Will world’s biggest chemical firm clear Covid-19 hurdle?

BASF stands to profit as workplaces open up, overcoming its Q2 loss.

12th August 2020 12:44

by Rodney Hobson from interactive investor

BASF stands to profit as workplaces open up, overcoming its Q2 loss – but ignore the chance of a quick takeover.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The world’s biggest chemical company has disappointed shareholders by revising its dividend policy and earnings targets. However, that is perfectly sensible in the current circumstances and investors can hope that normal service will be resumed as the world slowly recovers from the coronavirus crisis.

The company in question is German-based BASF (XETRA:BAS). It has a wide range of products that occupy key positions in most of its markets. Half of its sales are made in Europe, with North America and Asia each chipping in 20%. Size and diversity are welcome factors for international companies coping with the inevitable global economic downturn.

From its origins in making dyes, the company has constantly evolved in the 160 years since it was formed.

It has a knack of spotting opportunities in higher valued products that have included synthetic fibres, coatings, pharmaceuticals, pesticides and fertilisers.

- Top 10 most popular investment funds: July 2020

- Check out five of China’s top stocks

- Looking to diversify your portfolio? ii’s Super 60 recommended funds is full of great ideas

It now has subsidiaries and joint ventures in more than 80 countries and operates nearly 500 production sites across Europe, Asia, Australia, the Americas and Africa.

BASF has had a policy of raising its dividend every year, based on increasing its core earnings by an underlying 3-5% annually.

But chief executive Martin Brudermuller now warns of “a considerable risk that both the economic recovery and medium to long term overall business development will be slower” compared with the period before Covid-19. He is no longer providing guidance on the outcome for the full year.

Caution is clearly necessary after a tough second quarter in which sales fell by 12% to €12.7 billion (£11.45 billion) and BASF swung into a pre-tax loss of €923 million. It blamed a weak performance in its materials, surface technology and industrial solutions divisions.

- Want to buy and sell international shares? It’s easy – here’s how

- Chart of the week: How IBM missed the tech boom

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

This offset a perfectly satisfactory first quarter, but at least figures for the half year were better than they might have been in the circumstances.

Sales were down just 2% and an overall profit, albeit down 85%, was €277 million. Restrictions on workplaces during coronavirus lockdowns held back production, making it difficult to meet stable demand for detergents and cleaning products. This problem should ease as the year progresses.

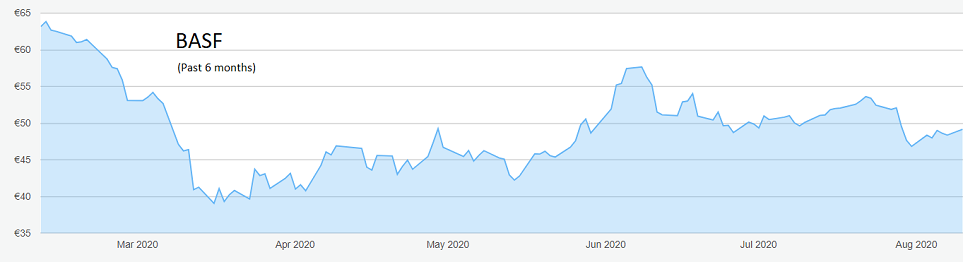

Source: interactive investor. Past performance is not a guide to future performance.

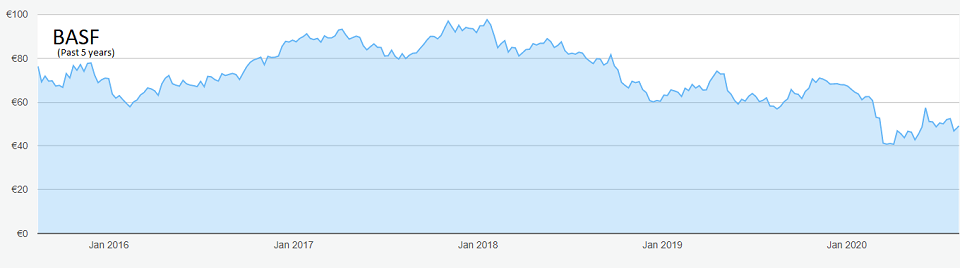

The shares performed strongly until the start of 2018, when a peak of €97 proved to be a watershed. They were already down to €62.50 before the stock market slump in March sent them tumbling to a low of €41.

Although a subsequent recovery petered out last month, the shares are edging higher again despite the dividend and earnings warning at the end of July. They currently stand at around €50, where the yield is 6.7%, which is particularly attractive for such a solid company.

A decision not to promise further increases does not mean the payout will be reduced, although that could happen. The board will be reluctant to avoid the ignominy of a deep cut, but even if the payment were halved, which is highly unlikely, the yield would still be worth having at more than 3% with the prospect of a progressive policy being reintroduced.

Source: interactive investor. Past performance is not a guide to future performance.

Brudermuller recently raised the possibility of a takeover bid for BASF while its share price is depressed. That would certainly create an instant profit for shareholders, but investors would do best to ignore the idea as it is hard to see where a bid would come from.

Any other chemical company would be bidding for a larger rival. Such a bid would be held up for months, and probably even then be blocked by competition authorities in Europe and America. Any bidder from another sector would be less able to deliver cost cutting or a value greater than the sum of the parts.

Hobson’s Choice: ‘Buy’ up to the recent peak of €53.60. The downside is likely to be limited to €46.80 while the potential short-term upside is to €70.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.