Wild’s Winter Portfolios 2022-23: still beating market despite setback

4th April 2023 12:27

by Lee Wild from interactive investor

In the fifth month of this six-month seasonal strategy, a banking crisis proved a major drag on performance, but could the best month still be to come?

One moment you’re asking how high the FTSE 100 can go, the next you’re panicking about how far it will fall. Investors experienced all the emotions during March as regular concerns about inflation, interest rates and recession were gate-crashed by a good old-fashioned banking crisis.

The answers to the questions above are - 7,974.40 early in the month and 7,206.82 on the 20th. The FTSE 100 ended the month, which also marked the end of the first quarter, at 7,631.74.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Last month was a real stinker for UK shares particularly, with all the FTSE indices – AIM, Small-cap, Fledgling, 100, 250, 350 and All-Share – deep in the red and propping up the performance table. It was a month when US tech shares fought back and American shares more broadly did well. UK stocks are now way behind Wall Street and European bourses in 2023 so far.

Despite the possibility of a US-led recession some time this year, latest inflation data from the States was better-than-feared, encouraging markets higher. What’s more, April is historically the best month of the year for equity markets. The FTSE All-Share rose in April by an average of 4.3% between 2018 and 2021, and in 2022 finished with only a tiny loss of 0.0635%, while the Nasdaq crashed 13%, the S&P 500 almost 9% and markets in Europe and the Far East fared worse than the UK.

There’s plenty of data to watch out for in the weeks ahead, too, but anything that suggests interest rates need to keep rising, or that recent increases are not bringing inflation under control, will likely be taken badly.

More than a fifth of the FTSE 100 is made up of banks, insurance stocks and financial services, so a banking crisis is going to have a serious impact on performance. Predictably, they were the worst performers in March. And it was two companies in these sectors that caused Wild’s Winter Portfolios to underperform over the past month – one of them appears in both portfolios.

