Wild’s Winter Portfolios 2023: one of the best starts ever

Much like last year, the winter portfolios have got off to a flyer. Hopefully, like last year, they end the six-month strategy in the same way – with big profits. Here’s the story so far.

5th December 2023 09:55

by Lee Wild from interactive investor

Last year’s winter portfolios did very well. It’s difficult to argue with a double-digit total return for each one. And the new editions of this six-month trading strategy have picked up where they left off, kickstarting the winter with returns in excess of anything the world’s major markets could muster.

A terrible October certainly helped, dumping stocks to their lowest levels in months. None of the world’s major stock markets ended the month in positive territory amid concerns about stock valuations, a return to conflict in the Middle East and speculation about central bank interest rate policy.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

But I wrote elsewhere last month, referencing the winter portfolios, that: “If history is any guide this should be a good time to invest, and certainly better than the summer months.”

Decades worth of data suggests that the six months from the end of October to end of April have been the most profitable time of year for equity investors. Ten years ago, to exploit this seasonal anomaly, we created two data-driven winter portfolios, one including five of the most reliable winter performers over the past decade, and the other consisting of five higher-risk shares.

You can find more information about the “consistent” and “aggressive” portfolios on our Winter Portfolio page.

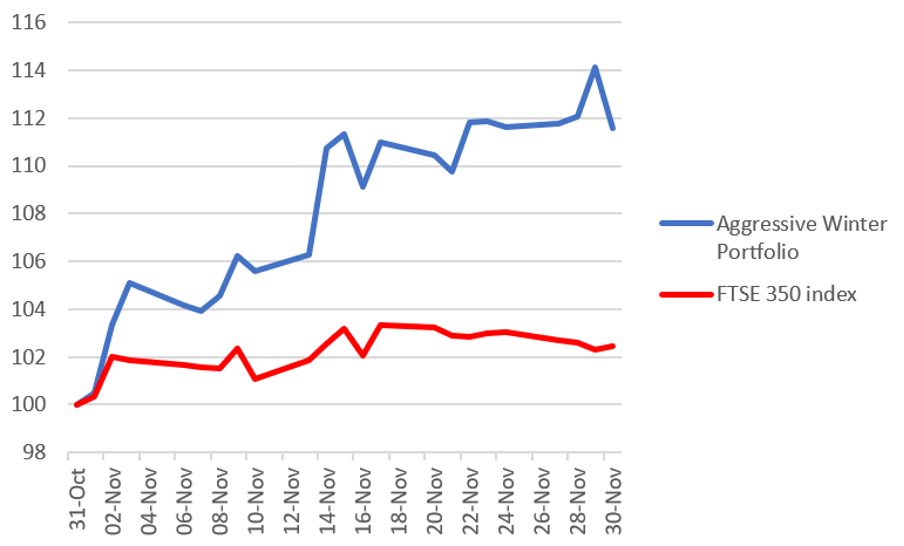

After a few brief jitters, performance quickly improved in November, and by the end of the month both portfolios had delivered on their two priorities – generate a profit and beat the benchmark index. In fact, the aggressive basket of shares staged the second-best start to a winter by any portfolio in their 10-year history.

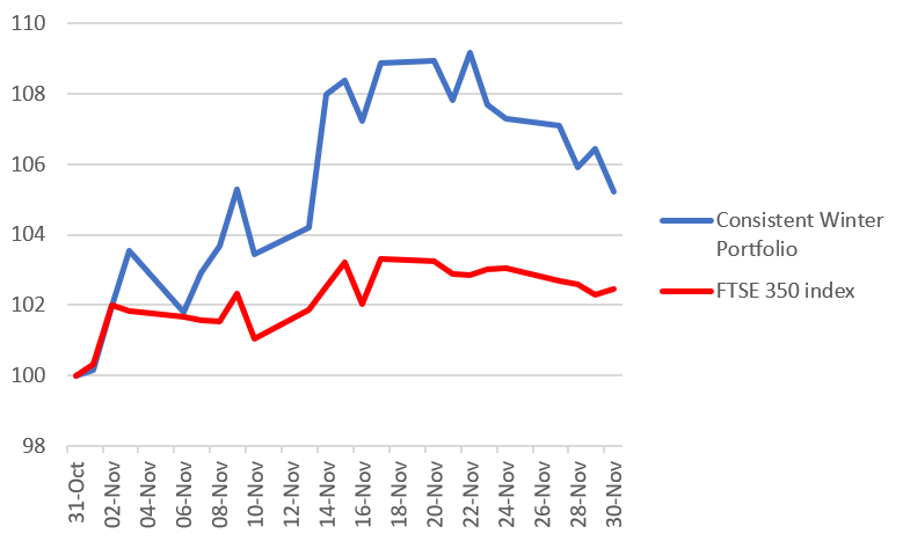

Wild’s Consistent Winter Portfolio, made up of the five FTSE 350 companies that have risen the most winters – between 1 November and 30 April – over the past decade, rallied 5.2% in November. It had been up as much as 9% at one point during the second half of the month.

