Early bird ISA investors catch an extra £33,000

Investing your ISA allowance at the start of the tax year has significant benefits. Here's the proof.

10th April 2019 10:49

by Jemma Jackson from interactive investor

Investing your ISA allowance at the start of the tax year has significant benefits. Here's the proof.

- Investing the maximum ISA allowance at the start of the tax year rather than the end means your portfolio could be worth £33,000 more over 20 years.

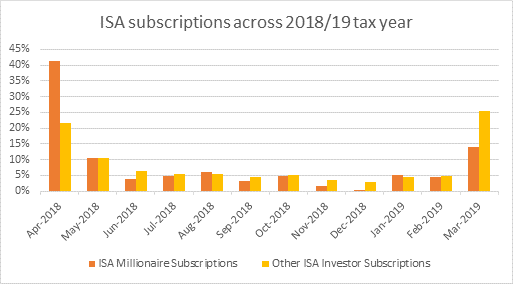

- Interactive investor's ISA millionaires are almost twice as likely to fund their ISA early, with more than 40% of all subscriptions invested in the first three and a half weeks of the 2018/19 tax year, compared to 22% for all other ISA investors.

- Investing early gives you more time and you're less likely to fall into the trap of choosing an unwise last-minute investment or keeping the money in cash and failing to invest at all.

Early-Bird investing – is it worth it?

There are hundreds of adverts for ISAs in March as investors are warned to 'use it or lose it' and many investors go down to the wire in subscribing to these tax-efficient accounts.

However, investors should also be asking themselves whether it is better to invest early in the tax year (if you can) rather than wait until the last minute.

Moira O'Neill, Head of Personal Finance, interactive investor says: "If you are in a position to start thinking about investing in your ISA early in the tax year rather than at the last minute, it is likely to be well worth it. It won't make you a millionaire overnight, but it will mean your money is working harder for longer – which will hopefully mean that you won't have to."

Rebecca O'Keeffe, Head of Investment, interactive investor says: "Most investors are aware of the long-term advantages of investing in a Stocks and Shares ISA, but many may not be aware that it can make a significant difference to your wealth if you invest early in the tax year rather than late."

"Although there only appears to be one day in it, if you start the clock on the 6th April and one set of investors chooses the early-bird route and invests £20,000 at the start of each tax year, they will end up with a portfolio worth £264,136 after 10 years assuming a 5% return after charges – which is £12,578 more than those investors who choose to invest the same £20,000 at the end of each tax year and effectively only have 9 years' worth of growth, where their portfolio would have grown to £251,558.

"Over 20 years the impact is even more stark, with the difference between early-bird and last-minute investors resulting in a portfolio worth over £33,000 more by investing early - £694,385 compared to £661,319 if you generated a 5% return after charges."

ISA contributions – millionaires do it differently!

In terms of when our ISA investors funded their account, interactive investor's ISA millionaires tend to be early-bird investors, while other ISA investors tend to be more last minute.

Total ii ISA subscriptions across 2018/19 tax year. April is new tax year from 6th – 30th.

Moira O'Neill, Head of Personal Finance, interactive investor says: "Over 80% of all our ISA millionaires are still subscribing to their ISA – they aren't resting on their laurels yet! Unlike the most ISA investors, who are more likely to wait until later in the tax year, of those ISA millionaires who invested in their ISA in the 2018/19 tax year, over half started to subscribe between 6 and 30 April of the new tax year, investing more than 40% of all ISA millionaire subscriptions in the first three and a half weeks of the tax year. Most ISA millionaire investors subscribed the full amount, with two thirds contributing a lump sum in their ISA, with the others making regular payments."

"Most of us aren't lucky enough to have £20,000 to invest in one go. However, taking advantage of regular contributions throughout the year is also a good strategy and can help to smooth out fluctuations in the market."

Other ISA investors were more likely to invest in March at the end of the tax year, rather than at the start, with just over 20% of money being subscribed at the start of the year compared to the 25% which is contributed in the last few weeks.

Being an engaged investor

While you don't have to invest your money straight away in an ISA, for end of the tax-year investors there can be a tendency to choose an investment at the last minute and think about it again twelve months later. This could leave you exposed to market timing issues or concentration risk. Alternatively, putting money in at the last minute could end up being left in cash that you never get around to investing.

Rebecca O'Keeffe, Head of Investment, interactive investor says: "Choosing to subscribe to your ISA at the start of the tax year doesn't eliminate the problem of market timing or uninvested cash, but it does mean you are less likely to get caught up in the last-minute rush. If you want to invest the whole amount straight away, then you have more time invested and can generate dividend income across the whole year. If you’re worried about the markets, you have the ability to take your time choosing when to invest your cash and can potentially be more diligent in selecting investment opportunities."

"You only need to look at the range of performance from funds or trusts in the same sector to know that there are some very good investments to own and ones that you would be better off avoiding – paying attention to what is going on is likely to make you much better off over the long term."

"ISAs are a fantastic product that millions rely on every year, but if you want to maximise their potential and make your money work harder for you, you might have to put in a little more effort and work a little bit harder for it."

About interactive investor

interactive investor (ii) is the UK's number one flat-fee investment platform. ii offers a wealth of unbiased information, analysis, tools and expert ideas to help customers make better informed investment decisions. ii’s award-winning trading platform provides access to an extensive choice of markets, instruments and currencies within Trading, ISA and SIPP accounts. This comprehensive investing service is underpinned by a strong focus on delivering great value for investors demonstrated through an innovative and competitive pricing model – featuring simple, flat fees and unique ‘trading credits’. interactive investor is authorised and regulated by the Financial Conduct Authority.

Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation. Past performance is no guide to the future and the value of investments can go down as well as up and you may not get back the full amount invested.

To view our privacy policy, please see here. To unsubscribe from interactive investor press releases, please contact the media team.