Wild’s Winter Portfolios 2021: a bleak period for some great companies

12th May 2022 08:10

by Lee Wild from interactive investor

Some trends look rock solid, and this trading strategy had successfully exploited one of them for years, until Covid ruined the party. Here’s our final analysis of this year’s winter portfolio.

At the start of every autumn, as the two seasonal winter portfolios are launched, I always warn of potential banana skins that might affect the historically successful trading strategy. In each of its first seven years, the portfolios outperformed the wider market and for six of those years generated a profit. Unfortunately, this time they did neither.

Among the ‘events to monitor over the next six months’ I flagged up outperformance of high-quality UK stocks over the summer period, inflation, an energy crisis, higher interest rates, supply issues, Covid, tapering of US stimulus measures and other risks over the pond. I also mentioned how UK shares had underperformed overseas peers during the pandemic recovery.

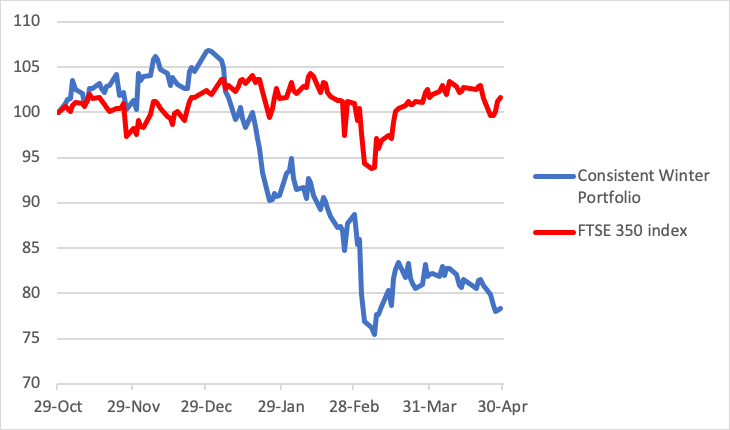

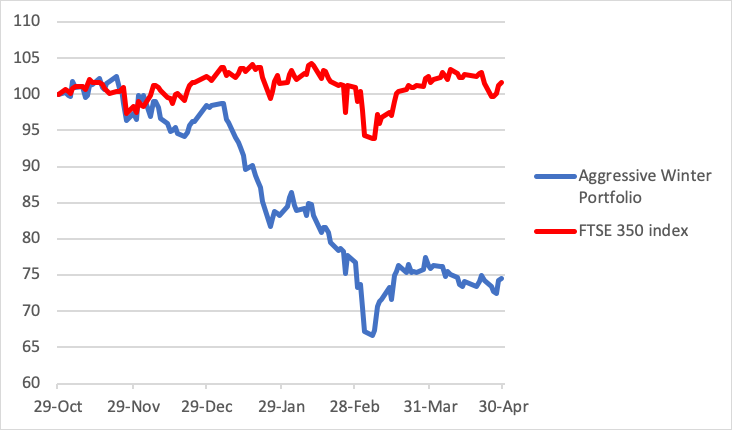

All these issues have contributed to a poor season for the winter portfolios, one in which the historically reliable consistent portfolio ended the six winter months from November to April down 21.7% and the potentially higher-risk, higher-return aggressive portfolio down 25.5%. The FTSE 350 benchmark index finished the period up 1.7%. On a total return basis, so including dividends, the consistent portfolio is down 20.5%, the aggressive basket of shares down 24.8% and the FTSE 350 up 3.26%.

One thing I hadn’t spotted, and which has had both a major humanitarian, social and economic impact, is Russia’s invasion of Ukraine at the end of February.

Russia’s military aggression has triggered sanctions against Moscow, which has had a dramatic affect on oil prices. Disruption to exports of commodities out of Ukraine, particularly of wheat and other staples, has added to the cost-of-living crisis and has a major impact on global food supply.

- Recessions are becoming more likely – here’s how to invest

- Russia and risk: what you need to know before trading Russia-focused stocks

This explains some of last winter’s underperformance, but why did a number of the stocks featured in these portfolios do so badly, and worse than the wider market, specifically the benchmark FTSE 350 index?

First, it’s important to explain that the selection of all five constituents of both the consistent and aggressive winter portfolios is data driven. The only time there is human intervention is if there is a takeover situation, in which case a potential portfolio company is excluded. The criteria for both portfolios is as follows:

The five constituents of Wild’s Consistent Winter Portfolio must each have risen every winter for at least nine of the past 10 years. The best-performing of these FTSE 350 companies make it into the portfolio. The average return for the 2021-22 consistent portfolio between November and April, excluding dividends, was 18.5% versus an average gain of just 4% for the FTSE 350 benchmark index.

