Why trusts on big discounts might not be all they seem

Here’s what to base the investment case on, not the opportunity a yawning discount seems to present.

3rd April 2020 15:41

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Discounts have widened across trusts investing in private companies, but appearances can be deceptive. Here’s what to base the investment case on as Covid-19 unfolds, not the opportunity a yawning discount seems to present.

William Sobczak is an analyst at Kepler Trust Intelligence.

Mind the gap

Recent years have seen companies opt to remain private for longer; due to their ability to access capital from alternative areas and to remain free of the increasingly burdensome requirements of being listed.

The implosion of the Woodford Equity Income Fund as a result of liquidity problems has shone a negative light on open-ended funds holding stakes in private companies. However, the capacity to hold illiquid assets is one of the key characteristics of the investment trust structure.

In this article we assess the advantages and disadvantages of holding minority stakes in private companies, and the impact that being re-valued periodically can have in a market characterised by wild swings in sentiment; which is perhaps of most relevance in the current market.

"As more firms are deciding to stay private for longer, significant growth opportunities can be found among unquoted companies..."

The pros

According to a report from McKinsey, the average number of IPOs in the US was 300 per annum from 1980 to 2000. This fell to an average of c. 160 per annum from 2000 to 2019, according to research published by Statista.

The falling number of IPOs, as well as M&A activity, has resulted in a halving of the number of US-listed companies compared to 20 years ago. Multiple factors have contributed to this development. The first is the ability of companies to raise capital from new sources such as venture capital, private equity and forms of debt.

The nature of growing businesses is also considerably different to how they were historically. These companies are increasingly reliant on intangible assets, such as brand power or software.

The costs associated with creating these assets are often covered in the early years, and such businesses need less capital investment to support expansion than traditional manufacturing industries did. Anyway the trend for companies to stay private for longer has meant that a growing number of investment trust managers have begun to fish in this pool.

Leading the charge has been Baillie Gifford, a firm which now has eight trusts with unlisted holdings, including: Baillie Gifford US Growth (LSE:USA), Scottish Mortgage (LSE:SMT) and Edinburgh Worldwide (LSE:EWI).

They view unlisted companies as a key ingredient in seeking long-term growth, and consider the investment trust structure as a key tool to help them achieve this aim.

The flexibility of the structure means they don’t need to sell an investment just because it lists, as is typically the case for private equity funds. Instead they apply a flexible approach to allocation, via a combined portfolio of private and public equity.

Some trusts have launched specifically to benefit from the trend of companies staying private for longer. For example the managers at Augmentum Fintech (LSE:AUGM) – which we updated a note on this week – invest in what they believe to be fast growing, exceptional fintech businesses across Europe.

They are something of a hybrid between a private equity company and a minority investor, in the sense that they do not control the company, but do look to be actively involved with their companies. Merian Chrysalis (LSE:MERI), launched in 2018, employs a similar approach.

The reasoning for the launch was to offer investors a vehicle that gives access to some of the most interesting, high growth and disruptive unlisted companies, which they wouldn’t be able to access otherwise.

These businesses are typically scalable, technology driven competitors looking to challenge and replace existing business models. Merian Chrysalis takes a long-term approach to investing in these companies, unlike venture capital or private equity firms which will typically sell at IPO.

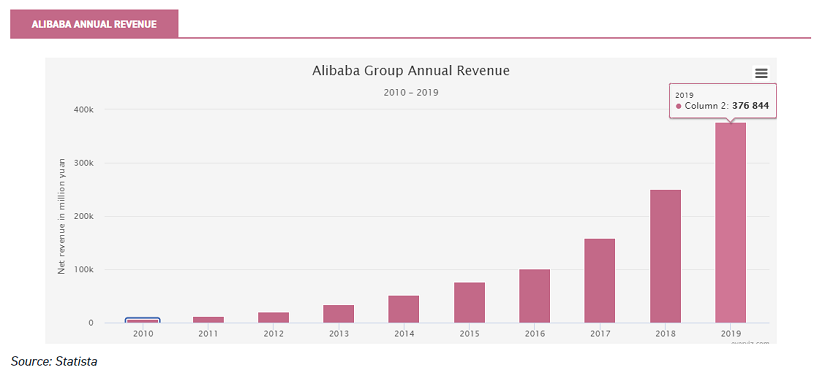

There are a number of key advantages in taking minority positions in unlisted companies. The first is the capacity to benefit from the high growth phase of a company’s trajectory. As companies stay private for longer, listed market investors are missing out on the best years of a company’s growth (McKinsey). This is illustrated in the graph below, which shows Alibaba’s revenue growth since 2010.

The company listed towards the end of 2014. In the four years leading up to the IPO, however, it increased its revenue almost tenfold. Since then the revenue has increased at half that rate.

