Wild’s Winter Portfolios are back for 2021-22

21st October 2021 12:33

by Lee Wild from interactive investor

Last year’s winter portfolios were back to winning ways, bouncing back strongly from the initial pandemic crash. Here’s what we expect from the new winter winners.

To say the impact of the pandemic on stock prices has been significant is a colossal understatement. Over half the FTSE 100’s initial 33% plunge was recovered in just three months, before 1,000 points were handed back over the summer. But a major rally coincided with the launch of last year’s winter portfolios at the end of October, demonstrating the beneficial seasonality on which they are based.

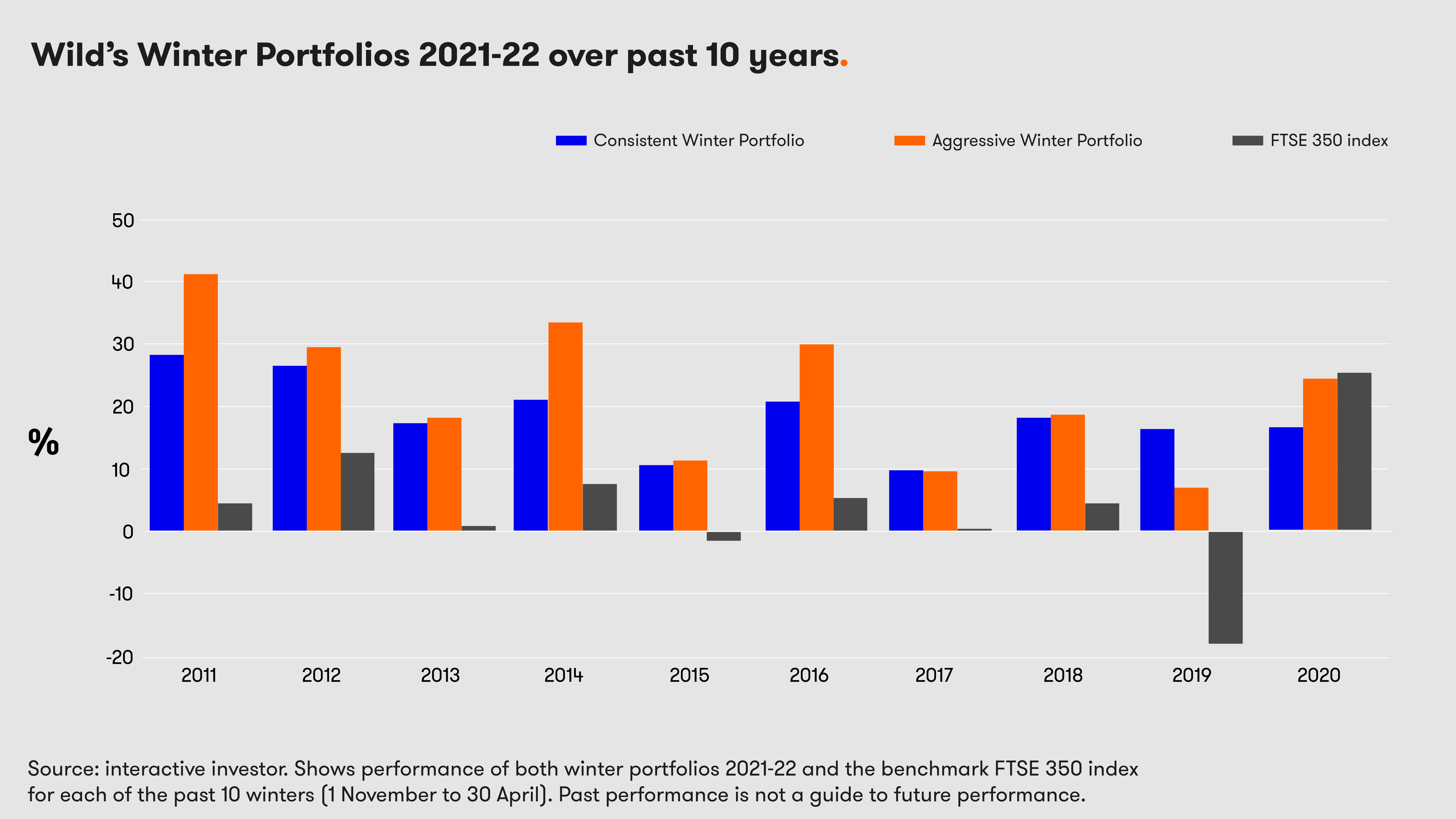

Historically, Wild’s Winter Portfolio’s have outperformed the wider stock market. The pandemic threw a spanner in the works in 2019-20 – both portfolios fell for the first time, and the higher-risk aggressive portfolio marginally underperformed the benchmark index.

Gains in 2020-21 were impressive and would have put a smile on any investor’s face in a normal year. Of course, it wasn’t a normal year – the second in a row – and the FTSE 350’s rocket-fuelled rally proved impossible to match.

