A wildly successful mid-cap stock under the microscope

This £3 billion company is in 'great shape', but will our companies analyst recommend the shares?

15th February 2019 14:48

by Richard Beddard from interactive investor

This £3 billion company is in 'great shape', but will our companies analyst recommend the shares?

SSP: Overpriced, and over here, there and everywhere

As well as steadily increasing profitability, it was Kate Swann's presence as chief executive that made me think SSP Group (LSE:SSPG) might be a good investment.

Swann was instrumental in turning WH Smith from a dowdy High Street stationer into a tatty anachronism run mostly by self-checkout machines and a highly profitable travel brand, with stores in many of our stations and airports. Milking the High Street for cash and ploughing it into travel stores was a highly profitable strategy at WH Smith (LSE:SMWH), and it must have caught the eye of SSP when it hired Swann in 2013.

In good shape

SSP specialises in operating food and beverage travel concessions at airports and railway stations. In fact, it operates WH Smith franchises, and Burger King, Starbucks and Leon. It can offer airport and station owners and operators more than 300 brands, including its own, like baguette broker Upper Crust, ubiquitous in UK railway stations. It is big, the market leader in the UK and Northern Europe, perhaps selling 15% of the food and drink sold in concessions at airports and railway stations worldwide (excluding the North American rail network).

Swann's going, though, in May. She says she is leaving the company "in great shape". Since she left WH Smith in good shape, and it has continued to prosper, perhaps the same will be true of SSP.

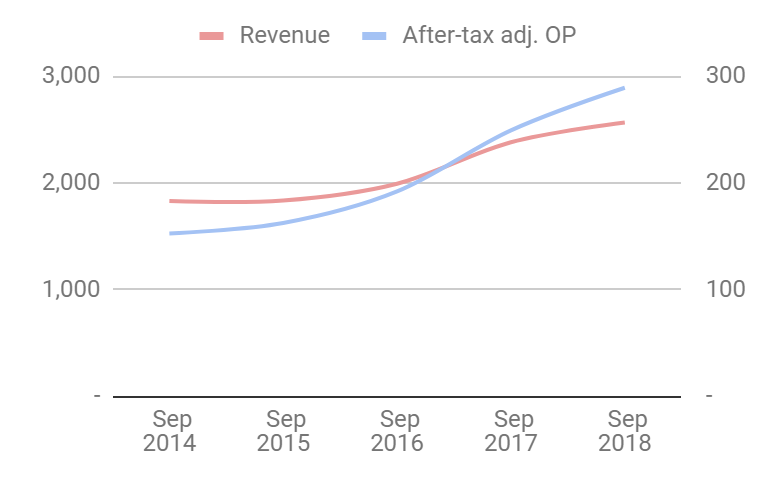

Source: interactive investor

The year to September 2018 was a year of highs since the company floated in 2014. Record revenue, record profit, near record return on capital. SSP paid a record dividend and a special dividend worth twice as much. It proposes to pay another special dividend in 2019.

Growth came mainly from two relatively small acquisitions, Germany's Stockheim in 2018, and an investment in India's TFS in 2017, but even excluding the impact of newly acquired business, SSP has sustained revenue growth of about 3% a year over the last five years.

Scale and efficiency

It is still doing what it has been doing a for a decade, probably since the financial crisis of 2008 when the company got into financial difficulty, raised money to pay off debt, and switched from an acquisitive strategy to refocus on profitability. Since then growth has been steady, the result of winning new contracts, efficiencies, and favourable trends. Air and rail passenger numbers are growing, and the rise of low-cost airlines with limited onboard menus means passengers spend more on food and drink before they depart.

SSP is installing self-order screens and self-scan checkouts, automating food production, rationalising recipes and procurement, and rostering staff more effectively to reduce labour costs. In 2018, among many new developments, it won a contract to operate 29 Starbucks concessions in railways across the Netherlands, introduced Millies Cookies to India, and opened a new Leon at Victoria Station. It developed a new brand, which sounds like a WH Smith for drinkers. Urban Express sells wine from Berry Bros. & Rudd, ready meals from Cook, and books from Foyles.

As usual, I am scoring SSP to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

Yes, but SSP's after-tax return on capital is far from stellar, at around 8%.

