Your state pension forecast: how to understand it and fix shortfalls

Pension Clinic: are you under state pension age? Do yourself a favour and get a state pension forecast,…

20th January 2020 11:54

by Steve Webb from interactive investor

Pension Clinic: are you under state pension age? Do yourself a favour and get a state pension forecast, advises Steve Webb.

If you are under state pension age, one very practical thing that you can do at the start of 2020 is obtain a state pension forecast. There were big changes in April 2016 and it is therefore worth understanding your rights under the new system, including the potential to top up at very favourable rates.

- Invest with ii: What is a SIPP? | Is a SIPP right for me? | SIPP Cashback Offers

You can get a state pension forecast almost instantaneously online, although you can also get one in the post if you prefer. If you visit the gov.uk website (gov.uk/check-state-pension) and satisfy the necessary security checks, you will be taken to a web page that provides full details of your national insurance history. It will also give you two figures for your state pension – one is the amount you have already built up, and the other is the maximum amount you could get.

- Explore more Pension Clinic pieces

- Why pension pots are not always better together

- Your essential guide to: the state pension and how the goalposts will shift in future

The amount you have already built up will reflect your national insurance record to date. If the figure isn’t what you expected, it’s worth reading through the details of your NI record in case contributions you have made in the past (for example, in a previous job) have not been credited.

Another reason the figure might be unexpected is that people who have been members of a public sector or company scheme will usually have spent years when they were ‘contracted out’ of part of the state pension system. There is a deduction from your state pension figure to take account of this.

The deduction for past contracting out causes a lot of confusion. People have heard that they need 35 years of contributions for a ‘full’ pension, but discover that despite having more than 35 years they are not going to get the maximum amount. This is because of past periods of contracting out.

To try to explain what was going on, the government invented something called the Cope – the ‘contracted out pension equivalent’ which appears on many state pension statements. This is designed to remind people that if they were in a ‘contracted out’ pension scheme, that scheme is expected to pay part of their state pension, rather than the government. This Cope figure makes some sense for those who were in final-salary type pensions, where the scheme did indeed promise to pay a replacement pension of at least this amount. But for those who were contracted out into a defined contribution or ‘pot of money’ pension, the Cope figure may bear no relation to the actual amount they get from their pension pot at retirement.

One important thing to note about the Cope figure is that it was already taken account of when your state pension was worked out. You do not have to do any further arithmetic to work out what you are entitled to, and can ignore the Cope figure if you wish.

What you’ve built up

The lower figure in your statement will be the pension you have built up so far. But if you have one or more full years to go before retirement then there could be a higher figure which is the amount you could get. This will take account of any further years of contributions you might make, either through paid work, national insurance credits (for example for being a carer) or voluntary contributions.

If you have stopped work and are short of the maximum pension amount, it is well worth considering voluntary contributions for years since the rules changed in 2016. Such contributions – known as Class 3 NICs – are offered at a heavily subsidised rate.

You typically have to pay roughly £750 to fill one year in your NI record, but this adds 1/35 of a full pension. As this is worth roughly £250 per year at retirement, you only have to live for three or four years post retirement to get your money back – anything else is profit. The only people for whom this is unlikely to make sense are those in very poor health or those who are on means-tested benefits and would lose benefit if they increased their state pension. You can find a simple guide to topping up your state pension on the Royal London website at royallondon.com/goodwithyourmoney.

Top-ups to go mainstream

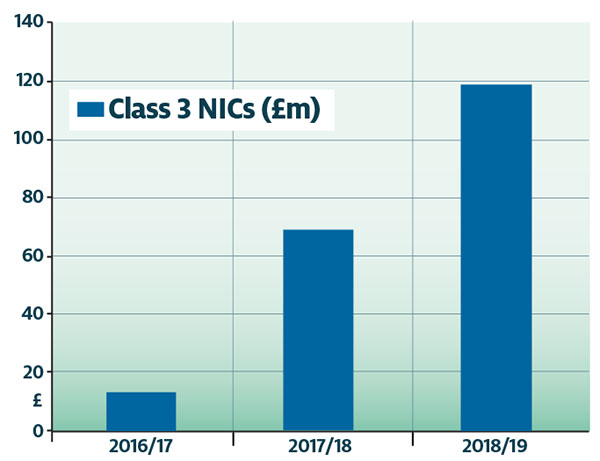

The new state pension has given a new lease of life to the idea of topping up your state pension through voluntary NI contributions. As the chart shows, back in 2016/17 just £13 million per year was paid in by people who wanted to boost their NI record, but two years later that figure had increased ninefold. Given the heavily subsidised rate at which you can top up your pension, it is good to see so many more people taking up the opportunity.

Source: Government’s Actuary’s Department

Steve Webb is a former pensions minister and director of policy at Royal London. He is currently a partner at consultancy Lane Clark and Peacock.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.