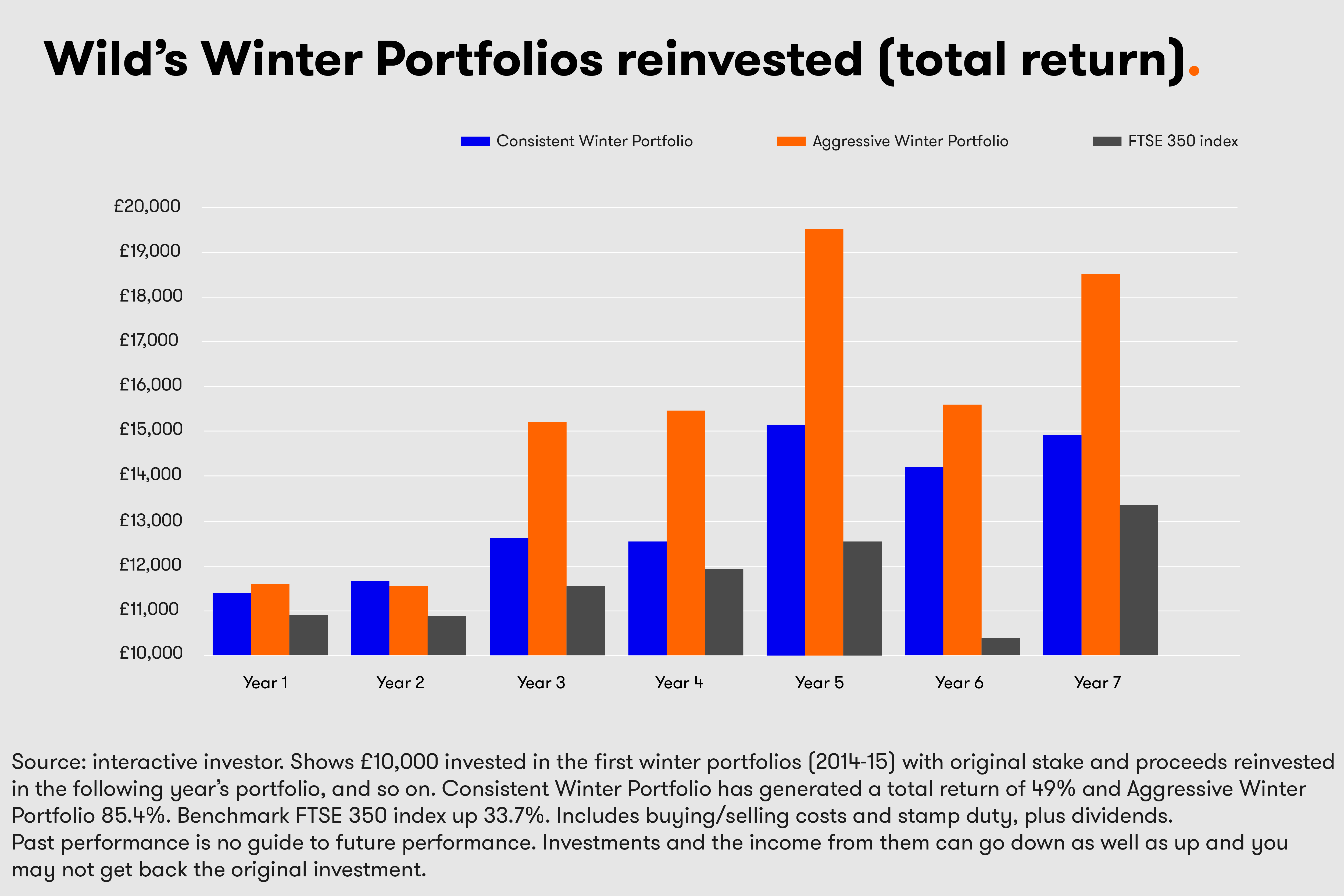

Still, both portfolios have been profitable for six out of seven years and have beaten the benchmark index more often than not. It’s why this beautifully simple trading strategy that’s run since 2014 gets an eighth season.

The rationale

Our interest was piqued by an anomaly in the stock market which demonstrates that buying and selling at two specific dates of the year has historically generated better returns than if you had stayed invested all year round.

Buying a portfolio of shares on 1 November, or late on 31 October, and selling them on 30 April has significantly outperformed the wider stock market, providing investors with a clear strategy that’s simple to execute and enjoys a successful performance history.

Data provided by Stephen Eckett, mathematician and co-founder of Harriman House, publisher of The UK Stock Market Almanac, shows that £100 invested in the UK stock market (as measured by the FTSE All-Share Index) in 1994 and held continuously for the past 26 years would have grown to £252 (excluding dividends). However, if they had only invested in the market between 1 November and 30 April every year, then that £100 would be worth £352. Conversely, if they had chosen to only invest over the summer months, they would have lost money; their original £100 would be worth just £65.

