World’s biggest banks to buy, hold and sell

As America’s lenders exit their latest quarterly reporting season, overseas investing expert Rodney Hobson analyses the numbers and reveals what he’d do with their shares and why.

17th April 2024 09:32

by Rodney Hobson from interactive investor

This has been a very mixed quarter for American banks. Higher interest rates are not flowing into the bottom line as much as one might have expected, while mergers and acquisitions have started to pick up at last, with US companies seeing opportunities in the undervalued London stock market. Meanwhile, some one-off charges have taken a toll.

However, analysts had expected worse, and it is increasingly clear that US interest rates are not going to come down quickly, so there is still time for banks to cash in on the wider spread between borrowing and lending rates.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

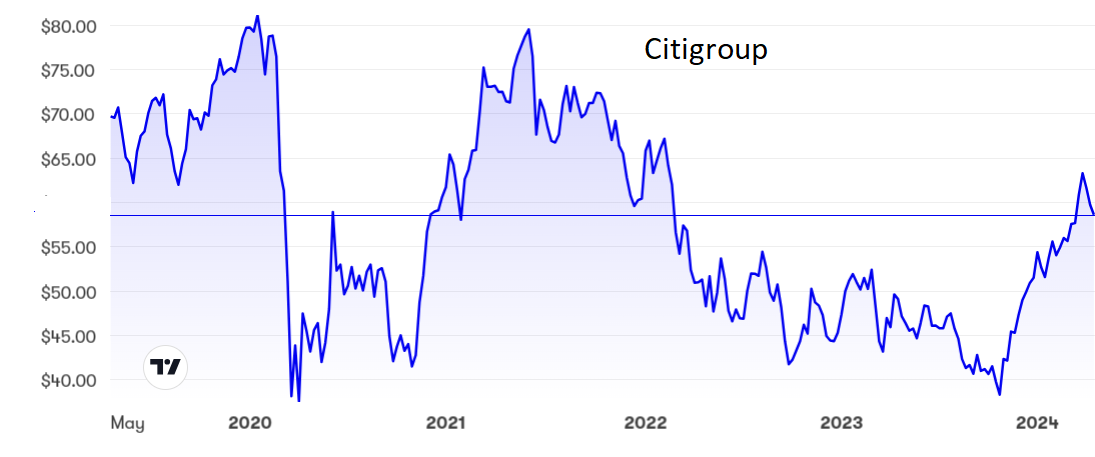

On the negative side, Citigroup Inc (NYSE:C) saw revenue and net income fall in the first quarter, with restructuring charges taking a chunk out of the bottom line. Efficiency and simplification come at a price. Citigroup was at least able to point to a better showing for its investment banking arm. See Keith Bowman’s expert analysis ii view: Citigroup beats estimates but shares fail to keep gains.

Source: interactive investor. Past performance is not a guide to future performance.

