Wild’s Winter Portfolios 2023-24: double-digit gains at halfway stage

It was optimistic to believe such a fantastic start to the winter would continue for a third month, and it didn’t, but the portfolios are still significantly outperforming the wider market. Here’s a round-up of all the action.

12th February 2024 08:57

by Lee Wild from interactive investor

A two-month rally at the end of 2023 hit the skids early in January, but most of the world’s major stock markets had recouped losses by month-end, finishing what has become the worst-performing month of the year with decent gains.

Predictably, the supercharged S&P 500 added another 1.6% and the Nasdaq Composite just over 1%, having successfully navigated the Federal Reserve’s latest interest rate decision. European bourses did well too, although Japan led the pack with an 8.4% profit in January.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Again, all too predictably, UK shares lagged rivals, the FTSE 100 giving up 1.3% last month. A quarter of the index fell 5% or more, a slump of 29.5% at JD Sports Fashion (LSE:JD.) and 27.9% at Ocado Group (LSE:OCDO) causing a lot of damage. So did hefty losses at Endeavour Mining (LSE:EDV), Mondi (LSE:MNDI), Glencore (LSE:GLEN), Lloyds Banking Group (LSE:LLOY) and BT Group (LSE:BT.A).

It’s generally accepted that inflation and rate expectations will continue to drive stock prices through 2024, but we’ve also seen plenty of evidence that any shortfall in profit or sales performance will be punished severely.

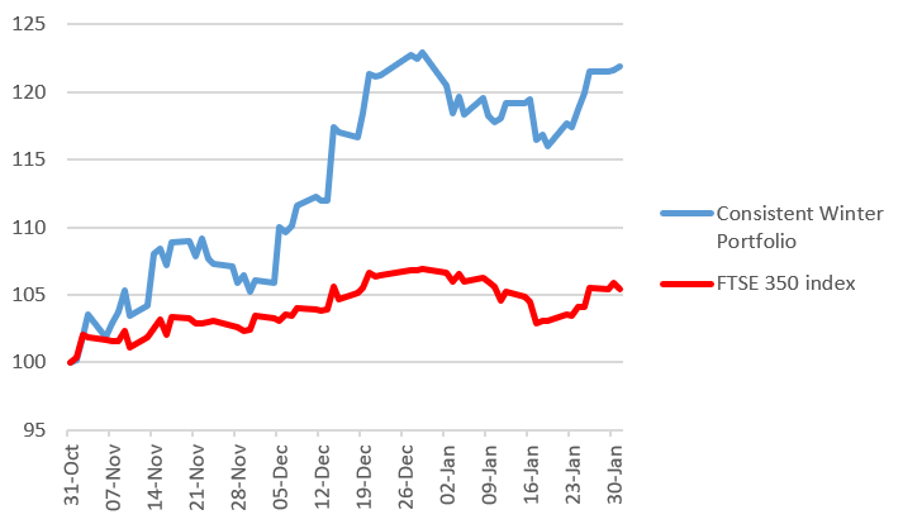

After an amazing start to the six-month strategy, Wild’s Consistent Winter Portfolio eased 0.8% in January. Made up of the five FTSE 350 companies that have risen the most winters (between 1 November and 30 April) over the past decade, it had surged 16.8% in December. Even taking a weaker January into consideration, this more historically reliable basket of shares is still up 21.9% since the end of October.