- Be first to find out this year’s Winter Portfolio stocks by subscribing to the ii YouTube channel here

- The great investment strategies: growth investing

“This anomaly, sometimes called the Sell in May Effect, has been known about for a long time,” explains Mr Eckett. “The first mention of it was in the Financial Times in 1935; and one academic paper claimed to have found evidence of the effect in data from 1694. Another paper found that the effect could be seen in the share markets of 81 countries - so it is not limited to the UK.”

Of course, this strategy is not without risk, none are. But the theory is compelling.

How do we do it?

The five constituents of Wild’s Consistent Winter Portfolio 2021-22 have each risen every winter for at least the past decade. The average return between November and April, excluding dividends, is 18.5% versus an average gain of just 4% for the FTSE 350 benchmark index.

The higher-risk Wild’s Aggressive Winter Portfolio 2021-22 still has two stocks that have a 100% winter record for a decade, while three of them have risen in nine of the past 10 winters. The average winter return for the 2021-22 aggressive portfolio since 2011 is 22.3%, exceeding the consistent basket of shares, as you would expect.

The five stocks in each of the 2021-22 winter portfolios will be announced on Friday 29 October.

Historic performance

The 2020-21 aggressive portfolio returned an impressive 18.1% in the six months to 30 April and the consistent portfolio 6.1%. Include dividends and total returns were 18.8% and 6.6% respectively.

Despite strong positive performances, the benchmark FTSE 350 index did better. It rose 26% from November to April, and by 28% if you factor in dividends. That’s three times better than its previous best during the winter portfolio’s seven-year history - a share price gain of 8.7% and total return of 9.2% in the portfolio’s inaugural year.

My excuse for this underperformance is well rehearsed, and something I’d flagged even before last winter began. The 10 constituents of the winter portfolios had already enjoyed a purple patch during the post-crash recovery. Most had recovered to pre-Covid levels and were trading at or near record highs. That’s because when the chips are down investors look for quality, and that’s what defines the stocks in the winter portfolios. Many other sectors only began their recovery after the Pfizer vaccine news on 9 November, so had far more catching up to do.

It was like the winter portfolios had given the wider market a massive head start. In no time at all, the FTSE 350 was up 15%, factoring in a rapid post-Covid recovery. Our portfolio stocks had already done that, so both strategies added just 5% in response.

However, the portfolios still did well and, while their critics, especially fund managers, argue that it’s about "time in the market rather than timing the market", statistics don’t lie, and the proven consistency of our baskets of winter shares makes them worth considering as part of a well-diversified investment portfolio.

Why does the winter portfolio strategy work?

While there are no conclusive studies that neatly explain the outperformance of stock markets during the winter months, there are plenty of theories, some more plausible than others. There are also some obvious reasons why individual stocks do better at this time of year.

Events to monitor over the next six months

UK shares recovered strongly from pandemic lows in March 2020, but it’s accepted in many circles that they remain undervalued compared to global peers who have done better. US markets like the broad S&P 500 and tech-heavy Nasdaq, and rivals in Europe have also outperformed the UK during the post-crash recovery, surging to record highs.

However, some of our Winter Portfolio stocks have done very well over the summer and trade at or near all-time highs. That might make some investors nervous, although these are high-quality companies, and they are winter performers after all.

And, as always, there are issues, some of which have already arrived and are already affecting stock prices, others looming on the horizon.

Most obvious threat currently is the spectre of inflation. In the past few months, we’ve already seen the biggest monthly increase in the cost of living since records began, and a rate of UK inflation - Consumer Prices Index including owner occupiers' housing costs (CPIH) of 3% - as high as anything since March 2012.

An energy crisis caused by gas shortages has fed through to higher fuel bills, and supply chain problems, exacerbated by a post-Covid growth spurt, have put a strain on the supply of things likes building materials, some food and petrol. Talk is that inflation could be as high as 7% by next spring.

Rising prices lead to higher interest rates, which some believe are imminent. The cost of borrowing is currently at a record low, but that could change very quickly.

And the Covid health crisis has not gone away. Thousands of Brits still catch it every day and people are dying. A Covid booster campaign is underway to help avoid a repeat of last year’s mass hospitalisations, but a harsh winter could do serious damage to the nation’s health. It could also tip the UK economy over the edge and into a winter of discontent.

Donald Trump may have been replaced by a more moderate alternative in Joe Biden, but supply issues and high prices affect Americans, too. Repercussions, as with most things over the pond, tend to have more far-reaching consequences.

Top of the agenda this year is tapering of US stimulus measures. Central bankers have been buying up billions of dollars worth of bonds and mortgage-backed securities every month during the pandemic to help keep borrowing costs low and stave off another financial crisis.

But this must stop at some point, and the Federal Reserve is looking for the right time to start winding down stimulus. Get it wrong and policymakers put the economy at risk, threatening another sell off in financial markets akin the so-called Taper Tantrum in 2013.

Despite the list of possible problems for investors, history tells us this is the time of year when stock markets do best.

We’ll be unveiling the constituents of both winter portfolios on Friday 29 October and will issue monthly updates until the strategy ends next April.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.