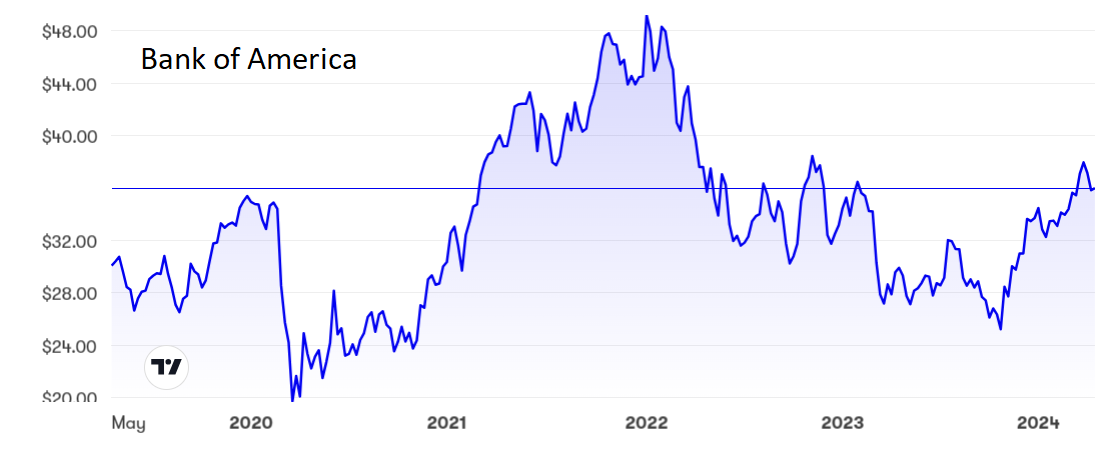

Bank of America Corp (NYSE:BAC) produced a similar story, beating analysts’ estimates but still showing falling revenue and profits. Revenue slipped 1.7% to $25.8 billion, while net income fell 18% to just under $6.7 billion, partly, but not entirely, due to a compulsory contribution to the federal deposit insurance scheme.

Again, it was investment banking and asset management that fared better, while net interest income was affected by higher payments to depositors.

Source: interactive investor. Past performance is not a guide to future performance.

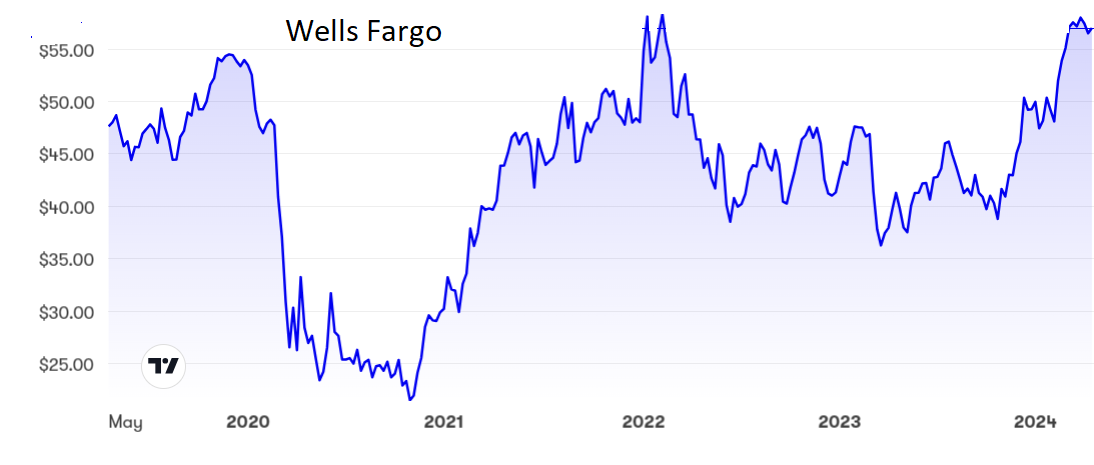

Wells Fargo & Co (NYSE:WFC) also suffered a slump in net earnings, down 7.5% to $4.6 billion despite a modest 0.6% rise in revenue to just under $21 billion. A big disappointment was an 8.3% fall in net interest income. Revenue from banking and lending fell, both to retail and commercial customers.

- Stockwatch: a US tech share with 130% upside potential?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Chief executive Charlie Scharf put on a brave face, calling the results solid, but somewhat ominously he added that the timing and size of future dividends will depend on “the earnings, cash requirements and financial condition of the company”. While technically that is true of any company, one wonders why he felt the need to spell it out. It sounds ominous.

Source: interactive investor. Past performance is not a guide to future performance.