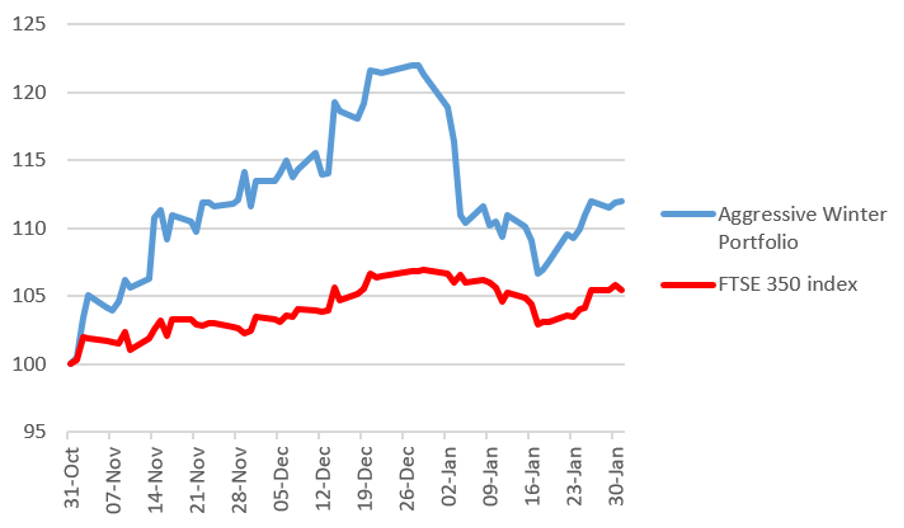

We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits. However, all constituents must have risen in at least 80% of winters over the past decade. The higher risk portfolio took a tumble last month, losing 7.7%. Much of that was down to a profit warning from JD Sports, which fell almost 30%. However, because of the strong start to this winter’s strategy, the portfolio is still up 12% in three months.

For context, the FTSE 350 benchmark index fell 1.4% in January and is now up a modest 5.4% so far this winter.

You can find more information about the ‘consistent’ and ‘aggressive’ portfolios on our Winter Portfolio page.

Wild’s Consistent Winter Portfolio 2023-24

Past performance is not a guide to future performance.

Four of the five constituents ended in the red last month, but a solid performance from InterContinental Hotels Group (LSE:IHG) meant the consistent portfolio did better than the wider stock market.

There was no fresh news from the hotelier, but data, especially out of the US, continues to indicate a soft landing is most likely for the American economy. That bodes well for consumer spending in the year ahead.

Analysts at Morgan Staney also named the company as one of its potential surprises for 2024 – “a possibility whose probability is not fully priced in”. They think that US and China revenue per available room (RevPAR) could materially strengthen, and net unit growth could accelerate. That could generate a rerating to £90, more than 16% above the current share price. The shares are already up 29.1% this winter.

Annual results are due to be published on 20 February.

Elsewhere, Liontrust Asset Management (LSE:LIO) brushed off a mid-month update showing “ongoing negative sentiment among investors” caused £1.7 billion of net outflows in the last quarter. The shares fell a modest 0.6% during the month but have still risen 12% in the past three months.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- 10 shares to give you a £10,000 annual income in 2024

- Bed and ISA: the handy tax trick to boost your wealth

Losses at discoverIE Group (LSE:DSCV) were similarly modest, managing to hang on to impressive gains made at the end of 2024, and the 27.1% profit so far for this strategy. An update in early Feb, said the electronics components firm is on track to deliver full-year underlying earnings in-line with expectations.

Hilton Food Group (LSE:HFG) also expects to match forecasts following a strong festive trading period. That news kept the food packaging firm’s three-month bull run intact and the shares, up 20.4% since the end of October, near their highest levels since a savage profits warning in September 2022.

I’ve left the worst till last, although self-storage chain Safestore Holdings Ordinary Shares (LSE:SAFE) is still up 21.1% this winter. Investors took flight mid-month despite annual results exceeding expectations in some areas, as much lower gains on investment properties halved profit and amid concerns about conditions in the UK.

In the first two months of the 2024 financial year, group like-for-like revenue was down 0.6%, and one analyst believed there was downside risk to current profit forecasts. And despite “strong” growth in the Netherlands and Belgium, and “solid” improvements in Paris and Spain, there has been a “modest decline” in the UK.

First-quarter results are pencilled in for Thursday 22 February.

Wild’s Aggressive Winter Portfolio 2023-24

Past performance is not a guide to future performance.

In a poor month for the aggressive portfolio, construction and regeneration firm Morgan Sindall Group (LSE:MGNS) stood out as the only stock to generate a positive return in January. It jumped 2.3%, taking winter gains to 20.5%, but there were no new catalysts. The company is winning contracts and achieving the numbers, which explains the share price’s upward trajectory since October 2022.

Engineering contractor Keller Group (LSE:KLR) was 0.7% lower for the month. It said underlying operating profit in 2023 would be significantly ahead of the £150 million expected by analysts following a “particularly strong end to the year”, but a lot of good news had already been baked into the share price.

Infrastructure products firm Hill & Smith (LSE:HILS) lost 1.8% in January, drifting back in line with the wider market in the absence of any company news.

Safestore, in both this year’s portfolios and which we’ve discussed above, was an obvious drag on performance last month, but JD Sports was the real villain of the piece. In the first week of the new year, the sports clothing chain issued a profits warning that wiped out a fifth of its value in quick time. The shares continued to drift, ending the month down 29.5%. Amazingly, they’d done so well before that - up almost 37% at one point in December – the deficit this winter is just 8.2%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.