Wild’s Winter Portfolios 2022: a record start for these winter winners

7th December 2022 10:59

by Lee Wild from interactive investor

Both of Wild’s new portfolios had their best start to a winter ever, easily beating the benchmark index. One of them was up over 20% at one stage. Here’s how it happened.

Having written at length about the risk of investing at the end of such a difficult year for stock markets, my new winter portfolios have shot the lights out. After just one month of this six-month trading strategy, both seasonal baskets of shares have easily beaten the benchmark index, one of them by 160%.

A wider stock market rally began in the middle of October, just as some global markets hit multi-year lows and nursed losses of 20% or more for 2022.

- Find out about: Transferring a Stocks & Shares ISA | Share prices today | Top UK shares

There was excitement about comment from US Federal Reserve chair Jerome Powell, who admitted that the size of interest rate rises could decrease “as soon as” December. Many were prepared for another hike of 75 basis points when US policymakers announce their decision on Wednesday 14th.

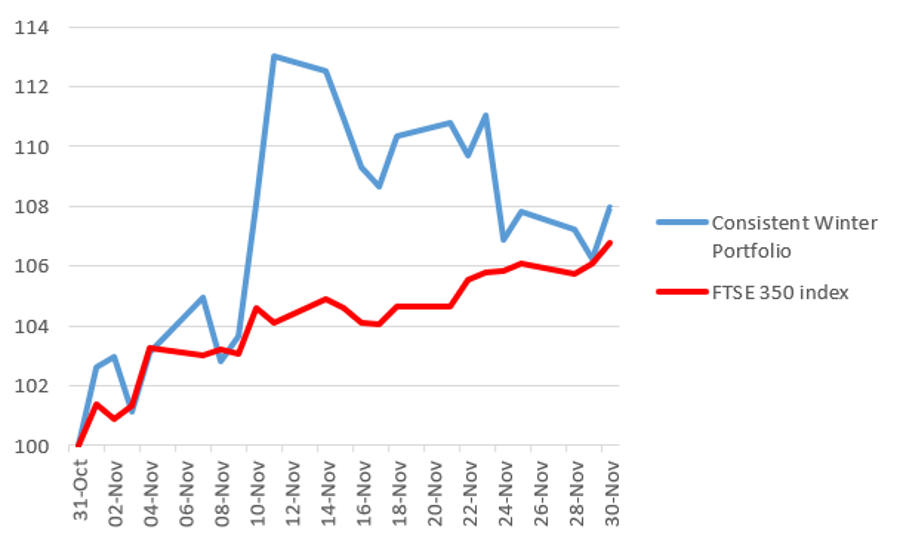

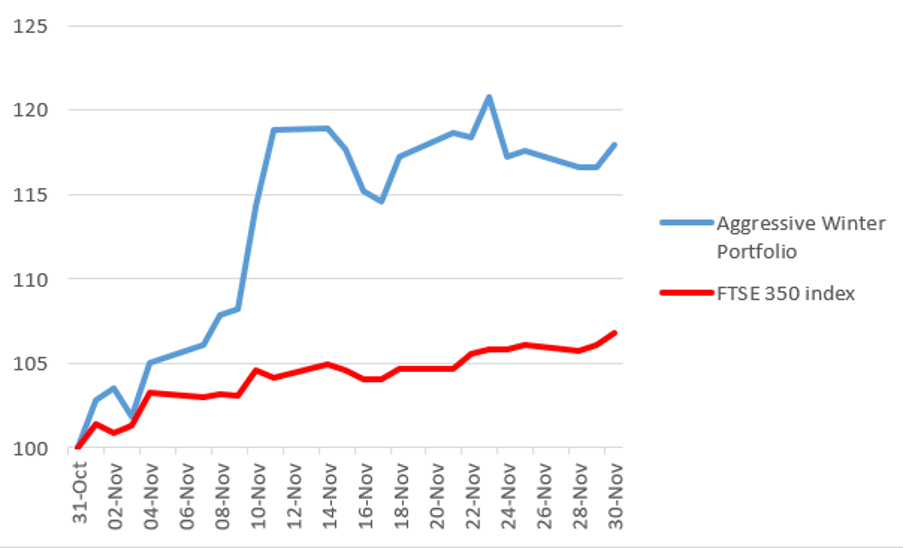

Wild’s Consistent Winter Portfolio, made up of the five FTSE 350 companies that have risen the most winters – between 1 November and 30 April – over the past decade, rallied 7.9% in November. It had been up as much as 13% mid month. We relax the entry criteria slightly for Wild’s Aggressive Winter Portfolio, giving up some consistency in return for potentially bigger profits - all constituents are up at least 80% of winters over the past decade. The portfolio ended the month up an incredible 17.9% and had been up 20.7% a week earlier. The FTSE 350 benchmark index rose 6.8%.