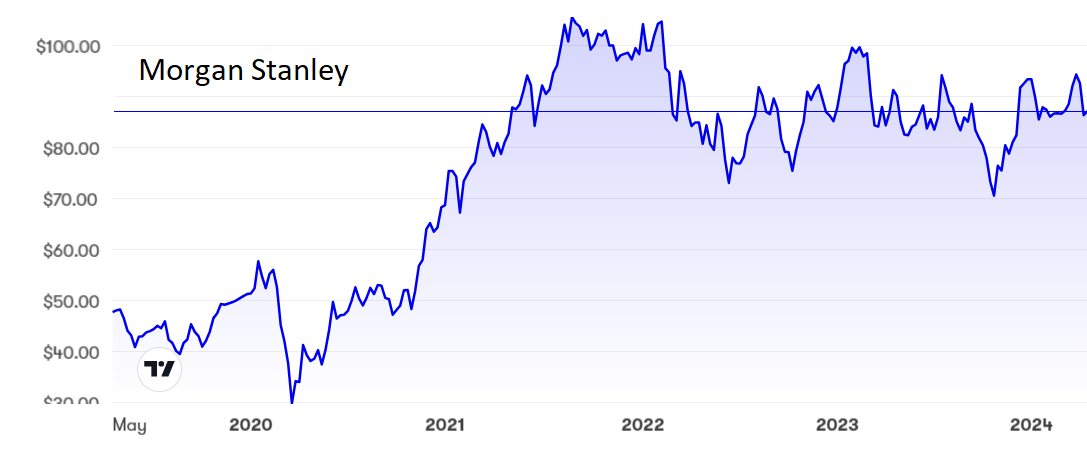

Morgan Stanley (NYSE:MS) has quite different worries. Last November there were reports that the Federal Reserve Bank had been looking into money laundering controls in the bank’s international wealth management business, a key driver of growth. Now it seems that other US regulators are investigating whether Morgan made sufficient efforts to vet risky clients.

Such interest from US banking regulators tends to turn out to be time-consuming and expensive. That was a pity, as the bank had a great first quarter with revenue up 4.2% to $15.1 billion and net income 14% higher at $3.4 billion.

Source: interactive investor. Past performance is not a guide to future performance.

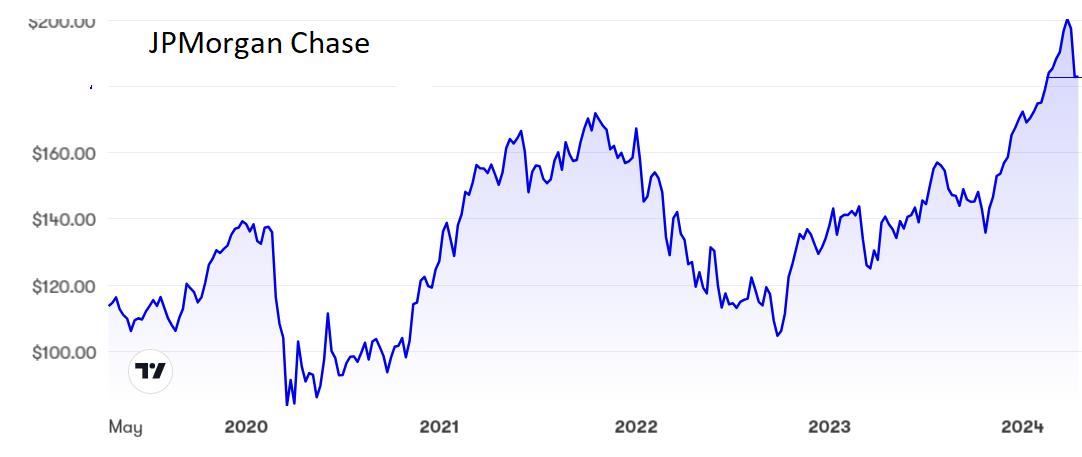

JPMorgan Chase & Co (NYSE:JPM) spoilt decent figures by adding a somewhat downbeat outlook. First-quarter revenue rose an impressive 9.3% to $38.35 billion and net earnings were 6.3% higher at $13.4 billion, despite the need to contribute $725 million to the US federal deposit insurance scheme. The balance sheet is particularly strong.

Chair and chief executive Jamie Dimon spooked the market by pointing to global uncertainties such as wars and inflation despite admitting that “many economic indicators continue to be favourable”.

