Wild’s Winter Portfolios 2020: successful strategy ends with a bang

An excellent finish to this winter’s portfolio has left followers sitting on big profits.

21st May 2021 14:32

by Lee Wild from interactive investor

An excellent finish to this winter’s portfolio has left followers sitting on big profits.

There’s little doubt the winter just gone was one of the most lucrative ever for stock market investors. A glance down the list of global indices tells the story – France up 36%, Germany 31%, Nasdaq 28%, Brazil 26%. Many UK stocks did well too, of course, more than making up for losses caused by the pandemic in March and April the winter before.

It was happy coincidence that Pfizer (NYSE:PFE) announced the success of its Covid vaccine on 9 November, just days after this year’s winter strategy began. The news reignited interest in stocks which had been treading water for months, providing many markets with the oomph required to eventually return to levels not seen since before the pandemic began.

November itself proved to be the FTSE 100’s best month since 1989, and relief around not just the virus, but also Joe Biden’s US election victory and a post-Brexit trade deal, put a rocket underneath UK small-caps and AIM shares.

Although the inflation implications of a strong post-pandemic recovery were a concern, and still are, April 2021 turned out to be a typically cracking month for stocks. That meant Wild’s Winter Portfolios ended the 2020-21 strategy in style.

- Inflation watch: savings rate shortfall widest since January 2020

- Inflation: what investors need to know

- Check out our award-winning stocks and shares Isa

How our winter portfolios performed this time

Key objectives for the winter portfolios are, firstly, to generate a profit. Second, is to beat the benchmark index, which in this case is the FTSE 350 index.

First objective was achieved, with the aggressive portfolio up an impressive 18.1% in the six months to 30 April and the consistent portfolio up 6.1%. Include dividends and total returns were 18.8% and 6.6% respectively. Just days before this year’s strategy ended, the aggressive portfolio was up as much as 20.8% on a share price return basis.

While creditable, both portfolios lagged the benchmark. The FTSE 350 index rose 26% from November to April, and by 28% if you factor in dividends. That is a rare performance indeed. For the record, the previous best in the seven years since we began running winter portfolios was in 2014-15, their maiden year, where the FTSE 350 posted a share price gain of 8.7% and total return of 9.2%.

| Consistent Winter Portfolio |

|---|

| Compiling the two winter portfolios is straightforward. The Consistent portfolio is a basket of five FTSE 350 stocks with the most stable track record of returns over the past decade. Each has risen every year for the past 10 years. |

| Aggressive Winter Portfolio |

|---|

| For the Aggressive Winter Portfolio, the FTSE 350 constituents must have delivered the highest average annual returns over the winter. While average returns are our primary criterion, stocks must also have risen over the winter months in at least nine of the past 10 years. |

Of course, I have a well-rehearsed excuse to defend the portfolios, one that I’ve mentioned on more than one occasion during the past six months, and before the winter even began.

In October, I explained that the 10 constituents of the winter portfolios had already enjoyed a purple patch during the post-crash recovery. Most had recovered to pre-Covid levels and were trading at or near record highs. That’s because when the chips are down investors look for quality, and that’s what defines the stocks in the winter portfolios. Many other sectors only began their recovery after the Pfizer news on 9 November, so had far more catching up to do.

It was like the winter portfolios had given the wider market a massive head start. In no time at all, the FTSE 350 was up 15%, factoring in a rapid post-Covid recovery. Our portfolio stocks had already done that, so both strategies added just 5% in response.

Winter Portfolio still long-term winners

But a profit is a profit, and both the consistent and aggressive portfolios have been reliable capital generators with the exception of last year. And gains in the latest winter period recouped much of the losses suffered the year before.

The aggressive portfolio is now up 74.4% on a share price basis since the strategy began in 2014 and the consistent portfolio is up 35.9% (these returns assume you bought the first winter portfolio at the end of October 2014 and sold the following 30 April, then reinvested proceeds into the 2015-16 portfolio and repeated the process each year). Performance also includes all costs and commission. Even after a knockout year, the FTSE 350 is still only up 20.1% in seven years.

Include dividends and the total return for the aggressive winter portfolio is 85.4% and 49.0% for the consistent strategy. The benchmark index has returned 33.7%.

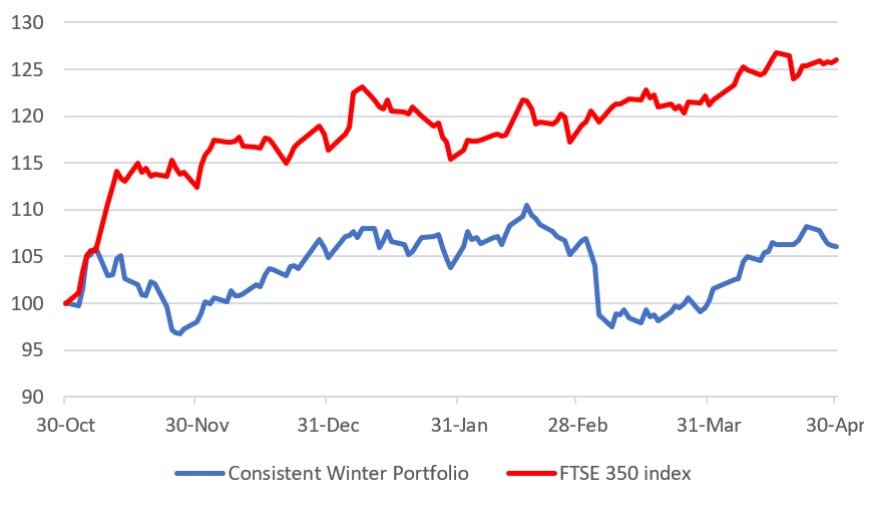

Wild’s Consistent Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

In any other year, a net profit of over 6% for a six-month portfolio would be very respectable. But the past winter wasn’t like any other year, and comparisons with the benchmark FTSE 350 index are not favourable.

