WPP plunges, and it can't blame coronavirus

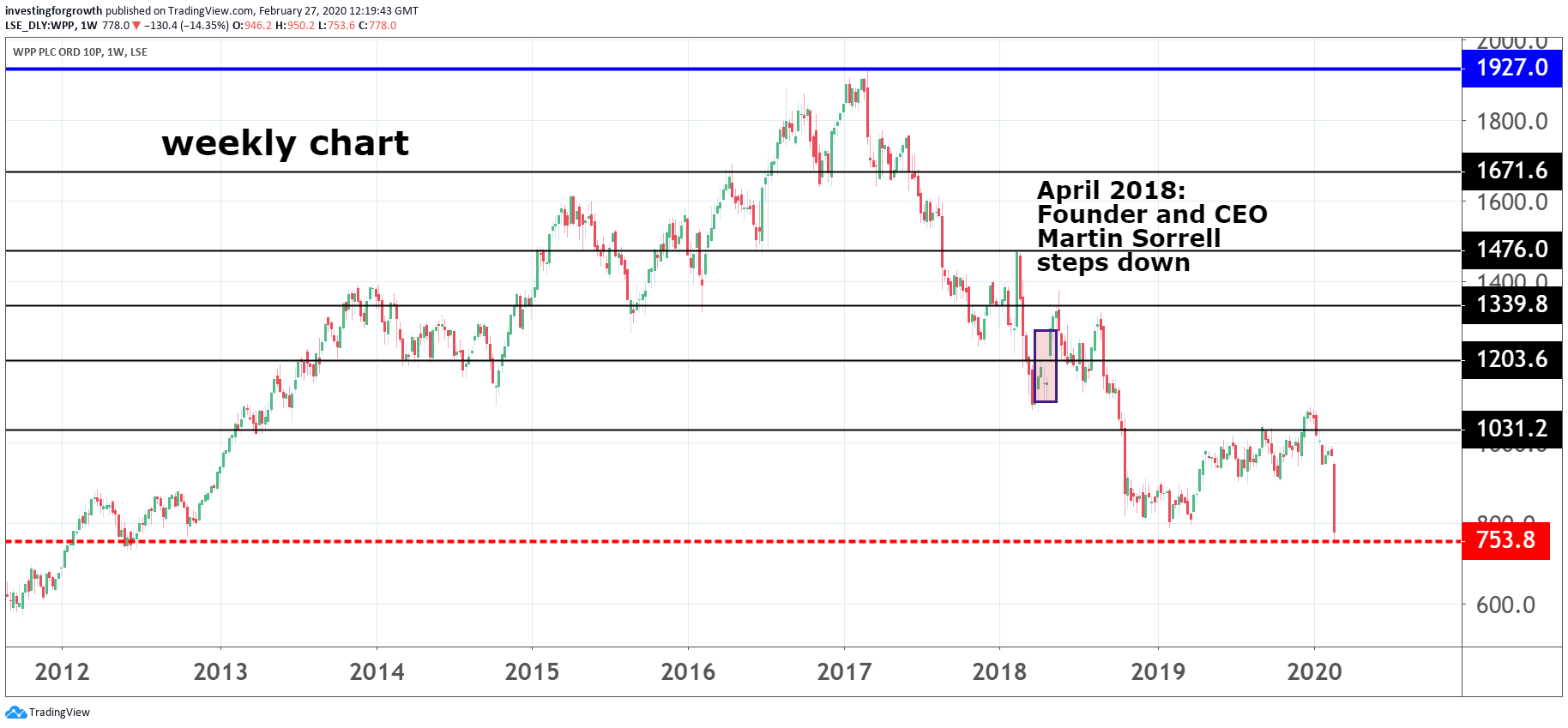

Down 60% from its record high and at a near-eight-year low, times are tough at the ad agency.

27th February 2020 12:22

by Graeme Evans from interactive investor

Down 60% from its record high and at a near-eight-year low, times are tough at the ad agency.

WPP (LSE:WPP) alarmed income investors today as the advertising and media giant produced 2020 guidance that managed to disappoint even without the impact of coronavirus.

Shares tumbled 17% during an already woeful session for the FTSE 100 index, with WPP hitting a multi-year low of 753.6p, and significantly less than the 1,188p seen around the time of the departure of long-time boss Sir Martin Sorrell in April 2018.

The slide follows a bigger-than-expected fall in revenues of 1.6% for the final quarter of 2019, which contributed to an overall 15% drop in annual earnings per share (EPS) from continuing operations to 78.1p.

Guidance for 2020 also disappointed analysts, with organic revenues set to be flat and the headline business margin unchanged at 14.4%. Analysts at UBS said the estimates implied an EPS of around 83p-84p, which is up to 7% short of the market consensus.

In addition, the guidance doesn't take into account the coronavirus outbreak, which may end up having a big impact on global business activity this quarter.

Source: TradingView Past performance is not a guide to future performance

WPP employs 9,000 staff in China, Hong Kong and Taiwan, making it one of the company's five biggest markets alongside the United States, the UK, Germany and India. An update on the outbreak's impact is expected with first quarter results in April.

The virus represents another challenge for a company that is coming to terms with a radical evolution in the digital advertising landscape driven by the likes of Google and Facebook.

Sir Martin's successor as CEO, Mark Read, has put in place a three-year restructuring plan involving the simplification and repositioning of the business, alongside a drive to overhaul its culture. With the marketing landscape becoming more dynamic and complex, Read said today that clients needed WPP's help and expertise more than ever.

Its focus on “creativity powered by technology” has already resulted in new business wins from the likes of Signet Jewelers (NYSE:SIG) and eBay (NASDAQ:EBAY) at its Mediacom agency, and from Mondalez International at WPP's creative arm. This was offset during 2019 by the loss of media accounts with Vodafone (LSE:VOD) and Disney (NYSE:DIS).

Read said that clients were noticing a new sense of purpose and a culture of creativity, collaboration and openness. He added: “As we enter the second year of our three-year turnaround plan, our ability to attract and retain the best people is key to long-term growth.”

By 2021, Read continues to expect WPP organic growth in line with the company's peers and with an operating margin of at least 15%. Income investors are being paid to wait in the meantime, with a forward dividend yield of more than 6.5% after today's total dividend was pegged at 60p a share.

WPP ended the year with net debt of £1.5 billion, which compares with more than £4 billion in 2018 following the sale of a 60% stake in data insight company Kantar to Bain Capital Private Equity. About £950 million of the proceeds have been set aside for share buy-backs, of which £247 million has already been spent.

UBS had a price target of 1,175p prior to today's update, while Morgan Stanley was at 1,010p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.