World peace and end of terrorism are this stock’s only threat

It’s been a stunning performer, but what does our companies analyst think of this mid-cap star?

31st January 2020 16:03

by Richard Beddard from interactive investor

It’s been a stunning performer, but what does our companies analyst think of this mid-cap star?

Few companies can claim to be world leaders, but Avon Rubber (LSE:AVON) claims leadership in two industries. Perhaps that is why investors have chased its share price up to £24.45, valuing the enterprise at about 30 times adjusted profit.

Transformational year for Protection

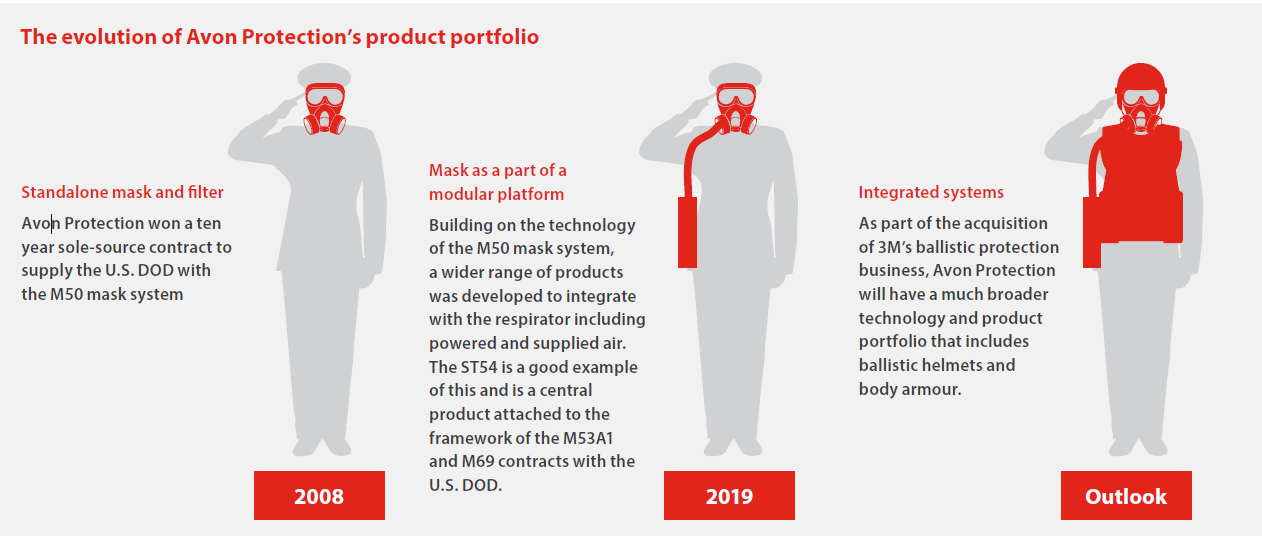

Avon describes this year as “transformational”, a year in which it demonstrated that the bigger of its two divisions, Avon Protection, was much more than a single product company supplying a very big contract for the US Department of Defense.

For a decade, Avon Protection, responsible for 72% of the company’s revenue, was the exclusive supplier of the M50 General Respirator, but in 2018 its 10-year contract expired, and investors wondered what would happen next. Now we know.

While it negotiates a new five-year “sustainment” contract, Avon remains the sole-source supplier of the M50, albeit in reduced numbers, and it has replaced the reduction in business with two further sole-source contracts, also with the DoD, to supply more specialised masks.

The new masks, the M53A1 mask system designed for special operations and the M69 aircrew mask system, took five years to co-develop with the US D0D and bring into production, so Avon Protection was hard at work long before the potential cliff-edge of the end of M50 contract. The company says the new contracts solidify its position as the “principal choice” of the US DoD for Chemical, Biological, Radiological and Nuclear (CBRN) protection systems.

It is also finding new customers around the World, exemplified by the sale of the MCM100 deep-water rebreather (used in deep dive operations like mine clearance) to the Norwegian military in 2019, a sole source contract to supply the new UK General Service Respirator, and a 143% increase in revenue from non-US military customers to £32.4 million in 2019 (18% of Avon Rubber’s total revenue).

Although the US is the focus of Avon Rubber’s efforts because it spends 45% of all global military expenditure, the company believes it can replace aging equipment in Europe because NATO countries have committed to increase military spending to 2% of GDP.

Selling more kit to more customers

The other major strategic developments involve acquisitions and disposals. After the year-end, Avon Rubber acquired Ceradyne from 3M for at least $91 million, and potentially more if Ceradyne wins pending tenders.

Ceradyne supplies helmets and body armour, primarily to the US military, although here too Avon Protection sees a “clear opportunity” to sell to other militaries, and police forces. The acquisition is a big one, potentially costing four times annual profit, but at approximately 10 times Ceradyne’s EBITDA it may not be extravagantly priced and advances Avon Protection’s strategy, which is to sell an increasing amount of kit to a growing list of customers:

Source: Avon Rubber annual report 2019

Avon Protection also supplies police and fire departments with equipment and these businesses are faring less well. The partial shutdown of the US Government in the early part of 2019 meant customers stopped ordering, and the company only partially recovered lost business once things returned to normal. It expects the division to return to growth in 2020.

