Wild’s Winter Portfolios 2023-24: record year for reliable shares

It’s been a long six months, but these seasonal share portfolios have delivered bumper profits again this winter. Here’s how they did it.

3rd May 2024 13:25

by Lee Wild from interactive investor

It’s official: UK stocks are back! After years in the doldrums playing second fiddle to exciting technology stocks in America and elsewhere, investors rediscovered unloved and undervalued British companies. And Wild’s Winter Portfolios have benefited.

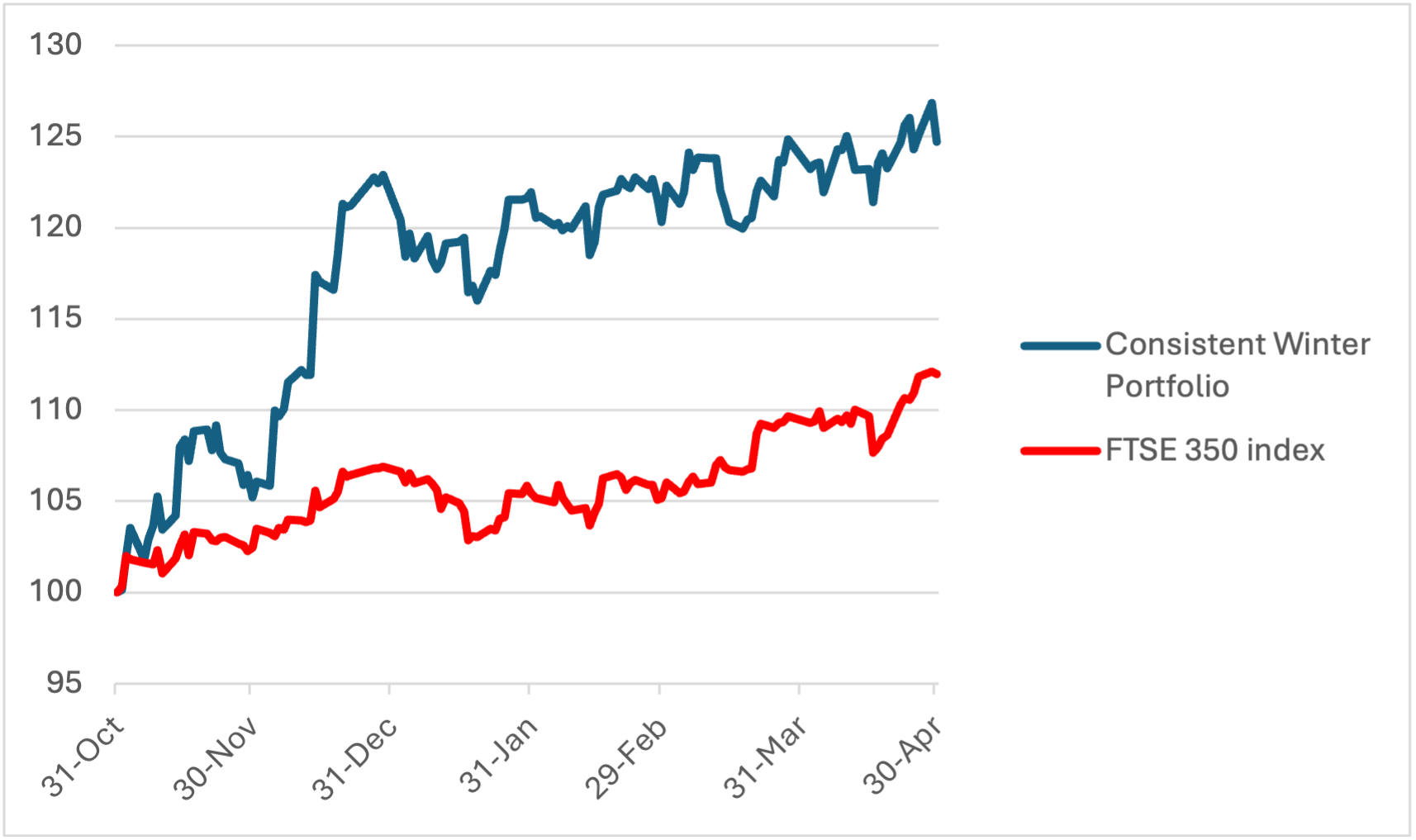

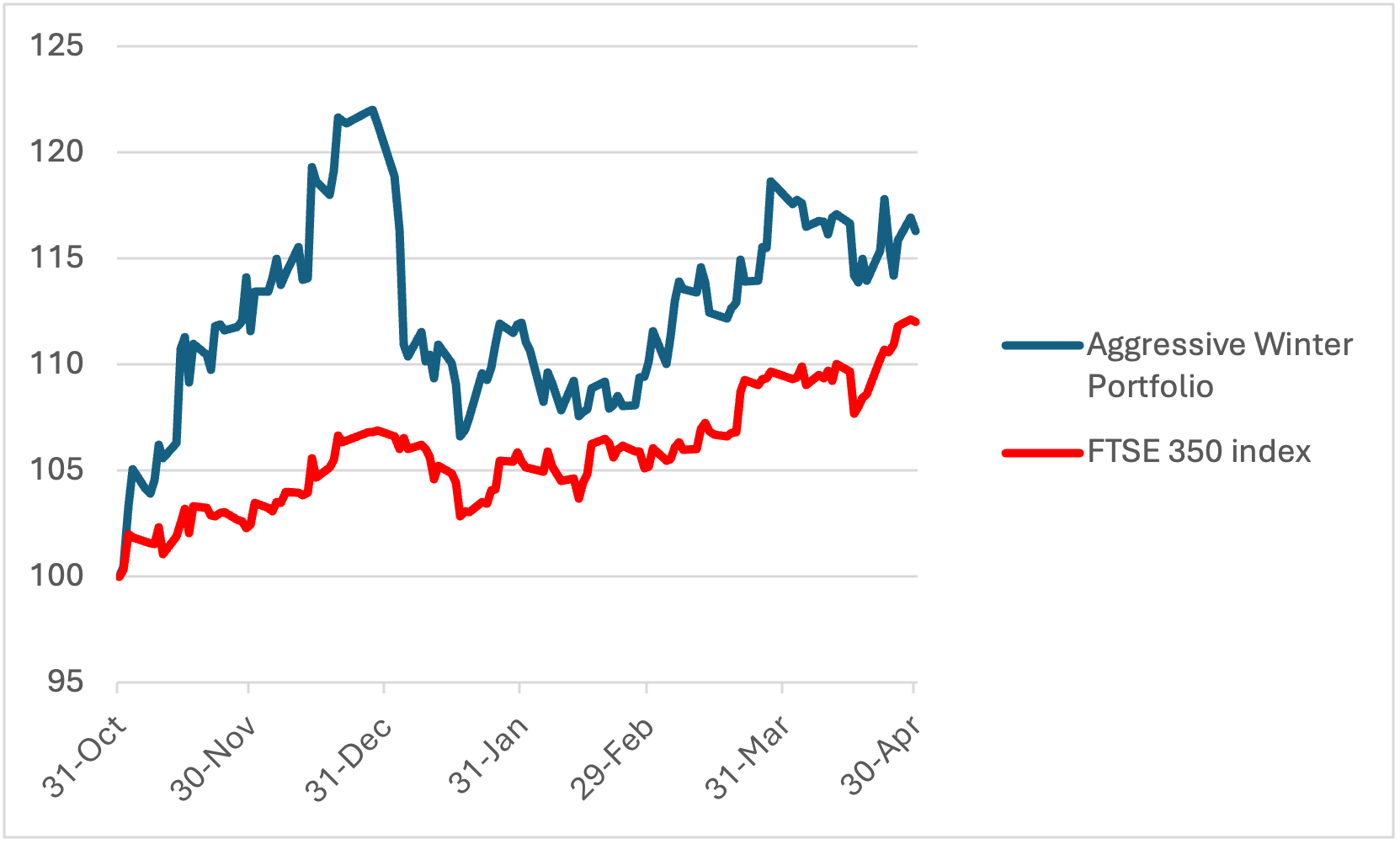

Both the consistent and higher risk “aggressive” portfolios racked up impressive gains over the six months to 30 April, significantly more than the wider stock market. In fact, the basket of most reliable stocks made its biggest profit since we launched these seasonal portfolios 10 years ago.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Despite ongoing concerns about higher-for-longer interest rates, inflation, anaemic economic growth, conflicts in the Middle East and Ukraine, oil prices and excessive tech sector valuations, equities remained one of the assets to own this winter.

Japan was the best performer over the past six months, up 24.5%, US tech jumped 21.8%, India 21.5% and the S&P 500 20.1%. True, the UK’s FTSE 100 only added 11.2% and the FTSE 250 index 16.9%, but over the past three months, it’s a different story. The FTSE 100’s 6.7% improvement is beaten only by China and is double the return of the Nasdaq Composite US tech index.

But one of our winter portfolios beat the lot. Wild’s Consistent Winter Portfolio - a basket of five FTSE 350 companies that have risen most winters (1 November to 30 April) over the past decade - returned 24.7% over the six months. Add in dividends received and the total return was 26.8%.

For Wild’s Aggressive Winter Portfolio, we relax the entry criteria slightly, giving up some consistency in return for potentially bigger profits. However, all constituents must have risen in at least 80% of winters over the past decade. The portfolio ended this winter with a 16.3% profit, which grows to 17.9% when dividends are added.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- UK interest rate outlook: will Bank of England cut first?

