Wild’s Winter Portfolios 2024: two stocks manage to outperform

I can only blame Trump for some of the underperformance of this winter’s portfolios. Here’s a look back at risers and fallers in March, before the latest crash.

10th April 2025 14:14

by Lee Wild from interactive investor

I started writing my fifth monthly winter portfolio update with one eye on a screen full of red. After President Trump delivered on his promise of reciprocal tariffs, global stock markets plunged into correction or even bear territory. As I finish off, stocks are up 10% or more. It’s a stark reminder of how quickly things can change under this US administration.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

A record high for the FTSE 100 early last month at 8,913 seems more than just a few weeks ago. The rest of March was spent anticipating President Trump’s next move on tariffs, ending with a loss of 2.6% for the UK’s flagship index. But the FTSE 250 fell more than 4%, the S&P 500 almost 6% and the Nasdaq Composite tech index over 8%.

There were some big blue-chip fallers. British Airways owner International Consolidated Airlines Group SA (LSE:IAG) led the pack lower with a 26% loss, giving back more of the stellar gains achieved over the previous six months. Melrose Industries (LSE:MRO) was close behind, followed by betting group Entain (LSE:ENT) down 22% and InterContinental Hotels Group (LSE:IHG) off almost 17%.

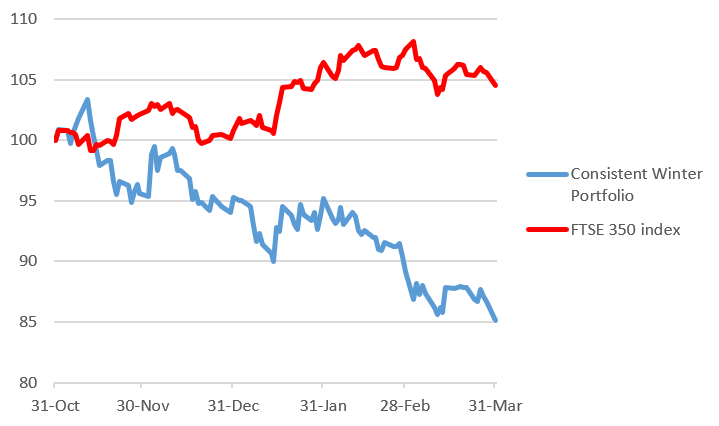

Wild’s Consistent Winter Portfolio, made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade, fell 4.6% in March, extending losses for the first five months of this six-month strategy to almost 14.9%.

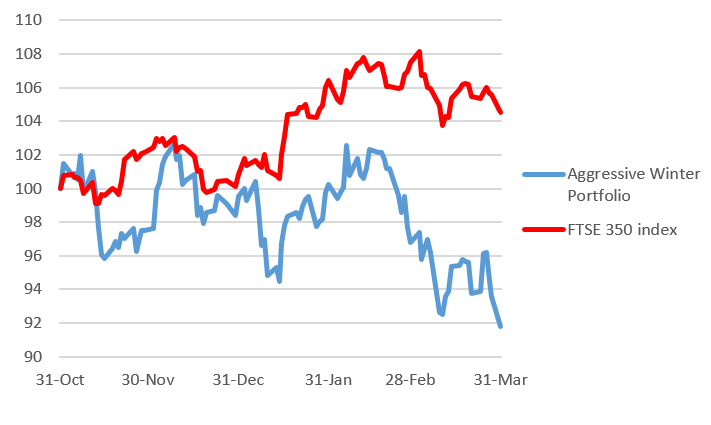

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits (all constituents are up at least 80% of winters over the past decade). This portfolio fell 5.2% over the month and is now down 8.2% since launch. The FTSE 350 benchmark index generated a monthly loss of 2.8% but was still 4.5% higher this winter up to 31 March.

Wild’s Consistent Winter Portfolio 2024-25

Past performance is not a guide to future performance.

Keller Group (LSE:KLR) kicked off the month with gains, something I’ve been unable to write as frequently as I’d have liked this winter. Shares in the engineering contractor ended the month up 5.7% after posting “another outstanding set of results”, including a 34% jump in operating profit, new share buyback programme and decline in net debt.

Self-storage firm Safestore Holdings Ordinary Shares (LSE:SAFE), another of this winter’s serial underperformers, finished the month with a 1.3% rise, although it’s still down 24% this season. Electronic components company discoverIE Group (LSE:DSCV) only lost 0.4%, but despite some director share buying during the month, was still down 18% for the winter. Food packaging business Hilton Food Group (LSE:HFG) fell 3.6%, extending winter losses to 8.4% ahead of well-received annual results published early April.

But it was Spectris (LSE:SXS) that really put a spanner in the works last month, slumping 19.5%. Having been a decent winter performer up to then, it was nursing seasonal losses of almost 8% by month end. Despite some positives, investors focused on the negatives, including a large decline in both profit and underlying margin, plus uncertainty about a “sustained recovery”.

Wild’s Aggressive Winter Portfolio 2024-25

Past performance is not a guide to future performance.

Good job Keller is in both portfolios this winter because it was the only riser in the aggressive basket of shares. Construction and regeneration business Morgan Sindall Group (LSE:MGNS) limited losses to 0.9% following a rally in response to a bullish trading update and outlook for 2025.

It said that since its full-year results on 26 February, the Fit Out division “has experienced an acceleration in its trading momentum and is now expected to exceed both the group’s previous expectations and the top-end of its revised medium term targets (of £60-£85 million).”

The company now thinks annual results for 2025 will be slightly ahead of market consensus.

- Anatomy of a stock market crash and playbook for the recovery

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Copper miner Antofagasta (LSE:ANTO) lost 3.7% last month, meaning the shares are now in negative territory for the winter. Hospitality real estate company PPHE Hotel Group Ltd (LSE:PPH) fell 8.8% as February’s annual results failed to inspire investors.

But it was Intermediate Capital Group (LSE:ICG) that was this month’s dog. Having enjoyed a great winter, peaking at a record high in February, the private equity investment firm fell 14.4% in March. Macro uncertainty and concerns about performance-based fees are clearly playing on people’s minds, although analysts at Morgan Stanley believes ICG has relatively more defensive earnings given lower gearing than peers to carry fees.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.