Meanwhile, Avon Protection has closed its Fire division, explaining that as a relatively small supplier in a fragmented market, it was unable to earn sufficiently high profit margins. It will no longer sell Self Contained Breathing Apparatus (SCBA) to fire departments and a thermal imaging camera range will be folded in with Law Enforcement in a new “First Responder” division. Fire contributed 3% of total revenue in 2019.

Avon’s second division, milkrite|InterPuls, supplies the dairy industry. Although it is much more fragmented, dairy farms are consolidating into more efficient mega-farms. Here, too, the company is, through product development and acquisitions, selling more kit to more customers.

As milkrite, it was the market leading supplier of milking liners and clusters that connect cows to milking machines, but it broadened its product range to milking machine components through acquisitions including InterPuls in 2015. It is giving customers the alternative to lease the equipment, positioning milkrite|InterPuls as a service provider reducing the capital cost of dairy farming:

Source: Avon Rubber annual report 2019

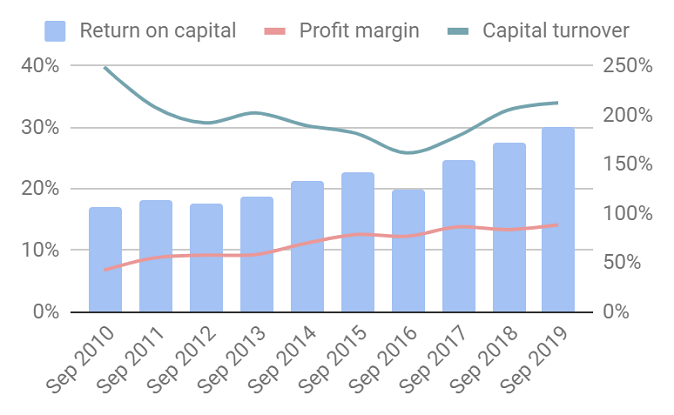

Revenue and profit at milkrite|InterPuls were flat in 2019 due to low milk prices in the early part of the year, which meant farmers spent less. Overall, Avon performed well though. Revenue increased 8% (4.4% at constant currency), adjusted profit increased 15%, and return on capital was 30%. Before we get carried away, though, there are some potential nasties in the numbers...

Nasties in the numbers

My adjustments to operating profit of £16.4 million, which is used in many other financial statistics like return on capital and the company’s valuation, add up to more than the operating profit figure itself, meaning adjusted profit is more than twice as big as the profit determined by the company using the statutory accounting rules:

| Operating profit £m | 14,400 |

|---|---|

| Amortisation of acquired intangibles | 3,500 |

| Defined benefit scheme past service costs | 3,500 |

| Acquisition costs | 2,900 |

| Exit costs re: FIRE SCBA market | 5,400 |

| Property impairment | 1,100 |

| Adjusted operating profit £m | 30,800 |

Source: Avon Rubber annual report 2019

I am relaxed about these adjustments. Most of them are one-offs I routinely ignore in assessing the underlying performance of a business, including costs relating to acquisitions and disposals. Due to a recent legal ruling, companies with defined benefit pension schemes are making one-off adjustments to ensure women receive the same benefits as men.

Does Avon Rubber make good money?

Yes. Both divisions are highly profitable and the group is not just making more profit, it has got better at making profit, earning incrementally higher profit margins and return on capital.

Source: Calculations by the author on data from Avon Rubber annual reports

Average cash conversion is high, 92% over the last six years, but Avon Rubber performed poorly in 2019 due to the timing of a $16.6 million contract. The order was fulfilled but the company had yet to be paid at the end of the year.

Score: 2

What could prevent it from growing profitably?

In 2019, 31% of Avon Rubber’s revenue came from the US DoD, much the same proportion as in 2018 and 2017. That number may increase due to the acquisition of Ceradyne, which earns 90% of profit from the US DoD. Avon Protection’s revenues could be put at risk by budget cuts, a squeeze on suppliers, or a switch to an alternative supplier.

World peace and the end of terrorism, which sadly seems like a distant threat.

Score: 2

How will it overcome these challenges?

While Avon Protection does depend on the US DoD, the DoD also depends on Avon Protection. The two collaborate closely on product development, resulting in sole-source contracts for five or more years. The development of new mask systems and the acquisition of Ceradyne has deepened the relationship, while Avon Rubber is successfully diversifying both its product range and customer base.

Continuing innovation should enable Avon Rubber to defend its leadership from competitors.

Score: 2

Will we all benefit?

Paul McDonald was promoted to chief executive in 2017, but joined over 15 years ago. The board is stable and very experienced, although the chairman will retire in 2021. The company targets profit margins, cash generation, dividends and research and development expenditure maintaining a balance between rewarding investors now and building the business for the future.

It recognises success depends on its people, identifies poor training and dysfunctional organisational structures as a key risk, and aims to be a great place to work. Somewhat surprisingly, though, employee engagement fell from 73% in 2018 to 61% in 2019.

Score: 2

Are the shares cheap?

No! Even assuming the company can maintain its current level of profitability, which is at an all-time high, the earnings yield is just 3% so to invest at this level we must be confident growth is assured.

Score: -1.7

With a score of 6.3, Avon Rubber is ranked 16 out of the 30 shares I follow most closely. The shares are probably fairly valued.

Richard owns shares in Avon Rubber.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.