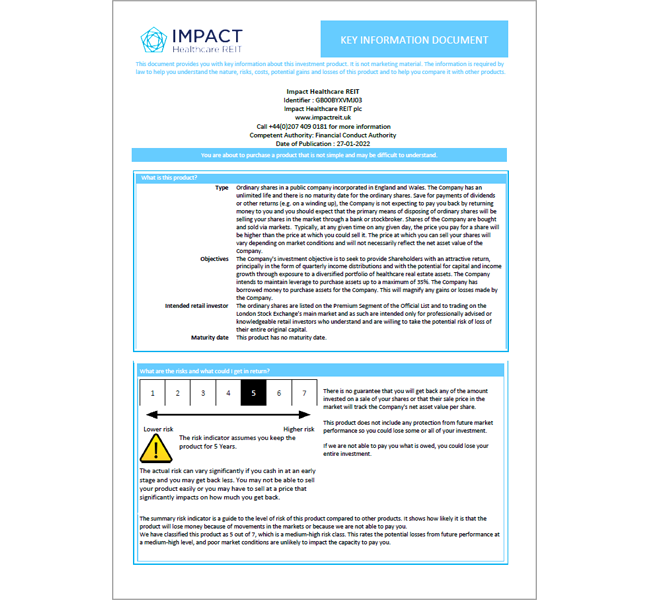

Investing in IPOs carries a high degree of risk. If you are unsure of the suitability of an investment please seek Financial Advice. You are not guaranteed to make a profit, the value of your investments can go down as well as up. You may not get back all the money you invest. Any notification of an IPO on our website is not an endorsement of the issue, nor is it solicitation for interest in the issue. Investment in the Company should not be regarded as short-term in nature. You should consider carefully all of the information set out in the Offer documents, including all the risks attached to investing in the Company before you apply.

"Impact Healthcare REIT plc" and the Impact Healthcare REIT plc logo are registered trademarks of Impact Healthcare REIT plc. Reproduced by kind permission of Impact Healthcare REIT plc. All rights reserved.

This announcement has been published by Interactive Investor Services Limited.

This announcement has been prepared and is the sole responsibility of Interactive Investor Services Limited of 201 Deansgate, Manchester, M3 3NW, which is an authorised person for the purposes of the Financial Services and Markets Act 2000.