Historic Winter Portfolio Performance each November | |||

Year | Consistent Portfolio (%) | Aggressive Portfolio (%) | FTSE 350 benchmark index (%) |

2022-23 | 7.94 | 17.9 | 6.80 |

2021-22 | 0.30 | -3.50 | -2.50 |

2020-21 | -2.03 | 2.10 | 12.3 |

2019-20 | 7.25 | 7.34 | 1.79 |

2018-19 | 6.48 | -4.44 | -2.11 |

2017-18 | -3.97 | -2.90 | -2.06 |

2016-17 | 4.97 | 4.49 | -2.06 |

2015-16 | 6.42 | 1.31 | 0.23 |

2014-15 | -1.69 | 5.04 | 3.98 |

Source: interactive investor using Morningstar prices data

The performance is especially pleasing given last year’s portfolios were battered from all sides by macro events. Still recovering from the Covid pandemic, rising interest rates ended a period of cheap money that had bankrolled a growth sector boom. Inflation, which higher rates seek to control, is making a cost-of-living crisis worse and makes a UK recession almost inevitable. What’s more, the knock-on effect of war in Ukraine and supply issues caused by the pandemic continues to inflate the cost of everyday goods.

- Don’t be shy, ask ii…what is a 'Santa rally' in the investing world?

- Why this bear market rally may have further to go

- Best shares in November and outlook for UK stock market in December

Last year’s winter portfolio constituents were also largely FTSE 250 companies, part of an index which significantly underperformed the FTSE 100 index of defensive, dividend-paying companies such as miners, utilities and military equipment. Rising energy prices also gave the big oil companies a boost.

Until the pandemic struck, the strategy had regularly delivered strong positive returns. That was what it had been designed to do, being based on a seasonal anomaly that demonstrates how stock markets have historically outperformed during the six winter months. This year’s strong start is encouraging, but it is early days.

Wild’s Consistent Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

There are three companies that appear in both the consistent and aggressive winter portfolios this year. As I explained in the Big reveal article in October, there isn’t much difference between the two portfolios this year in terms of historic performance, caused by the pandemic and some strong years dropping out of the 10-year period.

Liontrust Asset Management (LSE:LIO) is one of them. It was the month’s best performer, ending November up an amazing 30.2%, although the shares had been up as much as 41.5% after just 11 days. It’s worth remembering that prior to this rally, the asset manager had been down two-thirds in 2022. Investors had been enthusiastically withdrawing funds amid fears about the impact of higher interest rates and economic downturn on business. Now, the City is pricing in a future cyclical upturn, while short sellers have rushed to buy back shares, accelerating the rally.

Electronic components company discoverIE Group (LSE:DSCV) also appears in both portfolios. It generated double-digit gains, adding a profit of 11.4% after reporting strong growth in half-year sales, operating margin and earnings. One broker downgraded the shares to 'hold' from 'add' but increased its price target to 900p.

London Stock Exchange Group (LSE:LSEG) had already started to bounce back following an encouraging third-quarter update in October. Positive momentum continued to mid-month since when the shares have steadied.

Safestore Holdings (LSE:SAFE), a provider of self-storage facilities, is the only one of this year’s constituents that has risen every winter for the past decade. It managed to produce a gain last year when every other constituent lost money. This year, Safestore is the third company that appears in both the winter portfolios, and eked out a 0.4% gain in November, having been up as much as 6% earlier in the month.

There was one laggard in the consistent portfolio, and it was hardly a surprise. Hilton Food Group (LSE:HFG) had already issued a profits warning in September, and another followed last month. The food packaging company is still struggling to get supermarkets to help cushion the blow of rising costs at its UK seafood business.

Wild’s Aggressive Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

With Safestore, Liontrust and Discoverie appearing in both portfolios this year, there are just two companies left to cover.

The first is sports clothing chain JD Sports Fashion (LSE:JD.), which had a screamer in November, rallying 29.4% during the month. There’s been a clear shift back into growth stocks, and JD was a clear beneficiary. It hasn’t issued any updates recently, but there was optimism in the US around the Black Friday sales, which likely buoyed hopes this side of the pond too.

Finally, half-year results maintained momentum at financial services firm Investec (LSE:INVP). Cost control improved, with the cost-to-income ratio at 60.5% versus 64% a year earlier. A 31% boost to interest income from higher interest rates also excited investors and the share price rocketed 18.2%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.