Is Zoom’s dramatic dive a buying opportunity for tech investors?

1st December 2021 09:11

by Rodney Hobson from interactive investor

This famous tech share has been on a steady downward path for the past year and now sits at an 18-month low. Our overseas investing expert tells us what he’d do with them.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It is possible that the ill wind blowing in yet another Covid-19 variant will do good for video conference specialist Zoom Video Communications Inc (NASDAQ:ZM). More important, though, is whether businesses and, to a lesser extent, consumers, will stick with online contact when they are no longer forced to.

Although the growth in revenue has slowed since the heady days in the February-April quarter of 2020, when the pandemic ran out of control and lockdowns were commonplace, nonetheless the use of Zoom continues to expand.

Underlying earnings per share rose 12% in the three months to the end of October to $1.11, compared with a year earlier, as revenue jumped 35% to top $1 billion. This sort of growth would have been warmly welcomed at most companies, but such have been the overinflated hopes for Zoom that they were received with disappointment.

Nor were the superoptimists assuaged by the company’s projection that revenue will be flat at $1.052 billion in the current quarter to the end of January.

- Why I’m buying ‘value’ stocks and other top tips

- Ian Heslop's outlook for the US stock market in 2022

- Bill Ackman: hot sectors and the economy in 2022

- Want to buy and sell international shares? It’s easy to do. Here’s how

Yet there is no denying that Zoom was in the right place at the right time and with the right product, swiftly replacing the Skype online telecoms system that was once widely used but has fallen largely into disuse. While Zoom could theoretically be similarly replaced by another online giant, it has got control of this sector of the market for the foreseeable future. As long as it continues to supply what users want, it should stay on top of the pile.

Zoom has cleverly allowed free usage for one-to-one calls and, with a limited timeframe, for several participants. This has helped users to become familiar with how the product works. It also has a fairly cheap monthly subscription for consumers and small businesses, while it can ramp up the charges for allowing multiple participants on calls.

Businesses like the fact that it can be operated without the need for in-house tech staff, and it is much cheaper and less time consuming than having people travel to meetings. Zoom’s videoconferencing is also better quality than some earlier rival versions. That has encouraged 2,500 customers to subscribe more than $100,000 each annually, a total is growing rapidly.

Revenue from business customers with 10 or more employees is up 44% on last year and they account for two-thirds of revenue. Business customers tend to pay annual subscriptions rather than monthly ones, which gives better visibility of earnings.

- Bill Ackman: an industry as certain as food and oxygen

- Bill Ackman: why I've bet $100 billion on this event

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Zoom has also sought to expand through strategic acquisitions but shows a welcome propensity to walk away rather than overpay. It announced a proposed merger with call centre operator Five9 Inc (NASDAQ:FIVN) in July but the all-stock deal, originally valued at $14.7 billion, was rejected by Five9 shareholders after a fall in Zoom shares reduced the value of the stock.

Zoom dropped the deal rather than raise the price and diluting its own shareholders further, but it will continue to cooperate with Five9 while developing its own cloud-based contact centre service.

It did go through with its acquisition of German start-up Karlsruhe Information Technology Solutions, which provides online translations tools that use artificial intelligence and gives another line to offer customers.

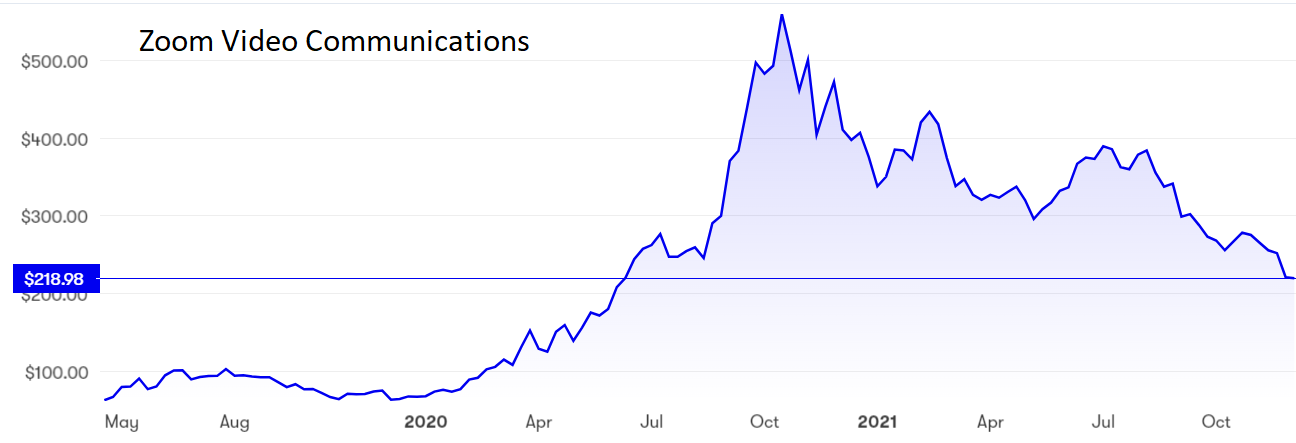

Zoom floated at $36 in May 2019 and has had an exhilarating ride, topping $60 at the end of the first day of trading and hitting a ludicrously overpriced $560 in October last year. The shares are now down to $220 and still falling. It may be some time before they stabilise.

Source: interactive investor. Past performance is no guide to future performance

Hobson’s choice: I thought the shares were worth buying around $300 in September, but overlooked the reality that once any stock goes into freefall it is best to stand clear until the dust settles. Hold on if you are in, but new investors should wait and see before splashing out. This is still a share for the long term.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.