Fidelity China Special (LSE:FCSS) was one trust that was able to benefit from this growth. Fidelity first invested in Alibaba (NYSE:BABA) two years prior to its IPO in 2012, when the trust was managed by Anthony Bolton, who invested 2.5% of the trust's assets in the company, then valued at $48 billion. The company is now worth more than $500 billion, valuing their initial investment of 2.5% at more than $10 billion.

Similarly, investments made by RIT Capital (LSE:RCP) illustrate just how beneficial it can be to hold a company before it lists. In 2011 the trust participated in a £250 million series B financing with file hosting service Dropbox (NASDAQ:DBX), which at the time was valued at $3.8 billion.

Between their first investment and the flotation, the value of their stake in Dropbox almost doubled.

In addition, making private market investments requires a lot of time and effort: there is unlikely to be much analyst research on the company, and sourcing opportunities is likely to take time.

Nonetheless being one of relatively few investors in a company enables investors to develop strong relationships with management. Over the long term this can be extremely beneficial to investors, who are not only able to access the insights that CEOs or experts have, but can also potentially invest in their future ventures.

Baillie Gifford, for example, were early investors in Alibaba and have since managed to develop a strong relationship with Jack Ma.

This was largely due to their patience with the company, not worrying about short-term events or dividends and not selling out as soon as the company IPO’d, like a private equity firm would have.

This ongoing relationship has meant they have been able to benefit from Jack Ma’s knowledge of the Chinese ecommerce market, while also investing in his other company ANT (which he in fact brought to their attention).

Baillie Gifford see ANT – which represents 2.5% of Scottish Mortgage portfolio and its largest single investment in an unquoted company – as one of their most exciting private market investments, and would not have been in a position to invest had they not been long-term investors in the company from prior to its flotation.

Just as there are many companies staying private for longer, there are higher numbers of mature, larger businesses to invest in. Baillie Gifford note that a lot of the companies that are IPO-ing nowadays are already the size of a FTSE 100 company by the time they go public.

Scottish Mortgage's investment into Facebook (NASDAQ:FB) pre-IPO in 2012 illustrates this tendency well. The Baillie Gifford team invested in Facebook when it was private, and it eventually IPO’d at a valuation of $100 billion.

At IPO Facebook would have been the second biggest company in the FTSE 100 (as of 18 March 2020). Similarly, when Baillie Gifford invested in Alibaba it was a $45 billion market cap company. But by this stage the company was already the biggest name in Chinese commerce, and eventually IPO’d at a staggering market valuation of $165 billion.

Shareholders of private companies are also able to take long-term perspectives. Listed companies will typically find themselves under pressure to deliver short-term results; placing too great an emphasis on quarterly earnings and analyst expectations.

When you are unlisted, however, you do not come under the same scrutiny, and there is little need to tinker with the process or business model. Instead, market falls and other short-term elements can be ignored and the long-term objective of building the business can be the number one goal.

The cons

On the other hand, there are disadvantages to holding unlisted companies. The most obvious issue is liquidity. Investing in an unlisted company is likely to mean a long-term commitment, with the result that it can be hard and costly to wind down a position if the company does not fare well.

Another difficulty is gathering reliable information. Third-party research is rarely available, so it can take a lot of skill, time and resources to be able to carry out adequate due diligence.

Furthermore, since a lot of new ideas brought to you as an investor in unlisted companies will be through other people in the industry, you are placing a great deal of trust in them without necessarily having a lot of information.

Corporate governance can be a major concern for investors in unlisted companies. Since a private company will typically have a much more concentrated investor base compared to listed companies, as a minority investor you can feel a sense of newcomers vs. incumbents.

In addition founders can have super voting shares or other ways of controlling the company, meaning that your opinions and votes can be without much influence. However, recent trends have seen listed companies flirt with structures of this kind too (Facebook, for example).

The prices

Following the spread of the Covid-19 pandemic, many investment trusts have fallen onto wide discounts; including some which invest in private companies. Even so, these discounts are not necessarily what they seem.

Given that private investments are infrequently valued, the further away from the last valuation point, the more liable the NAV is to be under or overestimated, particularly when the market has been moving on one direction — unfortunately, in this case, down.

Compounding this trend, many trusts with significant unlisted holdings publish a weekly or monthly rather than daily NAV. The risk of the discount being misleading will be higher the more a trust is invested in private companies. Likewise the longer since the last NAV was published and the longer since the unlisted holdings were valued.