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits - all constituents are up at least 80% of winters over the past decade. The portfolio ended the month up an 11.6% but had been up as much as 14.1% the day before month-end. The FTSE 350 benchmark index rose 2.5%.

Historic Winter Portfolio Performance each November | |||

Year | Consistent Portfolio (%) | Aggressive Portfolio (%) | FTSE 350 benchmark index (%) |

2023-24 | 5.22 | 11.6 | 2.46 |

2022-23 | 7.94 | 17.9 | 6.80 |

2021-22 | 0.30 | -3.50 | -2.50 |

2020-21 | -2.03 | 2.10 | 12.3 |

2019-20 | 7.25 | 7.34 | 1.79 |

2018-19 | 6.48 | -4.44 | -2.11 |

2017-18 | -3.97 | -2.90 | -2.06 |

2016-17 | 4.97 | 4.49 | -2.06 |

2015-16 | 6.42 | 1.31 | 0.23 |

2014-15 | -1.69 | 5.04 | 3.98 |

Source: interactive investor using Morningstar data. Past performance is not a guide to future performance.

Wild’s Consistent Winter Portfolio 2023-24

Past performance is not a guide to future performance.

Much like TV’s Great British Bake Off, Wild’s Winter Portfolios have their own equivalent of Star Baker. Appropriately, this month, for the consistent portfolio it’s Hilton Food Group (LSE:HFG).

The food packaging company has been volatile ever since a profits warning in September 2022. And in the five weeks before the start of this year’s winter portfolios, the share price had slumped by 17%. But they responded well to a third-quarter trading update on 7 November, then a £40,000 share purchase by non-executive director Patricia Dimond, ending the month with a 12.9% gain.

Self-storage firm Safestore (LSE:SAFE) wasn’t far behind, up 12% by month-end. It had already posted strong gains before a fourth-quarter trading update for the period to 31 October nudged returns into double figures. Three-month revenue increased, and although expansion meant the occupancy rate decreased, the tone of the report was positive.

- Shares for the future: the 31 companies I think are good value

- Stockwatch: will shift in rate expectations boost these two shares?

Largest of all the companies in this year’s portfolios, InterContinental Hotels Group (LSE:IHG) at over £10 billion, booked in a 5.3% gain for the month. After a number of years stuck in a volatile sideways range, which included the pandemic, IHG shares broke out to the upside at the beginning of 2023 and now appear in demand.

The final two constituents of the consistent portfolio failed to match the other three stocks, proving a drag on performance. Electronic components firm discoverIE Group (LSE:DSCV) had added as much as 10% three weeks into the month, but slipped back quickly ahead of results for the six months to 30 September, due 5 December.

Liontrust Asset Management (LSE:LIO) was one of the most vulnerable constituents before a ball was bowled. The share price is almost 80% lower than its peak in 2021 and currently trades near its five-year low. Half-year results published mid-month did not help the asset manager, revealing net outflows of £3.2 billion and slump to a loss of £10 million. Liontrust is in a tough place given its focus on currently unloved UK equities and failure to buy Swiss rival GAM.

As a reminder, Liontrust won its place in this year’s portfolio because it’s generated a profit for nine of the past 10 winters and at an average return of 12.9%.

Wild’s Aggressive Winter Portfolio 2023-24

Past performance is not a guide to future performance.

While the consistent portfolio did very well, the aggressive portfolio made a stunning start to the winter. And Star Baker for this basket of shares was an old favourite – JD Sports Fashion (LSE:JD.). It’s been in the portfolio a number of times over the past decade and has impressed before, and it didn’t disappoint this time.

After a strong first half of the month, JD picked up the pace in the second, accelerating with just days to go following a bullish update from US peer Foot Locker, who raised its sales outlook for the year. Earlier in the month, Citigroup started coverage of JD shares with a 'buy' rating and price target of 220p, about 65% above the market price at the time.

- FTSE 100 giants have £6bn dividend gift for investors this Christmas

- Shares vs bonds: which offers the best opportunity for income seekers?

Safestore features in both portfolios this year given its share price has risen 10 years in a row and at an average of 17.3%. So, third-best performer in the aggressive portfolio in November is Hill & Smith (LSE:HILS), another company that we’ve seen here before. This time, the maker of infrastructure products such as motorway gantries jumped 9.2% in the first month following a positive trading update for the four months to 31 October. Revenue was up 15%, margins improved, and strong cash generation helped reduce debt. Annual profit should now be better than expected.

Construction and regeneration firm Morgan Sindall Group (LSE:MGNS) celebrated its debut in these portfolios with an 8.2% gain. A trading update at the start of the month set the tone, when a confident chief executive John Morgan said the company was on track to hit targets.

Finally, another debutant Keller Group (LSE:KLR) ended its first month in the winter portfolios up 5.2%. The engineering contractor issued a bullish update just a week before the portfolios began and continued to feed off the optimism it generated. CEO Michael Speakman said a better than expected third quarter meant full-year profit would be “materially ahead of current market expectations”.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.