Wild’s Winter Portfolios 2022-23: incredible start to the new year

8th February 2023 09:00

by Lee Wild from interactive investor

After the portfolios had one of their best months since inception nine years ago, our head of equity strategy reveals the big drivers and how they’re smashing the benchmark index.

What a start to the year! An unusually poor December for stock markets gave cause for concern heading into an historically weaker January. We needn’t have worried.

Hopes that the current interest rate cycle may be near a peak, and that any recession will be much shallower than feared, have triggered a surge of optimism among equity investors, especially toward growth stocks. Data in the US also hints that inflation can be brought under control while keeping the economy ticking along.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

A seven-week growth sector rally that began mid-October resumed at the start of 2023, sending global equity markets back to their November peaks or, in the case of the UK mid- and small-cap indices, their best since last summer. The FTSE 100 takes the crown, however, making a multi-year high and laying the groundwork for the record levels we saw at the start of February.

As good as that performance was, both Wild’s Winter Portfolio did better.

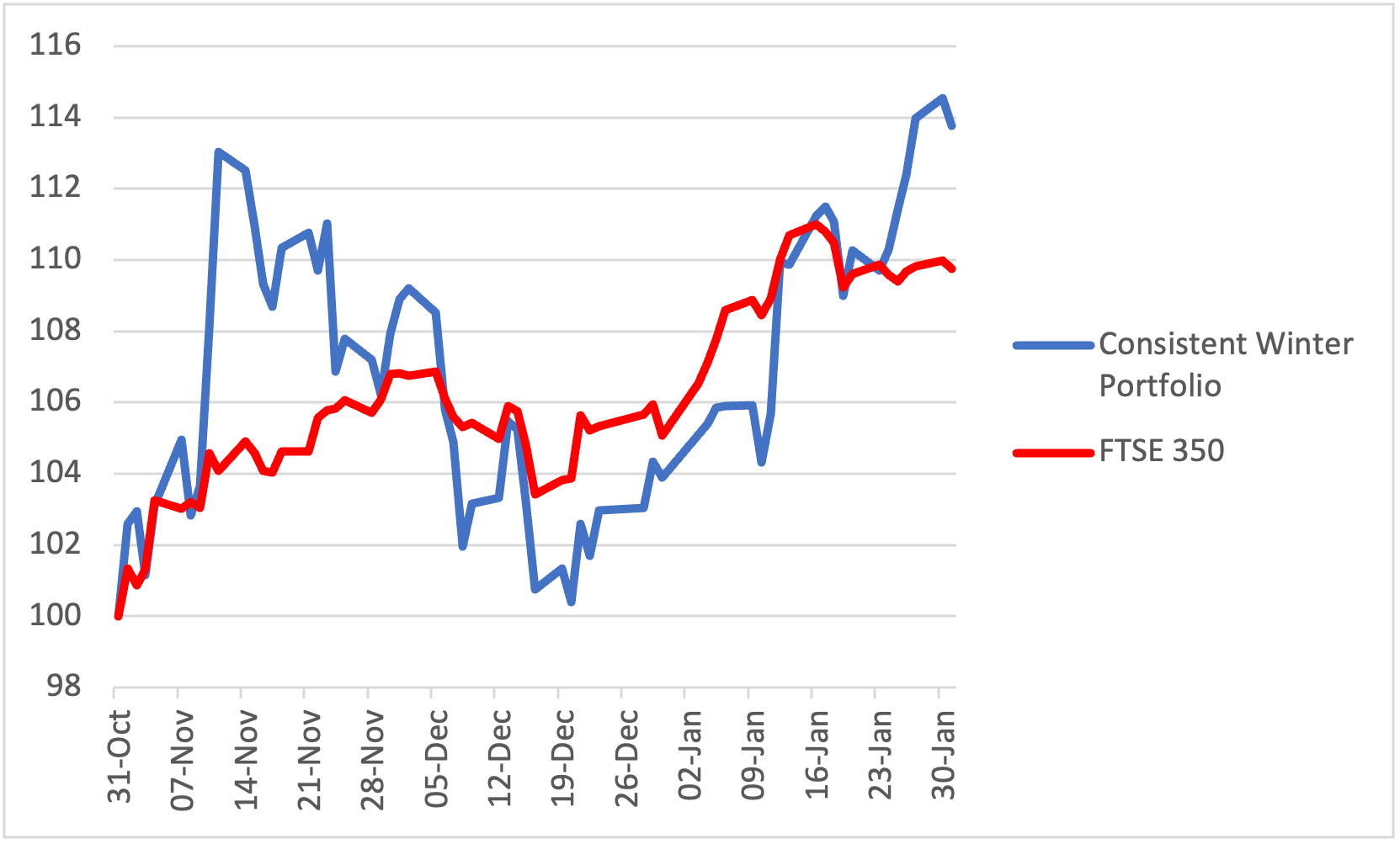

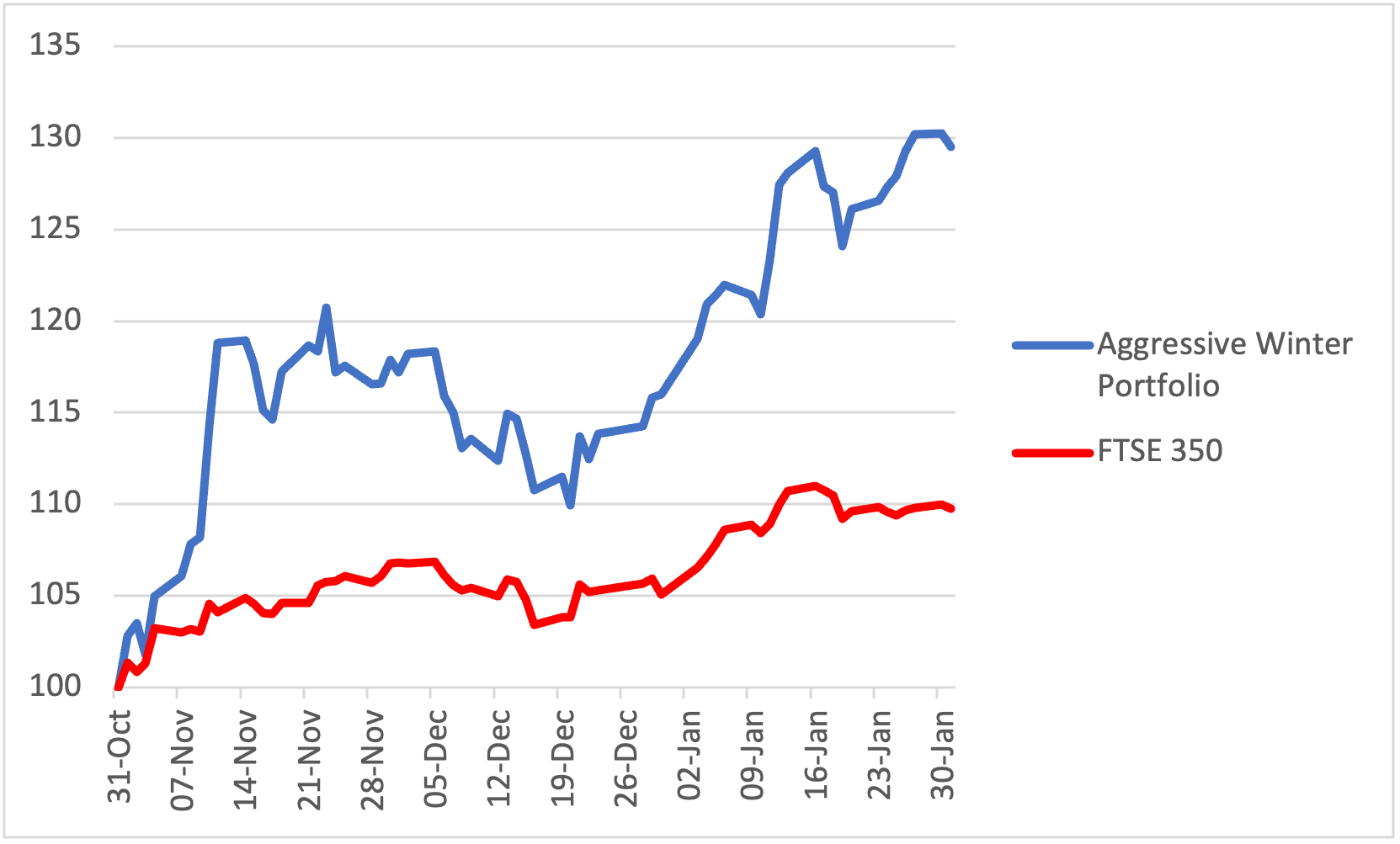

The consistent basket of five stocks returned 9.5% in January, taking its total for the first three months of this six-month strategy to 13.8%. The higher risk aggressive portfolio surged 11.6% in just one month and is now up 29.5% since the winter season began at the start of November. Both portfolios easily beat the FTSE 350 benchmark index, which added a modest 4.4% in January and now stands up 9.8% so far this winter.

