Why we are betting on the banks

Saltydog Investor reveals a new position in the financial sector, which is benefitting from politics in the US.

9th December 2024 13:42

by Douglas Chadwick from interactive investor

US stock markets have been on a roll since Donald Trump's presidential election victory.

Last week, the S&P 500 and Nasdaq closed at record highs, while the Dow Jones was not far off, having peaked earlier in the week. Since the beginning of November, the S&P 500 has risen by 6.7%, the Dow Jones Industrial Average is up 6.9%, and the Nasdaq has outperformed both with a 9.8% gain.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

This trend has been reflected in our weekly fund analysis. As a result, our Saltydog demonstration portfolios have been investing in funds from sectors we avoided in the immediate run-up to the election. In the last few weeks, I have written about the North American sectors and the Baillie Gifford American Fund, which we bought on 14th November and which is already showing a gain of 5.1%. I have also discussed the Technology & Technology Innovation sector: we invested in the BGF World Technology Fund on 28th November, and since then, it has risen by 4.5%.

We have now turned our attention to the Financials & Financial Innovation sector.

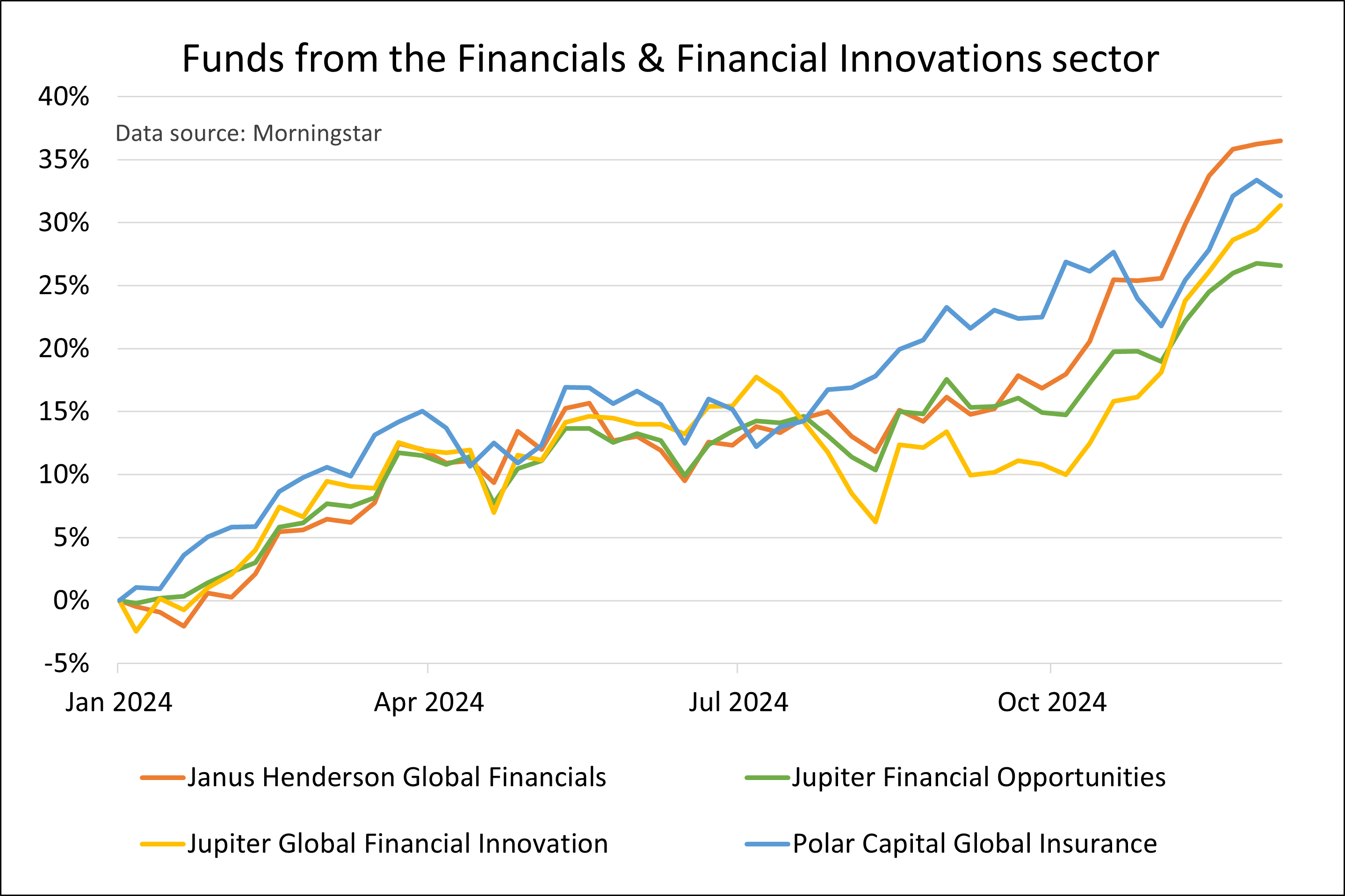

Last week, both of the Saltydog portfolios invested in the Janus Henderson Global Financials Fund from this sector. This is a relatively new sector, first introduced in 2021. It is also fairly small, so we only track a handful of funds. The chart above shows how the top four funds in this sector have performed since the beginning of the year. It is an updated version of the graph I produced in October when we highlighted that Financials & Financial Innovation was the leading sector of 2024 (and it still is).

Although these funds can invest anywhere in the world, they have a strong US focus. For example, over 60% of the Janus Henderson Global Financials Fund portfolio is invested in US companies. The funds predominantly invest in banks, insurance companies, and businesses providing financial services. As the name suggests, the Polar Capital Global Insurance fund is almost entirely invested in insurance companies. However, the other three funds allocate the lion’s share of their portfolios to banks, followed by financial services and then insurance.

US bank shares rose sharply at the beginning of November, and I can think of several possible reasons why.

Investors anticipate that a Trump administration will be beneficial for the US economy. This, in turn, is expected to lead to increased commercial lending, which will benefit banks - especially now that interest rates have risen from the record lows observed for most of the past 15 years. While rates have started to decline from the highs reached in the second half of last year, they remain at levels that are profitable for bank lending. Over the next year, the Federal Reserve may gradually lower its benchmark rate from its current range of 4.5% - 4.75%, but no one expects it to return to the historically low levels seen after the pandemic anytime soon.

- Video interview: JPMorgan Global Growth & Income

- Why concentration risk is a problem for many investors

Part of Trump’s pro-business approach involves removing constraints on companies caused by what he considers excessive regulation and bureaucracy. This could be particularly beneficial for banks, which have been under scrutiny since the 2008 financial crisis. For example, he might reduce the amount of capital banks are required to set aside to mitigate risk.

Additionally, the number of mergers and acquisitions is expected to increase, partly due to looser regulatory scrutiny. This would be especially good news for large US investment banks such as Goldman Sachs, JP Morgan, and Morgan Stanley.

This is all well and good, but it is worth remembering that Donald Trump has not yet been sworn in, and it will take time to see the true effects of his policies. It feels like a case of ‘buy the story,’ but we must also be prepared to ‘sell the news’ if the reality falls short of expectations.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.