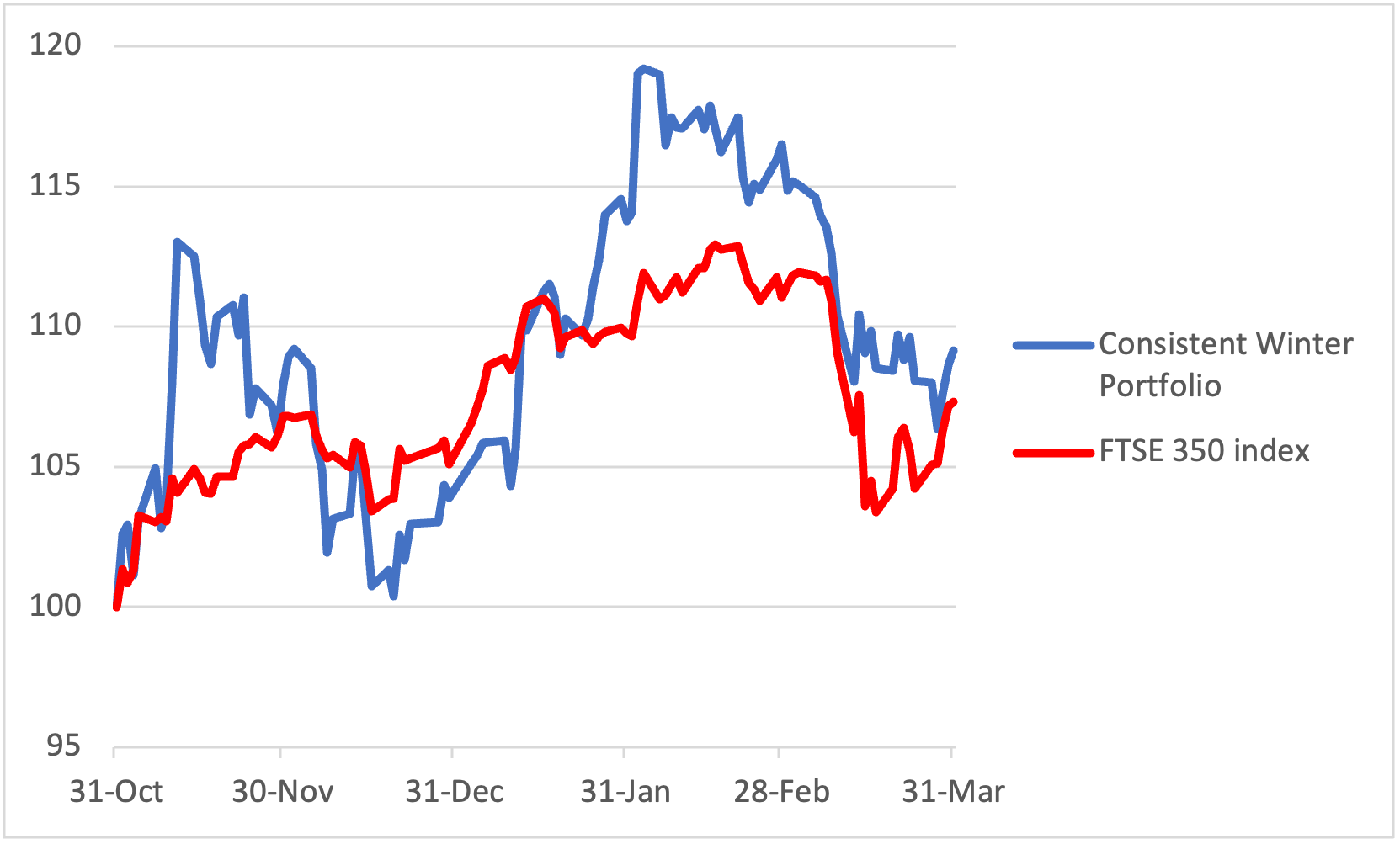

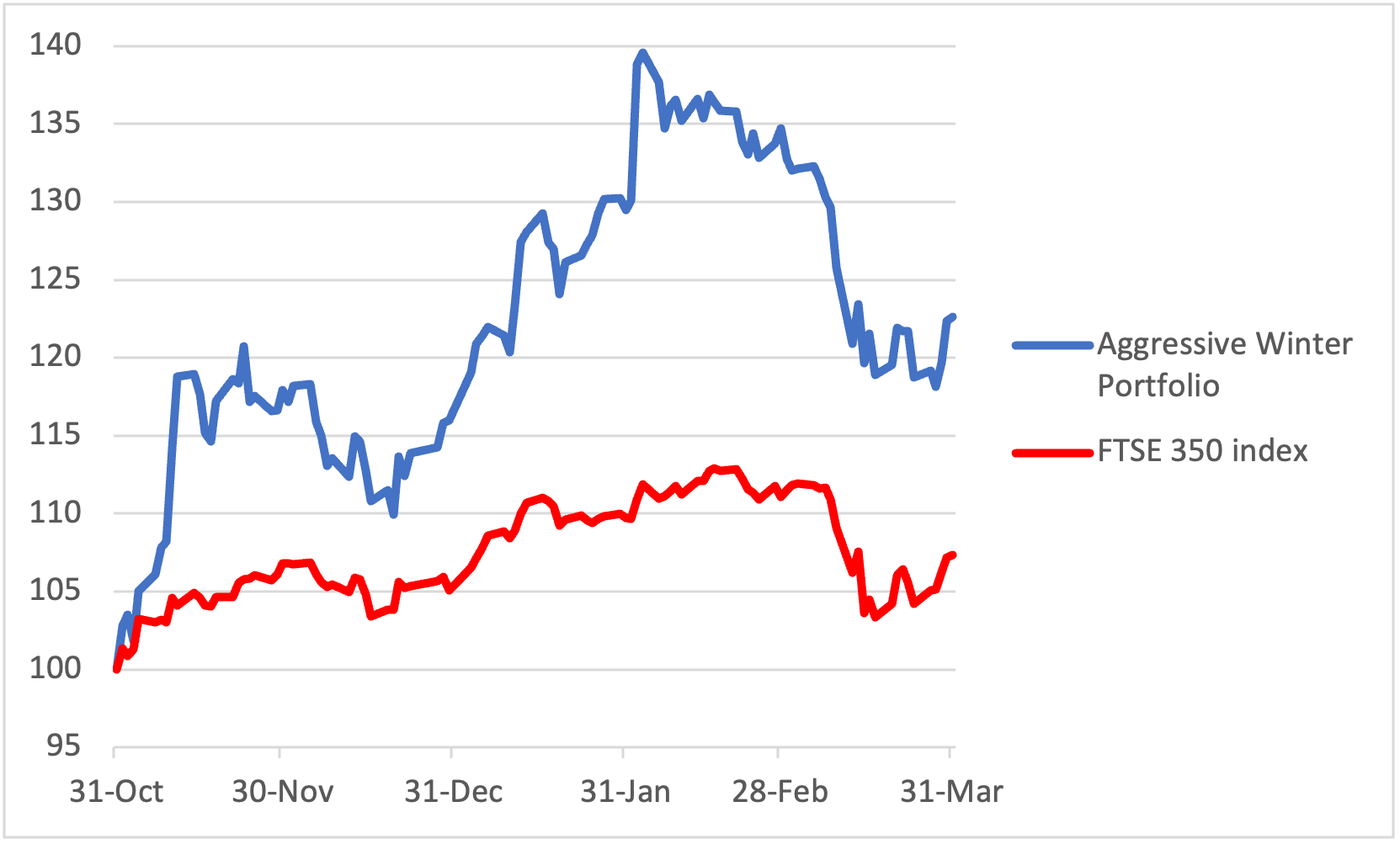

The consistent basket of five shares fell in value by 6.3% in March, reducing gains for the first five months of the six-month investing strategy from 16.5% to 9.1%. The higher risk aggressive portfolio, which ended February with a profit of 34.7%, fell 9% last month, reducing its gain since the seasonal portfolios launched at the end of October to 22.7%. However, both the consistent and aggressive portfolios are ahead of the FTSE 350 benchmark index, which is up 7.3% this winter following a 3.4% drop in March.

Wild’s Consistent Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

Starting with some good news – after a poor start to the winter, London Stock Exchange Group (LSE:LSEG) has made it a three-month winning streak. After rallying 3.8% in January and a modest 0.4% the following month, the stock exchange and data giant became the only constituent of either winter portfolio to register a gain in March, adding 5.9%.

Activity kicked off early in the month with publication of annual results. Numbers were pretty much as expected, with the outlook for 2023 a little better, although concerns about a stock overhang near-term continue to limit progress, as major shareholders locked into LSEG stock since the acquisition of Refinitiv begin to unlock.

- These 8 FTSE 100 shares will generate £8bn dividend windfall in April

- Insider: directors spend over £300,000 on three well-known shares

Unfortunately, there were more winter losers than winners last month. Biggest of them all was Liontrust Asset Management (LSE:LIO). At the end of February, the asset manager was up 39.8% for this year’s consistent portfolio, but a 14.4% loss in March left it up 19.7% over five months. A drift lower was already underway before the banking crisis accelerated a sell-off in the financials sector.

Electronic components firm discoverIE Group (LSE:DSCV) had a howler too, losing 9.8% over the month. Again, it’s still in positive territory for this winter - up 3.5% - but its shares had traded at over 900p near the start of the season compared with 771p now. Self-storage firm Safestore (LSE:SAFE) took time to get going this winter, but had put together a 17% gain by mid-February. Even after a 6.2% decline over the past month, the shares are still up 5.1% this winter.