The higher-risk Wild’s Aggressive Winter Portfolio relaxes the entry requirement to at least eight years of positive winter returns during the past decade. The average winter profit for the 2021-22 aggressive portfolio since 2011 was 22.3%, exceeding the consistent basket of shares, as you would expect.

Many of these companies have been a victim of their own success. For them to appear so high up the performance tables demonstrates their quality. Such companies have been sought after in recent years and during an extended period of cheap money when there have been few, if any, investments able to match returns from the stock market. It’s why valuations had become so frothy.

- How to invest for difficult times

- Shares for the future: my five best shares for long-term investment

Eventually, that momentum runs out and some level of reversion to the mean is inevitable. It’s not that they become bad companies all of a sudden, but key drivers of their success moderate and macro events change investor behaviour. As inflation causes central banks to raise interest rates, so the cost of borrowing for corporations rises, affecting the outlook for future earnings and making the shares appear more expensive.

Outperformance of the FTSE 350 has been just as shocking as the underperformance of the winter portfolios.

While highly rated growth indices such as the Nasdaq Composite and London’s AIM All-Share index were among the worst-performing markets over the winter - down 20.4% and 16.4% respectively – the UK’s main indices of larger companies – the FTSE 100 and FTSE 350 (up 4.2% and 1.7% respectively) – were the best-performing of the world’s major markets in the six winter months.

An underperformer since the Brexit vote, investors have found the UK's modest valuations increasingly attractive post the pandemic. But as quality stocks became more expensive, more defensive stocks such as British American Tobacco (LSE:BATS), Rio Tinto (LSE:RIO) and Vodafone (LSE:VOD) increased in popularity. So has BAE Systems (LSE:BA.), a beneficiary of the Ukraine conflict.

Key takeaways

Many reliable trends have been disrupted by hugely significant events - the Covid pandemic, war on mainland Europe and the end of 14-year period of record low interest rates - with an impact equivalent to the dotcom boom and bust, 9/11 and the Global Financial Crisis.

Whether or not there has been any permanent damage to these trends remains unclear. What is certain is that we face a possibly prolonged period of uncertainty, as the economic fallout from the war in Ukraine and inflation driven rate rises and quantitative tightening play out.

Consistent Winter Portfolio 2021-22

Past performance is not a guide to future performance.

Company (% price movements) | November | December | January | February | March | April | Winter share price performance |

-6.2 | 7.6 | -26.3 | -6.7 | -15.9 | -8.2 | -46.3 | |

10.7 | 5.9 | -10.2 | 0.6 | 5.3 | -6.0 | 4.8 | |

-7.5 | 5.4 | -4.7 | -10.7 | -20.2 | -7.1 | -38.4 | |

1.3 | 6.6 | -22.0 | -3.4 | 4.1 | -1.4 | -16.4 | |

3.0 | 6.8 | -0.4 | -5.3 | -13.9 | -1.5 | -12.1 | |

Consistent Winter Portfolio | 0.3 | 6.4 | -12.6 | -4.9 | -7.5 | -4.6 | -21.7 |

FTSE 350 | -2.5 | 4.5 | -0.3 | -0.7 | 0.7 | 0.0 | 1.7 |

Past performance is not a guide to future performance.

Aggressive Winter Portfolio 2021-22

Past performance is not a guide to future performance.

Company (% price movements) | November | December | January | February | March | April | Winter share price performance |

-6.2 | 7.6 | -26.3 | -6.7 | -15.9 | -8.2 | -46.3 | |

-7.1 | -15.1 | -8.8 | -21.3 | 6.6 | 0.0 | -39.7 | |

-6.9 | 4.4 | -8.0 | -16.6 | -7.4 | 13.5 | -21.6 | |

10.7 | 5.9 | -10.2 | 0.6 | 5.3 | -6.0 | 4.8 | |

-8.0 | 6.4 | -16.8 | -5.6 | 4.4 | -6.0 | -24.5 | |

Aggressive Winter Portfolio | -3.5 | 2.0 | -14.1 | -9.3 | -1.0 | -1.8 | -25.5 |

FTSE 350 | -2.5 | 4.5 | -0.3 | -0.7 | 0.7 | 0.0 | 1.7 |

Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.