This world-beating stock oozes confidence

If you missed this stock’s amazing rise, now might be a good opportunity before the next upward lurch.

31st March 2021 08:47

by Rodney Hobson from interactive investor

If you missed this stock’s amazing rise, now might be a good opportunity before the next upward lurch.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Record results from semiconductor maker NVIDIA (NASDAQ:NVDA) have done remarkably little for the share price. The stock could be worth considering by any investor who missed out on the opportunity to buy a couple of years ago.

Nvidia has been one of the winners from the Covid-19 crisis as enforced working from home has spurred demand for computer equipment. It designs graphics processing units for the gaming and professional markets, as well as for mobile computing and vehicles.

In the fourth quarter to 31 January, revenue hit a record $5 billion, a spectacular 61% leap from the same quarter a year earlier and a 6% increase on the excellent figure for the third quarter. Net income in the quarter was 53% higher year on year at $1.46 billion, so those extra sales did not come at correspondingly extra cost, as has happened at many companies during the pandemic.

- Your 50 most-popular US stocks

- Read more from Rodney here

- Open an ISA with interactive investor. Simply click here to find out how.

Star performers were the gaming and data centre platforms, a reflection of the changing lifestyles prompted by the pandemic. The shutdown has driven the bored and lonely into gaming on their personal computers and Nvidia is known for the high-performance levels of its graphics cards.

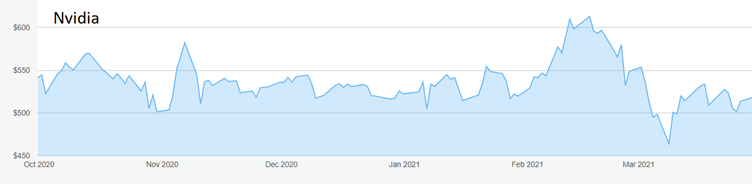

Source: interactive investor. Past performance is not a guide to future performance

For the full 12 months, revenue rose 53% to $16.7 billion and net income at $4.33 billion was 55% better. Further rapid improvement is expected in the current quarter to the end of April, with revenue likely to easily top $5 billion compared with just over $3 billion in the same three months last year, when the effects of the pandemic were only just being felt.

What has made American chipmakers particularly confident is the $3-4 billion stimulus package that is being prepared by the administration of President Joe Biden, on top of the Covid relief cheques already sent out to all families across the country.

The stimulus is adding more fuel to an economy that is already on fire, with GDP forecast to grow at more than 6% in 2021. The semiconductor industry expects sales to rise 8.4% this year, a forecast that will probably prove to be an understatement, although there is little spare capacity and shortages will last to the end of the year at least.

You cannot just set up a production factory at a moment’s notice, nor at little cost. Intel (NASDAQ:INTC) says it will take another two years to complete two $20 billion chip factories in Arizona, assuming that they can be finished on schedule, which is not guaranteed.

The shortage of chips that is restricting production of vehicles, mobile phones and computer equipment is therefore not a temporary phenomenon. Shortages mean rising prices for components that are in demand.

Carmakers, who were gearing up to meet expected higher sales to drivers waving their Covid relief cheques, are suffering as production lines remain shut or are brought to a halt. Ford (NYSE:F), for example, has just cut one shift at its Kentucky plant, having already decided to shut down in Ohio. General Motors (NYSE:GM) is part-assembling trucks that will stand idle until microchips can be fitted.

They and their rivals will be forced to pay over the odds for the one part that is holding up the entire industry.

- Get this stock while it’s hot

- Tesla drops to back of the grid as electric vehicle race hots up

- Check out our award-winning stocks and shares ISA

Nvidia shares had a good run in 2019 and 2020 but have come off the boil. For no good reason, they have lost $100 from a peak of $613 in February. The shares are moving up and down erratically at the moment and there are good opportunities to get in before the next upward lurch.

Hobson’s choice: Buy up to $533, where there could be resistance. There should be ample opportunity to do so.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.