Wild’s Winter Portfolios 2024: riskier portfolio outperforms Wall Street

After a rocky start to the winter period, one of this season’s two portfolios did better than the high-performing US tech index in December. Lee Wild explains how.

6th January 2025 14:48

by Lee Wild from interactive investor

December and the final three months of the calendar year are normally a time of optimism for stock markets. It’s why the winter portfolios have been a success for much of the past decade. But the month just gone has been tough for even the best-performing markets of 2024.

America’s S&P 500 index ended 2024 with a 23% gain for the year, but it was among the bottom five performers in December with a 2.5% loss. The Dow Jones did even worse, propping up the table of major indices with a 5.3% decline last month. While the Nasdaq Composite tech index managed a 0.5% gain for the month, it was Japan that did best, adding 4.4% in December to give a 19% return for the year.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Most UK markets registered a loss in December, with only the FTSE Small Cap index managing to advance, up 0.3%. Companies such as Ashtead Group (LSE:AHT), Frasers Group (LSE:FRAS), Vistry Group (LSE:VTY) and Tate & Lyle (LSE:TATE) were among 17 FTSE 350 companies whose monthly loss could be measured in double-digit percentages.

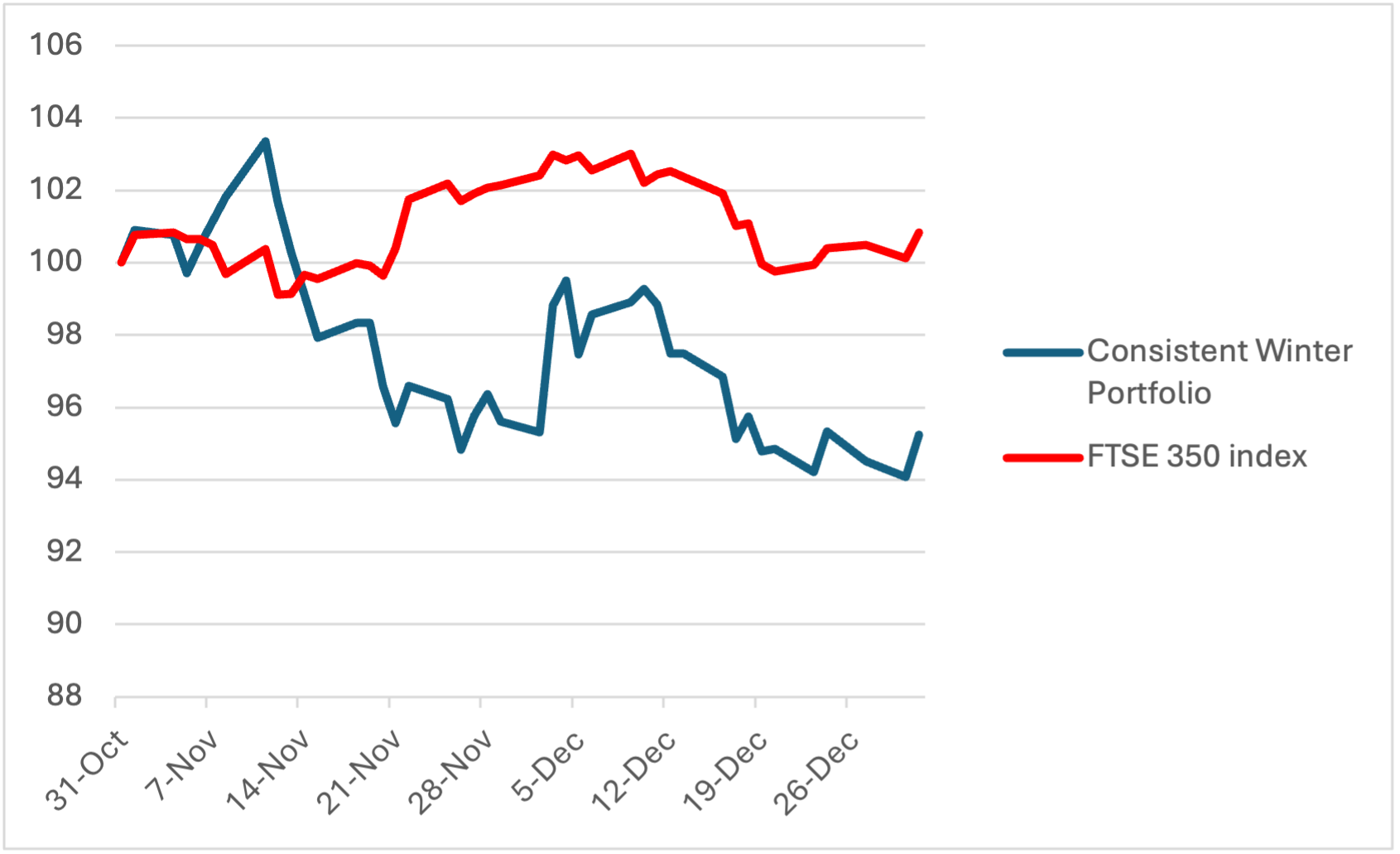

It was difficult for the winter portfolios too. Wild’s Consistent Winter Portfolio, made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade, was down 0.4% in December, taking the two-month decline to 4.8%.