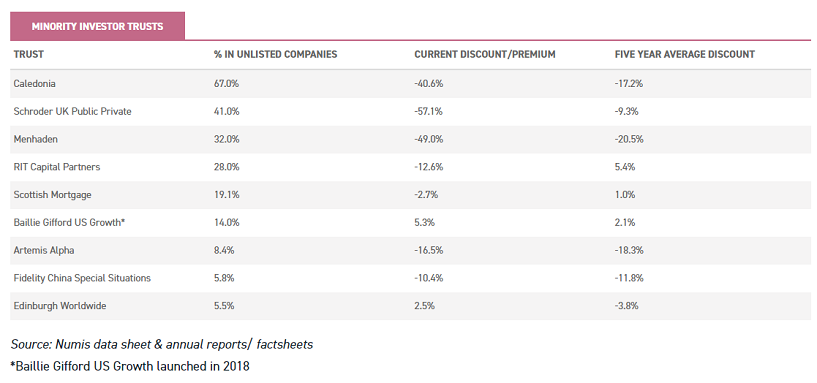

The below table includes nine companies we have identified as having significant enough exposure to unlisted companies for that to potentially impact the discount (more than 5%).

Across the nine trusts, it is no surprise to see that the trusts which have the widest discounts are those with the highest exposure to unlisted and/or those which update their NAVs less frequently. This implies that these NAVs are stale, and the market is accounting for this in the current share price.

RIT Capital (LSE:RCP), for example, is currently trading on a discount of 12.6%. This compares to its five year average premium of 5.4%.

However, the NAV is only updated monthly, as opposed to most equity trusts which are updated daily, and the last time it was reported was as of 29 February 2020. RIT is a multi-asset portfolio, and has some protection built in; nevertheless global equities have fallen by over 15% since 29 February.

Furthermore the trust has 28% of its portfolio in unlisted investments, whose valuations are inherently subjective and may be even older than February.

The majority of the trust’s direct private investments are in IT companies, including Coupang and KeepTruckin.

The largest private investment, however, is in Acorn Holdings (3.7%), a global coffee and soft beverage company. Following the merger of Keurig and Dr Pepper Snapple, the majority of Acorn’s interest is now in a quoted stock – Keurig Dr Pepper (NYSE:KDP) – which has performed reasonably well (relatively speaking) in this difficult 2020 environment.

Similar to RIT Capital, Caledonian (LSE:CNN), Menhaden (LSE:MHN) and Schroder UK Public Private Trust (LSE:SUPP) update their NAVs monthly, although SUPP has just announced it will do so quarterly going forward. In fact Caledonia has the highest percentage of assets in unlisted companies of the trusts we looked at (67%), yet last declared its NAV as of 29 February 2020.

Since then the trust’s benchmark, the FTSE All Share, has fallen more than 15%. The trust is trading on a discount of over 40%, which is more than double the five year average (17.2%).

The private investments in Caledonia’s portfolio are well diversified, ranging from investment management companies to bingo operators.

Menhaden has also not seen its NAV updated since the end of February, and holds a little over a third of its portfolio in unlisted companies. The benchmark for the trust, the MSCI ACWI, has dropped around 15% since that date, and Menhaden’s discount has widened out to close to 50%.

Menhaden is slightly different to the other eight trusts we looked at, as it invests in businesses and opportunities that deliver or benefit from the efficient use of energy and resources. Nonetheless most environmental funds (like Impax (LSE:IPX) and Jupiter Green (LSE:JGC)) have held up strongly over the past three months.

The other five trusts in our list update their NAVs daily, although this does not include revaluation of the unlisted portion of the portfolio.

Most of these trusts have invested considerably less in private companies and have discounts that are actually narrower than their five year average.

Scottish Mortgage is the only exception, with 19.1% of its portfolio in unlisted companies and a discount that is 3.6% wider than its five year average. Despite that, it is still on a narrow discount in absolute terms, having traded on a premium before the crisis.

Baillie Gifford US Growth (launched in 2018) and Artemis Alpha (LSE:ATS) have exposures to unlisted companies of 14% and 8.4% respectively. Baillie Gifford US Growth has actually seen its premium widen. Edinburgh Worldwide, with an exposure of 5.5% in unlisted companies, has had a volatile discount in recent weeks.

Trading on a premium before the crisis hit, it has traded on a 10% discount at times but is now closer to par. While Fidelity China Special Situations (5.8% in unlisteds) saw its discount widen out close to 18% after the crisis hit in China, but is now back on a single digit discount.

Conclusion

We believe that the potential rewards of investing in unlisted companies, when accessed through an investment trust, make it a highly attractive strategy.

Investors are able to access companies during their highest growth phases, and benefit from the experience and connections of the stakeholders.

All the while they can enjoy the long-term view that a company’s management can take if it is not subject to the noise and quarterly reporting requirements of public markets.

However, whilst investment trusts provide the best mechanism for exposure to unlisted companies, in the light of the coronavirus pandemic, the current outlook for private firms is as murky as it is for their listed counterparts.

Furthermore the valuations of private companies included in NAVs will not yet reflect the full impact of recent events.

With that in mind, we would caution that the discounts we are seeing on some trusts might not be all they seem. Any investment case should, therefore, be mainly be based on the company’s growth and earnings outlook and not the perceived opportunity that a yawning discount might seem to present.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.