Finally, food packaging business Hilton Food Group (LSE:HFG) gave back just 3.5% over the past month, not a bad effort for a company that looked like it would struggle following two profit warnings in quick succession last year. It’s still up 13.4% since the end of October and remains the real surprise stock this winter.

Wild’s Aggressive Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

As Liontrust, Safestore and Discoverie appear in both portfolios, the former’s 14% slump had a major impact on the aggressive basket of shares.

But financial services giant Investec (LSE:INVP) also appears in this year’s higher risk portfolio, and a 15.5% decline made it the worst-performing constituent of either portfolio in March. It also took the shine off the company’s spectacular rally so far this winter, which exceeded 24% late February. Investec shares are now up just 2.5% since the end of October.

All the damage was done in the few days following the Silicon Valley Bank collapse. After that, the share price traded sideways in a narrow range until month-end. That was despite a positive update for the year ending 31 March 2023. Management said the company should make an adjusted operating profit before tax of between £783 million and £834 million, up from £687 million the year before. UK profit should be up “at least” 15%.

JD Sports Fashion (LSE:JD.) had a bad month by its standards, despite limiting losses to a modest 1.8%. Shares in the tracksuits-to-trainers retail chain had been up 92% in February – they’d risen 29% in January and 11.3% in February. Despite the hiccup, JD is still up 82.4% this winter.

And directors think there’s more potential here. Non-exec Suzi Williams bought 27,579 ordinary shares at 181.29p each in February, but an oversight meant we only found out a few weeks later. And the wife of newly appointed non-exec Ian Dyson – former M&S finance director and currently chairman at Currys – snapped up 40,000 shares at 171.07p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.