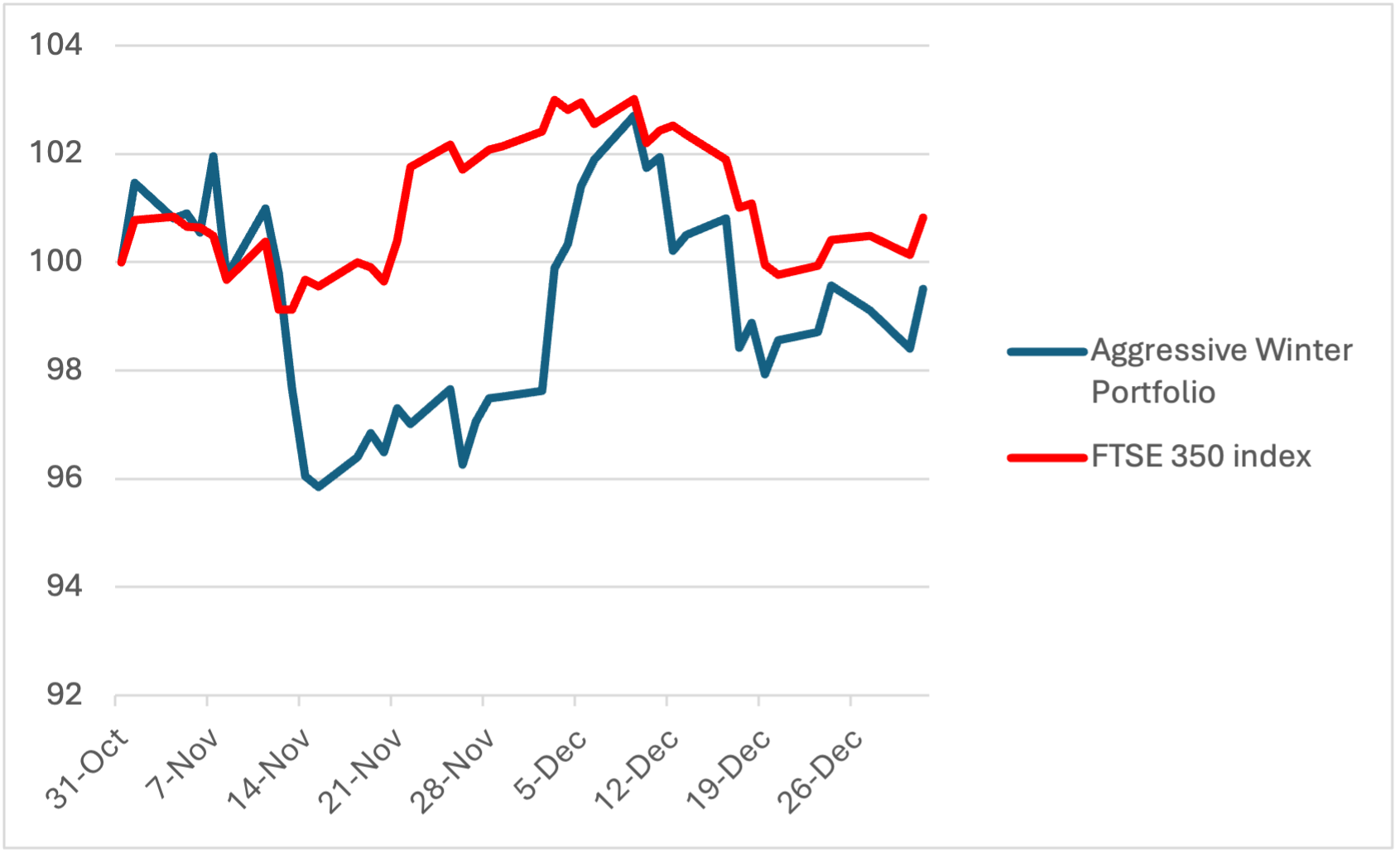

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits (all constituents are up at least 80% of winters over the past decade). This portfolio rose 2% over the month – outperforming the three big American indices - and is now down only 0.5% since launch. The FTSE 350 benchmark index fell 1.3% in December and is now up just 0.8% this winter.

While not the start we were hoping for, it’s worth remembering that the constituents of this year’s winter portfolios are there for a reason. In the consistent basket of shares, four of the five stocks have risen in nine of the past 10 years, averaging a gain each winter of 15.7%. Aggressive stocks have risen in at least eight of the past 10 winters and average a return of 20.8% every time.

Hopefully, the next four months will make up for a difficult start to this year’s seasonal strategy.

Wild’s Consistent Winter Portfolio 2024-25

Past performance is not a guide to future performance.

Electronic components company discoverIE Group (LSE:DSCV) started December with a bang. The stock raced ahead in the first week and held on to most of the gains until month-end.

Unfortunately, food packaging company Hilton Food Group (LSE:HFG) was the only other constituent of this portfolio to register a gain last month. Hilton shares remain volatile but have spent most of the past nine months trading between 870p and 950p. Expect a trading update on Thursday.

Precision instrumentation firm Spectris (LSE:SXS) lost less than 1%, and it is encouraging that non-executive director Kjersti Wiklund spent £48,600 on Spectris shares just before Christmas at 2,430p.

- Five AIM share tips for 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Ground engineer Keller Group (LSE:KLR) and self-storage provider Safestore Holdings Ordinary Shares (LSE:SAFE) did most of the damage this time.