See ii view: JP Morgan profits up but outlook disappoints for more details.

Source: interactive investor. Past performance is not a guide to future performance.

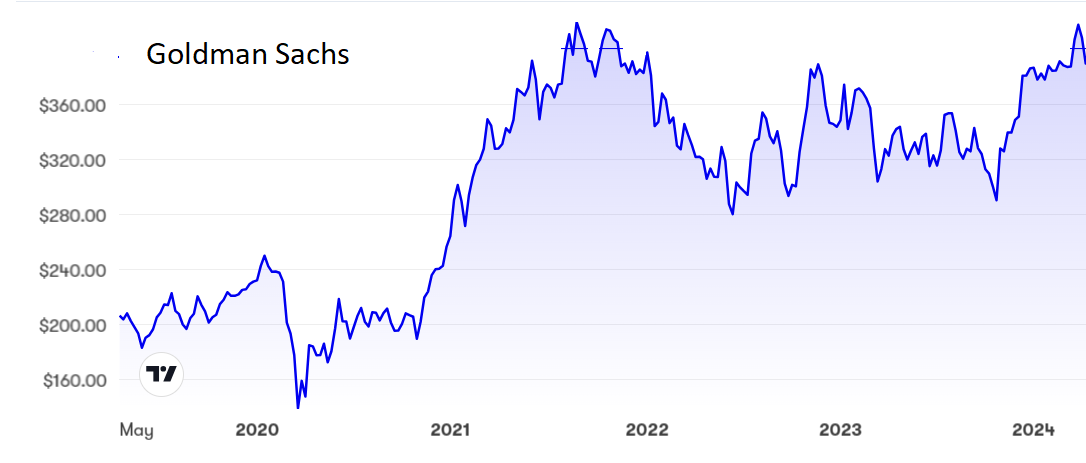

The best results came from The Goldman Sachs Group Inc (NYSE:GS), one bank that saw revenue and earnings rise in the first quarter. Revenue was up 16% to $14.2 billion, while net earnings jumped 27% to $3.1 billion, with all parts of the business playing their part.

This was much better than expected and it was due in large part to the investment arm delivering its best quarter for two years, a period in which Goldman struggled as it amassed losses from an ill-fated attempt to break into consumer banking while dealmaking was in a rut.

- Fixed income: how a monetary policy tool could unsettle markets

- Macro: central bank inflation campaign reaches last mile

- The hybrid hype has put even Tesla in the back seat

The rest of this year should show further improvements. Goldman is scaling back its consumer operations – not without cost, as it has written down the value of some assets and sold others. Now it can concentrate on its strengths in investment banking and trading.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: At $35, Bank of America is at the mid-point of its five-year range between $20 and $50 and it looks to have formed a ceiling around $40. It is probably no more than a hold at this stage. The price/earnings (PE) ratio is not too demanding at 11.7 but the yield is hardly enticing at 2.6%. Consider buying only if the shares slip to $32.

Wells Fargo continues to blow hot and cold. At $56 the lure is only lukewarm with a PE and yield slightly worse than at BoA. The shares are already pulling back from a peak and this could be a good time to take profits. Sell.

JP Morgan has fallen back from its $200 peak and could fall further, but if you are in, you should definitely hang on. The gloomy outlook was probably overdone. Consider buying on weakness as at worst there should be a floor at $172.

Citigroup has a more demanding PE at 17 but the yield is more attractive at 3.6%. The shares have slipped back from a recent peak just above $60 but are worth holding on to. Buy if they edge any lower. They will surely not drop as far as $50.

Morgan Stanley has been dragged down unfairly by a general sell-off of banking shares. At $89 the PE is not too demanding at 16.8, while the yield is better than most at 3.8%. Despite the possible attentions of the regulators, this is a buy.

At just under $400, Goldman Sachs shares have held up better than other banks but are still worth considering as a buy. The PE of 15.6 and yield of 2.7% are not spectacular but the outlook is the best in the sector.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.