Worrying lack of basic pension knowledge among self-employed workers

To mark Pension Awareness Week, interactive investor has published new data revealing a worrying lack of basic pension knowledge.

9th September 2024 13:26

by Myron Jobson from interactive investor

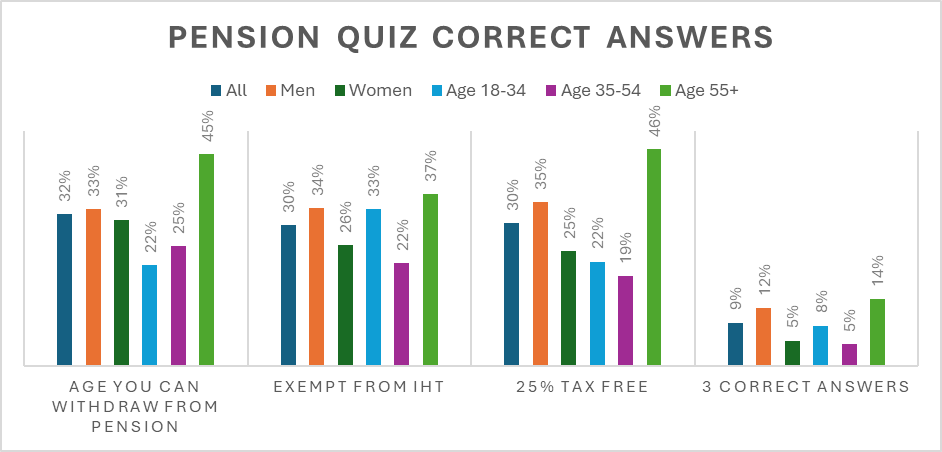

A mere 9% of self-employed workers can correctly answer three basic pension questions with middle-aged cohort faring worst, new interactive investor research finds.

- Self-employed workers aged 35-54 were the worst performers, with only 5% giving the correct answers to all three questions

- A greater percentage of self-employed men answered all three questions correctly (12% versus 5% for self-employed women).

- The research underscores the need for greater pension education and support for self-employed workers

- Self-employed workers often miss out on the structured support that employees receive regarding pensions, which can lead to a significant gap in awareness and engagement.

To mark Pension Awareness Week, interactive investor, the UK’s second-largest DIY investment platform, has published new data revealing a worrying lack of basic pension knowledge among self-employed workers.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Fewer than one in 10 (9%) respondents could answer three simple pension questions correctly, according to a poll of 700 self-employed workers conducted by strategic insight consultancy Opinium for interactive investor between 29 July and 5 August 2024.

The data is taken from the upcoming interactive investor Self-employed Wealth and Pension report, which offers unique insights into pension wealth, financial resilience, and attitudes toward retirement planning among self-employed workers.

We asked the following three basic pension questions:

1. Currently, at what age can someone start taking money out of a SIPP or personal pension? Answer: 55

2. Are pensions exempt from inheritance tax (IHT)? Answer: Yes

3. What percentage of your pension can you withdraw tax-free? Answer: 25%

Middle-aged cohort least knowledgeable

The 35-54 age group performed the worst, with only 5% answering all three questions correctly, compared to 14% and 8% among the 55+ and 18-34 age groups, respectively.

Fewer than one in five (19%) self-employed workers in the 35-54 age bracket knew they could withdraw a 25% tax-free lump sum from their pension, compared with 22% of those aged 18-34 and 46% of those aged 55+.

The 35-54 group also ranked last for correct answers to the IHT question (22% versus 33% among the 18-34 cohort and 37% among the 55+ group).

However, the 18-24 age group struggled most with the question about the age at which individuals can start taking money out of a pension, with 22% of the cohort answering correctly, compared to 25% of those aged 35-54 and 45% of those aged 55+.

Gender differences

The study also revealed a pension knowledge gap between the sexes. Most notably, a larger percentage of men knew that 25% of a pension can be taken tax-free (35% of men versus 25% of women). A similar pattern was observed for the question on IHT exemption, with over a third (34%) of men answering correctly, compared to 26% of women.

Overall, a higher percentage of self-employed men answered all three questions correctly (12% versus 5% for self-employed women).

Based on a poll of 700 self-employed people conducted by Opinium between 29 July and 5 August 2024. Source interactive investor.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “Our research reveals a concerning lack of knowledge on basic pension rules among self-employed workers, underscoring the need for greater pension education and support for this group.

“Self-employed workers often miss out on the structured support that employees receive regarding pensions, which can lead to a significant gap in awareness and engagement. With no employer to nudge them toward saving for retirement or to match contributions, many are left to navigate the complex pensions landscape on their own.

“The focus on managing fluctuating incomes and the immediate demands of running a business can easily push long-term planning, such as pensions, to the back-burner. A lack of understanding of pension rules could mean missing out on significant tax relief and investment growth, leading to a shortfall in retirement income when they need it most.

“The middle-aged cohort’s low level of pension awareness is particularly worrying, as they may not have enough time to remedy decisions made based on inaccurate assumptions.

“Another concerning statistic from the survey is that 63% of self-employed individuals aged 55 and over don’t know that pensions are exempt from IHT, which could result in an unnecessary tax bill on their estate when they pass away.

“The gender gap in pension awareness is also a cause for concern. Closing this gap is vital for closing the gender gap in pension savings and promoting financial equality.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.