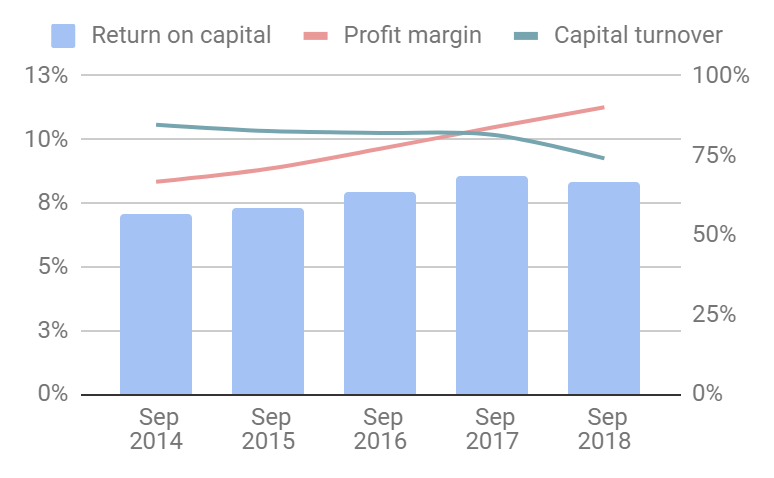

Source: interactive investor

Although it has successfully controlled costs and improved operating margins (pink line), that has not been fully translated into a rise in profitability because the company is having to deploy more capital. While automation has kept a lid on the wage bill, SSP hiked capital expenditure in 2018, perhaps spending more on machines, and it has been less successful at keeping rent down, which I capitalise.

Adaptable: How will it make more money?

Score: 2

With Autogrill and Elior, SSP is one of three big ‘International Concessions Operators', which also compete with local operators, like The Restaurant Group in the UK (owner of Frankie and Benny's), and high street brands. The big three are chasing economies of scale.

Running a concession in an airport or station is complicated because space is limited, kitchens are often shared, security is high, demand fluctuates dramatically, and the requirement to be open for up to 24 hours puts a strain on staff schedules. A big company can offer airport and station owners and operators a wider range of brands, more consistent standards, and more experience of operating in different conditions, while keeping costs down through bulk-buying, and shared administrative functions.

SSP also works with brands to adapt their menus, marketing and working practices to travel, saving them hassle, and cost, which is why it dubs itself "Food Travel Experts".

Scale, expertise, and efficiency, I think is a winning strategy.

Resilient: What could go wrong?

Score: 1

As market leader in the UK and Northern Europe, number two in the more fragmented US airport market, and with footholds in faster-growing and even more fragmented regions, SSP is probably in a good position to withstand direct competition. But clients, airport owners and operators, and partners, brands like Starbucks, are in their own ways like monopolies. Perhaps they are in an even stronger position. Despite its scale, SSP is not that profitable, probably because it has to share the profit with businesses that can drive a hard bargain.

When times are tough, I wonder whether the concession operators are squeezed the hardest. Concession fees are pegged to sales, but there is often a minimum fee stipulated that gives clients some protection at the expense of concession holders.

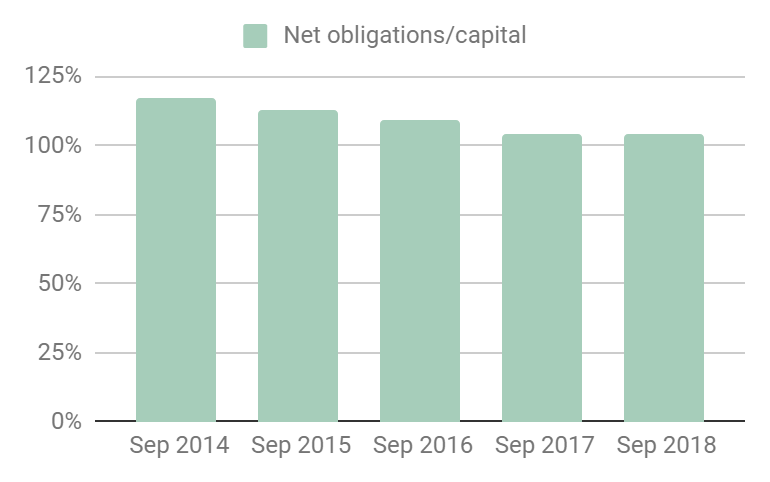

Even after the special dividend, SSP was not carrying much debt at the year-end, but by my rough calculations, it owed a lot of rent (and a small amount to its underfunded defined benefit pension scheme).

Source: interactive investor

Equitable: Will we all benefit?

Score: 1

After Kate Swann leaves, the board will still be highly experienced. The only other executive director, Jonathan Davies, has been chief financial officer since 2004, and Vagn Sørensen has been chairman since 2006. Simon Smith, the incoming chief executive, is an internal appointment, the chief executive of the company's UK operation since 2014. The executives are extremely well paid, though.

The company says all the right things about listening to employees, it has a global online learning platform and an all-employee share plan, but staff reviews on recruitment sites do not make easy reading. It is important to keep these in context though, SSP has 37,000 employees, and only about 500 have shared their experience online. Low paid, high pressure, work is unlikely to stir the passions, or indeed be a career move for many.

Cheap: Is the firm's valuation modest?

Score: -1

Maybe I am missing something, but SSP's valuation mystifies me. It is 24 times profit in 2018, adjusted for debt, lease, and pension obligations. I think investors see the travel retailer as a steady grower. They may be right, but there are cheaper and perhaps steadier growers out there. A total score of 4/10 means I cannot recommend SSP for long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.