I’ve explained already how many of the quality stocks within the winter portfolios peaked too soon – during the summer, before the portfolios launched on 31 October. Now it’s time to identify the weak links, and London Stock Exchange (LSE:LSEG), which made it into both of this year’s portfolios, is the perfect scapegoat.

By the middle of February, the LSE was showing a near-20% gain. However, two weeks later it was an 8% loss. At their worst, the shares were down over 16% this winter. Here’s how I explained the devastating collapse:

“The decline began as a reaction to LSE’s annual results early March. Higher costs meant adjusted profits missed forecasts. Refinitiv [the data giant which LSE bought for $27bn] also dilutes the growth profile, and the shares are certainly not cheap. Guidance for revenue growth of under 5% in 2021 is also disappointing, and analysts believe it could be worse given forecasts are made on a constant currency basis. A strong pound and high level of Refinitiv’s revenue in dollars is a worry.”

A strong April softened the blow, but the shares still ended the winter down 10.6%. If they had managed to maintain peak levels through to 30 April, the consistent portfolio’s return would have more than doubled to 13%.

Self-storage provider Safestore (LSE:SAFE), another stock with a record strong enough to gain entry to both winter portfolios, failed to impress, although it did generate a 6% profit plus some dividend income.

The other three constituents – technology conglomerate Halma (LSE:HLMA), speciality pharma group Croda International (LSE:CRDA) and insurer Admiral (LSE:ADM) – all did much better. Croda, which has been in every consistent portfolio since launch, extended its run of positive winter share price performances to at least 17 years. The shares returned 12.1% this time.

Halma had another strong year, up 9.3%, although it needed a knockout April to make a chunk of that profit. Admiral, among the most seasonal of stock market performers, finished the six-month strategy with a whimper, although a 13.8% profit easily justifies its inclusion in this portfolio.

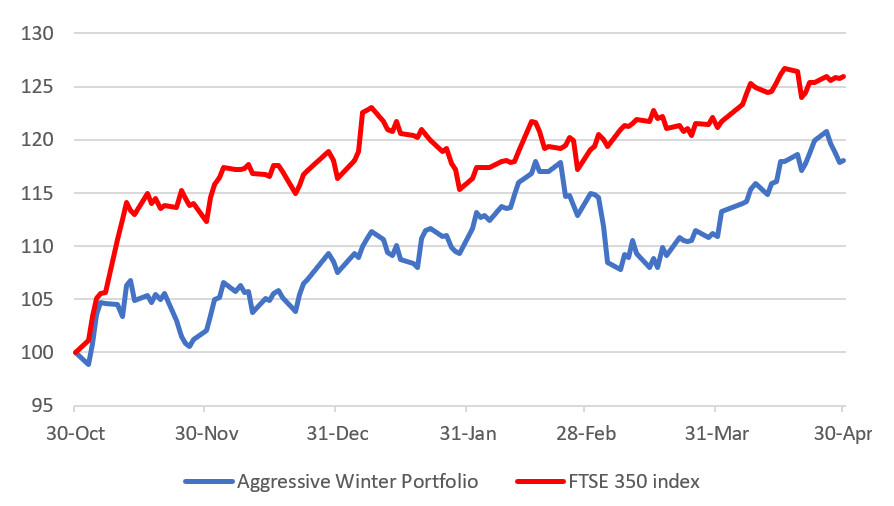

Wild’s Aggressive Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

It paid to be aggressive this winter, and the higher-risk portfolio returned over 18%, three times as much as its safer sister portfolio. At one point in late-February it was just a single percentage point behind the benchmark index.

Again, to emphasise the impact of LSE’s miserable performance, the aggressive portfolio would have returned over 24% had LSE held the best of its winter gains.

The three other constituents had a stunning winter, each returning between 29% and 35%.

Latex glove maker Synthomer (LSE:SYNT) was the star turn after cementing an already impressive rally with a 9.6% gain in April to within a whisker of a record high. The company has been a major beneficiary of a demand boom at its nitrile latex business in 2020, which has spilled over into 2021.

Precision instrumentation firm Spectris (LSE:SXS) excelled too, its shares adding 31.4% in the past six months despite profit taking during the last few weeks of the portfolio. Investors spotted recovery potential at Spectris, and quickly switched from growth to value names in the engineering sector.

Restructuring its portfolio of businesses makes sense and will bear fruit, but valuation is becoming a concern among City analysts.

Finally, a portfolio-leading gain for April of 12.6% was the cherry on top for Diploma (LSE:DPLM). The technical products and services firm, which focuses on the life sciences, heavy machinery and hi-tech industries, was a slow burner, but made steady progress from late January, culminating in a final big push as the winter season ended. By the close of business on 30 April, the six-month gain was almost 29%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.