Keller shares enjoyed a modest recovery during the first part of December but gave up ground during the second half of the month to register a 2.5% decline. That took losses so far this winter to 11.4%. As I said in the Big Reveal article at launch, Keller had already done incredibly well in the run up to this winter, putting it among the riskiest stocks across the portfolios.

If we need a pantomime villain for the festive period, the role goes to Safestore. It had already suffered a poor start to this edition of the winter portfolios following an uninspiring update and concerns about softer business customer demand. But things got worse as December wore on, with the Christmas Eve joint venture acquisition of Italy’s Easybox for €175m seemingly doing little to improve sentiment. Perhaps there’ll be a better reaction to final results on 16 January.

Wild’s Aggressive Winter Portfolio 2024-25

Past performance is not a guide to future performance.

After a disappointing start to this year’s portfolio, PPHE Hotel Group Ltd (LSE:PPH) had a much better second month. Climbing steadily through December, shares in the hospitality real estate company added 20% for the month to end 2024 at a five-month high and with a 12.8% return for the aggressive portfolio so far.

Construction and regeneration business Morgan Sindall Group (LSE:MGNS) also ended the month higher, with a 2.5% gain following a decent November, leaving the shares up 4.1% this winter.

But the other three constituents, of which Keller is also one, suffered losses. Like Keller, private equity investment firm Intermediate Capital Group (LSE:ICG) fell 2.5% in December, although it is still marginally ahead since the portfolio’s launch at the end of October.

Antofagasta (LSE:ANTO) did most damage in December, losing 6.6% during the month. Given a weak start to the winter, the copper miner is now down 8.2% since launch.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.