Wild’s Consistent Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

It was close for top spot in Wild’s Consistent Portfolio, but it was food packaging business Hilton Food Group (LSE:HFG) that took it, rocketing to its best price since the aftermath of a profits warning in September. There was huge relief that a trading update for the 52 weeks ended 1 January provided no surprises, with results still expected to match expectations revised in November. Management is also “confident in the outlook for 2023”. The shares shot up 18.9% in January to leave them up 8.5% so far this winter.

Electronic components firm discoverIE Group (LSE:DSCV) wasn’t far behind. It too had underperformed this winter despite business going well, but turned the tables with better-than-expected third quarter results. The company, which makes customised electronics for industrial use, said it is on track to deliver full-year underlying earnings ahead of expectations, prompting one analyst to reiterate its “buy” rating and 1,000p target price. The shares added 17.6% in January, ending the month at 860p and up 15.4% this winter.

- 2023 Investment Outlook: stock tips, forecasts, predictions and tax changes

- 10 shares to give you a £10,000 annual income in 2023

Self-storage firm Safestore Holdings (LSE:SAFE) had a strong month, too, with a 6.5% jump taking winter gains to 11.3%. The FTSE 250 company issued a positive trading update, with levels of demand stable and rates paid by new customers still growing.

Elsewhere, Liontrust Asset Management (LSE:LIO) rose for a third month, this time by 3.4%. A strong trading update for the final quarter of 2022 means the asset manager is now up 35.6% this winter, and is by far the biggest contributor to the consistent portfolio’s market-beating return.

Finally, London Stock Exchange Group (LSE:LSEG) fought back from December’s big loss to post a 3.8% gain. However, the financial markets and data giant remains the laggard this year across both portfolios, down 2.1%.

Wild’s Aggressive Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

The three companies included in both of this year’s portfolios have all done well, which is reflected in the performance of Wild’s Aggressive Portfolio. But there’s one stock exclusive to the basket of five higher-risk shares that’s head and shoulders above the rest, and which explains its stunning returns.

Tracksuits-to-trainers retail chain JD Sports Fashion (LSE:JD.) sprinted 29% higher in January after confirming strong trading over Christmas. Revenue in the six weeks to 31 December grew more than 20%, and the company expects annual profit of £933-£985 million, at the top end of market expectations. Next year it could top £1 billion. Chair Andy Higginson added to the bullish mood when he bought £240,000 of JD shares at just above 150p each.

Finally, financial services giant Investec (LSE:INVP) made it a clean sweep of positive returns for the portfolios in January. A 1.2% monthly profit made it 18% for the past three months.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.