After such a great winter, the final day of the strategy was a poor one. And April was weaker overall, with the consistent portfolio easing 0.1% and the aggressive portfolio down 2%. Had the watch stopped a day earlier on 29 April the consistent portfolio would have finished with a 26.8% profit (28.9% with dividends) and the aggressive portfolio 16.9% (18.5%).

The FTSE 350 benchmark index delivered a 2.1% gain in April, making it 12% for the winter as a whole and 14.2% on a total return basis. The index received a boost from a rush of takeover activity this year including Anglo American (LSE:AAL), Darktrace (LSE:DARK), Currys (LSE:CURY) and Spirent Communications (LSE:SPT). None of the winter portfolio stocks attracted a suitor.

You can find more information about the “consistent” and “aggressive” portfolios and how they work on our Winter Portfolio page.

Wild’s Consistent Winter Portfolio 2023-24

Past performance is not a guide to future performance.

The star stock in Wild’s Consistent Winter Portfolio this year has been Hilton Food Group (LSE:HFG). And its shares ended the season with a flourish.

With profits warnings firmly in the rear-view mirror, an ongoing turnaround included a gain of 8.7% in April, which takes the share price to where it was before the crash in September 2022. That took gains for this six-month portfolio to 40.3%, making it the best-performing “consistent” stock. It also means Hilton Food shares have risen every winter for the past six years and fallen only once in the past 11 years (a 0.7% dip in 2017).

InterContinental Hotels Group (LSE:IHG) has been another top stock as the pandemic becomes a distant memory and people continue to travel more. Its share price hit a record high in February and, despite losing 4.7% in April, ended the winter with a 35.1% profit.

- ii view: Hilton Foods’ profits boosted by appetite for seafood

- Lloyds Bank and Aviva part of FTSE 100’s £9bn dividend windfall

Asset managers have had a tough few years as higher interest rates put off investors in equities, especially those which Liontrust Asset Management (LSE:LIO) specialises in. Its core strategies of quality growth, small/mid-caps and UK equities funds have been out of favour, but sentiment has picked up since mid-December. After a tricky start, Liontrust shares added 0.5% in April, giving them a 20.8% gain for the winter.

An analyst tip put a rocket under discoverIE Group (LSE:DSCV) shares in March, but it handed back half of what it made in April. Shares in the electronics components firm fell 6.9% last month, but still ended a volatile six month period up 14.3%.

It says much about this portfolio that the worst performer was Safestore Holdings Ordinary Shares (LSE:SAFE) with a return of 13.2%. Disappointment is understandable though given the shares were up as much as 31.2% late December. However, Safestore remains the most reliable stock across both portfolios having now risen every winter since at least 2010.

Wild’s Aggressive Winter Portfolio 2023-24

Past performance is not a guide to future performance.

Wild’s Aggressive Winter Portfolio had plenty to crow about. Two debut stocks – Keller Group (LSE:KLR) and Morgan Sindall Group (LSE:MGNS) – ended the six months as the higher-risk portfolio’s best performers.

Keller, an engineering contractor, was a consistently strong performer through the winter, but received a significant leg-up in March when it reported a big increase in annual profits. The shares were cheap at the time and offered a generous dividend, making them a target for investors. Ending the winter in style with a 5.3% jump meant Keller shares contributed a 42.5% profit to the portfolio.

Morgan Sindall shares had been in an uptrend for a year before the winter began, but the good times continued to roll. The construction and regeneration firm eased 2.4% in April but finished the six-month strategy up 20.5%.

- Making the most of your tax breaks in 2024

- 10 hottest ISA shares, funds and trusts: week ended 26 April 2024

Hill & Smith (LSE:HILS) did well too. It had also been on a winning streak ahead of the portfolio’s launch at the end of October. The infrastructure products business gave back 3.4% in April after a 7.8% rally the month before. However, a 14.7% gain for the winter is commendable.

We know about Safestore, which appears in both portfolios this year, but I’ve saved the worst till last – the only stock in either basket of shares to register a six-month loss this time.

JD Sports Fashion (LSE:JD.) got off to a fantastic start, outperforming all nine stocks across the portfolios at the end of both November and December. But a 30% gain was wiped out when the sports clothing retailer issued a profits warning at the start of January. Within a fortnight the shares were down 16% on our start price as investors digested news of weak consumer spending and the impact of heavy discounting on margins.

There was relief that a late March trading update held no further surprises, and the shares jumped 14%, but there’s little confidence in this retail stock while the interest rate outlook remains uncertain. A 14% slump in April condemned JD to a 9.3% loss for the six winter months.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.